According to Bloomberg, US President Donald Trump warned the Iranian military not to attack protesters. President Trump declared that the US will take action to protect protesters in Iran if they are attacked by the Islamic Republic government.

If Iran opens fire and kills peaceful protesters, the United States of America will come to rescue them" - Mr. Trump wrote on the social network Truth Social early Friday morning (Washington time). "We are ready, in combat gear.

In response, Secretary of the Iranian National Security Council Ali Larijani wrote on social network X that the US "should pay attention to the safety of its soldiers".

The global stock market started 2026 with a bright start. European stock markets continued their upward momentum on the first trading day of 2026, with many key indices reaching new historical peaks, despite thin liquidity after the New Year holiday. The main driving force for growth came from the defense stock group, thanks to prolonged geopolitical tensions and increased military spending expectations in the region.

STOXX 50 index increased by 1.1%, to a record high of 5,850 points; STOXX 600 increased by 0.5%, reaching 596 points - the highest level ever. In the UK, FTSE 100 increased by about 1% on the first trading day of the year, for the first time exceeding the symbolic milestone of 10,000 points. Germany's DAX index increased by 0.4%, approaching 24,600 points, setting a new historical peak.

In Asia, Hong Kong's Hang Seng index (China) jumped 708 points (2.8%), to 26,384 points - the highest level in 6 weeks, thanks to the strong recovery of many industry groups. Meanwhile, India's BSE Sensex index closed up about 0.67%, to 85,762 points, also a record high, thanks to widespread buying pressure.

In the coming time, global investors are looking for new driving factors, especially monitoring the US interest rate outlook, while geopolitical developments are still the fundamental factor dominating market sentiment. US stock indices are forecast to open up to increase points in today's session.

The US Treasury bond market went sideways. The 10-year US Treasury bond yield remained around 4.10% on the first trading day of 2026, as trading activity remained quite sluggish due to the holidays. Investors continue to consider the US Federal Reserve (Fed)'s interest rate roadmap this year, with attention focused on upcoming economic data, especially the December jobs report expected to be released next week.

The minutes of the Fed's December meeting released earlier this week show that policymakers are increasingly open to the possibility of monetary easing if inflation continues to cool down. However, the Fed is still divided on the timing and scale of interest rate cuts.

Currently, traders are betting on two interest rate cuts in 2026. The market is also closely monitoring the issue of Fed leadership personnel, as President Trump is expected to soon announce the successor to Chairman Jerome Powell, with many speculations about a "bee-like" option.

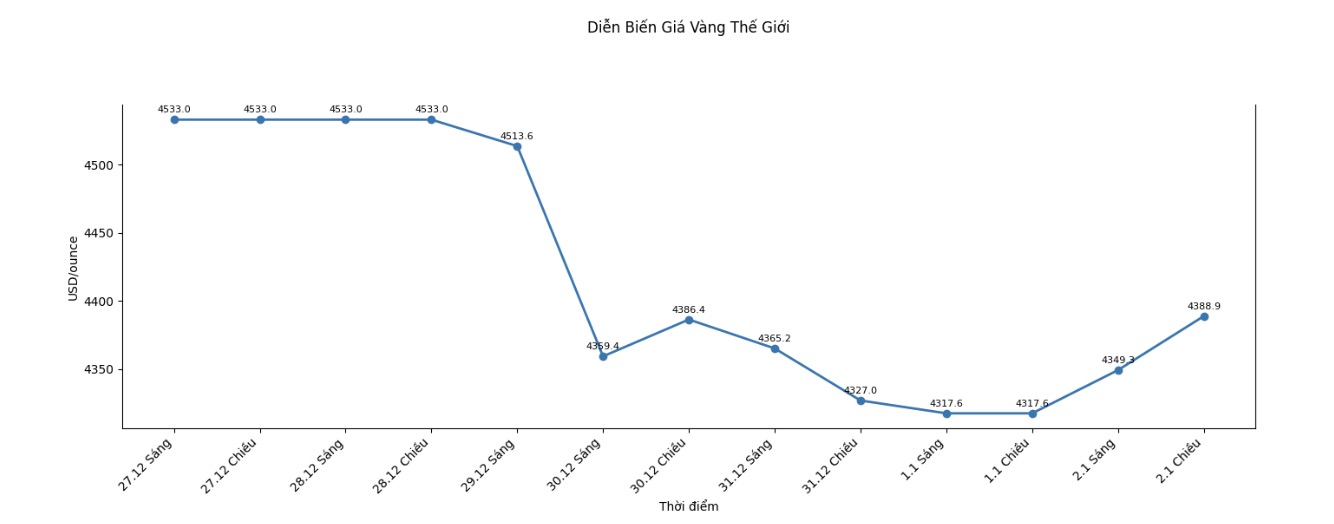

The next goal is to bring the closing price to surpass the very strong resistance zone at a record peak of 4,584 USD/ounce. In the opposite direction, in the short term, the selling side is trying to pull the price down below the important technical support level around the 4,200 USD/ounce mark.

In the most recent session, the immediate resistance zone was determined at the peak overnight of 4,414.80 USD/ounce, followed by the threshold of 4,433 USD/ounce. Meanwhile, the nearest support levels are respectively at the bottom overnight of 4,337.30 USD/ounce and deeper is the 4,300 USD/ounce zone. The market assessment on the Wyckoff scale currently reaches 7.0 points, showing that the upward trend still prevails but comes with the risk of strong fluctuations in the short term.

Key external markets showed a slight increase in the USD index. Crude oil prices fell, trading around 57 USD/barrel. US Treasury bond yields for 10-year terms are currently at 4.11%.

See more news related to gold prices HERE...