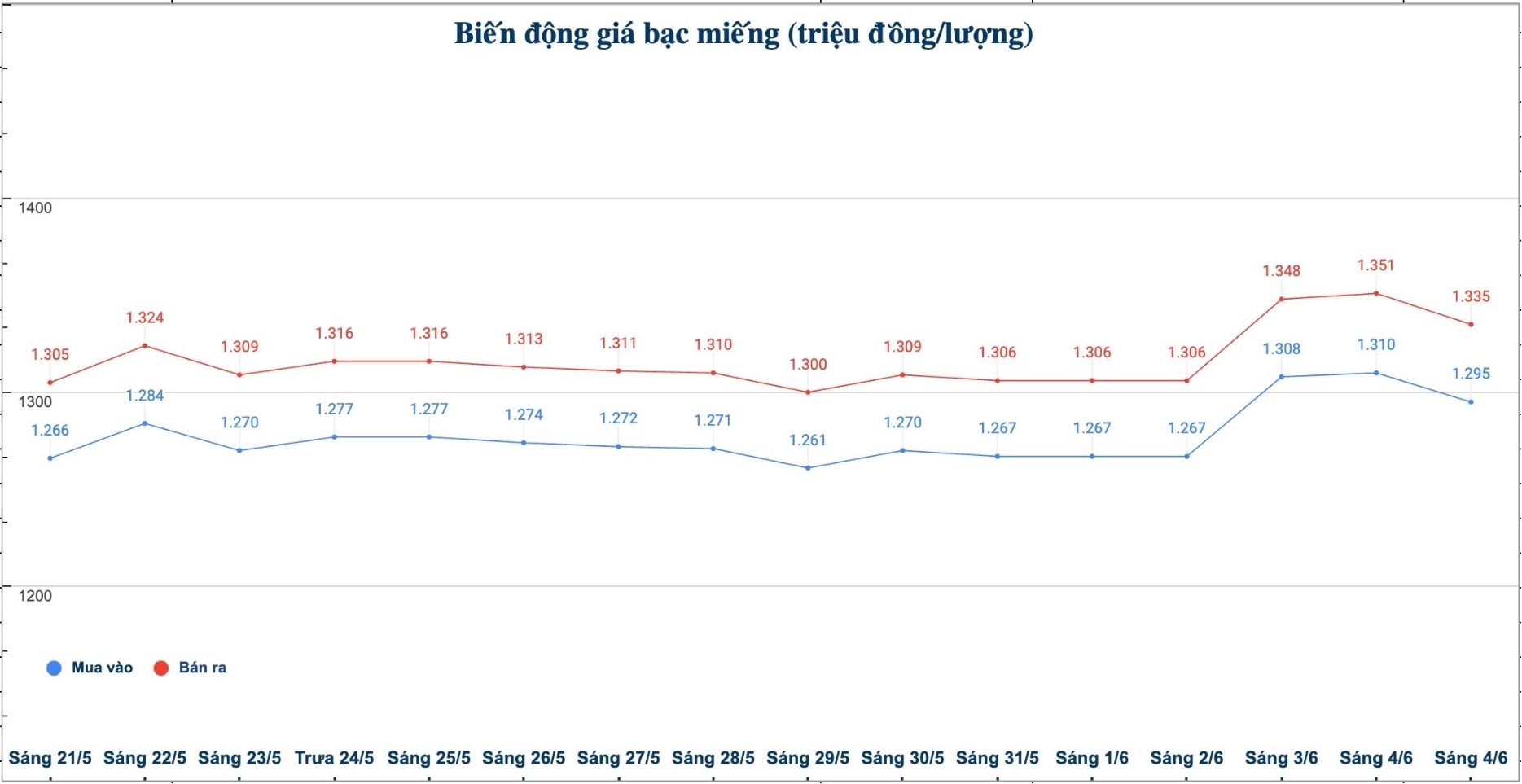

Domestic silver price

As of 9:08 a.m. on June 5, the price of 999 silver bars at Phu Quy Jewelry Group was listed at 1.295 - 1.335 million VND/tael (buy - sell); down 15,000 VND/tael for buying and down 16,000 VND/tael for selling compared to early this morning.

The price of 999 gold bars at Phu Quy Jewelry Group was listed at 1.295 - 1.335 million VND/tael (buy - sell); down 15,000 VND/tael for buying and down 16,000 VND/tael for selling compared to early this morning.

At the same time, the price of 999 (1kilo) taels of silver at Phu Quy Jewelry Group was listed at 34,533 - 35.599 million VND/kg (buy - sell); down 400,000 VND/kg for buying and down 427,000 VND/kg for selling compared to early this morning.

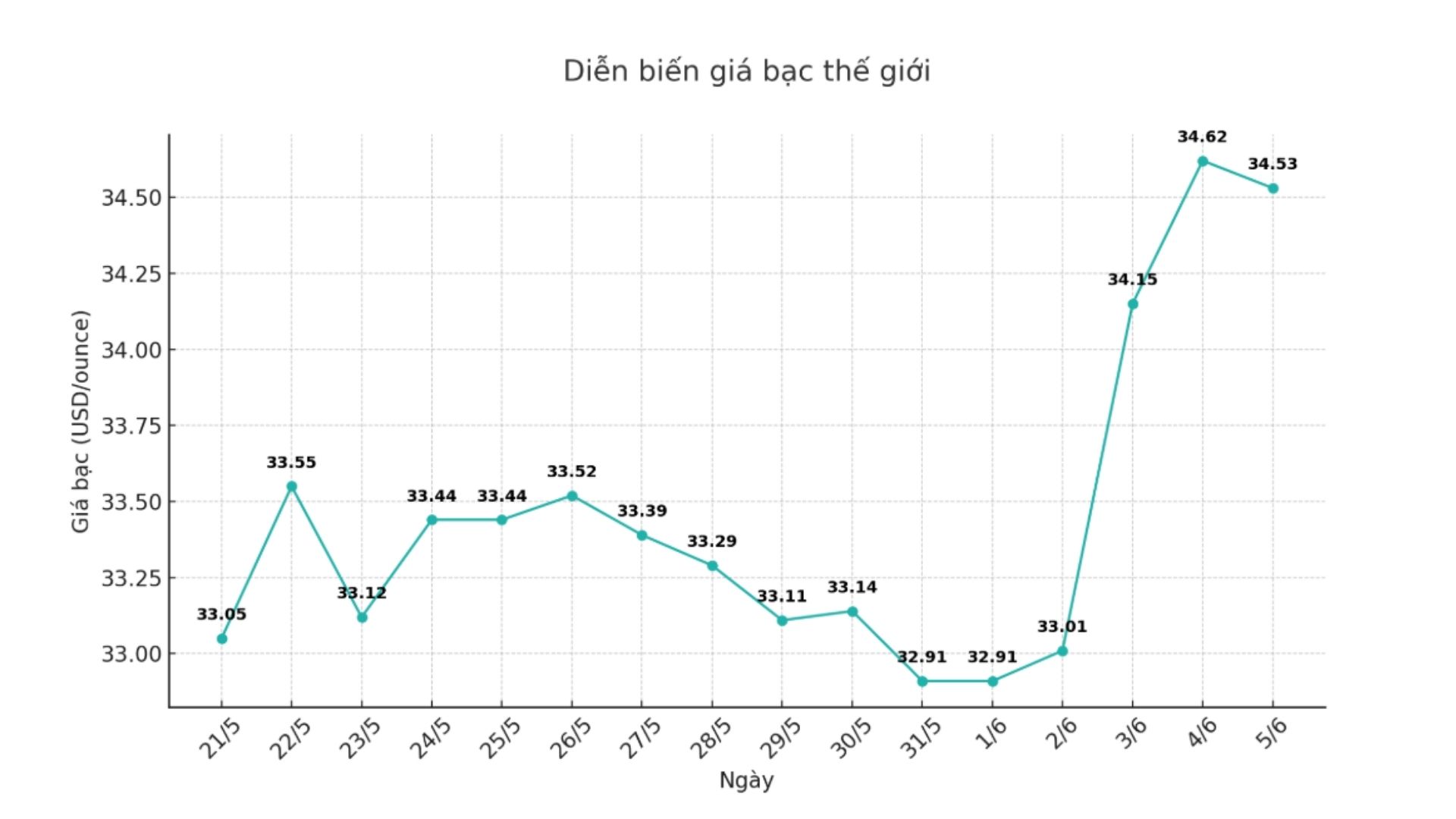

World silver price

On the world market, as of 9:10 a.m. on June 5 (Vietnam time), the world silver price was listed at 34.53 USD/ounce; down 0.09 USD compared to early this morning.

Causes and predictions

Silver prices are cooling down after hitting a multi-month high of $24.79 at the beginning of the week. The market is currently being affected by external factors such as new trade tensions between the US and China, expectations about the interest rate policy of the US Federal Reserve (FED) and gold price developments.

The US raising steel import tariffs from 25% to 50% has raised concerns in commodity markets, increasing uncertainty in forecasting global demand for industrial metals such as silver.

In addition, the tax increase also raises concerns about a return of inflation, which could help raise silver prices if the Fed reconsider its monetary policy roadmap. However, traders have not yet clearly defined the actual impact.

James Hyerczyk - a market analyst - said: "In the short term, the market will wait for the US employment report to publish on Friday. If the non -agricultural table data is positive, the Fed capability keeps the interest rate higher, thereby putting pressure on silver due to the strong dollar and the bond yield increases."

The expert added that the fact that gold prices could not surpass the peak of the week also made the silver market less vibrant. The trend of silver is still dependent on upcoming employment data and the USD's movements, because these two factors are closely related to gold.

"With no clear market leaders yet, investors need to closely monitor signals from gold prices and job data on Friday. The short-term outlook for silver is currently neutral, but the risk of depreciation is increasing if the USD strengthens and the Fed maintains a tight stance" - James Hyerczyk assessed.

See more news related to silver prices HERE...