Last night, February gold futures increased by 84 USD, to 4,471 USD/ounce. March futures increased by 0.91 USD, to 68.43 USD/ounce. February gold contracts hit a daily peak of $4,477.7/ounce, while March silver prices hit an inter-session peak of $69.525/ounce.

The two precious metals increased in price after the weekend's information showed increased tensions in the energy market, as the US implemented control measures on an oil tanker operating near Venezuela. This development raises concerns about crude oil supply, thereby boosting demand for safe-haven assets such as gold and silver.

The chased ship is flying a fake flag and is subject to a judicial seizure order; believed to be the idea 1 with a Panama flag, which has been sanctioned by the US, according to Bloomberg. The interception comes after the US military docked the Centuries oil tanker early Saturday and the Skipper on December 10.

The blockade appears to be putting pressure on Venezuela's oil storage capacity and could lead to output cuts, posing a risk of widespread civil unrest. crude oil prices for the term also increased following the US-Venezuela tensions.

Meanwhile, a senior Russian general was killed after a bomb exploded on a car in Moscow, according to the investigation agency. Lieutenant General Fanil Sarvarov, head of the combat training department under the Russian General Staff, died from injuries after a car-based explosive device exploded early Monday morning, the Investigation Committee said in a Telegram announcement, according to Bloomberg.

The agency has opened a murder investigation and said the involvement of Ukrainian special services is one of the assumptions being considered. Ukraine has not commented.

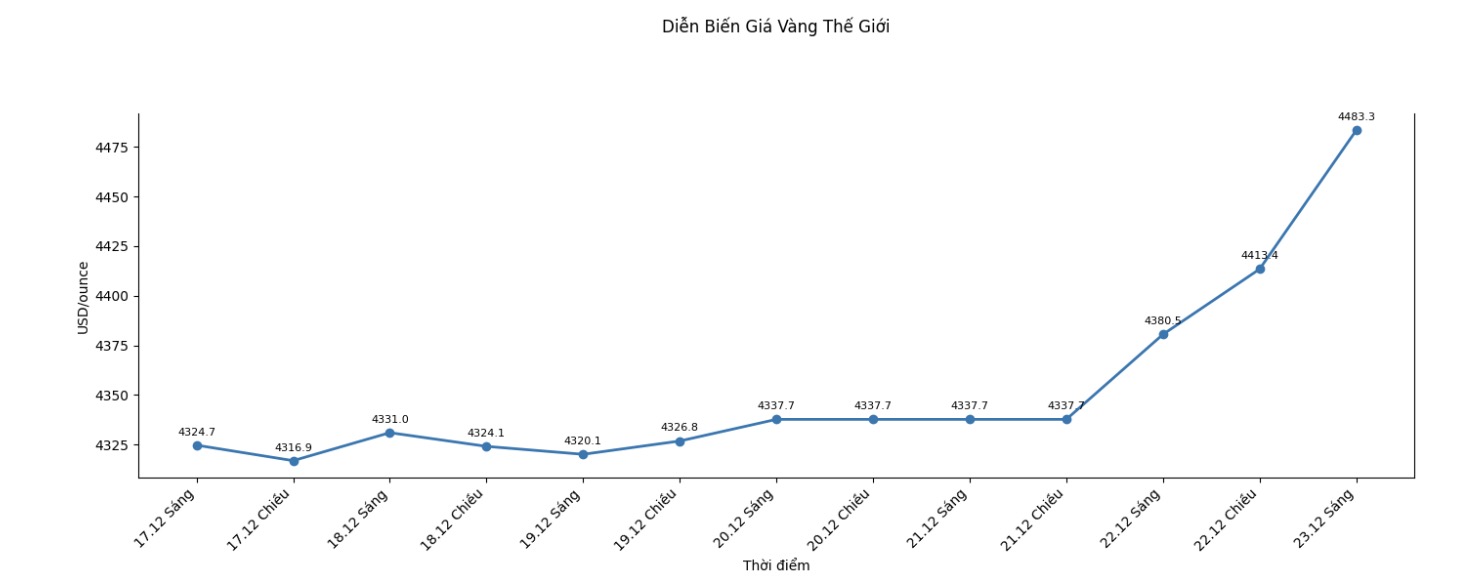

Technical analysis: With February gold futures, the next upside target for buyers is to close above the strong resistance level at $4,500/ounce. The near-term downside target for the sellers is to push prices below the strong technical support zone of 4,250 USD/ounce. The resistance is expected to peak at a record day of $4,477.7/ounce, followed by $4,500/ounce.

The first support level was at 4,400 USD/ounce, followed by the all-night low of 4,367.9 USD/ounce.

For March futures, the next upside target for buyers is to close above strong resistance at $70/ounce.

The target for the bears is to close below the strong support zone of $63/ounce. The immediate resistance was at an all-time high of $69.525 an ounce overnight, followed by $70 an ounce. Next support was at an overnight bottom of 67.47 USD/ounce, then up to 66 USD/ounce.

Key markets outside the day also leaned in support for precious metals. The USD index decreased. Crude oil prices increased, trading around 57.75 USD/barrel. The benchmark 10-year US Treasury yield is currently around 4.16%.

Note: The world gold and silver markets operate according to two main pricing mechanisms. The first is the spot delivery market, listing prices for buying and selling and immediate delivery. Second is the futures market, which sets prices for delivery at a certain time in the future. Due to year-end liquidity, the December gold contract is currently the most actively traded contract on the CME.