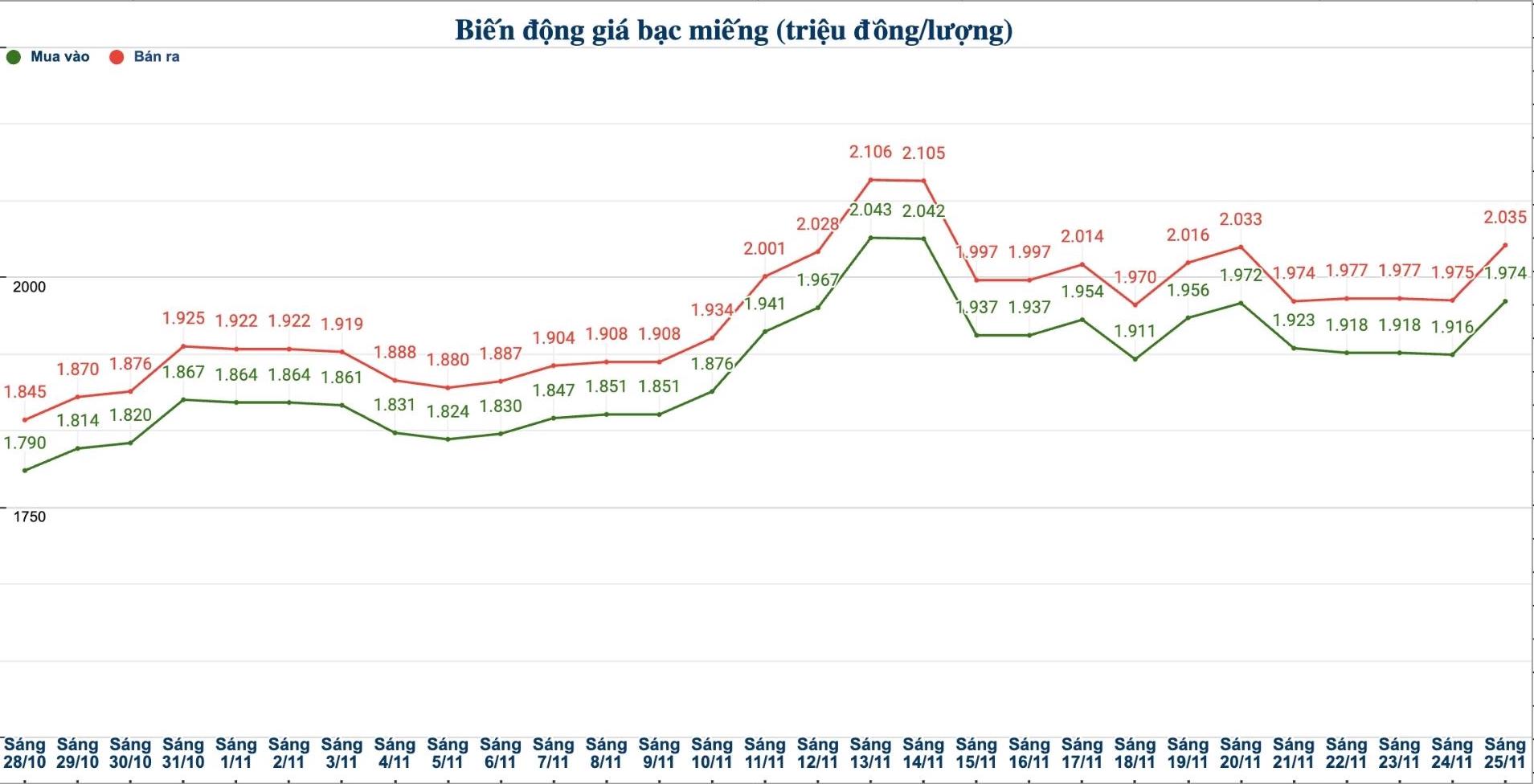

Domestic silver price

As of 9:40 a.m. on November 25, the price of 2024 Ancarat 999 silver bars (1 tael) at Ancarat Metallurgy Company was listed at 1,960 - 2,002 million VND/tael (buy - sell); an increase of 49,000 VND/tael in both directions compared to yesterday morning.

The price of 999 Ancarat 999 (1kg) at Ancarat Petrochemical Company was listed at 51.476 - 52.936 million VND/kg (buy - sell); an increase of 1.266 million VND/kg for buying and an increase of 1.306 million VND/kg for selling compared to yesterday morning.

The price of 999 gold bars of Saigon Thuong Tin Bank Gold and Gemstone One Member Co., Ltd. (Sacombank-SBJ) was listed at 1.950 - 2.001 million VND/tael (buy - sell); increased by 51,000 VND/tael in both directions compared to yesterday morning.

At the same time, the price of 999 999 coins (1 tael) at Phu Quy Jewelry Group was listed at 1.974 - 2.035 million VND/tael (buy - sell); an increase of 58,000 VND/tael for buying and an increase of 60,000 VND/tael for selling compared to yesterday morning.

The price of 999 taels of silver (1kg) at Phu Quy Jewelry Group was listed at 52.639 - 54.266 million VND/kg (buy - sell); an increase of 1.546 million VND/kg for buying and an increase of 1.6 million VND/kg for selling compared to yesterday morning.

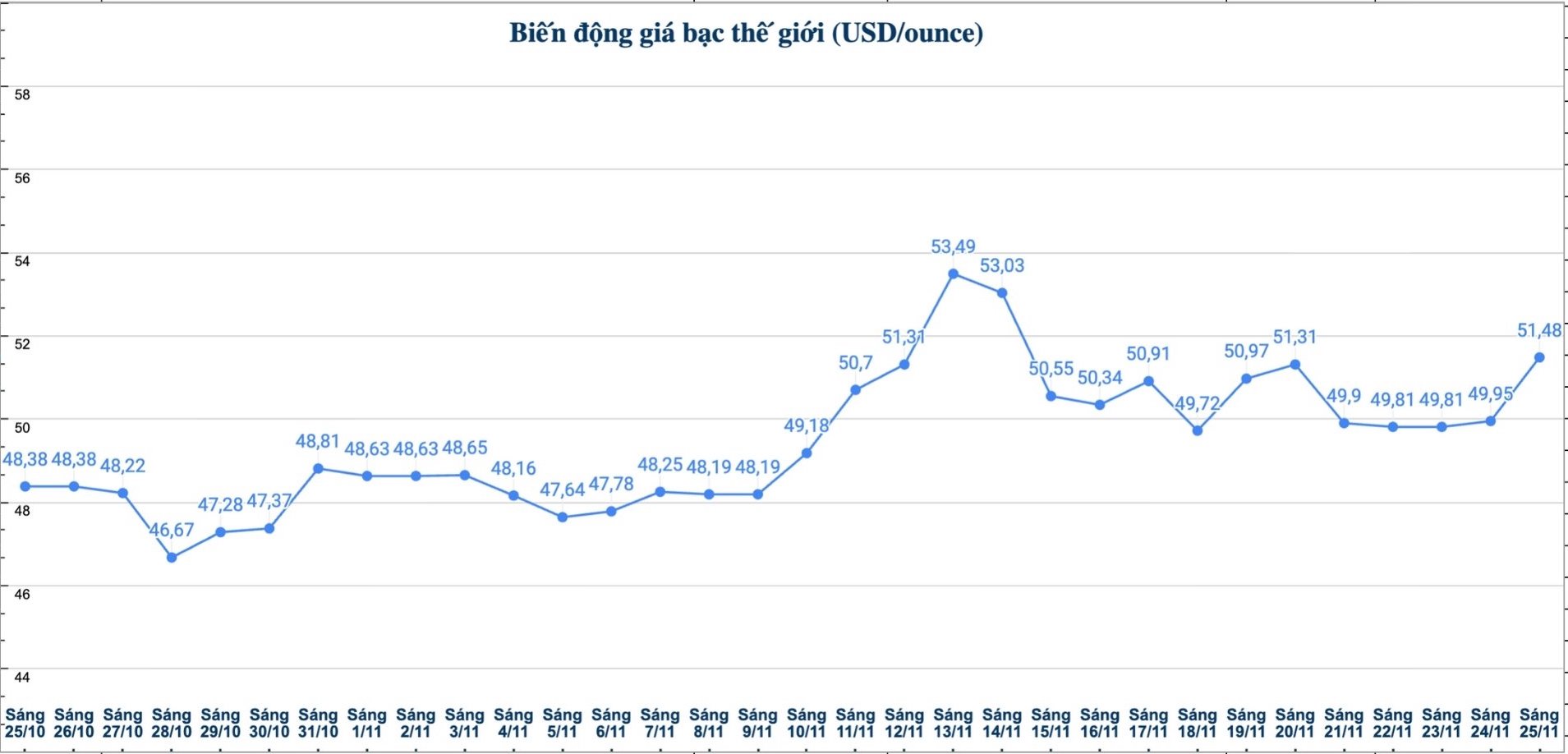

World silver price

On the world market, as of 9:45 a.m. on November 25 (Vietnam time), the world silver price was listed at 51.48 USD/ounce; an increase of 1.53 USD compared to yesterday morning.

Causes and predictions

Silver prices rebounded in the trading session on Tuesday morning. According to FXStreet technical analyst Christian Borjon Valencia, the increased momentum comes from investors expecting that the US Federal Reserve (FED) may start loosening monetary policy in December, causing US Treasury yields to decrease. In addition, falling yields often support non-interest-bearing metals such as silver, helping prices increase sharply.

"In the short term, the trend of silver continues to increase. However, to maintain this momentum, prices need to overcome the important resistance level at 52.46 USD/ounce - the peak set on November 13" - Christian Borjon commented.

Technically, the expert said that if prices break through this resistance zone, the market could move towards 54.46 USD/ounce, the highest peak of the year recorded in mid-October. Then, the next target will be the psychologically important milestone of 55 USD/ounce.

"On the contrary, if silver prices fall below $51/ounce, prices could retreat to $50/ounce" - Christian Borjon expressed his opinion.

See more news related to silver prices HERE...