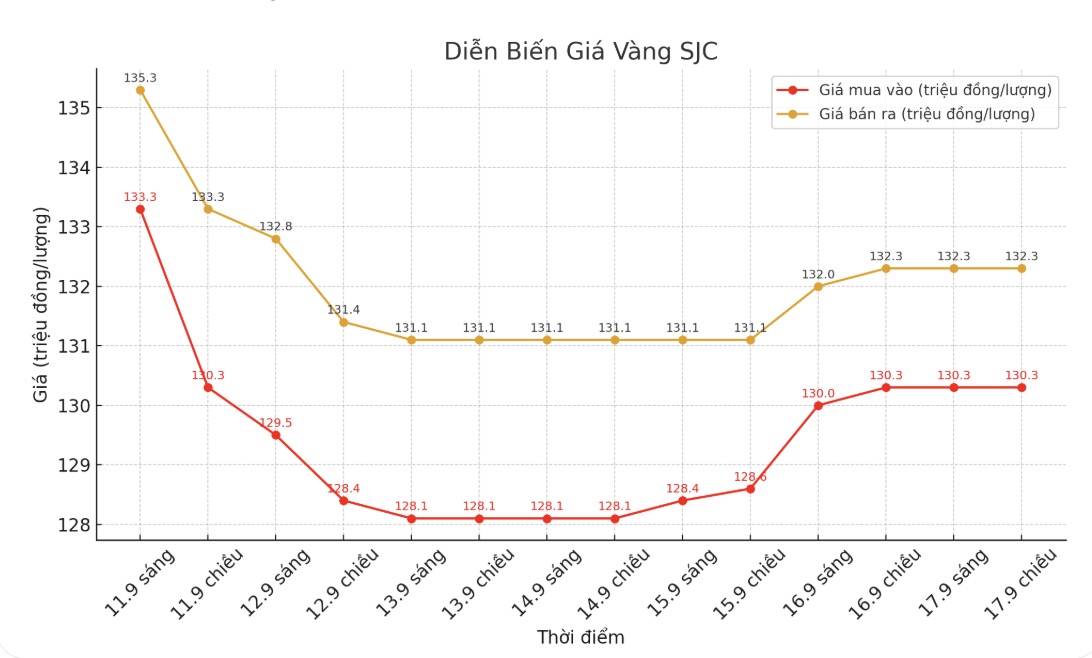

SJC gold bar price

As of 6:00 p.m., DOJI Group listed the price of SJC gold bars at VND130.3-132.3 million/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 130.3-132.3 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 129.8-132.3 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 2.5 million VND/tael.

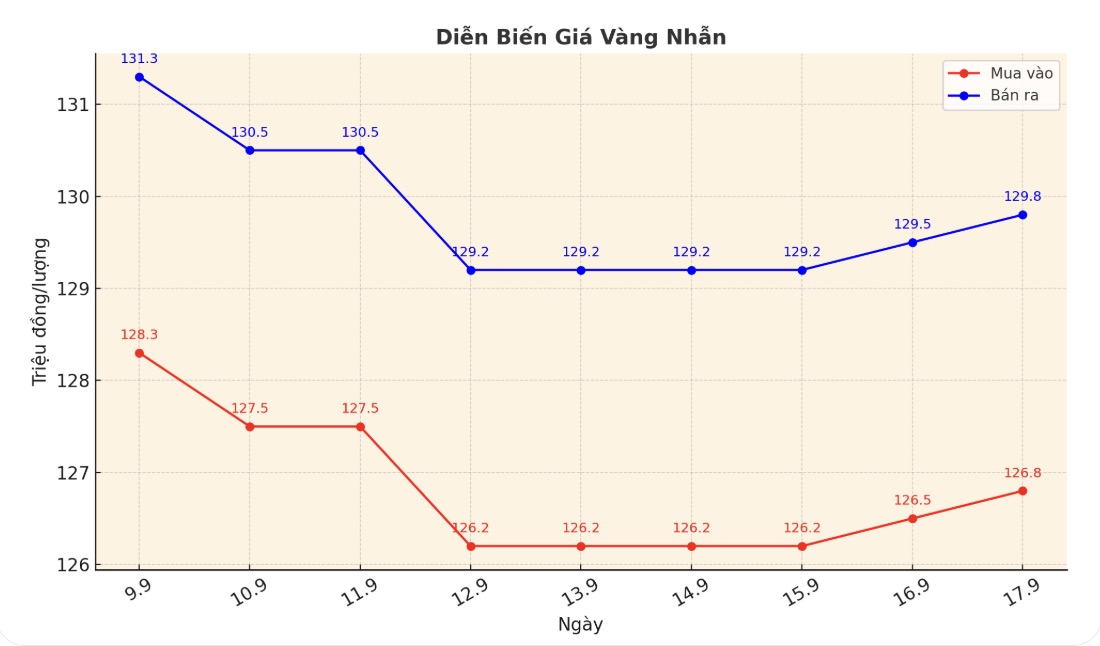

9999 gold ring price

As of 6:00 p.m., DOJI Group listed the price of gold rings at 126.8-129.8 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 127.6-130.6 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 126.8-129.8 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Currently, the difference between buying and selling gold rings is at a very high level, around 3 million VND/tael, posing a potential risk of loss for investors.

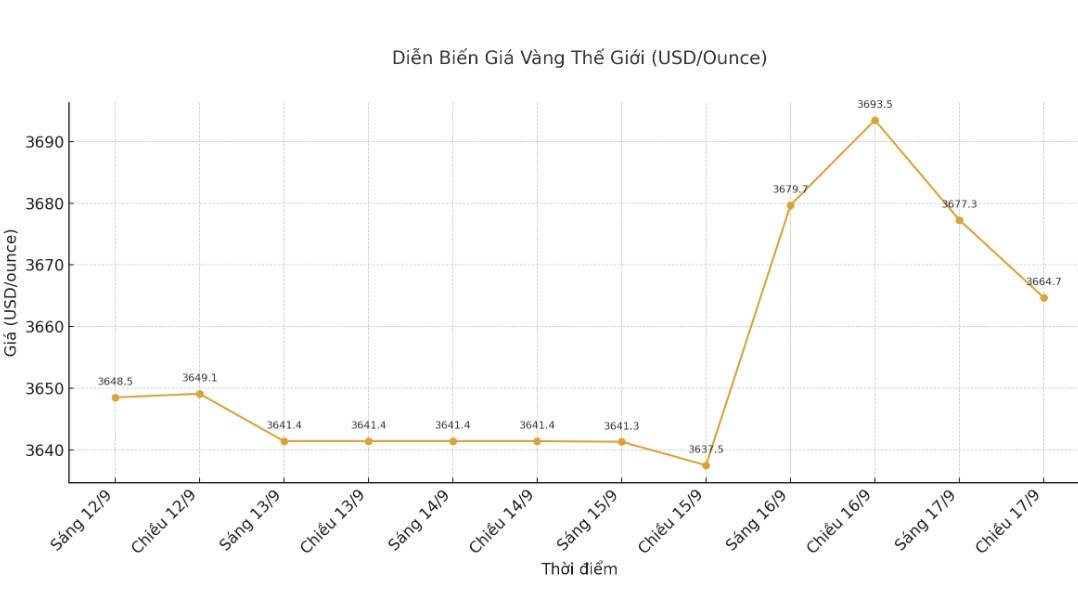

World gold price

The world gold price was listed at 6:00 p.m. at 3,664.7 USD/ounce, down 28.8 USD.

Gold price forecast

Gold prices fell in the fourth session from the record high reached in the previous session, due to investors' profit-taking activities and a stronger USD, which put pressure on the time the US Federal Reserve (FED) announced monetary policy.

The USD Index (DXY) increased by 0.2% after falling to a 2-month low in the previous session. The yield on the 10-year US Treasury note remained near a 5-month low.

During the several times gold has approached the $3,700/ounce mark, prices have fallen back, suggesting that analysts are defending this threshold, said StoneX analyst Rhona OConal.

Mr. Tim Waterer - Director of Market Analysis at the KCM Trade foreign exchange and commodity exchange, commented: "The increase in gold prices to the mark of 3,700 USD/ounce is supported by the weakening of the USD and the expectation that the Fed will signal to continue cutting interest rates before the end of 2025.

Profit-taking around this threshold has caused gold prices to fall, but if the Fed sends a more dovish message at the monetary policy meeting, gold prices could well rebound, the expert said.

Deutsche Bank on Wednesday raised its forecast for the average gold price in 2026 from 3,700 USD to 4,000 USD/ounce.

Bank of America experts say the current economic context is especially favorable for gold. The bank stressed the risk of stagflation as a key driver of demand for precious metals.

In fact, as high inflation comes with slow growth, the intrinsic value of gold becomes more attractive to both institutional and individual investors.

In further strengthening this trend, the US consumer price index (CPI) in August increased by 2.9% - high enough to continue supporting gold prices.

SPDR Gold Trust the worlds largest gold ETF said its holdings rose 0.32% to 979.95 tonnes on Tuesday, up from 976.80 tonnes on Monday.

Technically, December gold futures show that buyers still have a strong advantage in the short term. The next upside target is to close above the resistance level of $3,800/ounce.

The first support level was at an overnight low of $3,711.8/ounce and then $3,700. The first resistance was at $3,750/ounce and then $3,775/ounce.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...