Domestic silver price

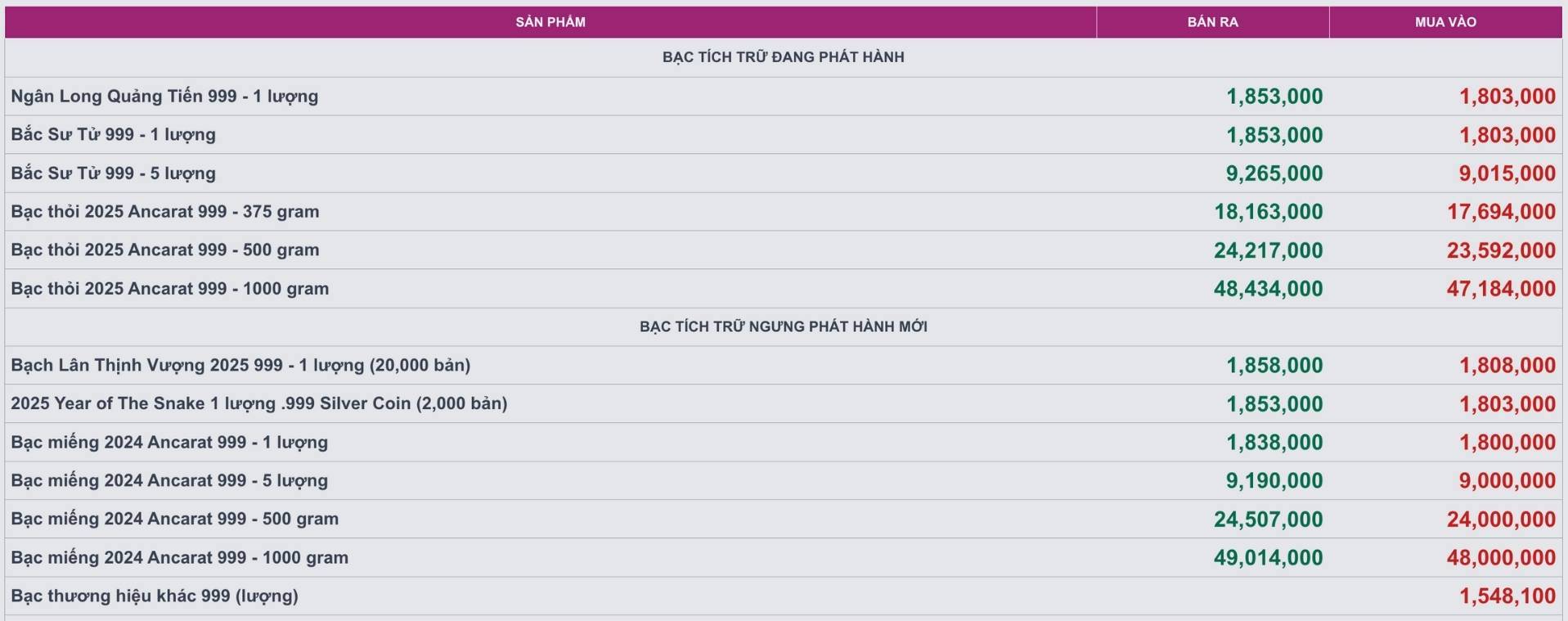

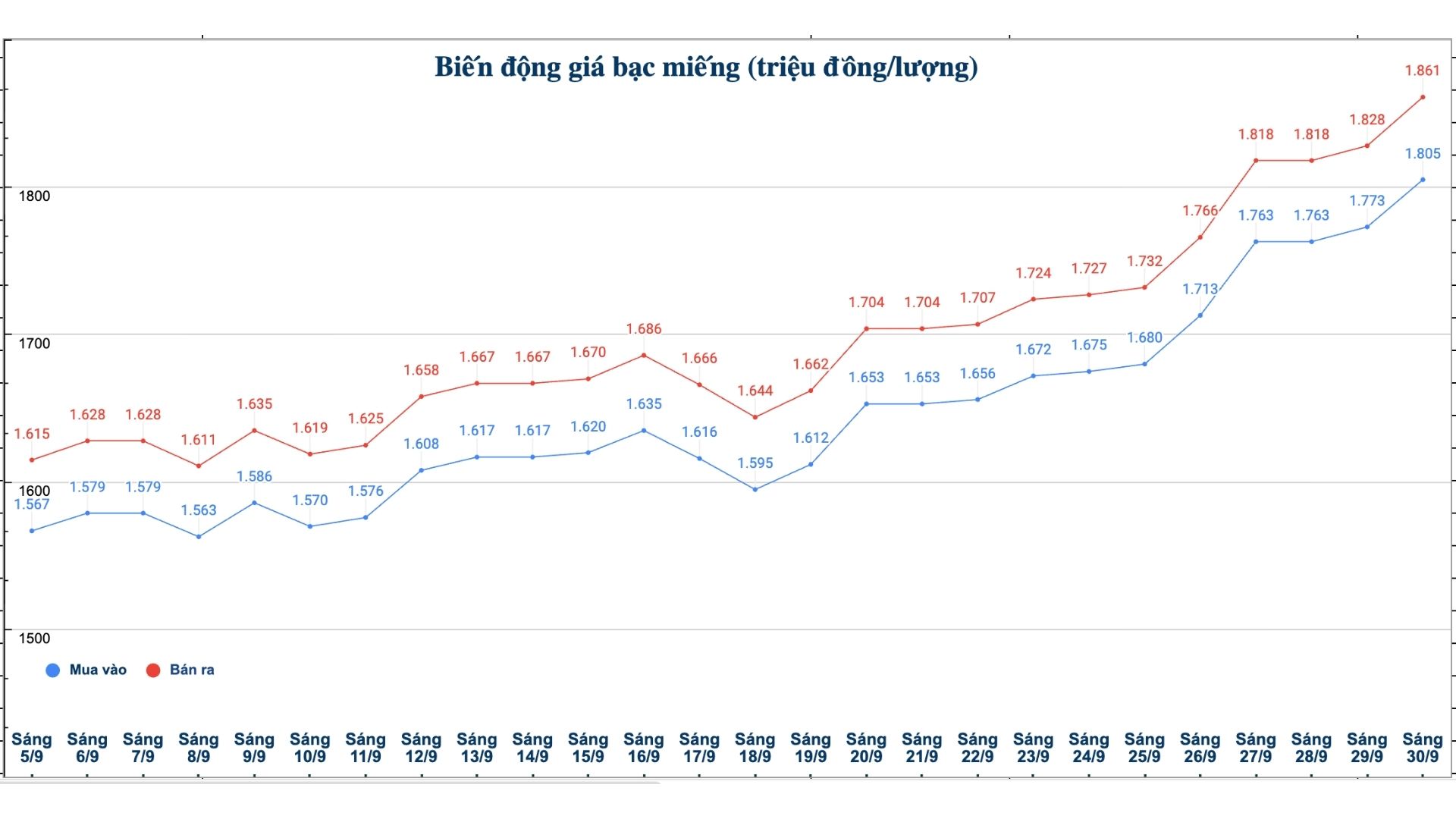

As of 10:55 on September 30, the price of 2024 Ancarat 999 silver bars (1 tael) at Ancarat Metallurgy Company was listed at VND1,800 - 1.838 million/tael (buy - sell); an increase of VND28,000/tael in both directions compared to yesterday morning.

The price of 999 Ancarat 999 (1kg) at Ancarat Petrochemical Company was listed at 47,184 - 48.434 million VND/kg (buy - sell); an increase of 648,000 VND/kg for buying and an increase of 748,000 VND/kg for selling compared to yesterday morning.

Saigon Thuong Tin Bank Gold and Gemstone One Member Co., Ltd. (Sacombank-SBJ) listed the price of 999 Golden Rooster silver bars (1 tael) at 1.815 - 1.855 million VND/tael (buy - sell).

At the same time, the price of 999 999 coins (1 tael) at Phu Quy Jewelry Group was listed at 1.805 - 1.861 million VND/tael (buy - sell); an increase of 32,000 VND/tael for buying and an increase of 33,000 VND/tael for selling compared to yesterday morning (September 29).

The price of 999 taels of silver (1kg) at Phu Quy Jewelry Group was listed at 48.133 - 49.626 million VND/kg (buy - sell); an increase of 854,000 VND/kg for buying and an increase of 880,000 VND/kg for selling compared to yesterday morning (September 29).

World silver price

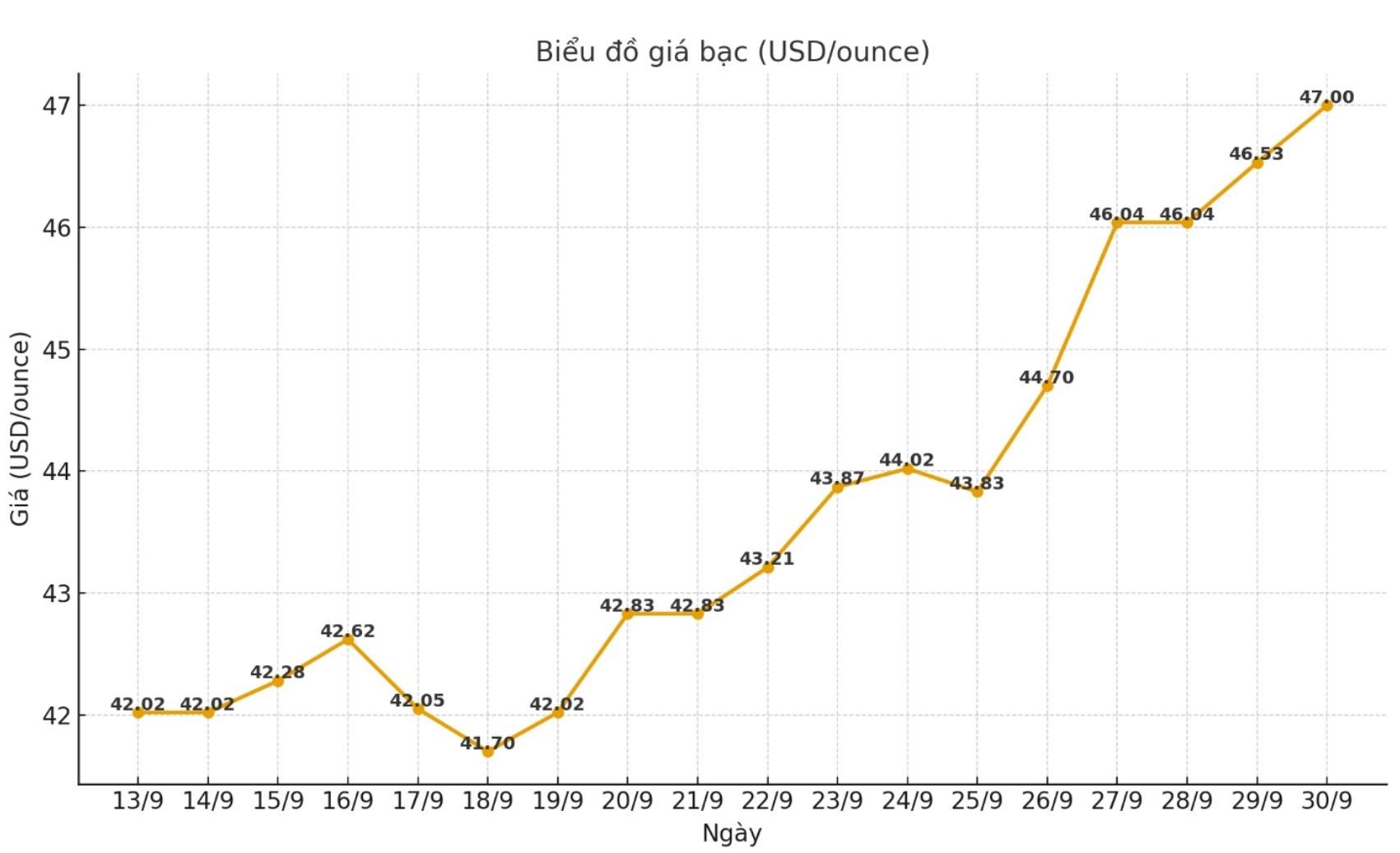

On the world market, as of 10:55 a.m. on September 30 (Vietnam time), the world silver price was listed at 47 USD/ounce; up 0.47 USD compared to yesterday morning.

Causes and predictions

The silver market opened the new week with impressive gains, as spot prices soared to $47 an ounce - the highest level in 14 years. According to analyst James Hyerczyk, this is a strong step forward and the important resistance level is currently only around 49.81 USD/ounce, with a large psychological target of 50 USD/ounce.

The expert said that the main driver comes from expectations that the US Federal Reserve (FED) will cut interest rates. "The market is pricing in a 90% chance of a 25 basis point cut in October and a 66% chance of a further cut in December. This development has reduced the USD index, making silver cheaper for international buyers, thereby boosting demand," said James Hyerczyk.

He added that silver supply is also in a state of prolonged scarcity. This is the fifth consecutive year that silver has fallen into a situation of a structural deficit. Along with that, demand from solar energy, electric vehicles and electronic equipment industries continues to increase, helping silver become the focus of the precious metal market.

Since the beginning of the year, silver prices have increased by about 53%, exceeding the 49% increase of gold.

Technically, James Hyerczyk believes that silver prices still have the potential to increase further. There is currently no clear resistance zone to the 49.8 - 50 USD/ounce area. If prices fall, $44.2/ounce is considered the first bottleneck to prevent prices from falling further. Subsequent support levels are around $41.1 an ounce, $40.7 an ounce, and $40 an ounce.

See more news related to silver prices HERE...