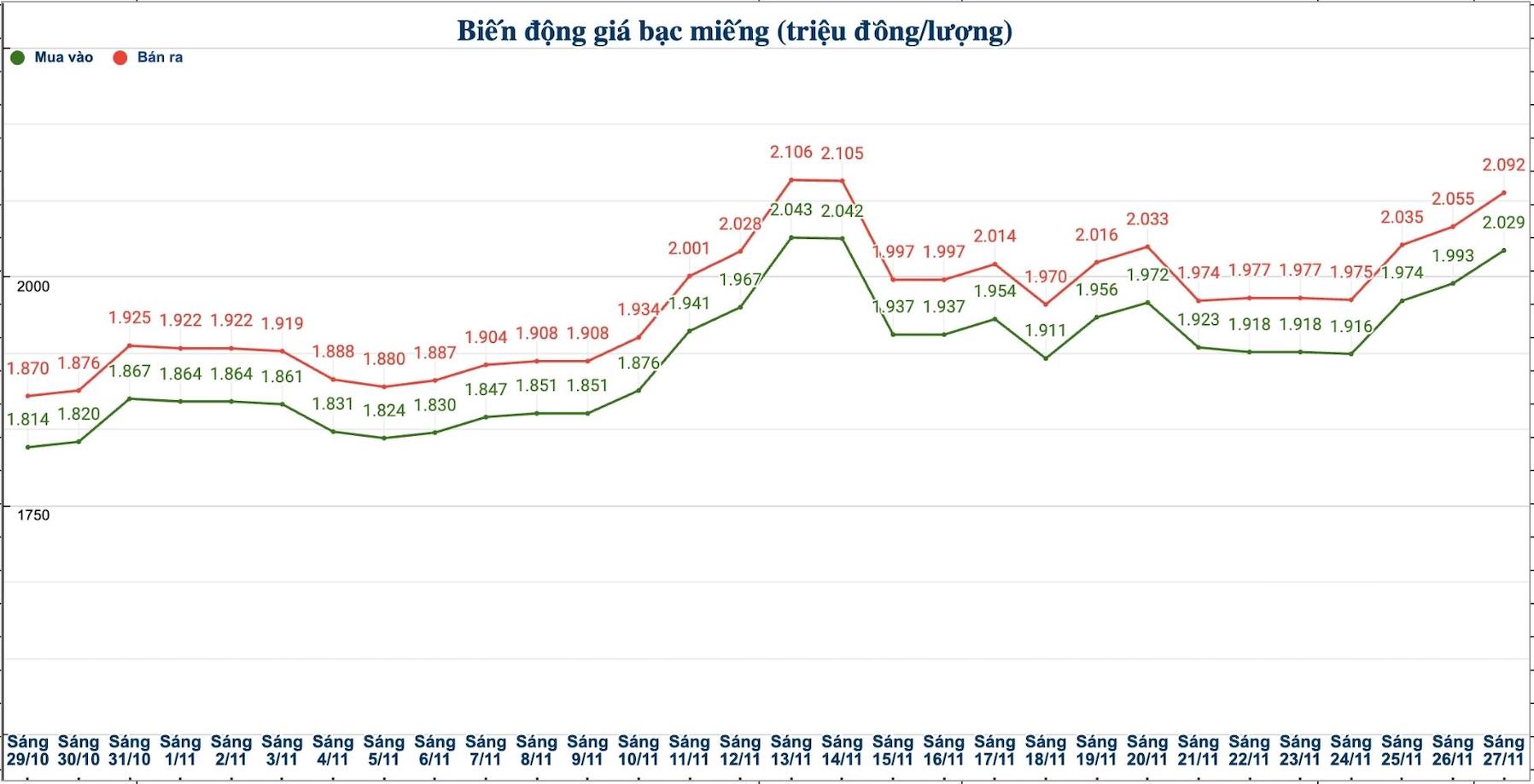

Domestic silver price

As of 9:45 a.m. on November 27, the price of 2024 Ancarat 999 silver bars (1 tael) at Ancarat Metallurgy Company was listed at VND 2.020 - 2.062 million/tael (buy - sell); an increase of VND 26,000/tael in both directions compared to yesterday morning.

The price of 999 Ancarat 999 (1kg) at Ancarat Petrochemical Company was listed at 52.986 - 54.536 million VND/kg (buy - sell); an increase of 622,000 VND/kg for buying and an increase of 622,000 VND/kg for selling compared to yesterday morning.

The price of 999 gold bars of Saigon Thuong Tin Bank Gold and Gemstone One Member Co., Ltd. (Sacombank-SBJ) was listed at VND2.001 - VND2.052 million/tael (buy - sell); increased by VND21,000/tael in both directions compared to yesterday morning.

At the same time, the price of 999 999 coins (1 tael) at Phu Quy Jewelry Group was listed at 2.029 - 2.092 million VND/tael (buy - sell); an increase of 36,000 VND/tael for buying and an increase of 37,000 VND/tael for selling compared to yesterday morning.

The price of 999 taels of silver (1kg) at Phu Quy Jewelry Group was listed at VND54.106 - 55.786 million/kg (buy - sell); an increase of VND 960,000/kg for buying and an increase of VND 987,000/kg for selling compared to yesterday morning.

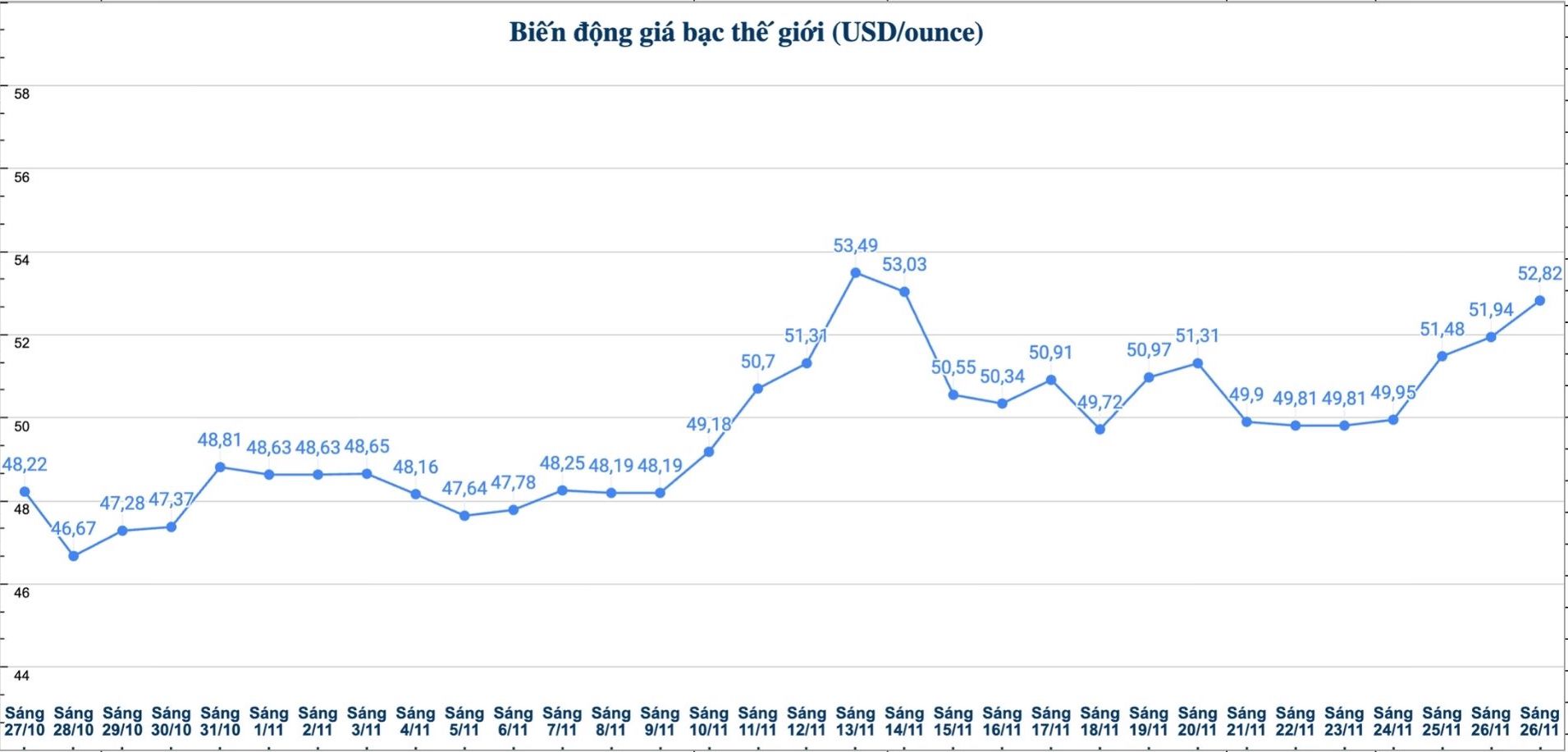

World silver price

On the world market, as of 9:50 a.m. on November 27 (Vietnam time), the world silver price was listed at 52.82 USD/ounce; up 0.85 USD compared to yesterday morning.

Causes and predictions

Silver prices continue to rise. FX Empire financial analyst Arslan Ali said gold prices have risen to a two-week high as the market assessed an 84% chance of the US Federal Reserve cutting interest rates in December, thereby boosting safe-haven demand for precious metals.

"According to the CME FedWatch tool, the probability of the Fed cutting interest rates in December has increased sharply from 50% to 84%, reflecting the reversal of investors' expectations in a short time" - he said.

Along with that, Arslan Ali commented that recent US economic data, including retail sales increasing lower than forecast and the producer price index (PPI) remaining at 2.7%, raised concerns that current monetary policy may be tightening more than necessary, thereby supporting the precious metal's increase.

He added that the weak US dollar (USD) and falling US Treasury yields to a one-month low continue to strengthen the upward trend of gold and silver, as the opportunity cost of holding non-yielding assets decreased.

"Click prices are rising alongside gold, benefiting from a weak US dollar, low yields and expectations of a Fed easing policy, despite fluctuating industrial demand. However, the metal could be adjusted to $51 an ounce if it fails to maintain its upward momentum, said Arslan Ali.

See more news related to silver prices HERE...