Domestic silver prices

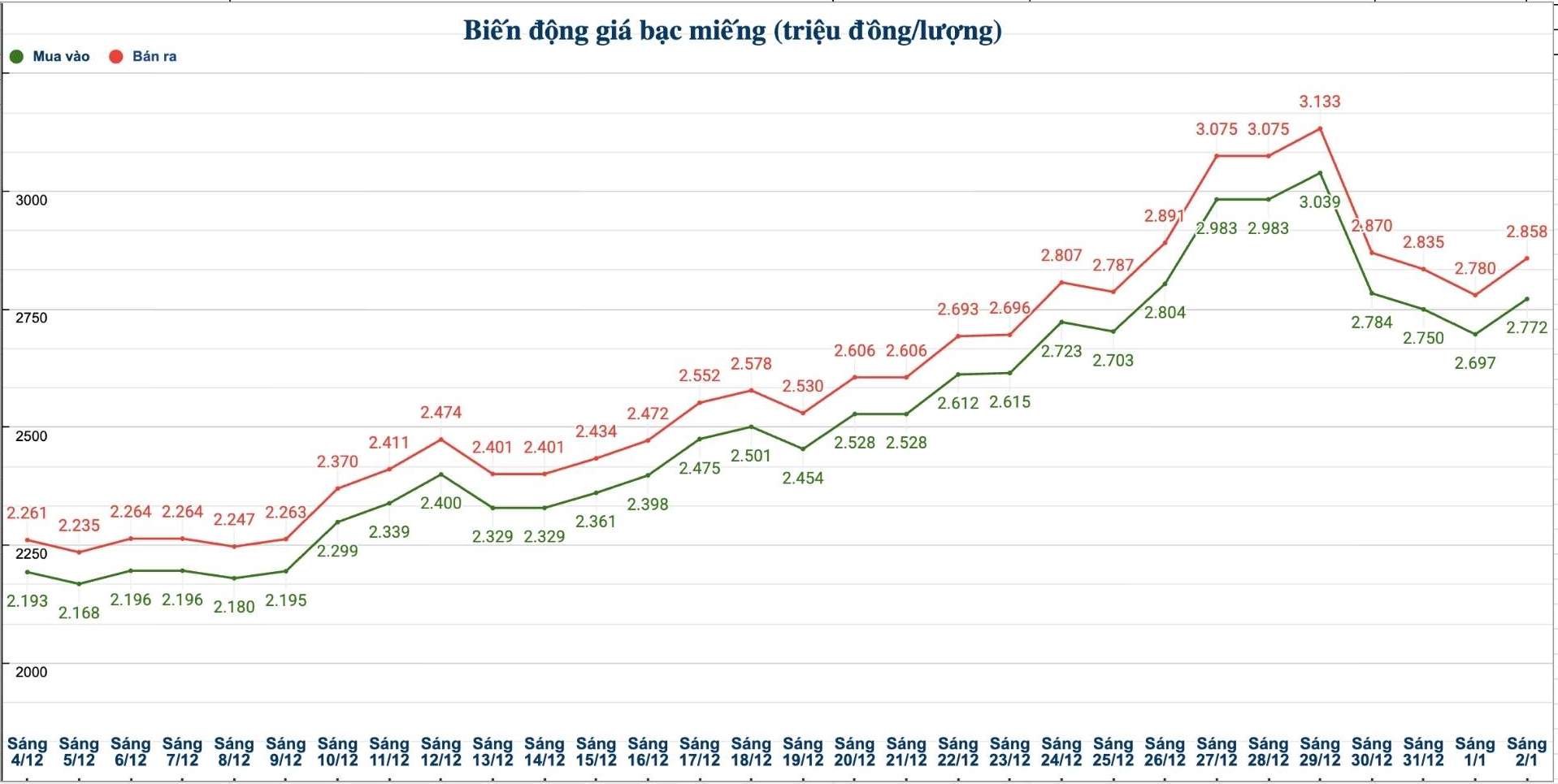

As of 11:40 am on January 2, the price of Kim Phuc Loc 999 silver bars (1 tael) of Saigon Thuong Tin Bank Gold, Silver and Gems One Member Limited Liability Company (Sacombank-SBJ) was listed at the threshold of 2.793 - 2.868 million VND/tael (buying - selling).

At the same time, the price of 999 silver bars (1 tael) at Phu Quy Jewelry Group was listed at the threshold of 2.772 - 2.858 million VND/tael (buying - selling); an increase of 75,000 VND/tael on the buying side and an increase of 78,000 VND/tael on the selling side compared to yesterday morning.

The price of 999 silver bars (1kg) at Phu Quy Jewelry Group is listed at 73.919 - 76.213 million VND/kg (buying - selling); an increase of 2 million VND/kg on the buying side and an increase of 2.08 VND/kg on the selling side compared to yesterday morning.

World silver prices

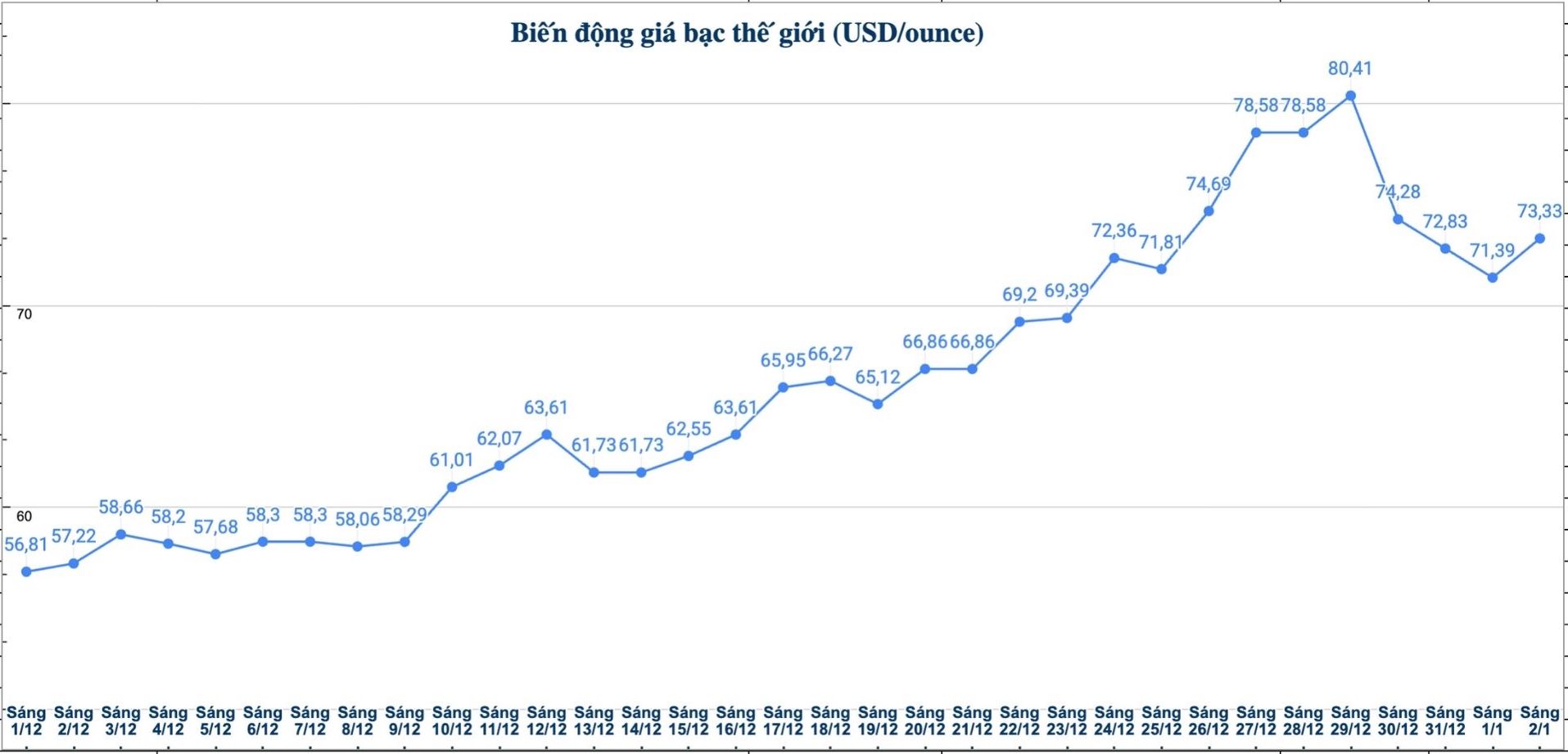

On the world market, as of 11:45 am on January 2 (Vietnam time), the world silver price was listed at 73.33 USD/ounce; up 1.94 USD compared to yesterday morning.

Causes and forecasts

In recent trading sessions, silver prices have at times fallen to 70.07 USD/ounce. This development is quite quiet due to weakening market liquidity during the holidays. However, precious metals analyst at FX Empire James Hyerczyk said that profit-taking pressure has appeared, helping silver prices recover slightly.

He also noted that technical signals currently show that the adjustment risk of silver prices is increasing. Specifically, the price penetration of some important support levels is considered a sign confirming the short-term reversal trend, thereby opening up the possibility that prices may fall deeper in the near future.

However, Mr. Hyerczyk believes that the long-term outlook for silver is still positive. However, market entry costs are now significantly higher. "Silver prices are at a much higher level than just a month ago, while deposit requirements have also been raised," he said.

The reason comes from the fact that CME Group - the largest derivative market operator in the world - decided to increase the margin level for precious metal contracts after a volatile trading session on December 26. This move caused transaction costs to increase, forcing investors to consider more carefully when participating in the market.

In the long term, Mr. James Hyerczyk assessed that silver demand for the industrial production sector in 2026 is still trending upwards, in the context that supply continues to be tight. However, the market is no longer favorable in the "buy then hold" style as before. Instead, investors need to be more flexible and choose a suitable disbursement time.

In this context, although still leaning towards the upward trend in the medium term, the expert recommends that investors should patiently wait for more attractive price ranges before buying, instead of rushing to follow short-term market recovery.

See more news related to silver prices HERE...