Domestic silver prices

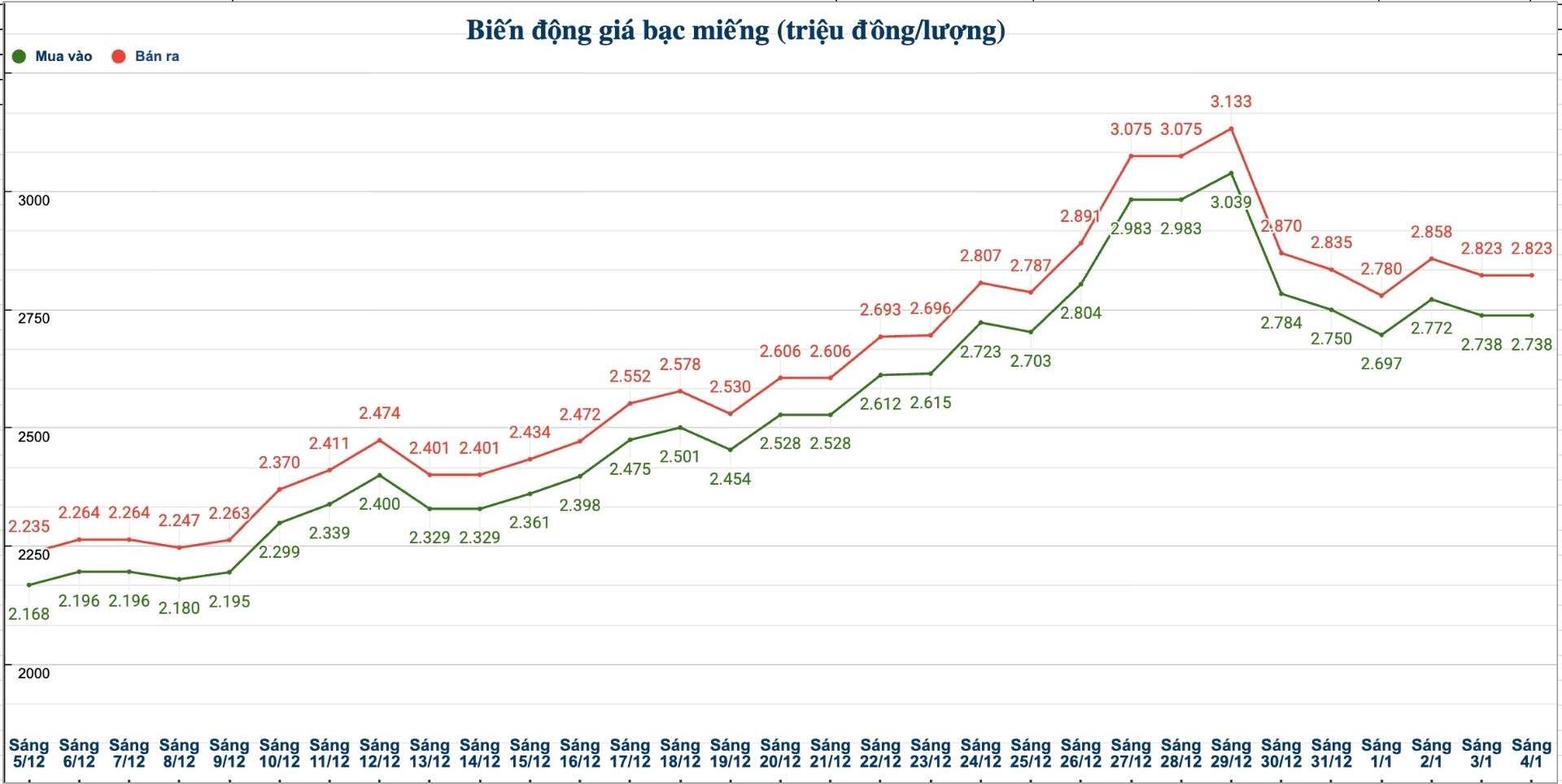

As of 10:20 am on January 4, the price of Kim Phuc Loc 999 silver bars (1 tael) of Saigon Thuong Tin Bank Gold, Silver and Gems One Member Limited Liability Company (Sacombank-SBJ) was listed at the threshold of 2.793 - 2.868 million VND/tael (buying - selling).

In the previous week's trading session (morning of December 28, 2025), the price of Kim Phuc Loc 999 silver bars (1 tael) of Sacombank-SBJ was listed at the threshold of 2.826 - 2.898 million VND/tael (buying - selling).

Thus, if you buy Kim Phuc Loc 999 silver bars (1 tael) from Sacombank-SBJ in the session on December 28, 2025 and sell them in the session this morning (January 4, 2026), buyers will lose 105,000 VND/tael.

At the same time, the price of 999 silver bars (1 tael) at Phu Quy Jewelry Group was listed at the threshold of 2.738 - 2.823 million VND/tael (buying - selling).

The price of 999 silver bars (1kg) at Phu Quy Jewelry Group is listed at 73.013 - 75.279 million VND/kg (buying - selling).

In the previous week's trading session (morning of December 28, 2025), the price of 999 silver bars (1kg) at Phu Quy Jewelry Group was listed at 79.546 - 81.999 million VND/kg (buying - selling).

Thus, if you buy 999 silver bars (1kg) at Phu Quy Jewelry Group in the session on December 28, 2025 and sell them in the session this morning (January 4, 2026), buyers will lose VND 8.989 million/kg.

World silver prices

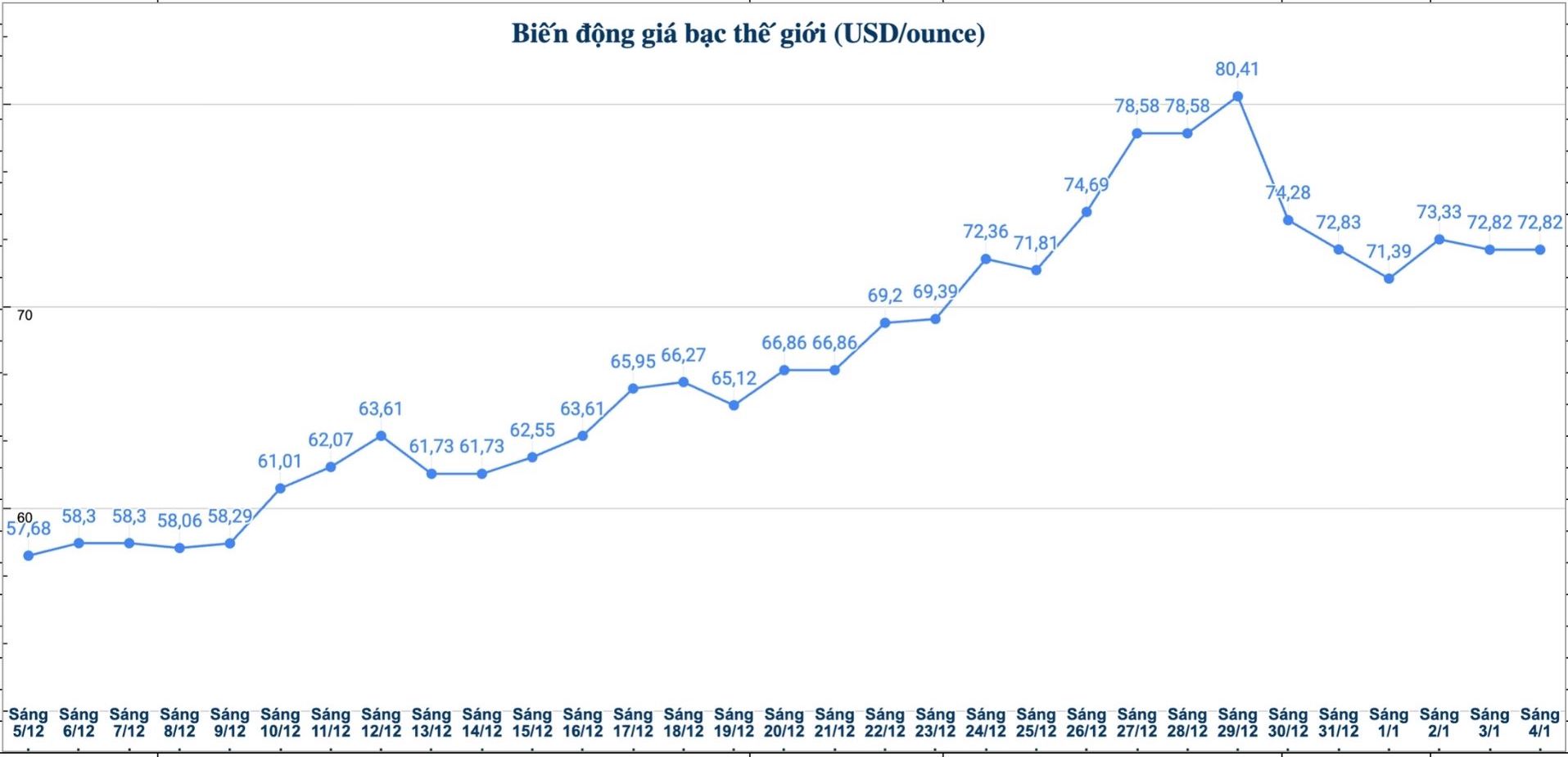

On the world market, as of 10:45 am on January 4 (Vietnam time), the world silver price was listed at 72.82 USD/ounce.

Causes and forecasts

According to precious metal analyst Christopher Lewis at FX Empire, silver prices are currently fluctuating around the threshold of 70 USD/ounce, showing efforts to form a new price level after a period of strong fluctuations.

However, he believes that this does not mean that the market falls into a "freeze" state, because buying and selling activities are still quite active.

The past trading week witnessed a large level of fluctuation in silver prices, notably taking place in the context of the market closing one day in the week. This clearly reflects the sensitive psychology and strong fluctuations of investors in the face of rapid market changes" - Christopher Lewis said.

Christopher Lewis analyzed that there are two main scenarios being set out. First, silver prices may enter a sideways phase, accompanied by a slight correction. This is considered a positive development, helping the market "cool down" after the previous strong increase, because no market can continuously increase without adjustment pressure.

The second scenario, Christopher Lewis believes will be more negative, which is that silver prices may break the 70 USD/ounce mark and fall deeply to the 60 USD/ounce zone. He added that this decrease may seem large, but if placed in the context of previous strong increases, this is still considered a relatively normal technical correction.

History shows that too-fast gains often come with strong corrections, which can cause small investors to suffer great losses, especially in the context of using high leverage and trend-seeking psychology" - he assessed.

However, if prices do not fall deeply, Christopher Lewis believes that the market going sideways in the next few weeks may also be a necessary scenario to create a more stable foundation for the next trend.

See more news related to silver prices HERE...