Update SJC gold price

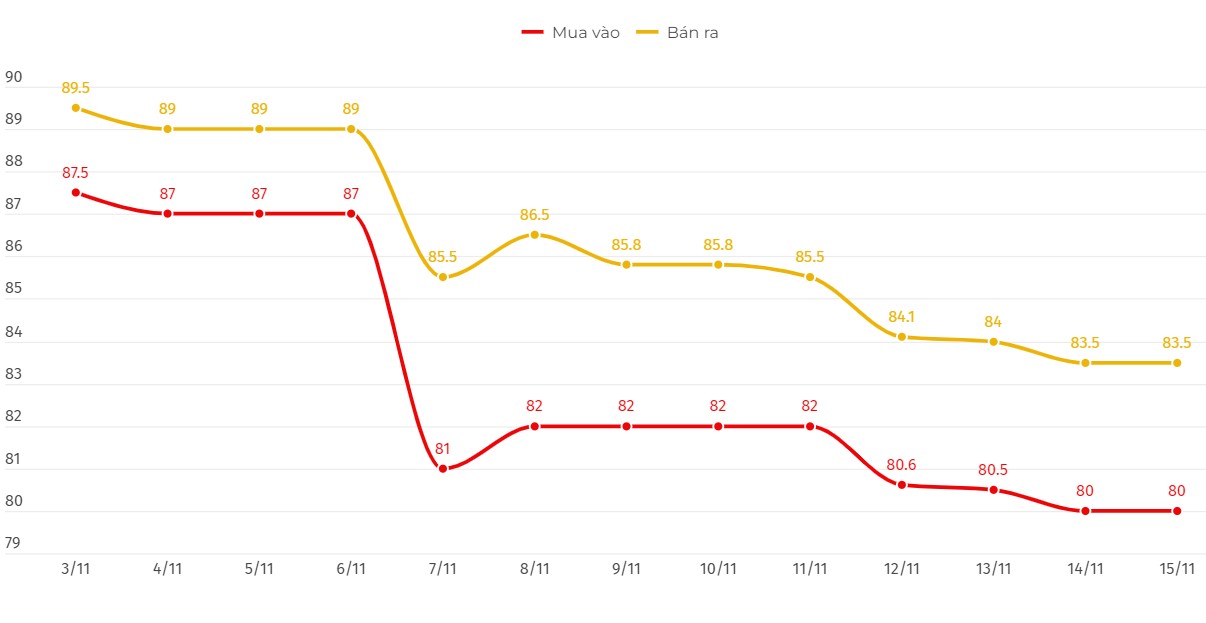

As of 9:30 a.m., the price of SJC gold bars was listed by DOJI Group at 80-83.5 million VND/tael (buy - sell).

Compared to the beginning of the previous trading session, gold prices at DOJI remained unchanged in both buying and selling directions.

The difference between buying and selling price of SJC gold at DOJI Group is at 3.5 million VND/tael.

Meanwhile, Saigon Jewelry Company listed the price of SJC gold at 80-83.5 million VND/tael (buy - sell).

Compared to the beginning of the previous trading session, the gold price at Saigon Jewelry Company SJC remained unchanged in both buying and selling directions.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 3.5 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 80-83.5 million VND/tael (buy - sell).

Compared to the beginning of the previous trading session, gold prices at Bao Tin Minh Chau remained unchanged in both buying and selling directions.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 3.5 million VND/tael.

Currently, the difference between buying and selling gold prices is listed at around 2 million VND/tael. Experts say that this difference is very high, causing investors to face the risk of losing money when investing in the short term.

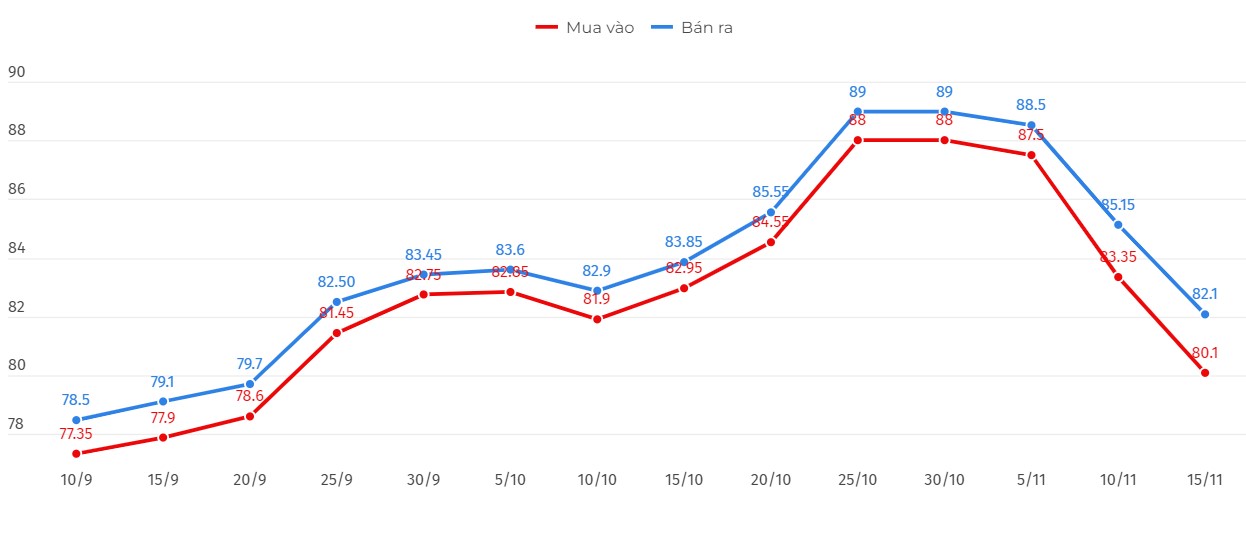

Price of round gold ring 9999

As of 9:30 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 80.1-82.1 million VND/tael (buy - sell); down 400,000 VND/tael for both buying and selling compared to early this morning.

Bao Tin Minh Chau listed the price of gold rings at 80.12-82.22 million VND/tael (buy - sell), down 400,000 VND/tael for buying and down 450,000 VND/tael for selling compared to early this morning.

World gold price

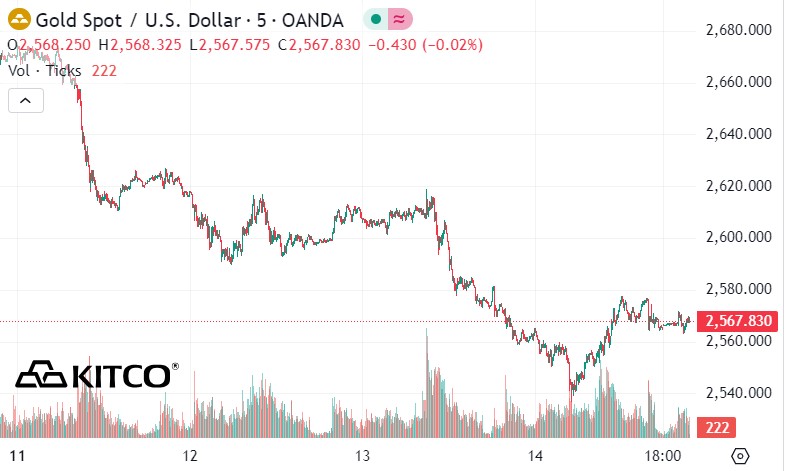

As of 9:35 a.m., the world gold price listed on Kitco was at 2,567.8 USD/ounce, up 5.8 USD/ounce compared to the beginning of the previous trading session.

Gold Price Forecast

World gold prices fell due to pressure from the strong increase of the USD. Recorded at 9:40 a.m. on November 15, the US Dollar Index, which measures the fluctuations of the greenback against 6 major currencies, was at 106.739 points.

Gold's decline in the global market showed signs of slowing as the number of weekly US jobless claims fell. Better-than-expected labor market data was released after the number of Americans filing new claims for unemployment benefits was lower than economists forecast.

The U.S. Labor Department said Thursday that initial jobless claims rose to a seasonally adjusted 217,000 for the week ended Nov. 9. That was lower than expectations, as the consensus estimate forecast claims of 223,000.

Currently, expectations for the US Federal Reserve (FED) to cut interest rates for the third time in a row remain high. According to the CME Fedwatch tool, the market forecasts an 82% chance that the FED will cut interest rates by 25 basis points at its December meeting, marking the third cut this year.

This week, in their remarks, FED officials remained cautious about cutting interest rates in the future, citing concerns about inflation risks.

Accordingly, St. Louis Fed President Alberto Musalem expects inflation to gradually decline, while Dallas Fed President Lorie Logan warns that excessive policy easing could reignite inflationary pressures.

Jim Wyckoff, senior market analyst at Kitco, predicts that gold will recover to $2,700/ounce in the near future; if it fails to recover, the precious metal could stand firm at $2,500/ounce.

Meanwhile, Mr. Zain Vawda - market analyst of OANDA predicts that when the US enters a new presidential term, the FED may pause its easing cycle if inflation spikes after the new round of tariffs. He believes that in the short term, gold prices are likely to recover slightly, but will then fall again.

See more news related to gold prices HERE...