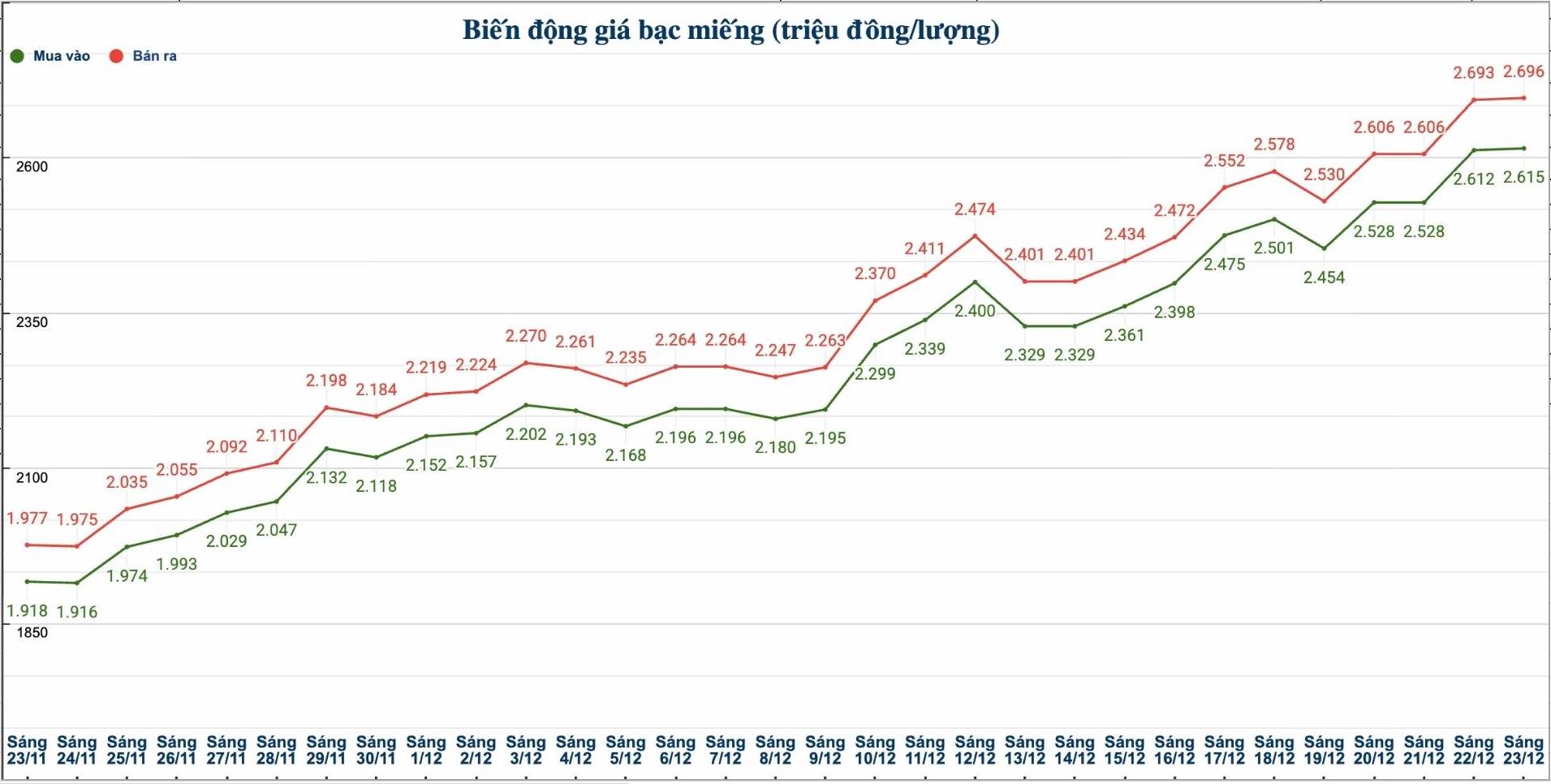

Domestic silver price

As of 1:50 p.m. on December 23, the price of 2024 Ancarat 999 silver bars (1 tael) at Ancarat Metallurgy Company was listed at VND 2.612 - VND 2.676 million/tael (buy - sell); an increase of VND 3,000/tael in both directions compared to yesterday morning.

The price of 999 Ancarat 999 (1kg) of silver bars at Ancarat Metallurgy Company was listed at 68.770 - 70.860 million VND/kg (buy - sell); an increase of 80,000 VND/kg in both directions compared to yesterday morning.

The price of 999 gold bars of Saigon Thuong Tin Bank Gold and Gemstone One Member Co., Ltd. (Sacombank-SBJ) was listed at 2.613 - 2.679 million VND/tael (buy - sell); an increase of 12,000 VND/tael in both directions compared to yesterday morning.

At the same time, the price of 999 coins (1 tael) at Phu Quy Jewelry Group was listed at 2.615 - 2.696 million VND/tael (buy - sell); an increase of 3,000 VND/tael in both directions compared to yesterday morning.

The price of 999 taels of silver (1kg) at Phu Quy Jewelry Group was listed at 69.733 - 71.893 million VND/kg (buy - sell); an increase of 80,000 VND/kg in both directions compared to yesterday morning.

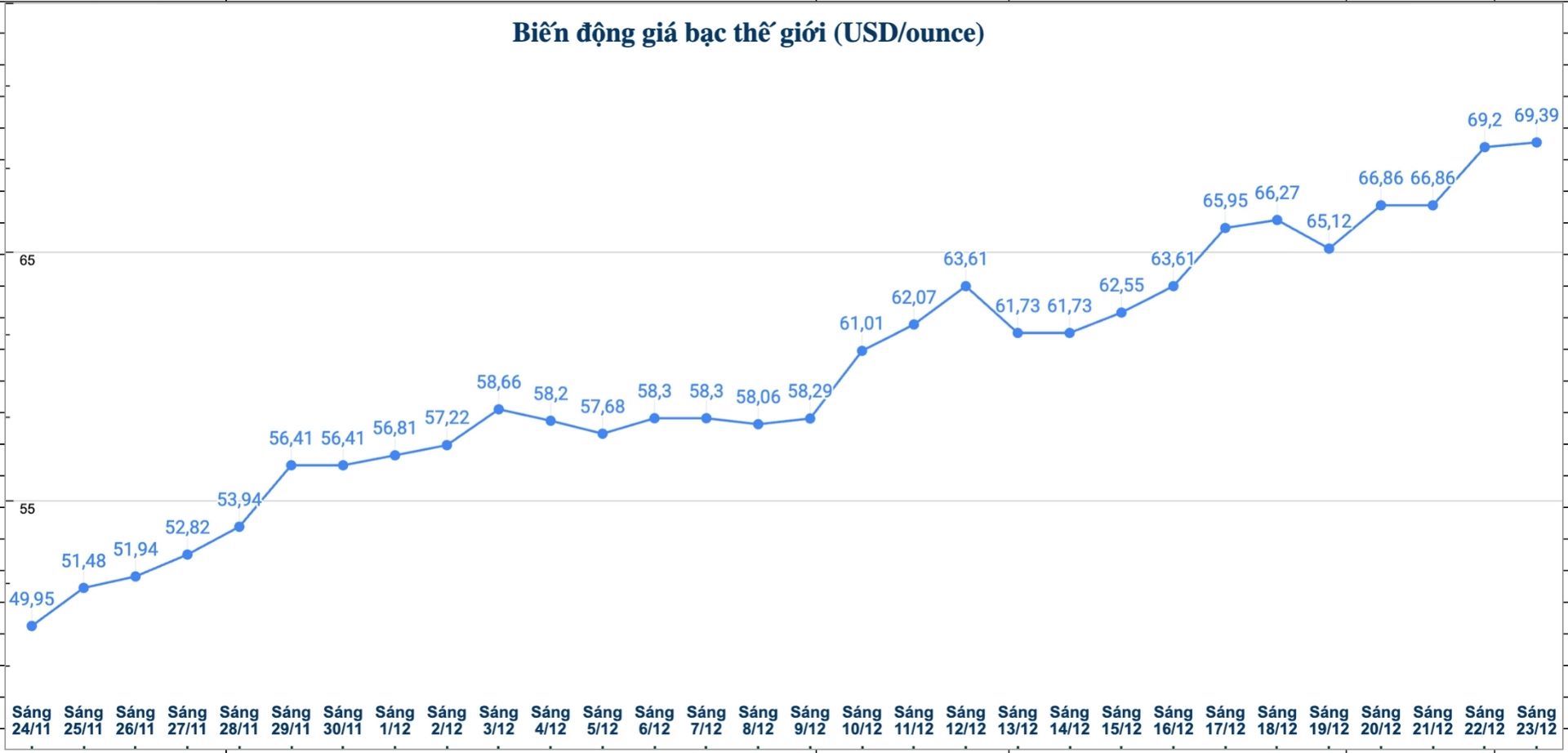

World silver price

On the world market, as of 2:05 p.m. on December 23 (Vietnam time), the world silver price was listed at 69.39 USD/ounce; up 0.19 USD compared to yesterday morning.

Causes and predictions

The silver market increased strongly again in the first trading session of the week, showing that upward pressure is still dominant.

According to precious metals analyst Christopher Lewis at FX Empire, in the current context, downward corrections are seen as an opportunity for investors to buy, rather than a signal to reverse trends.

"The strong rally makes the silver market particularly notable, although it is not ruled out that prices will have a few short-term corrections before continuing to move up next month," he said.

Christopher Lewis said that silver prices are fluctuating around $69/ounce and approaching $70/ounce.

"In the past, silver has failed to break $50 an ounce many times. Therefore, the current price maintenance in this zone is considered a very significant step forward, while changing the perspective on the long-term prospects of the silver market" - he commented.

Christopher Lewis noted that the concern now is how long the rally can last before there is strong profit-taking pressure. "Although the possibility of an adjustment is inevitable, the current trend is still leaning towards price increase. Accordingly, every time prices decrease, the market tends to quickly have new buying power" - he said.

In the short term, Christopher Lewis believes that the $65/ounce mark is considered the closest support zone for silver prices. If adjusted further, the 62.5 USD/ounce and 60 USD/ounce levels could become the next fulcrum.

"On the other hand, the $70/ounce mark is likely to create certain market reactions, but this is also a common phenomenon when prices approach important psychological thresholds" - Christopher Lewis assessed.

See more news related to silver prices HERE...