Domestic silver price

As of 9:00 a.m. on April 9, the price of 999 silver bars at Phu Quy Jewelry Group was listed at VND 1.182 - 1.219 million/tael (buy - sell); an increase of VND 3,000/tael for buying and an increase of VND 4,000/tael for selling compared to early this morning.

The price of 999 gold bars at Phu Quy Jewelry Group was listed at 1.182 - 1.219 million VND/tael (buy - sell); an increase of 3,000 VND/tael for buying and an increase of 4,000 VND/tael for selling compared to early this morning.

At the same time, the price of 999 (1kilo) taels of silver at Phu Quy Jewelry Group was listed at 31,439 - 32,399 million VND/kg (buy - sell); an increase of 80,000 VND/kg for buying and an increase of 107,000 VND/kg for selling compared to early this morning.

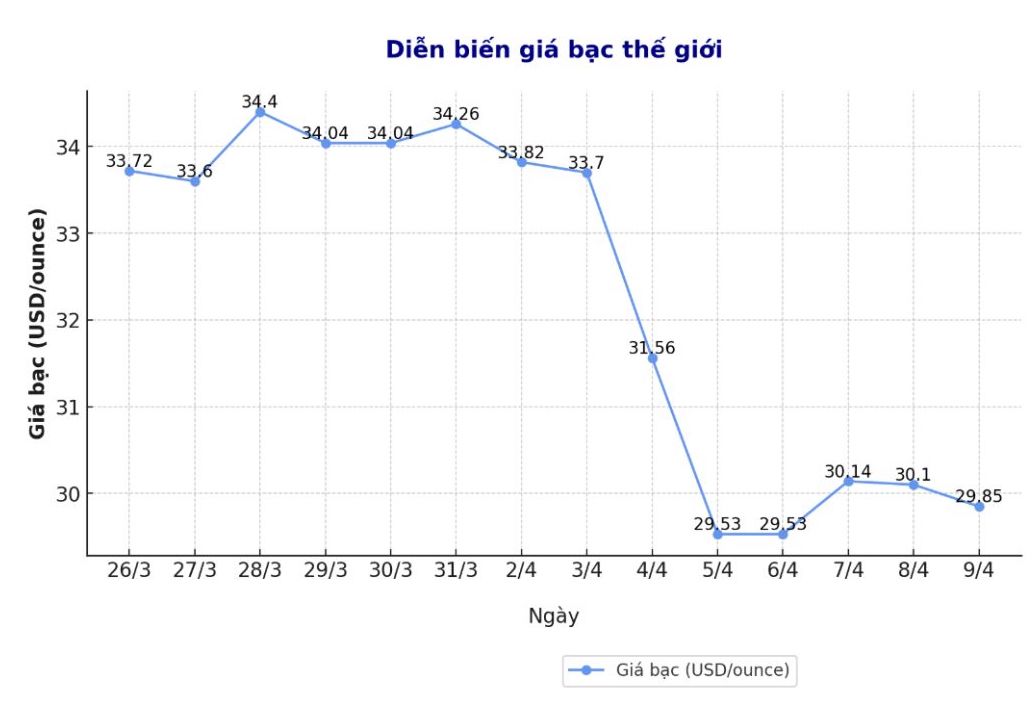

World silver price

On the world market, as of 9:05 a.m. on April 9 (Vietnam time), the world silver price listed on Goldprice.org was at 29.85 USD/ounce.

Causes and predictions

According to Kitco, silver prices recorded a rapid recovery in the US, but have decreased slightly compared to the highest level in the last trading session. The price of silver futures for May is currently increasing by 0.340 USD to 30.01 USD/ounce.

Kitco analyst Jim Wyckoff said that investors have rushed to buy when prices have fallen and made purchases with profit potential - when there were signs that the selling side had begun to weaken.

Meanwhile, US stock indexes are currently rising strongly and risk concerns have eased. However, Jim Wyckoff believes that the possibility of market confidence returning to normal in the near future is very low.

"Daily declarations of tariffs from the White House or other major countries will continue to worry traders and investors, keeping them worried about risks," he said.

China and the US continue to maintain their views on tariffs, with neither side making any transfers. Some market analysts are paying attention to the possibility that China will adjust the value of the yuan to improve global trade competitiveness.

Reports say the People's Bank of China has adjusted its daily benchmark exchange rate to below 7.2 against the USD. Currently, the yuan is at its lowest level against the USD since September 2023.

Expert Jim Wyckoff assessed that in terms of silver contracts for the May term, both buyers and sellers are in a balanced position in terms of short-term techniques. Price developments this week show that the selling side is gradually losing strength and a short-term price bottom may have been set.

The next target for buyers is to push silver prices above the important resistance level at 32.00 USD/ounce. On the contrary, the sellers are aiming to pull prices below the solid support level at 27.545 USD/ounce.

The first resistance level for silver prices was at 30.76 USD/ounce, followed by 31.00 USD/ounce. Meanwhile, the current important support levels are 29.81 USD/ounce and 29.50 USD/ounce.

According to FXStreet, in the coming time, the next important factor affecting silver prices will be the consumer price index (CPI) data for March, expected to be released on Thursday. This inflation data will affect market expectations for the monetary policy outlook of the US Federal Reserve (FED).

See more news related to silver prices HERE...