Domestic silver price

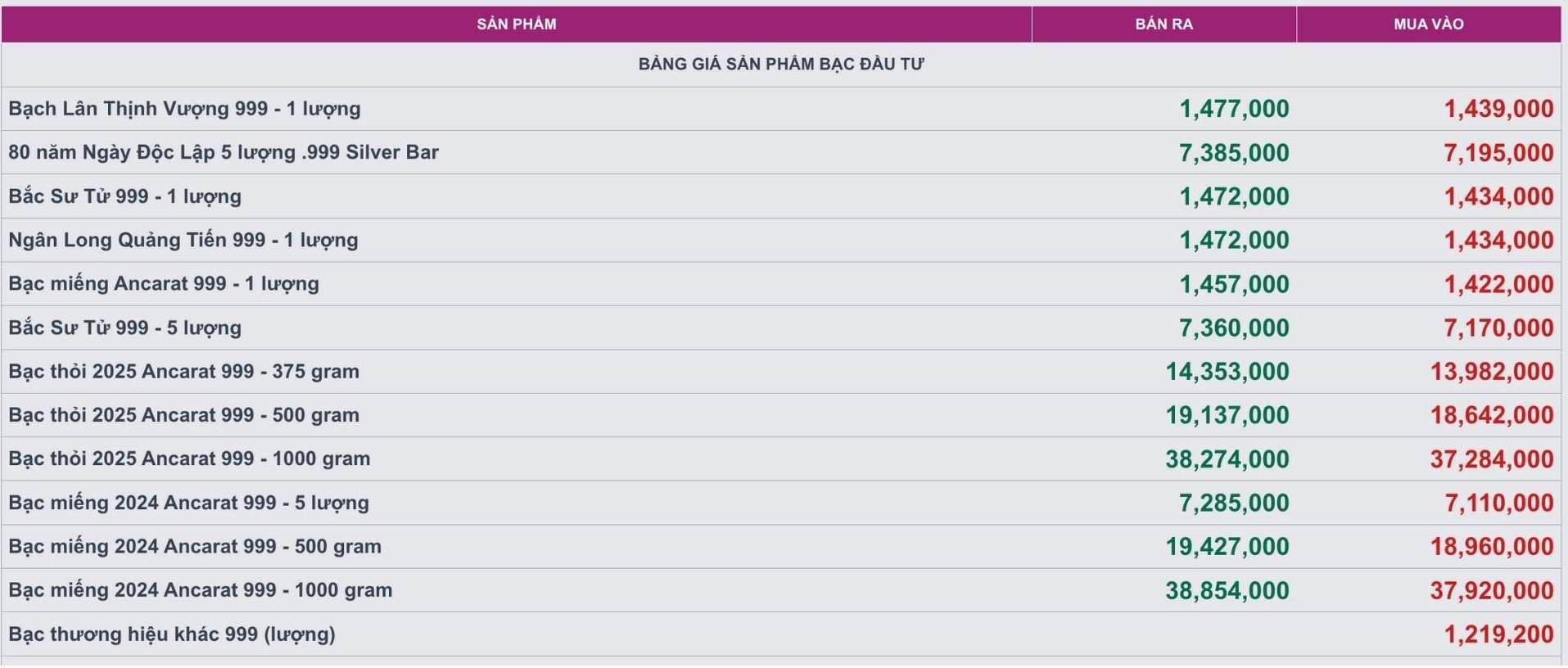

As of 9:20 a.m. on August 20, the price of 999 silver bars at Ancarat Metallurgy Company was listed at 1.422 - 1.457 million VND/tael (buy - sell).

The price of 999 999 Ancarat silver bars (1kg) at Ancarat Metallurgy Company is listed at 37.284 - 38.274 million VND/kg (buy - sell).

The price of 2024 Ancarat 999 (1kg) silver bars at Ancarat Metallurgy Company was listed at 37.920 - 38.854 million VND/kg (buy - sell).

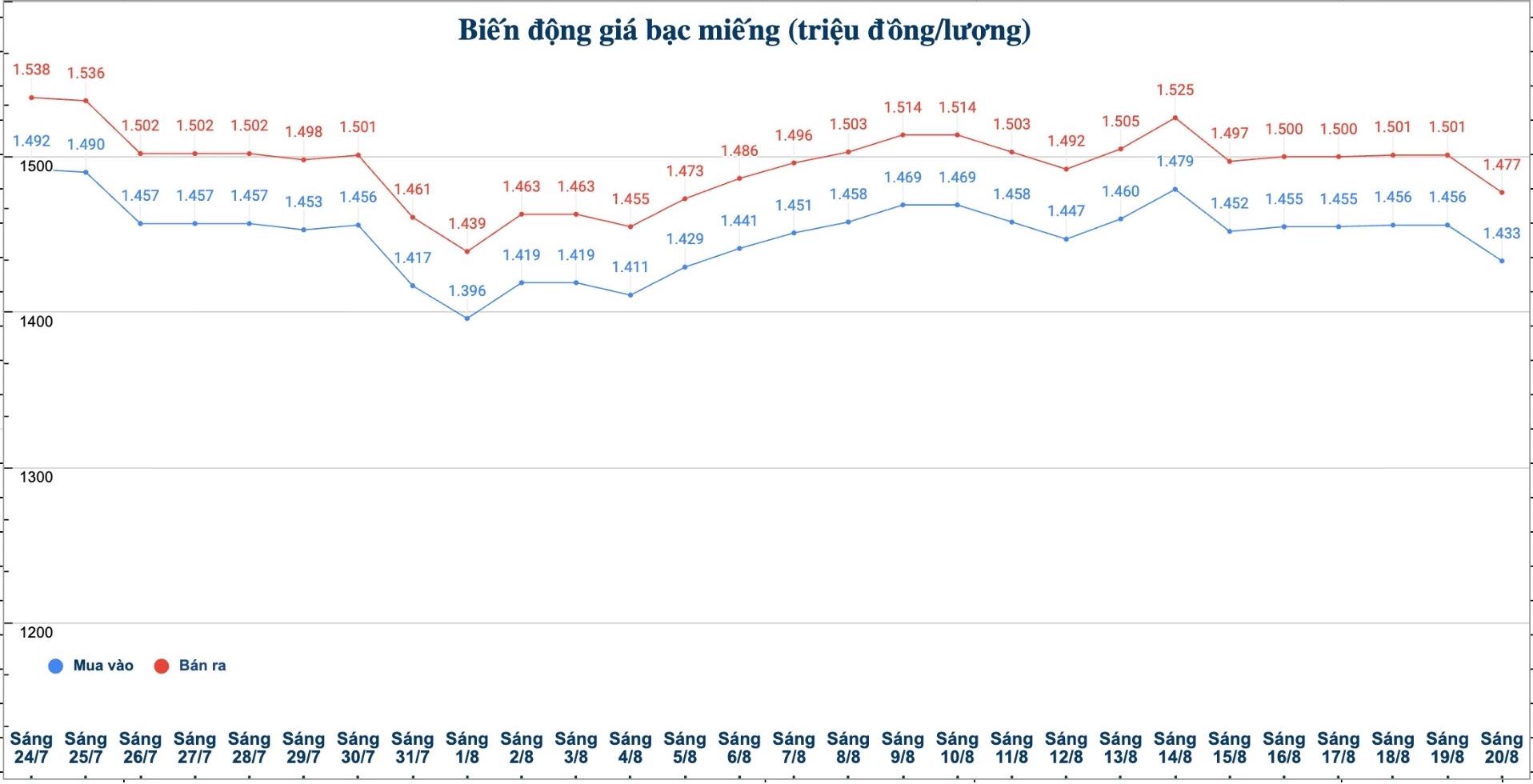

At the same time, the price of 999 silver bars at Phu Quy Jewelry Group was listed at 1.433 - 1.477 million VND/tael (buy - sell); down 23,000 VND/tael for buying and down 24,000 VND/tael for selling compared to yesterday morning.

The price of 999 gold bars at Phu Quy Jewelry Group was listed at 1,433 - 1.477 million VND/tael (buy - sell); down 23,000 VND/tael for buying and down 24,000 VND/tael for selling compared to yesterday morning.

The price of 999 taels of silver (1kg) at Phu Quy Jewelry Group was listed at 38.213 - 39.386 million VND/kg (buy - sell); down 613,000 VND/kg for buying and down 640,000 VND/kg for selling compared to yesterday morning.

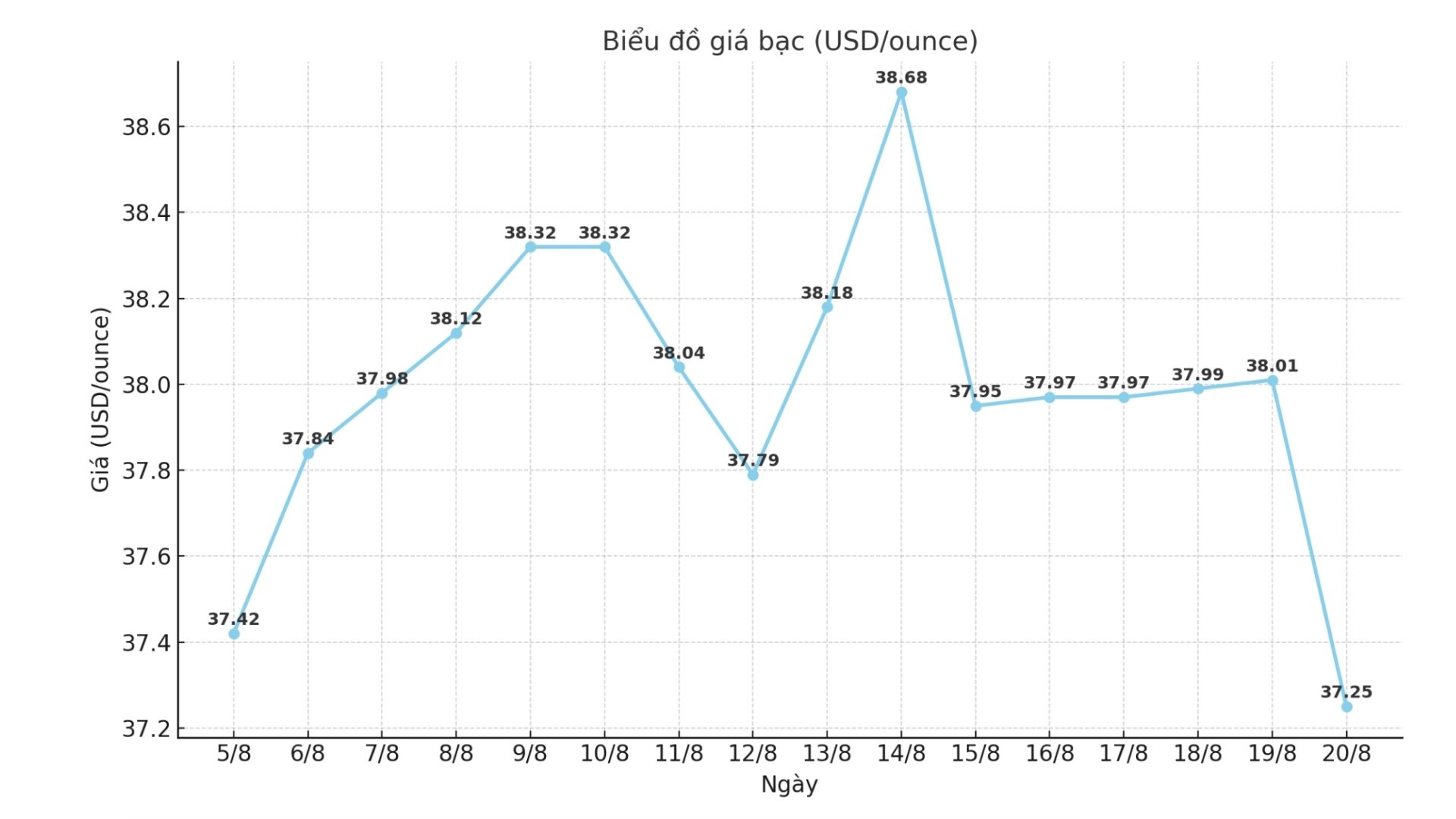

World silver price

On the world market, as of 9:20 a.m. on August 20 (Vietnam time), the world silver price was listed at 37.25 USD/ounce; down 0.76 USD compared to yesterday morning.

Causes and predictions

Silver prices fell sharply. According to senior analyst Christopher Lewis, in the current situation, investors do not have a basis to conduct counterfeit sales.

"The 37.50 USD/ounce zone continues to be an important support level. This was a strong resistance level in the past, so when it became support, buying power became very large" - he said.

However, according to Christopher Lewis, the market is still quite sensitive to the resistance level of $39/ounce.

"If it breaks through this mark, prices could move up to $40 an ounce, but it is unlikely to happen immediately. There will likely be more fluctuations and tensions," said Christopher Lewis.

According to Christopher Lewis, investors should now take advantage of price adjustments to buy, instead of selling for bad. Only when prices fall below $35/ounce will the uptrend be truly risky. He also noted that this is a period when trading volumes often decrease, so moving sideways in the short term is normal.

"The market is also waiting for many important factors: the results of the Jackson Hole Conference, the interest rate decision from the US Federal Reserve (FED), as well as data reflecting silver demand in industry. With these data, the general outlook remains positive, but expectations need to be kept cautious" - Christopher Lewis expressed his opinion.

See more news related to silver prices HERE...