Domestic silver price

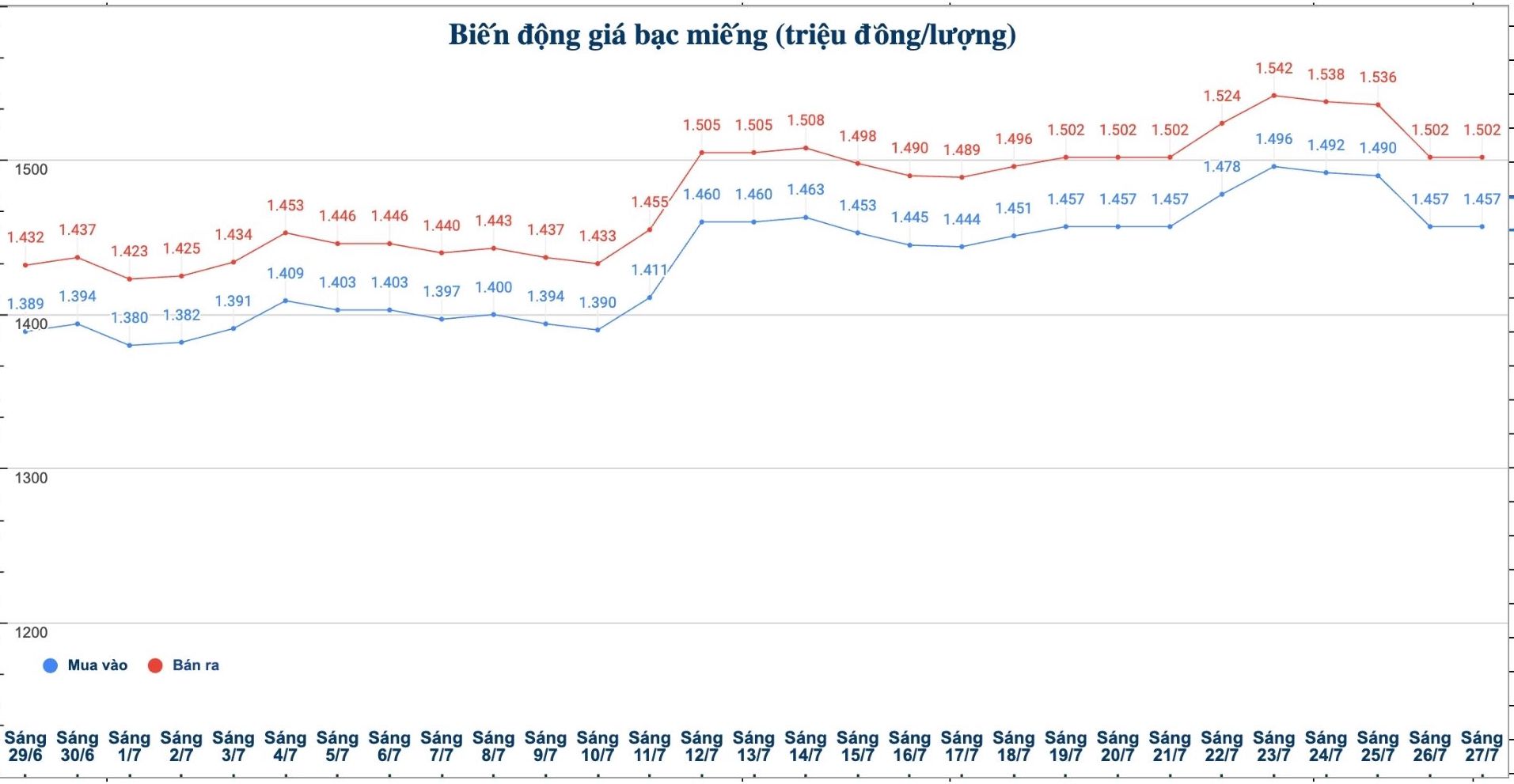

As of 9:30 a.m. on July 27, the price of 999 silver bars at Phu Quy Jewelry Group was listed at VND1.457 - 1.502 million/tael (buy - sell); unchanged in both buying and selling directions compared to yesterday morning.

The price of 999 gold bars at Phu Quy Jewelry Group was listed at 1.457 - 1.502 million VND/tael (buy - sell); unchanged in both buying and selling directions compared to yesterday morning.

At the same time, the price of 999 taels of silver (1kg) at Phu Quy Jewelry Group was listed at 38.853 - 40.053 million VND/kg (buy - sell); unchanged in both buying and selling directions compared to yesterday morning.

In the trading session of the previous 2 months (morning of May 27, 2025), the price of 999 taels of silver (1kg) at Phu Quy Jewelry Group was listed at 33.919 - 34.959 million VND/kg (buy - sell).

Thus, if buying 999 taels of silver (1kg) at Phu Quy Jewelry Group on May 27 and selling it this morning (July 27), buyers will make a profit of VND 3.894 million/kg.

World silver price

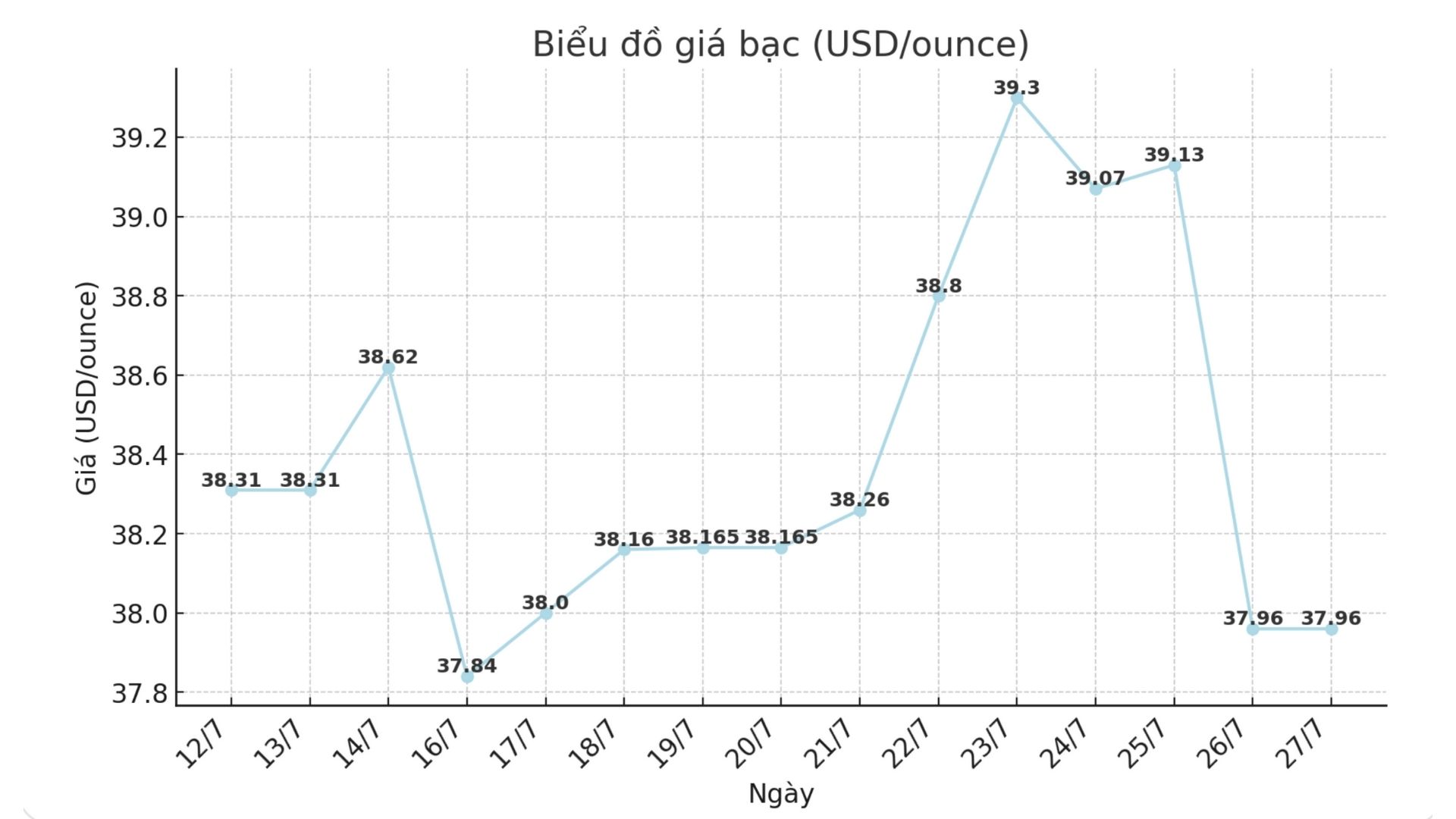

On the world market, as of 9:30 a.m. on July 27 (Vietnam time), the world silver price was listed at 37.96 USD/ounce; unchanged from yesterday morning.

Causes and predictions

Despite a strong start to the week, both gold and silver ended the week in a state of stagnation when they could not maintain a strong increase.

Gold prices surpassed $3,400/ounce at the beginning of the week, but market sentiment has since changed, dragging prices down to near the support level of $3,300/ounce. Similarly, silver prices once hit a 14-year high of $29.527/ounce on Tuesday, but are now retreating to check the support level around $38/ounce.

Although gold prices are struggling, many experts still have high expectations for silver.

Christian Magoon - CEO of Amplify ETFs, the SILJ fund manager specializing in investing in small-scale silver mining companies - said that if the US achieves favorable trade agreements, this will help the manufacturing sector become more stable, thereby boosting demand for silver in the industry.

Meanwhile, senior market analyst Christopher Lewis said that silver prices remain in a long-term growth trend, despite short-term fluctuations and correction pressure near resistance zones.

"In the short term, prices may fluctuate, but in the long term, the trend is still up. Therefore, I support the buying strategy when prices are adjusted, not fake sales. If it breaks above $40 an ounce, silver could head toward $42.50 an ounce, Christopher Lewis said.

See more news related to silver prices HERE...