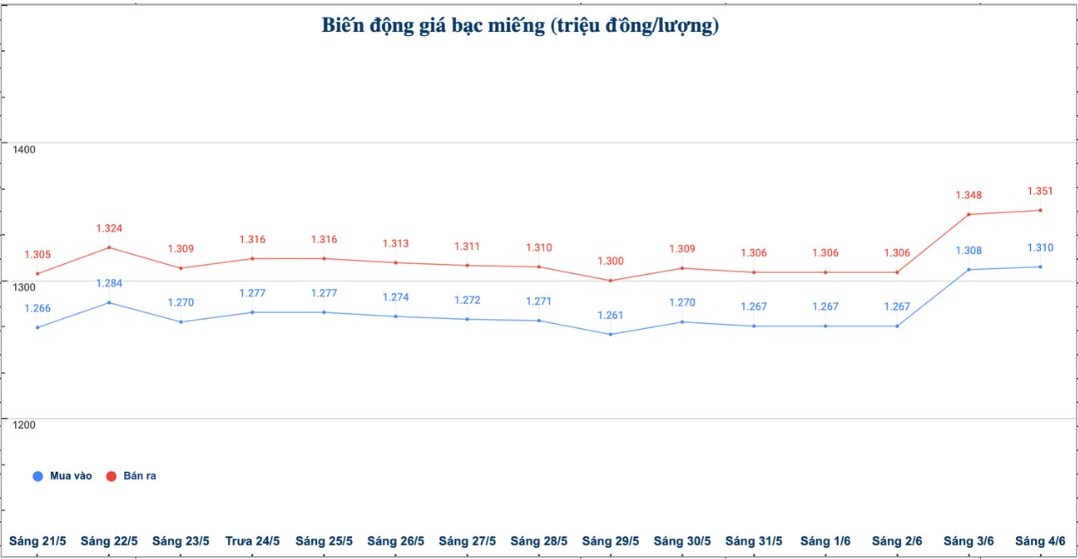

Domestic silver price

As of 9:08 a.m. on June 4, the price of 999 silver bars at Phu Quy Jewelry Group was listed at 1.310 - 1.351 million VND/tael (buy - sell); an increase of 2,000 VND/tael for buying and an increase of 3,000 VND/tael for selling compared to early this morning.

The price of 999 gold bars at Phu Quy Jewelry Group was listed at 1,310 - 1.351 million VND/tael (buy - sell); an increase of 2,000 VND/tael for buying and an increase of 3,000 VND/tael for selling compared to early this morning.

At the same time, the price of 999 (1kilo) taels of silver at Phu Quy Jewelry Group was listed at VND34,933 - 36,026 million/kg (buy - sell); an increase of VND54,000/kg for buying and an increase of VND80,000/kg for selling compared to early this morning.

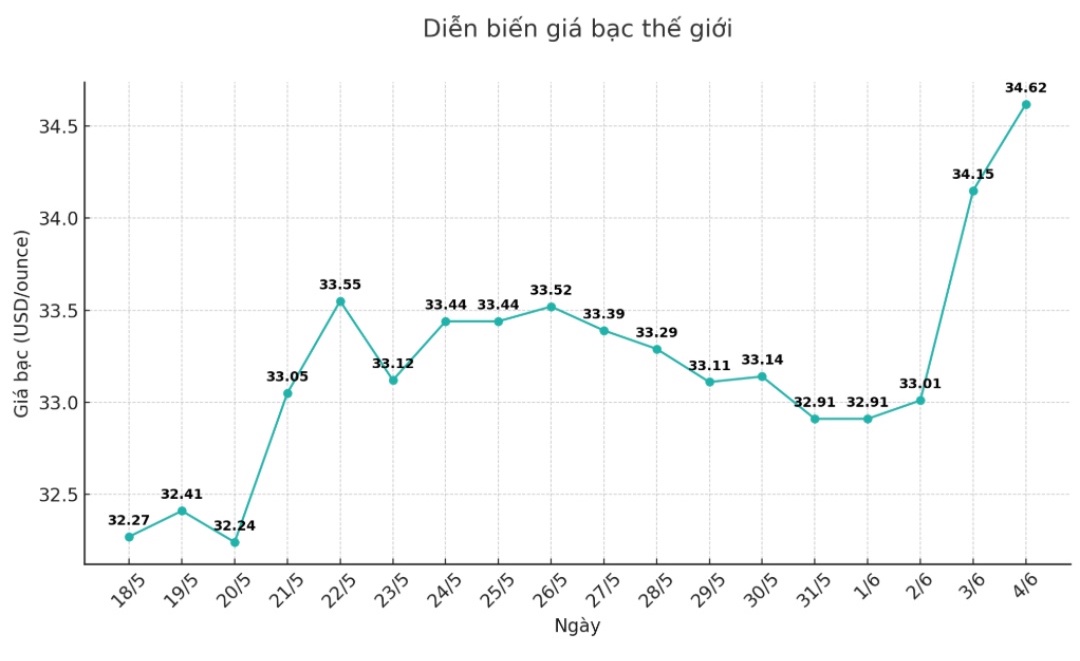

World silver price

On the world market, as of 9:10 a.m. on June 4 (Vietnam time), the world silver price was listed at 34.62 USD/ounce; up 0.47 USD compared to early this morning.

Causes and predictions

The increase in silver is slowing as the USD strengthens, reducing the attractiveness of the precious metal in the eyes of international buyers.

Accordingly, the USD index rebounded after hitting a low of 98.58 - the lowest level since April 22. Investors' selling orders and profit-taking have helped the greenback recover, putting pressure on metals priced in USD.

The market is also reacting to geopolitical tensions, especially the phone call scheduled to take place this week between US President Donald Trump and Chinese President Xi Jinping. This has caused increased concerns and affected risky assets.

"Although the situation initially supported metal prices, the US dollar's recovery has disrupted the uptrend.

Silver is often moving along the gold price, gold also decreased in the third session after reaching a 4-week high. This correction is mainly due to the rebound of the US dollar and profit-taking by investors," said James Hyerczyk, a market analyst.

However, the expert added that technically, gold is still holding steady above $3,310/ounce. If gold continues to stabilize or increase, this will support the recovery of silver.

"The next driver for the market could come from the Federal Reserve's statements and the upcoming jobs report. Without a strong increase in the USD or a strong stance from the FED, silver prices are likely to maintain their upward momentum," said James Hyerczyk.

See more news related to silver prices HERE...