Domestic silver price

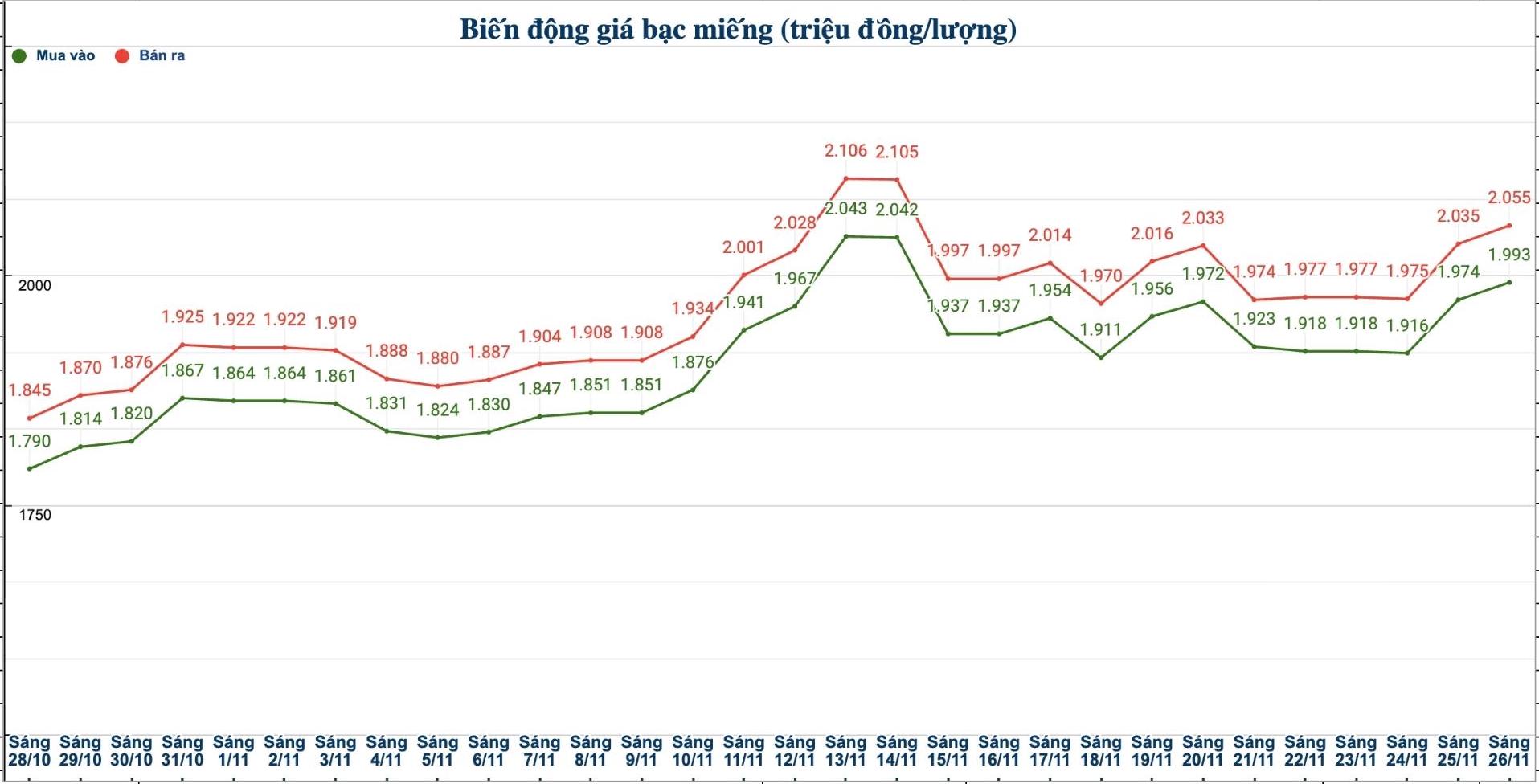

As of 10:05 on November 26, the price of 999 Phuc Loc 999 gold bars (1 tael) of Saigon Thuong Tin Bank Gold and Gemstone One Member Co., Ltd. (Sacombank-SBJ) was listed at 1.980 - 2.031 million VND/tael (buy - sell); increased by 30,000 VND/tael in both directions compared to yesterday morning.

At the same time, the price of 999 999 coins (1 tael) at Phu Quy Jewelry Group was listed at 1.993 - 2.055 million VND/tael (buy - sell); an increase of 19,000 VND/tael for buying and an increase of 20,000 VND/tael for selling compared to yesterday morning.

The price of 999 taels (1kg) at Phu Quy Jewelry Group was listed at 53,146 - 54.799 million VND/kg (buy - sell); an increase of 507,000 VND/kg for buying and an increase of 533,000 VND/kg for selling compared to yesterday morning.

World silver price

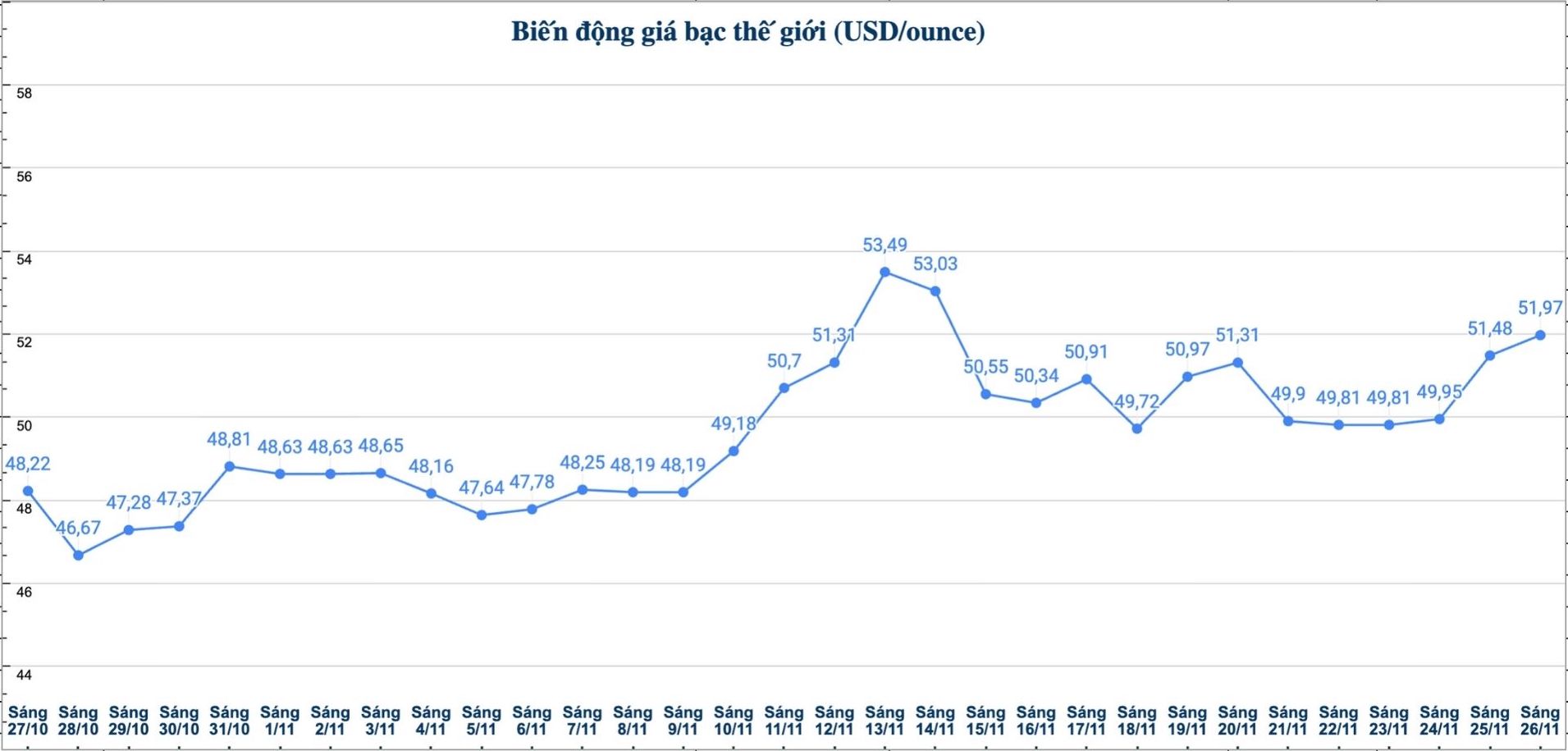

On the world market, as of 10:10 on November 26 (Vietnam time), the world silver price was listed at 51.97 USD/ounce; up 0.49 USD compared to yesterday morning.

Causes and predictions

Silver prices continued to increase strongly in the middle of the week, after surpassing the important level of 51.07 USD/ounce; thanks to the increase in gold prices and the weakening of the US dollar (USD). Although the rally is not a big leap, it is more stable, giving investors confidence in defending their buying position, according to FX Empire precious metals analyst James Hyerczyk.

"Traders are looking up to 52.47 USD/ounce; if prices surpass this level, silver could increase more strongly instead of just fluctuating slightly, moving sideways," he said.

James Hyerczyk said the USD is still anchored near last week's high, but has fallen slightly by about 0.17%, breaking the bottom 3 days ago. "This weakness of the US dollar is not enough to push silver prices up sharply, but it helps ease pressure from the US dollar, which has held silver prices back for many days," the expert said.

Regarding external factors, James Hyerczyk said that the market continues to expect interest rates to be cut by the US Federal Reserve (FED) in December, with a probability of about 81%.

"These signals support investor sentiment, even with fluctuating economic data," he said.

See more news related to silver prices HERE...