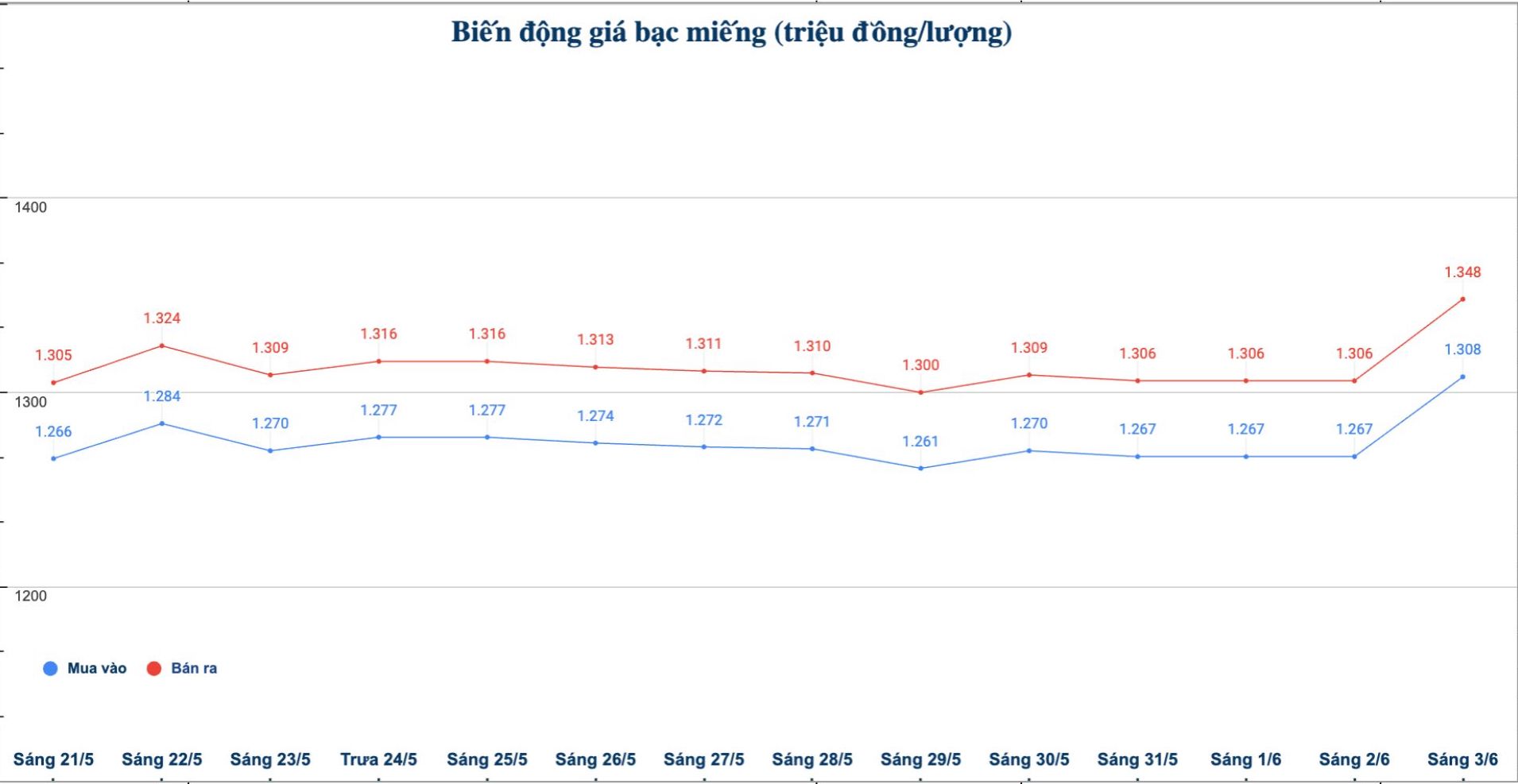

Domestic silver price

As of 9:06 a.m. on June 3, the price of 999 silver bars at Phu Quy Jewelry Group was listed at VND1.308 - 1.348 million/tael (buy - sell); an increase of VND41,000/tael for buying and an increase of VND42,000/tael for selling compared to early this morning.

The price of 999 gold bars at Phu Quy Jewelry Group was listed at 1.308 - 1.348 million VND/tael (buy - sell); increased by 41,000 VND/tael for buying and increased by 42,000 VND/tael for selling compared to early this morning.

At the same time, the price of 999 (1kilo) taels of silver at Phu Quy Jewelry Group was listed at 34.879 - 35.946 million VND/kg (buy - sell); an increase of 1.09 million VND/kg for buying and an increase of 1.12 million VND/kg for selling compared to early this morning.

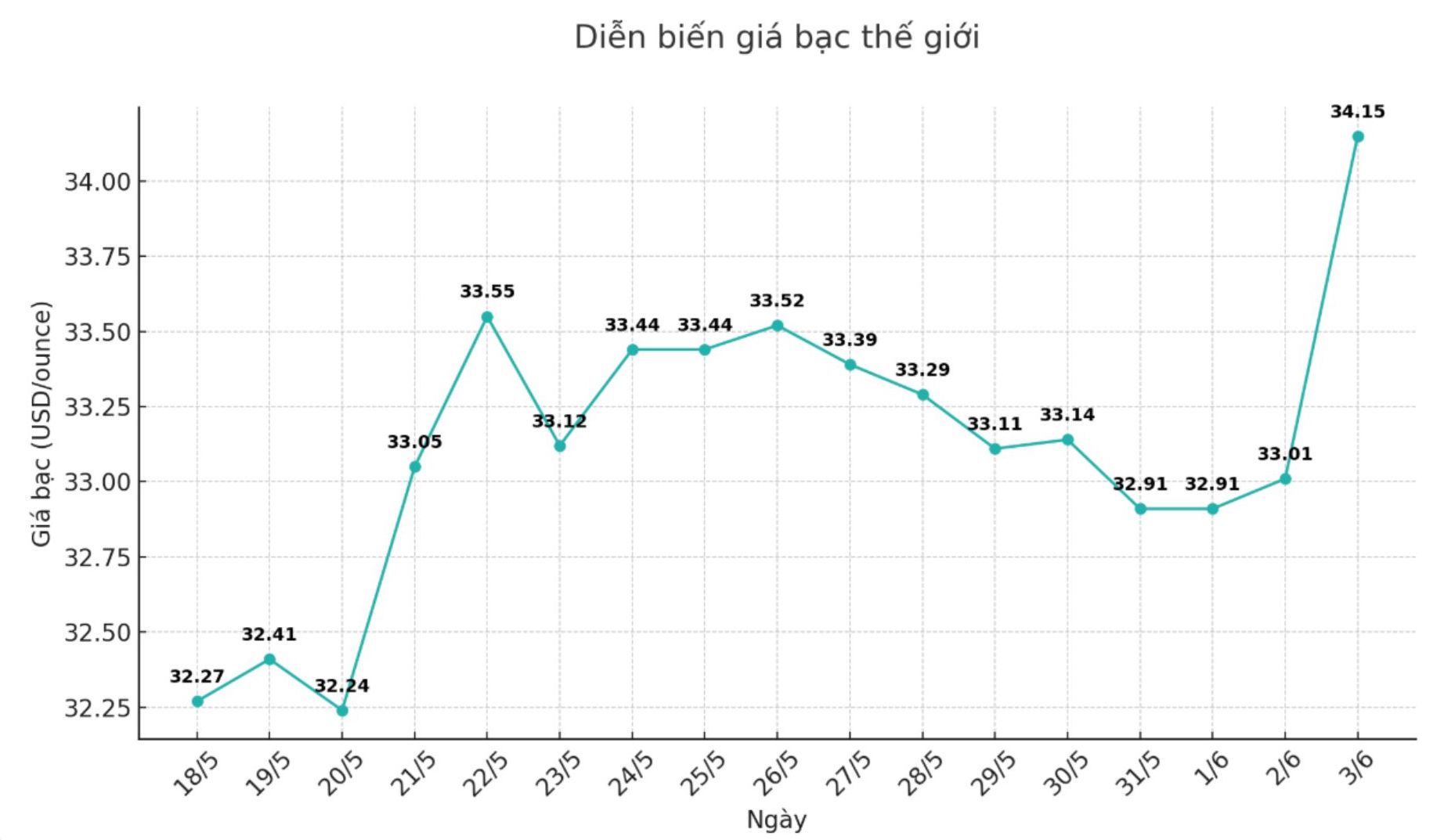

World silver price

On the world market, as of 9:07 a.m. on June 3 (Vietnam time), the world silver price was listed at 34.15 USD/ounce; an increase of 1.14 USD compared to early this morning.

Causes and predictions

Silver prices soared following gold's strong recovery, reflecting market sentiment shifting towards safe-haven assets amid a weakening USD and increased demand for shelter.

This increase in gold comes from the weakening of the greenback and growing expectations that the US Federal Reserve (FED) will soon start a rate cut cycle. Accordingly, the USD depreciated after the April personal consumption expenditure (PCE) index showed that inflation had fallen to 2.1% year-on-year - the lowest level since the beginning of 2021.

Meanwhile, core inflation also fell from 2.7% to 2.5%. The cooling of inflation has led the market to believe that the Fed could start easing monetary policy as early as September and could continue to cut interest rates again in December.

Arslan Ali - currency and commodity analyst - commented: "In addition to risk-off factors, the strength of silver is also supported by industrial demand, especially in the context of global production showing signs of stability.

Investors are also cautious ahead of key US economic data and the upcoming speech of Fed Chairman Jerome Powell.

He added that the market currently rates a 60% chance of a Fed rate cut in September and could cut again in December.

"Overall, the rally in gold and silver is the result of many factors: a weak US dollar, falling inflation and prolonged geopolitical risks, including tensions in Eastern Europe and Asia.

As the global situation is uncertain, precious metals are still a popular choice for investors looking to protect their assets and diversify their portfolios," said Arslan Ali.

See more news related to silver prices HERE...