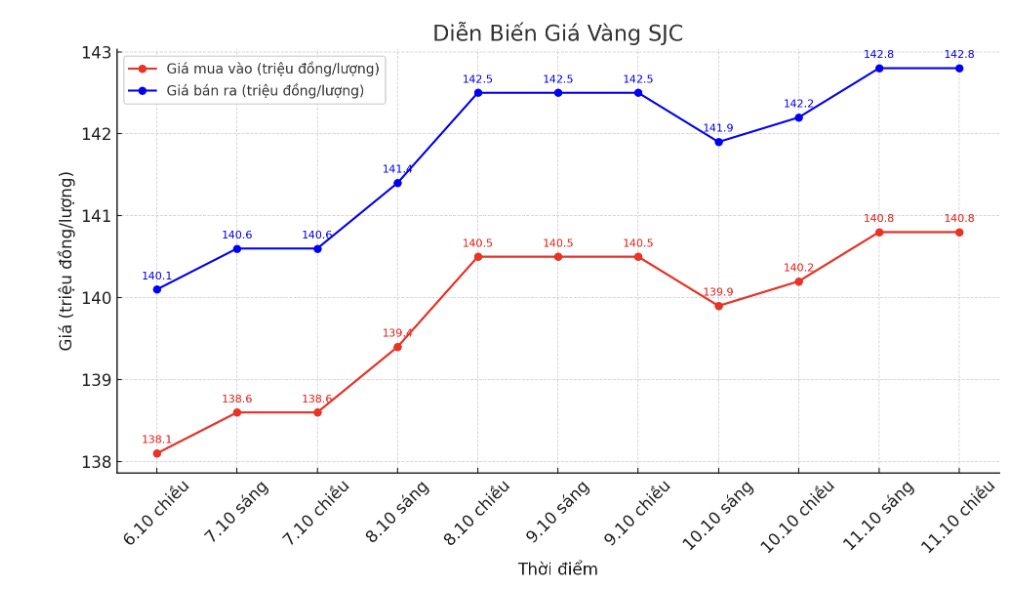

SJC gold bar price

As of 5:15 p.m., the price of SJC gold bars was listed by DOJI Group and Bao Tin Minh Chau at 140.8-142.8 million VND/tael (buy in - sell out), an increase of 600,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 140-142.8 million VND/tael (buy - sell), an increase of 500,000 VND/tael for buying and an increase of 600,000 VND/tael for selling. The difference between buying and selling prices is at 2.8 million VND/tael.

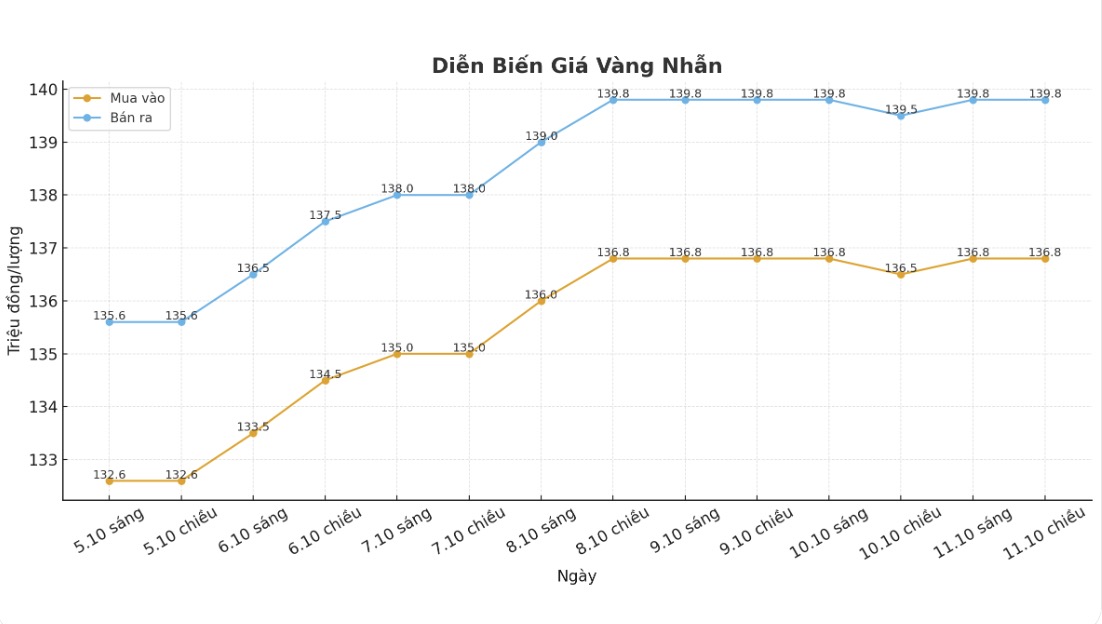

9999 gold ring price

As of 5:15 p.m., DOJI Group listed the price of gold rings at 136.5-139.5 million VND/tael (buy in - sell out), an increase of 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 138.4-141.4 million VND/tael (buy - sell), an increase of 400,000 VND/tael. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 137.3-140.3 million VND/tael (buy in - sell out), an increase of 800,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

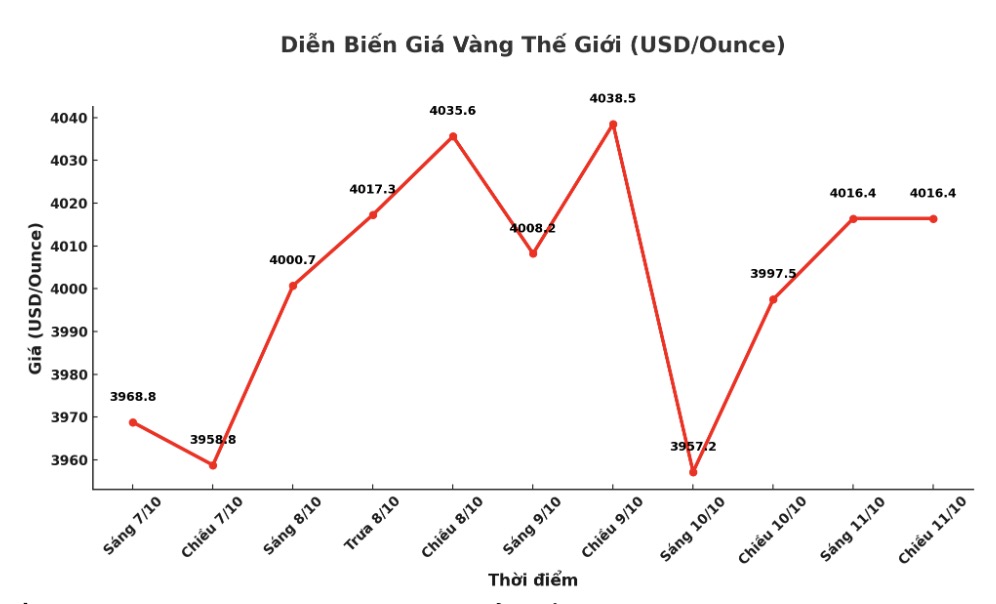

World gold price

The world gold price was listed at 5:15 p.m. at 4,016.4 USD/ounce, up 18.9 USD compared to a day ago.

Gold price forecast

Lukman Otunuga - senior market analyst at FXTM - commented: "If geopolitical tensions in the Middle East cool down, the selling side can take advantage of this opportunity. However, fundamental factors still support the long-term upward trend of gold. In the short term, if prices fall below the support zone of $3,950/ounce, gold may correct, while if they surpass $4,000/ounce, prices could completely move up to $4,050/ounce and reach a new peak.

Michele Schneider - Market Strategist at Market Gauge - said that she took profits from all gold and silver positions because she felt the "fear of missing out" (FOMO) mentality was spreading.

Gold and silver have risen too strongly, so taking profits and waiting for new buying opportunities is completely reasonable, she said, warning that gold prices may be forming a peak model like in 2011.

The $4,000/ounce mark is a key psychological threshold, with the market likely to hover around $3,900-4,100/ounce to accumulate, emphasized Paul Williams, CEO of Solomon Global. However, each adjustment this year is quickly absorbed by strong buying power. The fundamental factors that have pushed gold to this level are not yet gone.

He also added: individuals are increasingly aware of financial risks, public debt and the weakening of legal currency, especially the USD. Many are looking for stability in tangible assets such as gold. In addition to central banks continuing to net buy, retail investors are becoming an important part of this story.

Notable economic data next week

Tuesday: FED Chairman Jerome Powell attends a discussion at the National Association for Business Economics (NABE) Annual Meeting.

Wednesday: New York FED manufacturing survey.

Thursday: survey of FED Philadelphia's business performance.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...