Domestic silver price

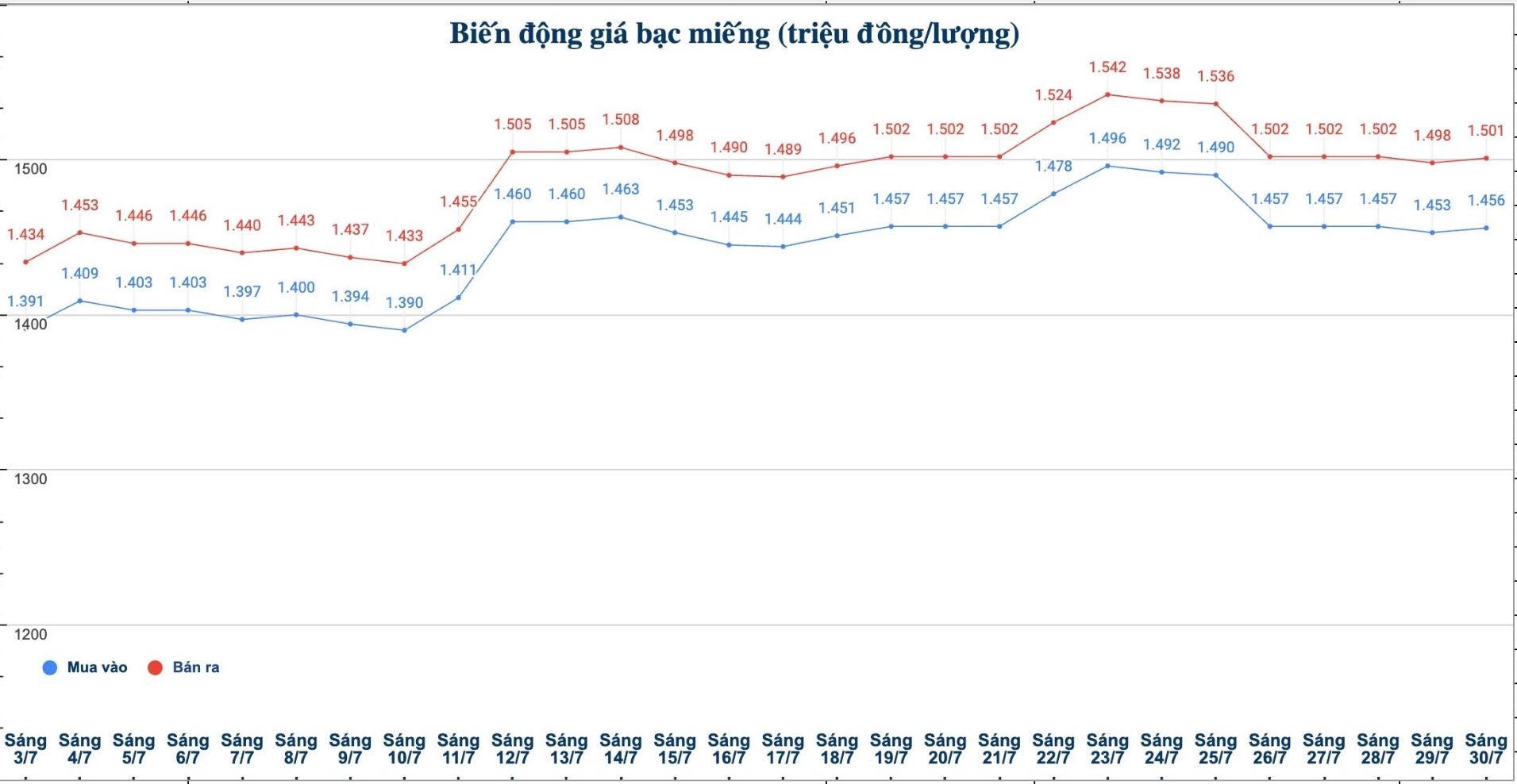

As of 9:25 a.m. on July 30, the price of 999 silver bars at Phu Quy Jewelry Group was listed at VND1.456 - VND1.501 million/tael (buy - sell); an increase of VND3,000/tael for both buying and selling compared to yesterday morning.

The price of 999 gold bars at Phu Quy Jewelry Group was listed at 1.456 - 1.501 million VND/tael (buy - sell); an increase of 3,000 VND/tael for both buying and selling compared to yesterday morning.

At the same time, the price of 999 taels of silver (1kg) at Phu Quy Jewelry Group was listed at 38,826 - 40,026 million VND/kg (buy - sell); an increase of 80,000 VND/kg in both buying and selling directions compared to yesterday morning.

World silver price

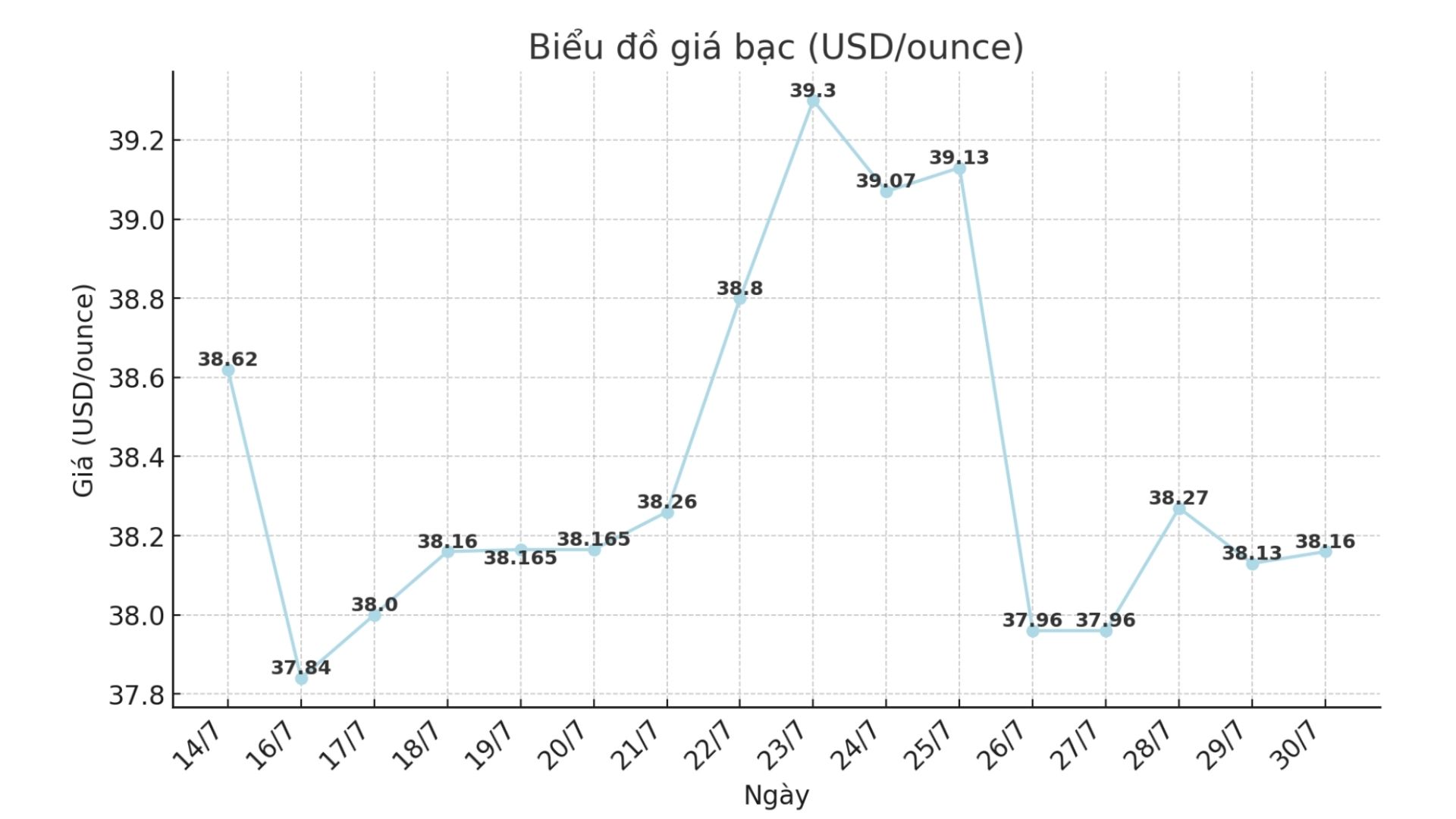

On the world market, as of 9:20 a.m. on July 30 (Vietnam time), the world silver price was listed at 38.16 USD/ounce.

Causes and predictions

The silver market has not determined a clear trend as the whole market is waiting for important signals from the Federal Open Market Committee (FOMC) meeting today (Wednesday).

Senior market analyst Christopher Lewis said that traders are closely watching how Federal Reserve Chairman Jerome Powell will speak, and that is why cautious sentiment is permeating the market - which is very likely to fluctuate strongly during the current period.

"After a sharp increase before, silver prices are now stagnant to accumulate and adjust. In my opinion, the upcoming market will need to answer the important question: Will there be enough buyers to continue pushing prices up, or will there be a decrease to 37.50 USD/ounce - which used to be a strong resistance zone and has now become a support zone" - Christopher Lewis said.

On the other hand, the expert said that $40/ounce is an important psychological milestone, followed by many people and may be related to options trading.

"Therefore, I lean towards observation and wait for opportunities. The question is whether to look for points in the order right before the FOMC meeting - and in my opinion, not. If after the meeting, the price reacts negatively but bounces back to near the 37.50 USD/ounce zone, I will be interested" - Christopher Lewis gave his opinion.

In the long term, he believes that silver could surpass $40/ounce and aim for $42.50/ounce.

"However, if prices penetrate $37.50 an ounce, the market will need to reassess the situation, although there are still many potential support zones below," Christopher Lewis added.

See more news related to silver prices HERE...