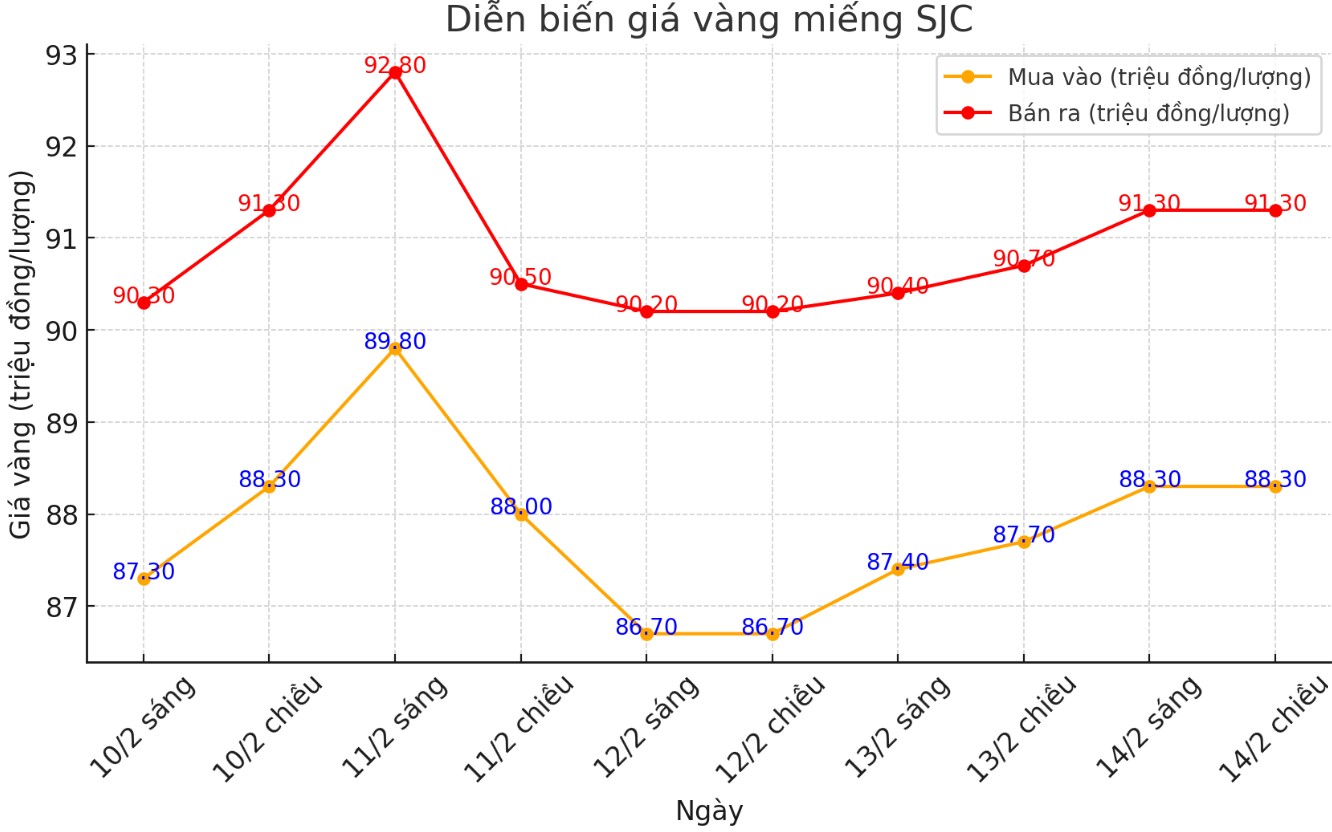

Updated SJC gold price

As of 6:00 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND 88.3-91.3 million/tael (buy - sell), an increase of VND 600,000/tael for both buying and selling.

The difference between the buying and selling prices of SJC gold at Saigon Jewelry Company SJC is at 3 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 88.3-91.3 million VND/tael (buy - sell), an increase of 600,000 VND/tael for both buying and selling. The difference between the buying and selling prices of SJC gold was listed by Bao Tin Minh Chau at 3 million VND/tael.

DOJI Group listed the price of SJC gold bars at 88.3-91.3 million VND/tael (buy - sell), an increase of 600,000 VND/tael for both buying and selling. The difference between the buying and selling prices of SJC gold was listed by DOJI at 3 million VND/tael.

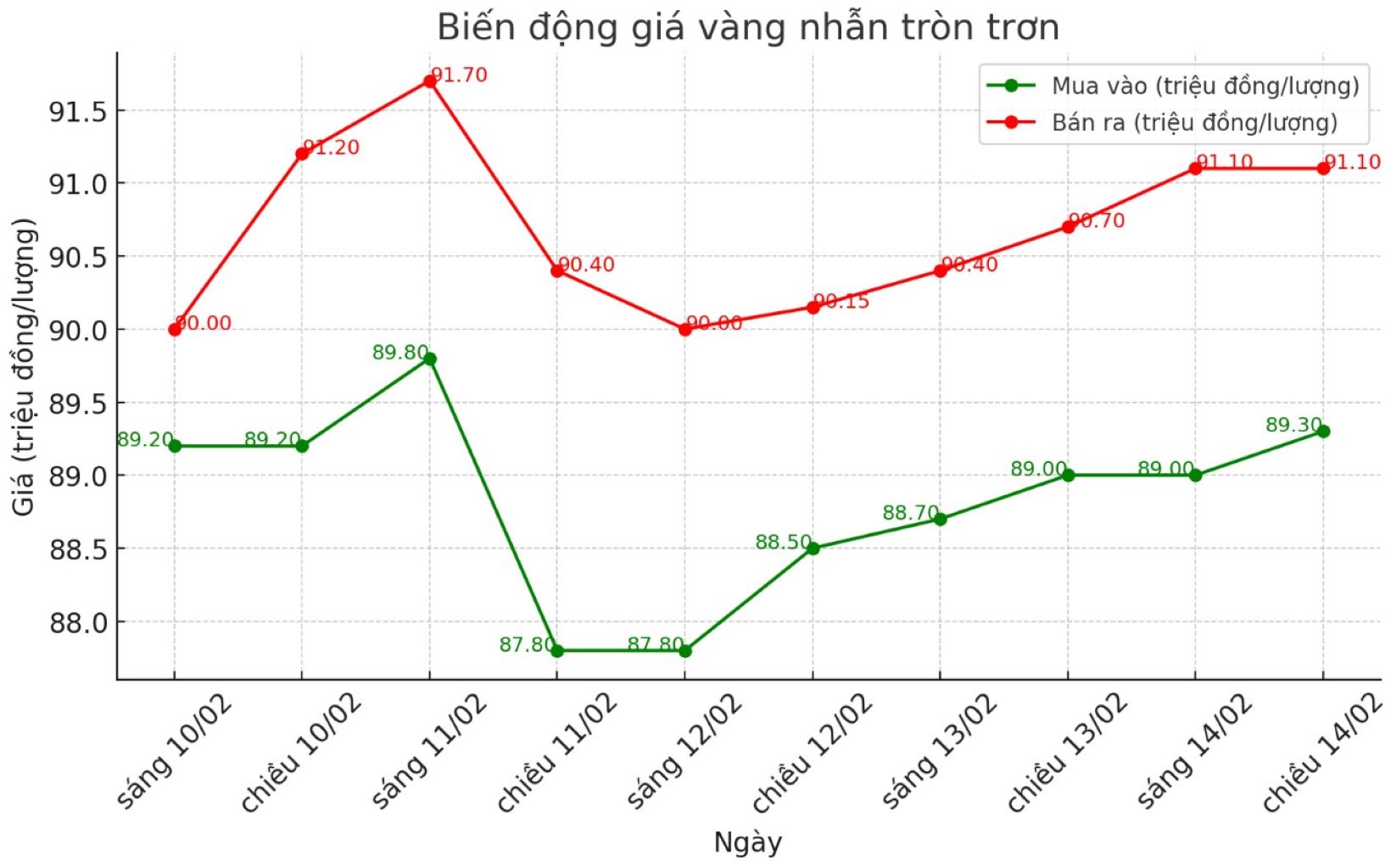

9999 round gold ring price

As of 6:00 p.m. today, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at VND89.3-91.1 million/tael (buy - sell); increased by VND300,000/tael for buying and increased by VND400,000/tael for selling. The difference between buying and selling is listed at 1.8 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 89.3-91.3 million VND/tael (buy - sell); increased by 200,000 VND/tael for buying and increased by 600,000 VND/tael for selling. The difference between buying and selling is at 2 million VND/tael.

World gold price

As of 6:10 p.m., the world gold price listed on Kitco was at 2,934.7 USD/ounce, up 18.2 USD/ounce compared to the same time of the previous session.

Gold price forecast

World gold prices increased as the USD decreased. Recorded at 6:15 p.m. on February 14, the US Dollar Index measuring the fluctuations of the greenback against 6 major currencies was at 106.880 points (down 0.31%).

The world gold market is recording a strong increase, with gold futures reaching an all-time high. According to Kitco, the main reason driving this trend is the weakening of the USD.

Although the decline in the USD is the main factor, there is an important reason behind it: Concerns about tariffs.

US President Donald Trump has just announced that he will impose counterpart tariffs on countries that tax imports from the US, raising concerns about an escalating trade war.

Meanwhile, the latest data from the US Department of Labor showed the January PPI rose 0.4%, reinforcing the view that inflationary pressures are rising. Previously, the January Consumer Price Index (CPI) report showed inflation increased by 0.5%, higher than December's 0.4% increase and far exceeding the market's forecast of 0.3%.

According to Reuters, the sharp increase in US manufacturing prices in January is a clear sign that inflation is returning. This makes investors believe that the US Federal Reserve (FED) is likely to delay interest rate cuts until at least the second half of this year.

However, the recent gold market has shown a good ability to absorb unfavorable information. Despite higher-than-expected inflation data, gold prices are still rising, reflecting strong safe-haven demand, especially from central banks around the world. Investors are concerned that new US tariffs could slow global economic growth, further boosting demand for precious metals.

Peter Grant - Vice President and senior metals strategist at Zaner Metals - commented that although high interest rates create some pressure, the trend of gold is still positive, in the context of concerns about the US - China trade war continuing to weigh on the market.

Nicky Shiels - appraisal expert at PAMP SA MKS, predicted that gold prices could continue to increase to 3,200 USD/ounce.

Tobina Kahn - President of House of Kahn Estate Jewelers - believes that spot gold will soon reach $3,000/ounce. She even said that some investors are considering a scenario where gold prices skyrocket to $4,000-6,000/ounce in the future.

See more news related to gold prices HERE...