Domestic silver price

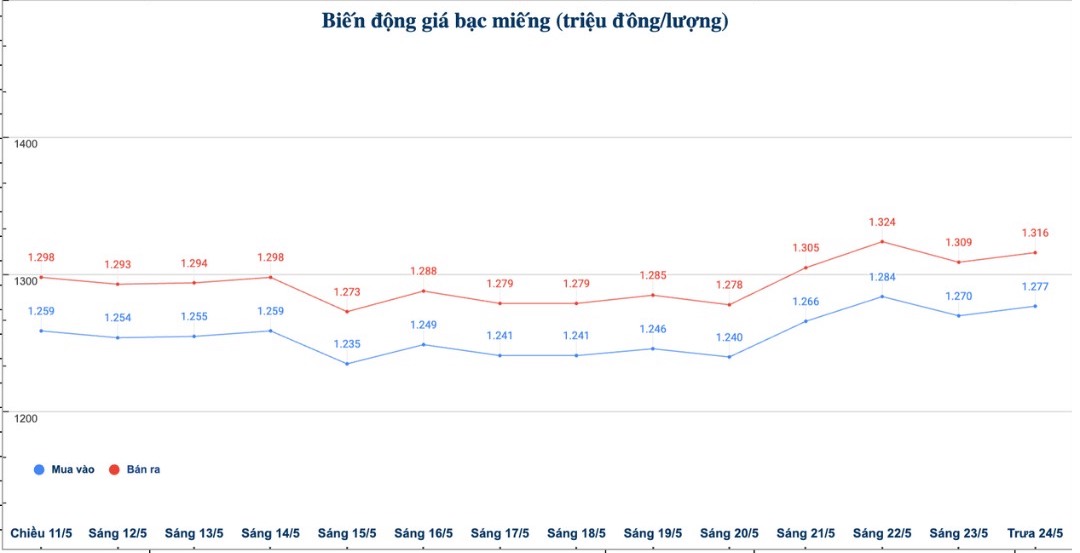

As of 12:55 on May 24, the price of 999 silver bars at Phu Quy Jewelry Group was listed at VND1.277 - 1.316 million/tael (buy - sell); an increase of VND7,000/tael for both buying and selling compared to early this morning.

The price of 999 gold bars at Phu Quy Jewelry Group was listed at 1.277 - 1.316 million VND/tael (buy - sell); an increase of 7,000 VND/tael for both buying and selling compared to early this morning.

At the same time, the price of 999 (1kilo) taels of silver at Phu Quy Jewelry Group was listed at 34.053 - 35.093 million VND/kg (buy - sell); an increase of 169,000 VND/kg for buying and an increase of 187,000 VND/kg for selling compared to early this morning.

World silver price

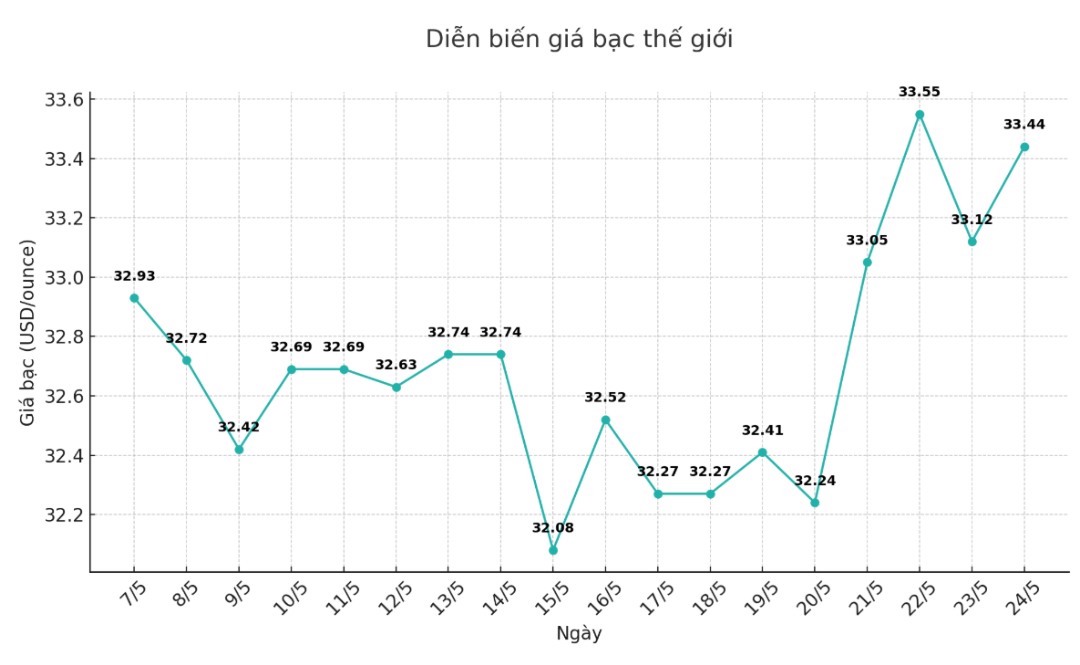

On the world market, as of 12:36 on May 24 (Vietnam time), the world silver price listed on Goldprice.org was at 33.44 USD/ounce; up 0.32 USD compared to early this morning.

Causes and predictions

According to FX Empire, silver prices are driven by the strength of gold and broader interest in safe havens.

James Hyerczyk - market analyst at FX Empire - commented: "With the psychology of finding safe haven assets and gold in a bullish mode, silver still maintains its upward momentum. However, the short-term trend of silver will depend largely on the closing price of today's session".

The yield on the 30-year US Treasury note rose to 5.02% on Friday, showing investors are concerned about the US issuing too many debts. However, the USD index fell sharply again this week, losing 1.35% - the strongest decline since April.

"The fact that yields have increased but the US dollar has weakened shows skepticism about the long-term appeal of US assets. In that context, safe-haven assets such as gold and silver are becoming the priority choice" - James Hyerczyk emphasized.

See more news related to silver prices HERE...