Domestic silver price

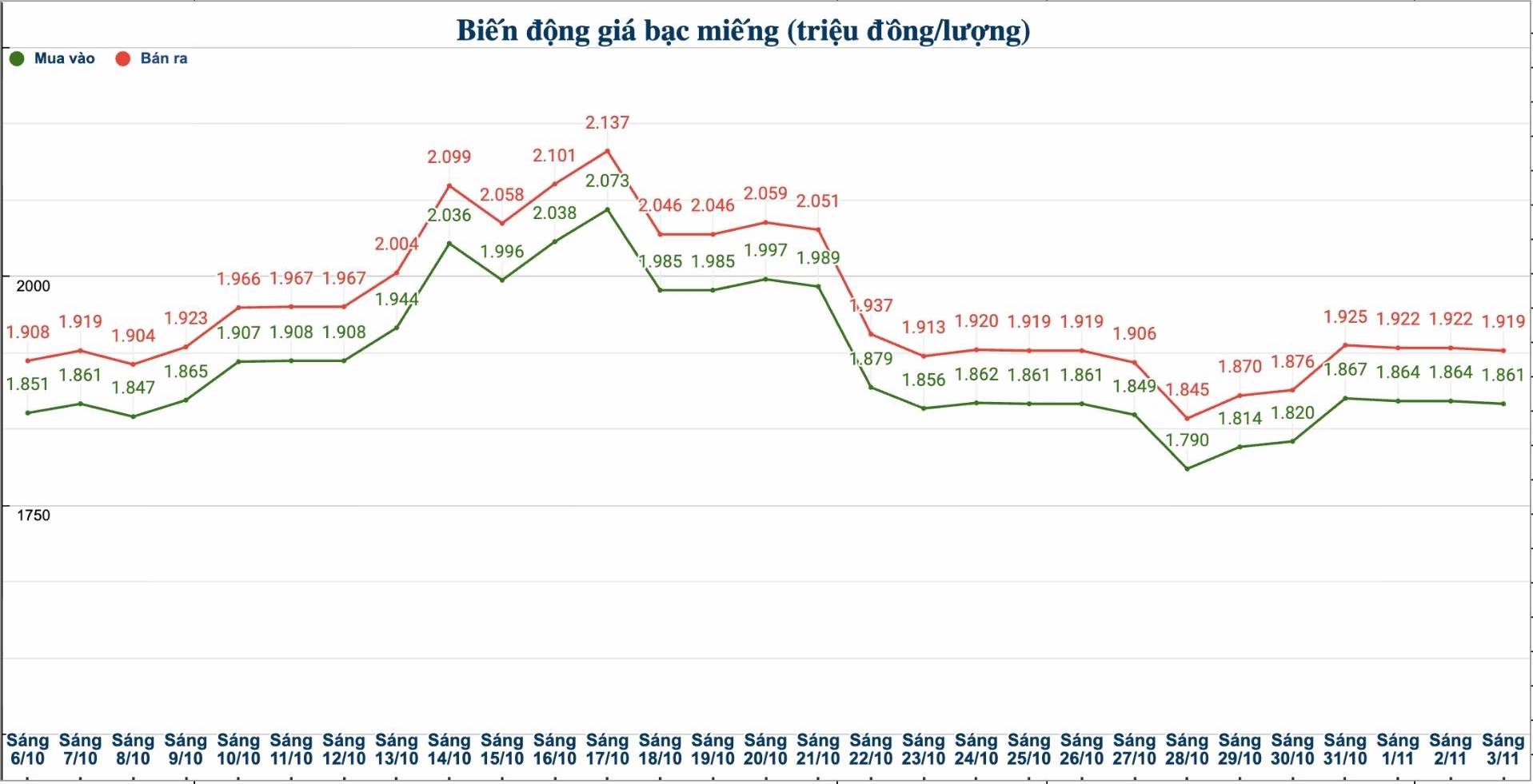

As of 9:25 a.m. on November 3, the price of 2024 Ancarat 999 silver bars (1 tael) at Ancarat Metallurgy Company was listed at VND1.859 - 1.901 million/tael (buy - sell); down VND4,000/tael in both directions compared to yesterday morning.

The price of 999 Ancarat 999 (1kg) at Ancarat Petrochemical Company was listed at 48.884 - 50.244 million VND/kg (buy - sell); down 56,000 VND/kg for buying and down 106,000 VND/kg for selling compared to yesterday morning.

The price of 999 gold bars of Saigon Thuong Tin Bank Gold and Gemstone Company Limited (Sacombank-SBJ) was listed at 1.848 - 1.896 million VND/tael (buy - sell); down 33,000 VND/tael in both directions compared to yesterday morning.

At the same time, the price of 999 coins (1 tael) at Phu Quy Jewelry Group was listed at 1.861 - 1.919 million VND/tael (buy - sell); down 3,000 VND/tael in both directions compared to yesterday morning.

The price of 999 taels of silver (1kg) at Phu Quy Jewelry Group was listed at 49.679 - 51.226 million VND/kg (buy - sell); down 27,000 VND/kg in both directions compared to yesterday morning.

World silver price

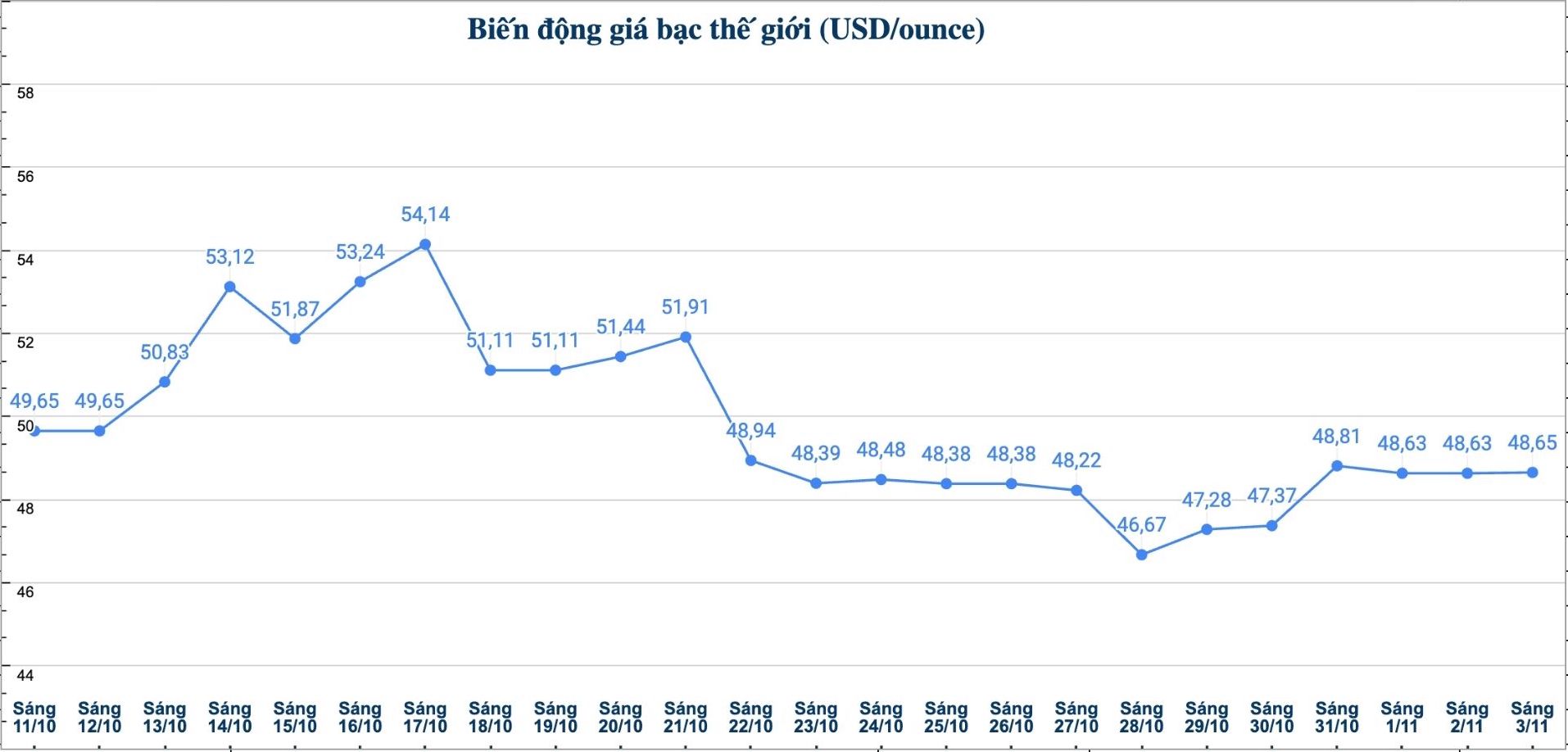

On the world market, as of 9:30 a.m. on November 3 (Vietnam time), the world silver price was listed at 48.65 USD/ounce.

Causes and predictions

According to precious metals analyst James Hyerczyk at FX Empire, silver prices are still under pressure, showing that sellers continue to control the market and the short-term trend is still down.

He said that the US Federal Reserve (FED) has cut interest rates by another 25 basis points, bringing the interest rate to about 3.75% - 4.00%. The decision initially supported silver and other precious metals, but Chairman Jerome Powell did not commit to further easing policy. According to James Hyerczyk, this cautious attitude has caused unstable market sentiment.

"The probability of the Fed continuing to cut interest rates in December has dropped sharply from 91% to 63%, dragging the US dollar and bond yields higher - two unfavorable factors for non-yielding metals such as silver," the expert said.

James Hyerczyk added that the metal still lacks momentum alone from actual demand. In particular, cash flow is returning to stocks, limiting the increase of silver.

However, according to James Hyerczyk, in the long term, silver is still supported by scarce supply and high industrial demand in the fields of solar energy, electric vehicles and artificial intelligence (AI).

"However, in the short term, the market is still dominated by the Fed's monetary policy, bond yields and global risk sentiment. With upward signals still unclear and resistance zone not broken, waiting for lower entry points could be a safer option for investors," James Hyerczyk analyzed.

See more news related to silver prices HERE...