Domestic silver price

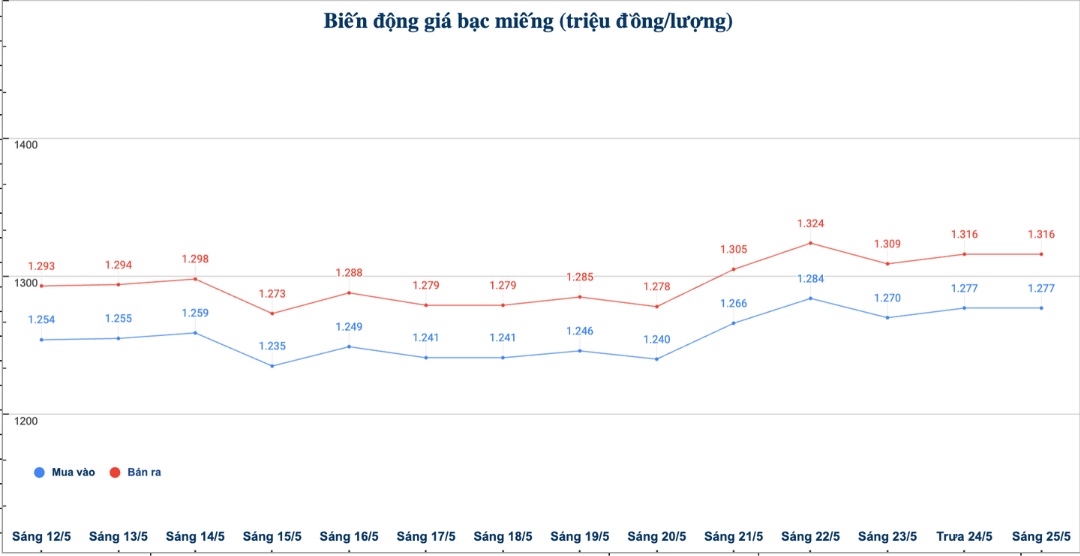

As of 9:00 a.m. on May 25, the price of 999 silver bars at Phu Quy Jewelry Group was listed at VND1.277 - 1.316 million/tael (buy - sell); unchanged in both buying and selling directions compared to early this morning.

The price of 999 gold bars at Phu Quy Jewelry Group was listed at 1.277 - 1.316 million VND/tael (buy - sell); unchanged in both buying and selling directions compared to early this morning.

At the same time, the price of 999 (1kilo) taels at Phu Quy Jewelry Group was listed at 34.053 - 35.093 million VND/kg (buy - sell); unchanged in both buying and selling directions compared to early this morning.

In the trading session last week (morning of May 18, 2025), the price of 999 gold bars (1kilo) at Phu Quy Jewelry Group was listed at 33.093 - 34.106 million VND/kg (buy - sell).

Thus, if buying 999 taels of silver (1kilo) at Phu Quy Jewelry Group on May 18 and selling it this morning (May 25), buyers will lose VND0.053 million (VND53,000/kg).

World silver price

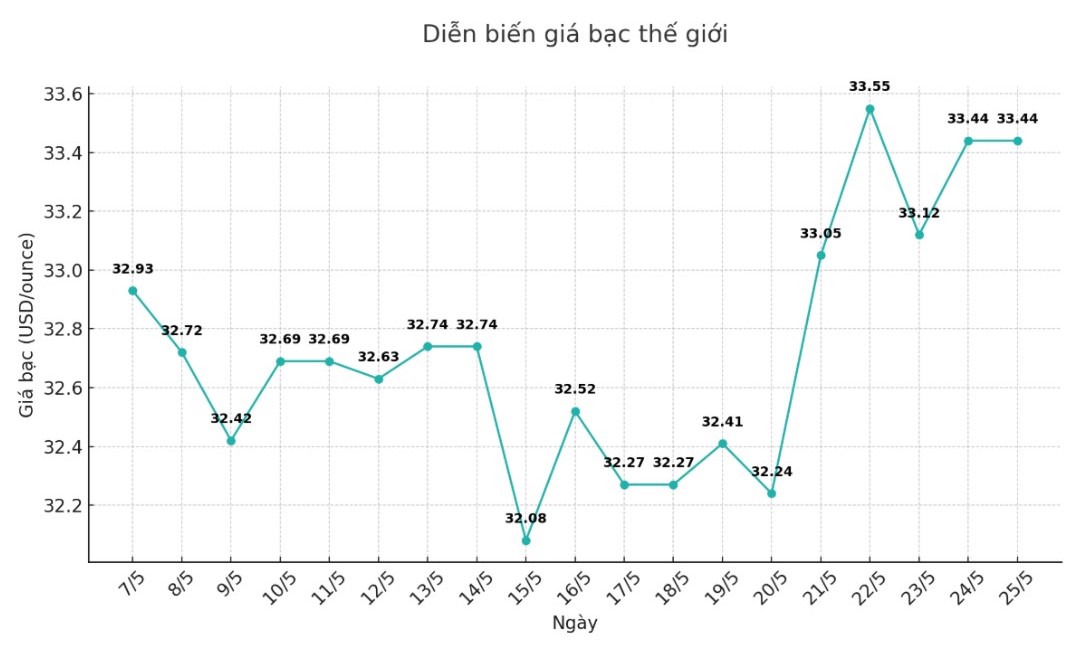

On the world market, as of 9:05 a.m. on May 25 (Vietnam time), the world silver price listed on Goldprice.org was at 33.44 USD/ounce.

Causes and predictions

According to FXStreet, the sluggish USD has supported silver's price increase. The USD Index (DXY), which measures the strength of the greenback against six major currencies, has fallen to its lowest level in more than 3 weeks, around 99.10.

"Technically, the weakening of the US dollar makes silver more attractive to investors," said experts at FXStreet.

The US dollar is under pressure due to growing concerns about financial imbalances in the US, after the House passed a tax cut and spending increase bill proposed by President Donald Trump.

"In addition, escalating trade tensions between the US and the European Union (EU) also contributed to supporting silver prices. In fact, demand for safe-haven assets such as silver is often increasing as global economic risks increase," said experts at FXStreet.

Kitco analyst Jim Wyckoff assessed that July silver futures speculators still have a short-term advantage.

The next target for buyers is to push silver prices above the important resistance level at 34.015 USD/ounce. On the contrary, the sellers are aiming to pull prices below the important support level at 31.78 USD/ounce - the bottom level of May.

The first resistance level for silver prices was at 33.50 USD/ounce, followed by 34.015 USD/ounce. Meanwhile, the current important support levels are 33.00 USD/ounce and 32.74 USD/ounce.

See more news related to silver prices HERE...