According to CBS News, silver prices have increased steadily over the past 5 years, from about 20 USD/ounce in 2020 to nearly 50 USD/ounce today. In particular, the price increase in 2025 is considered a remarkable milestone when silver surpassed the historical peak for the first time.

This development reflects the trend of investors rushing into precious metals amid prolonged inflation, increased demand from central banks and the psychology of seeking safe-haven assets during times of economic instability.

According to experts, in the historical context, silver reaching 100 USD/ounce is completely feasible.

Mr. Brett Elliott - Marketing Director at the US Precious metals Exchange (APMEX) - commented: "If adjusted according to inflation, the price increase in 1980 is equivalent to nearly 200 USD/ounce today. From that perspective, it is entirely realistic for silver to reach $100 an ounce.

Meanwhile, Mr. Brand Aversano - Director of The Alloy Market precious metals trading company - emphasized that the current supply factor could speed up this price increase process.

"As physical demand for silver increases, including central banks buying silver as kilo, available supply and production capacity decline. This scarcity could push silver above the $100/ounce mark in this rally," said Brandon Aversano.

Similarly, Mr. Ben Nadelstein - Head of content at Monetary Metals gold exchange - emphasized that silver reaching 100 USD/ounce is a possibility. However, he believes that it is likely to happen gradually, not a sudden "breakthrough".

In terms of market characteristics, Ben Nadelstein said that it is silver's own factors that can slow down the metal's price increase.

"When the price of silver increases, people will take old silver items to melt, resell silver that is being kept or businesses will find ways to replace silver in production. This has caused the amount of silver circulating in the market to increase, becoming a natural factor to curb the price increase" - Mr. Ben Nadelstein expressed his opinion.

According to the expert, the future of silver depends on whether silver can maintain its position as a precious metal or not.

"Siliver has more industrial applications than gold. If the role of industry overwhelms, silver could lose its monetary value and trade like industrial metals such as copper or platinum," he said.

Another risk is the development of shredded gold investment technology, which allows investors to own small amounts of gold more easily, adding Ben Nadelstein, thereby reducing the need to hold silver as an alternative.

"Investors should change their perspective, instead of asking "how much gold and silver should be held", ask "how much monetary risk can you accept". Silver can play a supportive role in gold, providing similar characteristics but more volatile, suitable for investors with a long-term vision or willingness to take higher risks, Nadelstein recommended.

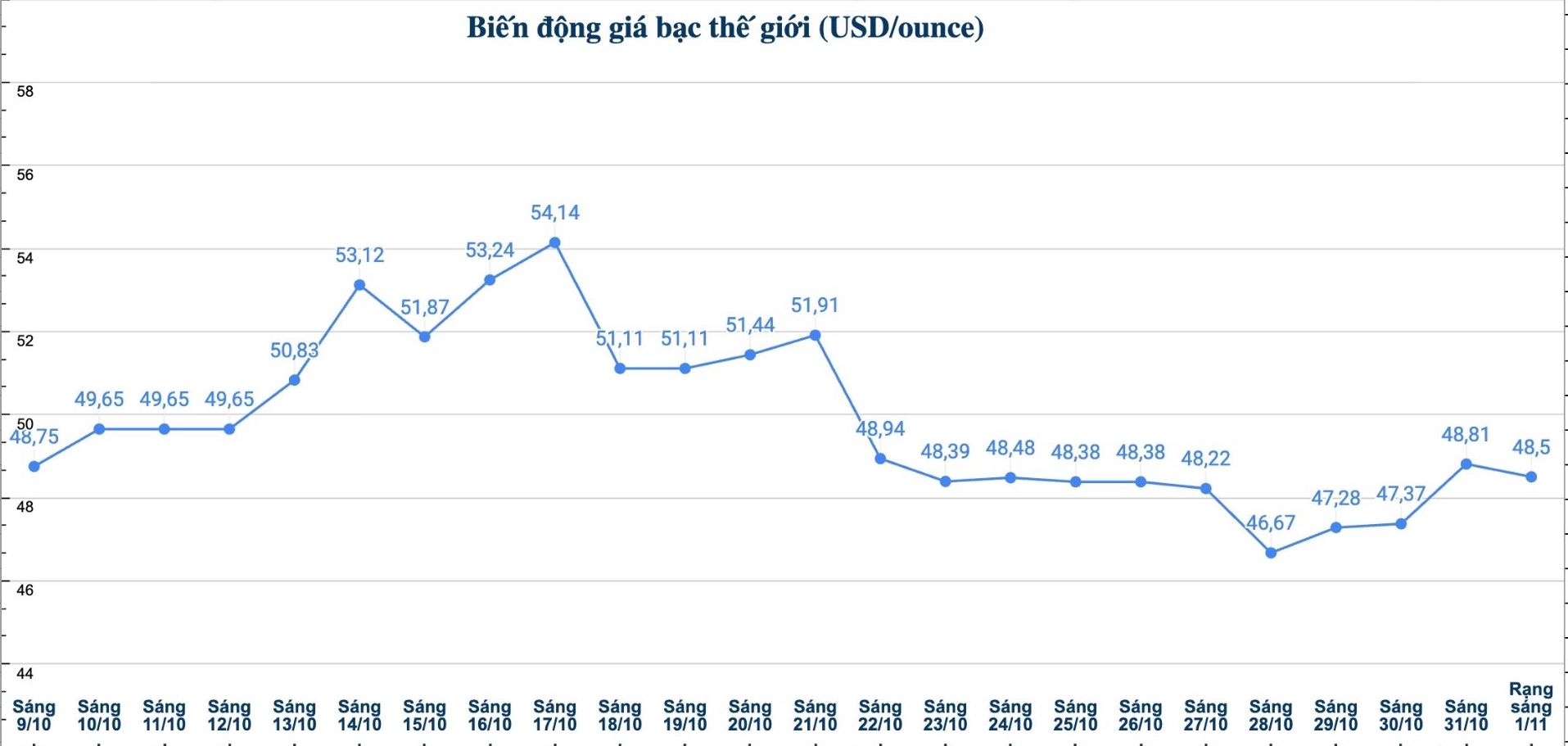

Updated silver price

As of 6:00 a.m. on November 1, the price of 2024 Ancarat 999 silver bars (1 tael) at Ancarat Metallurgy Company was listed at 1.873 - 1.915 million VND/tael (buy - sell).

The price of 999 999 Ancarat silver bars (1kg) at Ancarat Metallurgy Company is listed at 49,196 - 50.616 million VND/kg (buy - sell).

At the same time, the price of 999 coins (1 tael) at Phu Quy Jewelry Group was listed at VND1.874 - 1.932 million/tael (buy - sell).

The price of 999 taels (1kg) at Phu Quy Jewelry Group was listed at 49.973 - 51.519 million VND/kg (buy - sell).

See more news related to silver prices HERE...