Domestic silver price

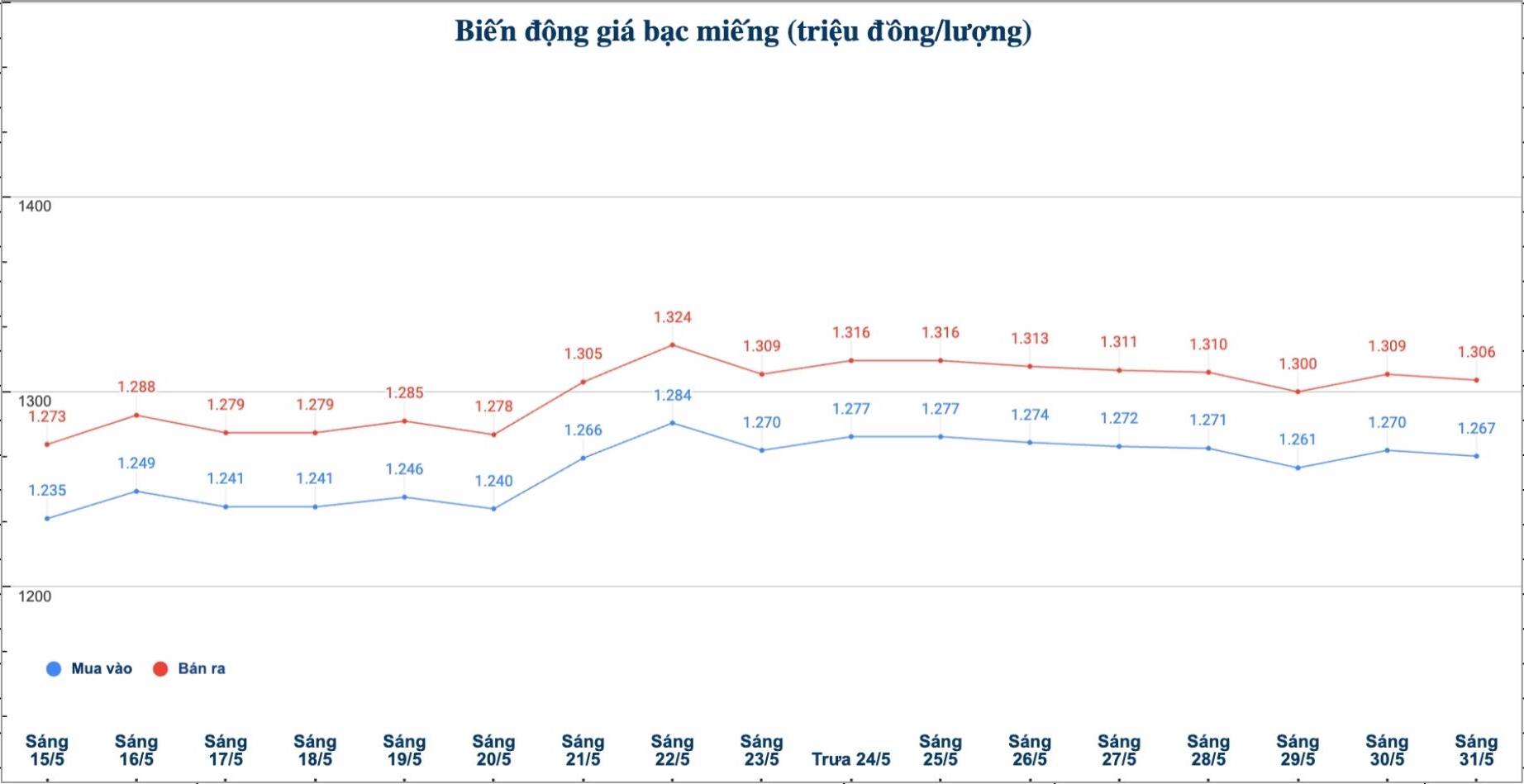

As of 9:15 a.m. on May 31, the price of 999 silver bars at Phu Quy Jewelry Group was listed at VND1.267 - VND1.306 million/tael (buy - sell); down VND3,000/tael for both buying and selling compared to early this morning.

The price of 999 gold bars at Phu Quy Jewelry Group was listed at 1.267 - 1.306 million VND/tael (buy - sell); down 3,000 VND/tael for both buying and selling compared to early this morning.

At the same time, the price of 999 (1kilo) taels at Phu Quy Jewelry Group was listed at 33.786 - 34.826 million VND/kg (buy - sell); down 80,000 VND/kg in both buying and selling directions compared to early this morning.

World silver price

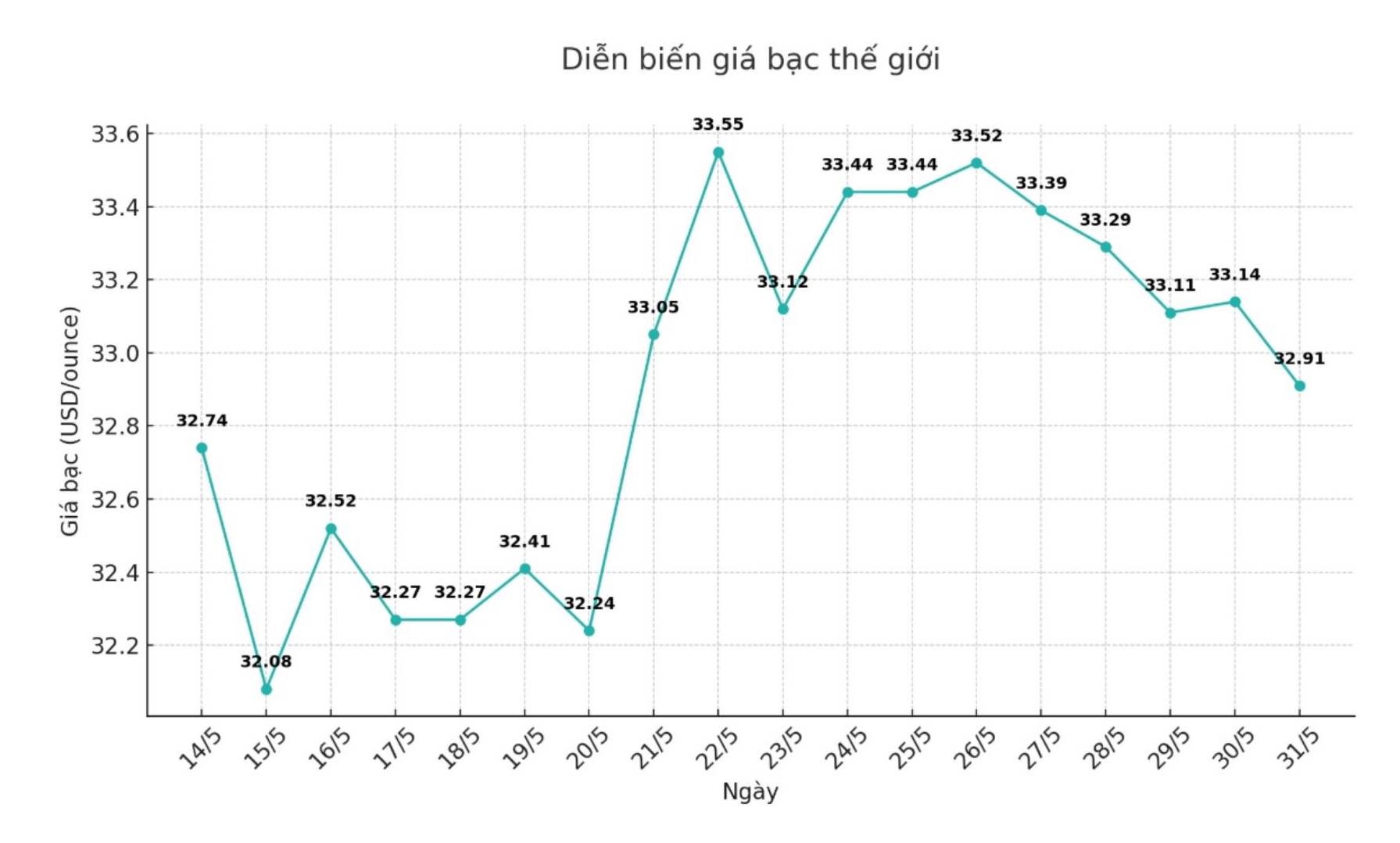

On the world market, as of 9:20 a.m. on May 31 (Vietnam time), the world silver price listed on Goldprice.org was at 32.91 USD/ounce.

Causes and predictions

According to FX Empire, silver prices fluctuated slightly after the US PCE report in April confirmed a downward inflationary trend.

The PCE - the Federal Reserve's preferred inflation measure - rose just 0.1% for the month and 2.1% for the same period last year, below expectations. Core PCE, which excludes food and energy prices, also rose 0.1% for the month and fell to 2.5% year-on-year, below expectations of 2.6%.

Although the data shows cooling inflation, silver prices are unlikely to react strongly as the market has forecast, said James Hyerczyk, a market analyst at FX Empire. This move of little change reflects the mentality of waiting for a new catalyst".

He said that if it breaks above the price of 33.70 USD/ounce, silver could attract new buying power with a target of 34.59 - 34.87 USD/ounce. Conversely, if it falls below 32.70 USD/ounce, selling pressure could bring prices back to around 31.56 USD/ounce.

The expert said that developments related to tariffs continue to affect market sentiment. An appeal court has just temporarily restored the 10% import tax and the selective tax rates proposed by Mr. Donald Trump, increasing policy instability. Although it has not created clear inflationary pressure, the risk of increased production costs and weakening industrial demand still exists.

"In that context, the meeting between Donald Trump and Fed Chairman Jerome Powell did not provide any clear policy signal. The Fed reaffirms its independence and does not issue any guidance, leaving the market to continue to speculate about when to cut interest rates," added James Hyerczyk.

See more news related to silver prices HERE...