Domestic silver price

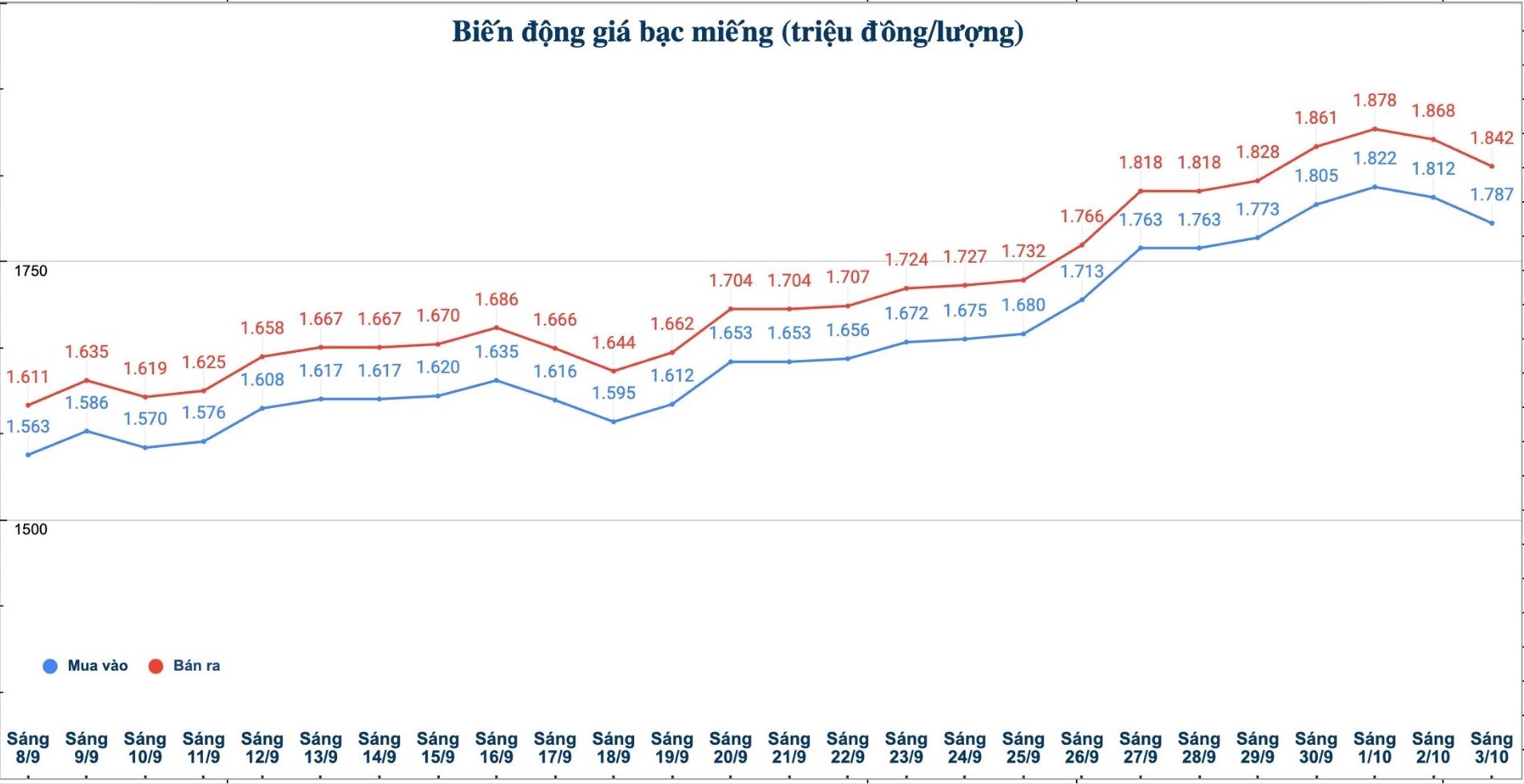

As of 10:40 a.m. on October 3, the price of 2024 Ancarat 999 silver bars (1 tael) at Ancarat Metallurgy Company was listed at 1.814 - 1.852 million VND/tael (buy - sell); down 18,000 VND/tael in both directions compared to yesterday morning.

The price of 999 Ancarat 999 (1kg) of silver bars at Ancarat Metallurgy Company was listed at 47.076 - 48.326 million VND/kg (buy - sell); down 480,000 VND/kg in both directions compared to yesterday morning.

999 Phuc Loc Gold bars (1 tael) of Saigon Thuong Tin Bank Gold and Gemstone Company Limited (Sacombank-SBJ) are listed at VND1.809 - 1.854 million/tael (buy - sell); down VND20,000/tael for buying and down VND15,000/tael for selling compared to yesterday morning.

At the same time, the price of 999 999 coins (1 tael) at Phu Quy Jewelry Group was listed at 1.787 - 1.842 million VND/tael (buy - sell); down 25,000 VND/tael for buying and down 26,000 VND/tael for selling compared to yesterday morning (October 2).

The price of 999 taels of silver (1kg) at Phu Quy Jewelry Group was listed at 47.653 - 49.119 million VND/kg (buy - sell); down 666,000 VND/kg for buying and down 694,000 VND/kg for selling compared to yesterday morning (October 2).

World silver price

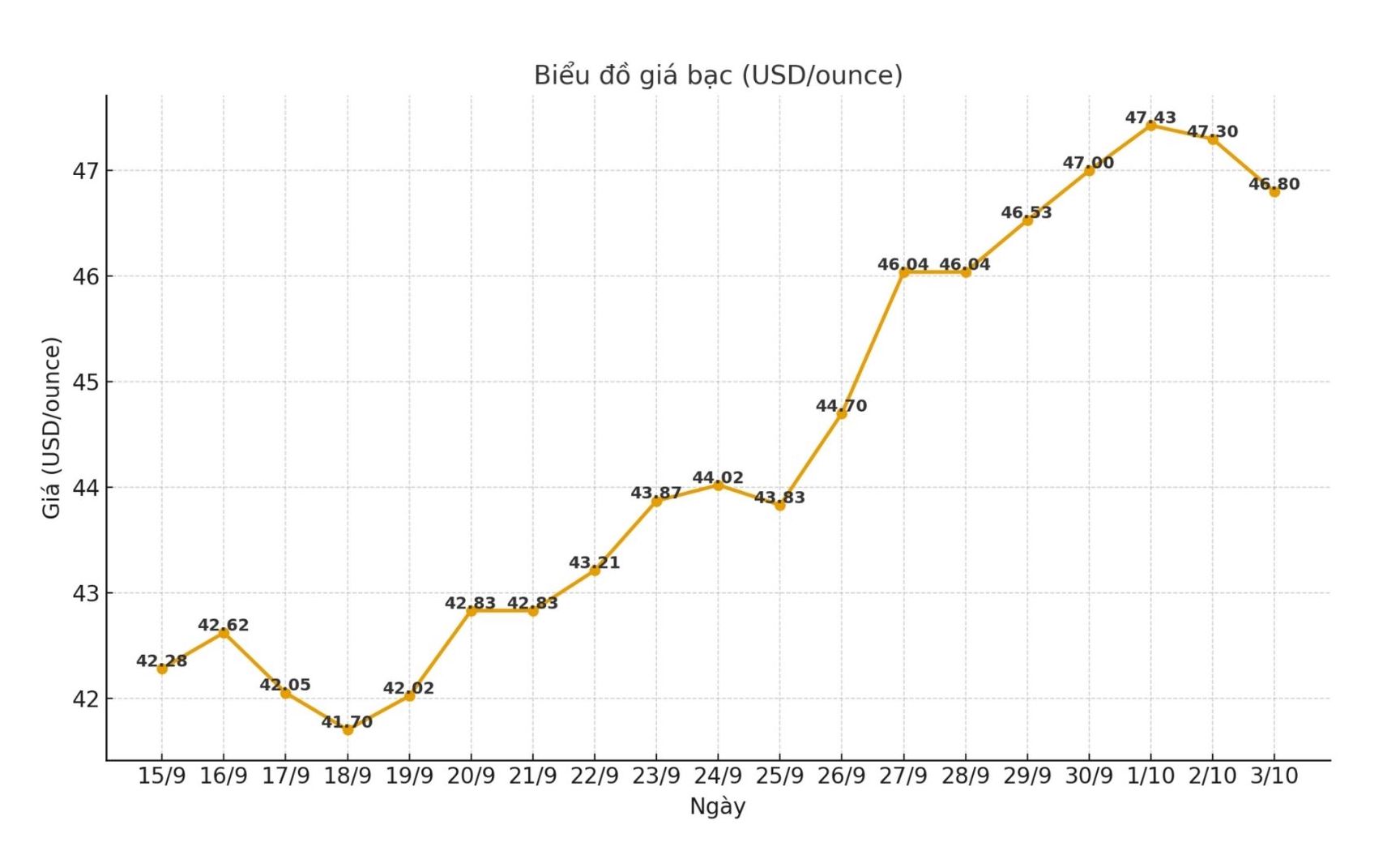

On the world market, as of 9:40 a.m. on October 3 (Vietnam time), the world silver price was listed at 46.8 USD/ounce; down 0.5 USD compared to yesterday morning.

Causes and predictions

The silver market almost repeated yesterday's session range. According to analyst James Hyerczyk, this sign shows that investors are temporarily waiting, but there is also the potential for strong fluctuations when new information appears.

The expert believes that in the long term, silver still has the potential to increase in price. "Instability from the policy of the US Federal Reserve (FED) continues to be the driving force for raising the price of precious metals" - he said.

He added that the US government's closure has delayed many important economic reports, such as unemployment claims and non-farm payrolls. Instead, the market is forced to rely on private data and technical signals. ADP report shows businesses unexpectedly cutting 32,000 jobs in September - the second consecutive month of decline - thereby reinforcing expectations that the Fed will soon cut interest rates.

As a result, US Treasury yields cooled down, gold bounced to near a record of $3,895.50/ounce and dragged silver up. Strong flows of ETFs into gold also supported silver prices, which were considered to be "following" the gold trend with higher sensitivity.

"In addition to the impact of gold, silver is also supported by strong industrial demand for electric vehicles and solar energy, especially from China. Meanwhile, supply continues to fall for the fifth consecutive year, further creating long-term upward pressure on prices," said James Hyerczyk.

Technically, he believes the $47.83 threshold is an important milestone to overcome to pave the way to the $49.8/50/ounce range. On the other hand, if it falls below 46.82 USD/ounce, the price could retreat to 45.81 USD/ounce, even 44.22 USD/ounce.

"In the short term, buyers still have the advantage, but the uptrend is only consolidated when prices clearly break out above 47.83 USD and gold remains at a record peak, in the context of the USD continuing to weaken" - James Hyerczyk expressed his opinion.

See more news related to silver prices HERE...