Domestic silver price

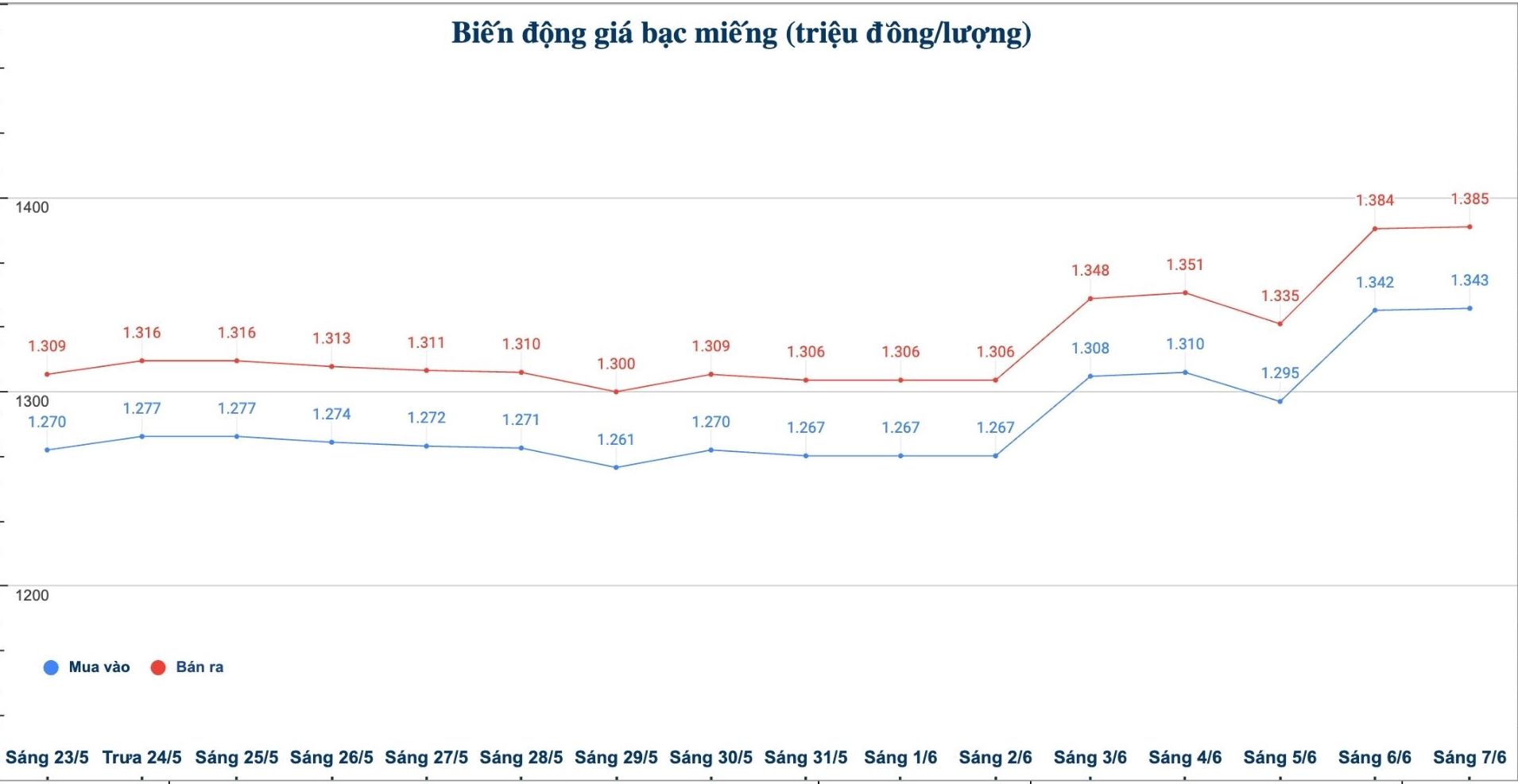

As of 9:08 a.m. on June 7, the price of 999 silver bars at Phu Quy Jewelry Group was listed at VND1.343 - 1.385 million/tael (buy - sell); an increase of VND1,000/tael for both buying and selling compared to early this morning.

The price of 999 gold bars at Phu Quy Jewelry Group was listed at 1.343 - 1.385 million VND/tael (buy - sell); an increase of 1,000 VND/tael for both buying and selling compared to early this morning.

At the same time, the price of 999 (1kilo) taels of silver at Phu Quy Jewelry Group was listed at 35.813 - 36.933 million VND/kg (buy - sell); an increase of 27,000 VND/kg in both buying and selling directions compared to early this morning.

World silver price

On the world market, as of 9:09 a.m. on June 7 (Vietnam time), the world silver price was listed at 35.92 USD/ounce; up 0.06 USD compared to early this morning.

Causes and predictions

Silver prices have surged above $36 an ounce (Thursday) - for the first time since 2011 - with a positive momentum signaling the start of a "super cycle". While gold has attracted attention in recent times, silver is gradually getting out of the shadow of gold and may soon become the focus.

According to analysts from GSC Commodity Intelligence, silver prices have officially entered a breakthrough phase and could reach $50/ounce much earlier than market expectations.

Although gold has increased steadily over the past few months, history shows that silver has often increased more slowly than gold. However, when silver began to increase, its growth rate was very fast. Currently, the gold- silver price ratio is nearly 90. much higher than the historical average of 60, which could lead to a strong increase in silver prices in the future.

Phil Carr, head of trading at GSC, said: "Every major rally in gold is followed by a counter-denominated rally in silver. We saw this in 2011, in the 1970s and we are on the threshold to see it again in 2025".

The appeal of silver is not just in price. Silver is an important raw material in industries such as solar energy, electric vehicles, 5G and AI, and the demand for silver in these fields is increasing.

"Silver is in a similar position to gold two years ago - has too little possession and is facing a strong re-evaluation opportunity. Unlike gold, silver is scarce, practical and has strong potential for price increase. From the current price, the possibility of silver growing is huge" - analysts at GSC Commodity Intelligence commented.

See more news related to silver prices HERE...