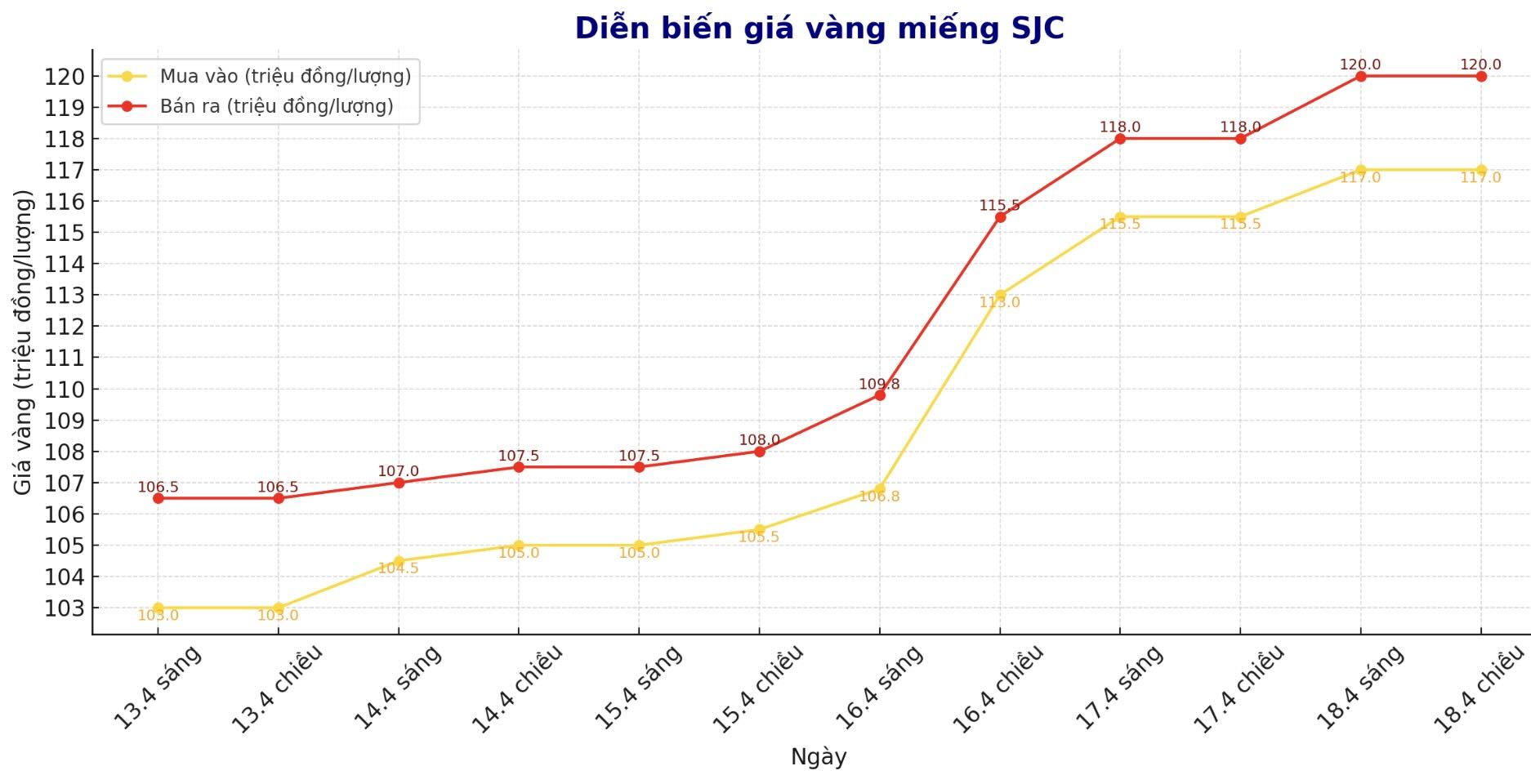

Updated SJC gold price

As of 5:00 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND117-120 million/tael (buy - sell); increased by VND1.5 million/tael for buying and increased by VND2 million/tael for selling. The difference between buying and selling prices is at 2.5 million VND/tael.

At the same time, DOJI Group listed the price of SJC gold bars at 117-120 million VND/tael (buy - sell); increased by 1.5 million VND/tael for buying and increased by 2 million VND/tael for selling. The difference between buying and selling prices is at 2.5 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 117-120 million VND/tael (buy - sell); increased by 1.5 million VND/tael for buying and increased by 2 million VND/tael for selling. The difference between buying and selling prices is at 2.5 million VND/tael.

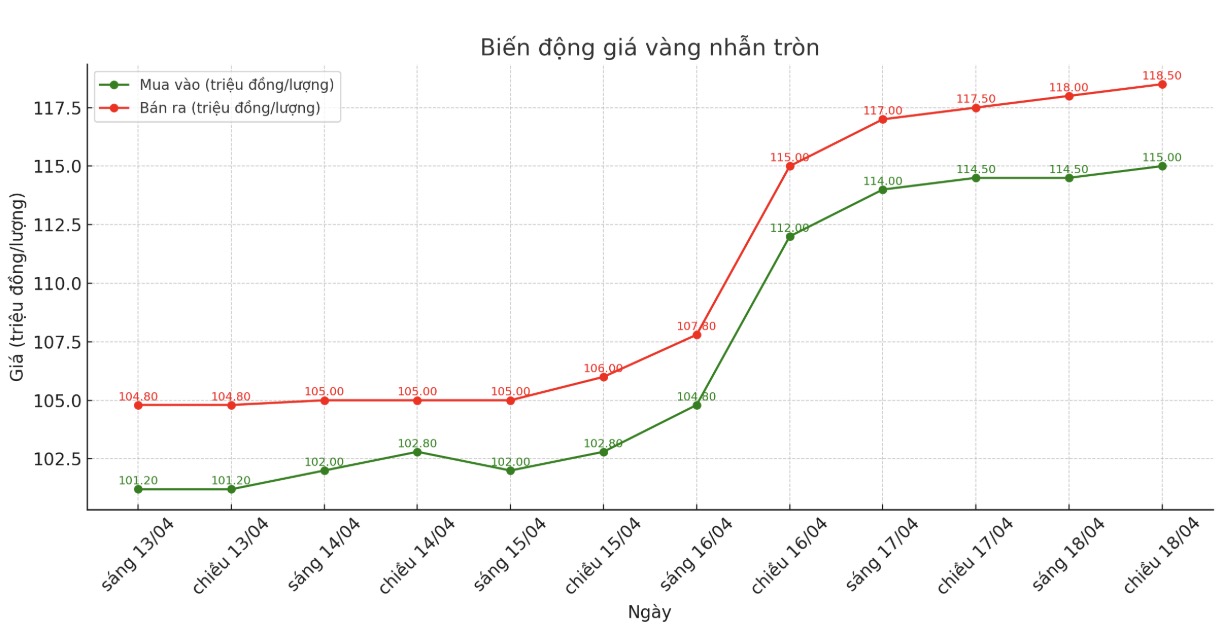

9999 round gold ring price

As of 5:00 p.m. today, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 115-118.5 million VND/tael (buy - sell); increased by 500,000 VND/tael for buying and increased by 1 million VND/tael for selling. The difference between buying and selling prices is at 3.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 116.5-1195 million VND/tael (buy - sell); an increase of 1.5 million VND/tael for both buying and selling compared to early in the morning. The difference between buying and selling prices is at 3 million VND/tael.

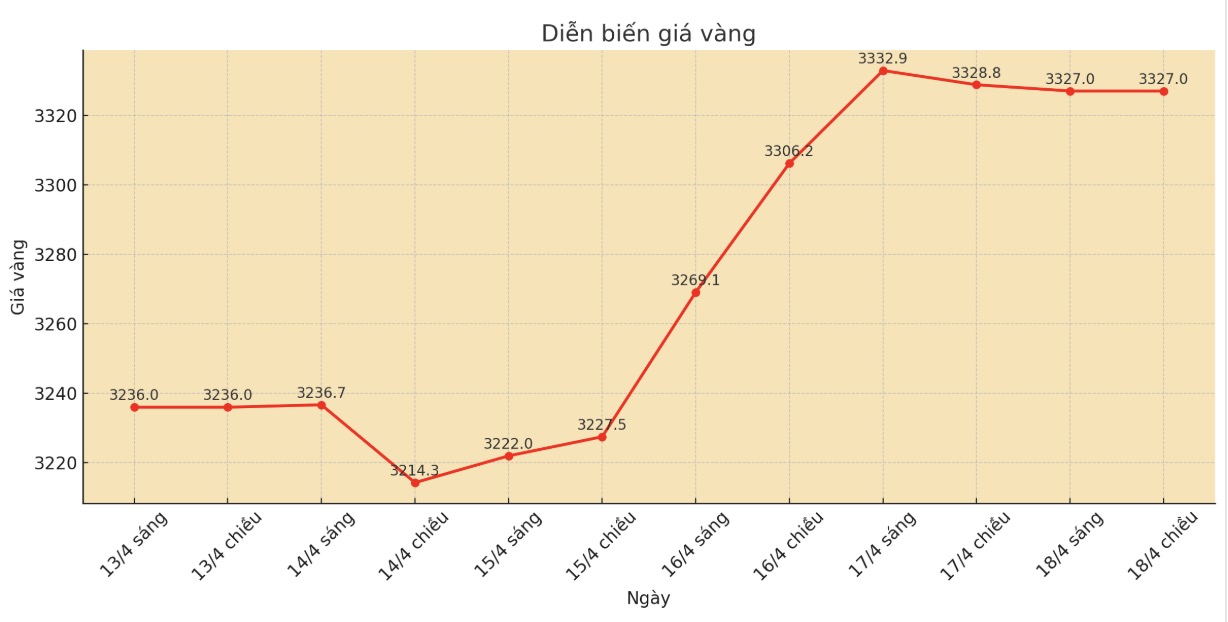

World gold price

As of 5:15 p.m., the world gold price was listed at 3,327 USD/ounce, down 1.8 USD.

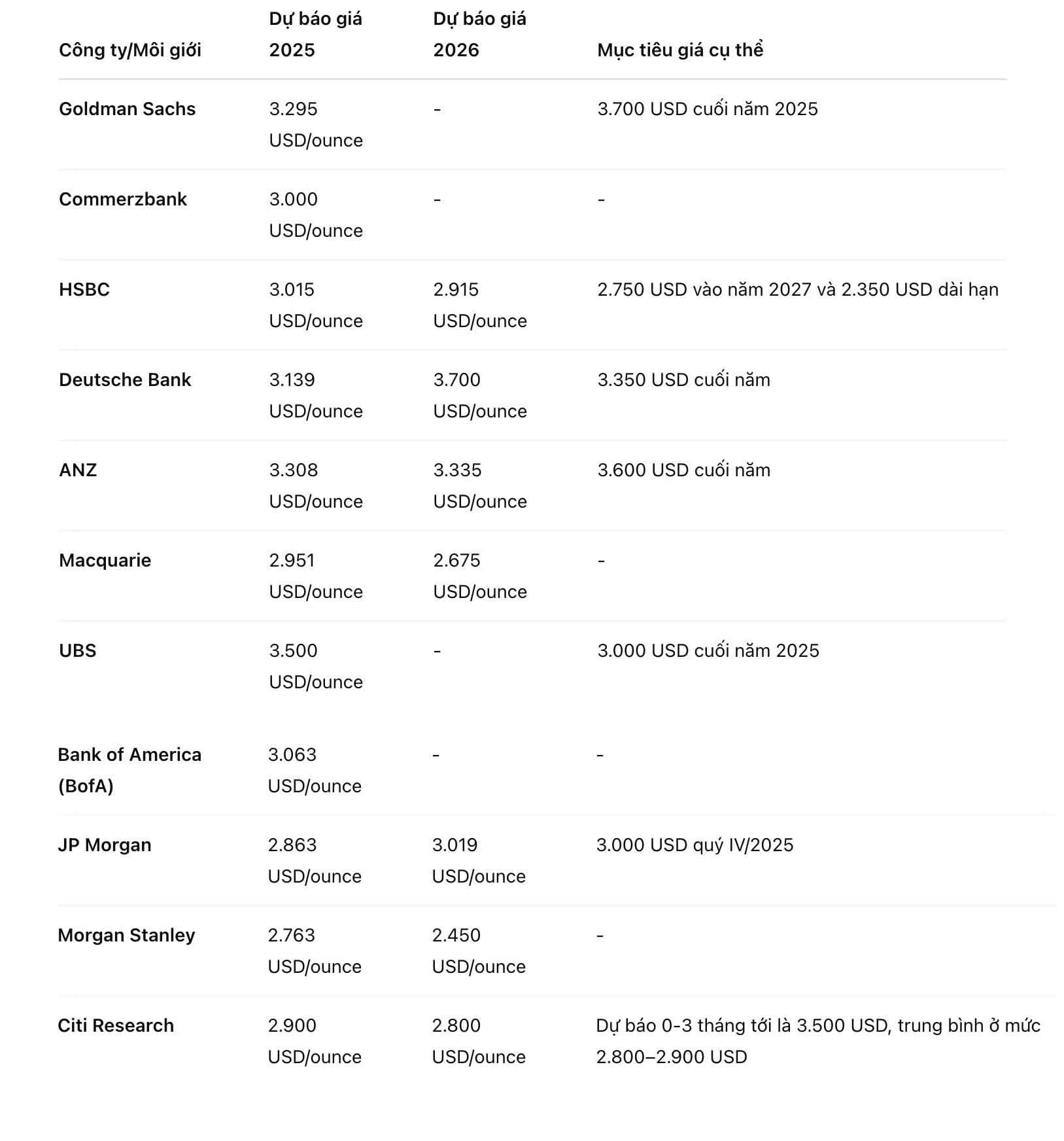

Gold price forecast

Many major financial institutions have simultaneously raised their gold price forecasts. The momentum comes from the strong demand for shelter and cash flow of Chinese insurance companies.

In a report released on Thursday, Citi Research (market research and economic analysis department of Citigroup, one of the world's largest financial groups headquartered in the US) said it had raised the gold price target for the next 3 months from 3,200 USD/ounce to 3,500 USD/ounce.

The reason for the adjustment is due to strong demand for gold from Chinese insurance companies and tax risks and weak market cash flow.

According to Citi, China's recent decision allows 10 insurance companies to allocate up to 1% of total assets to gold that can create demand of about 255 tons per year, equivalent to about 1/4 of the total gold purchases by global central banks.

Gold prices fell more than 1% in the session on Thursday after reaching a record peak of $3,357.4/ounce at the beginning of the session, as investors took profits before a long holiday.

However, a weak US dollar and escalating US-China trade tensions still keep gold prices above $3,300/ounce. Gold prices have rallied this morning and regained almost all of their previous gains.

Not only Citi Research, many banks and financial institutions have recently raised their forecasts for the precious metal. Analysts at UBS believe that prices will reach $3,500 by December 2025 at the latest. Last month, both UBS and Goldman Sachs raised their gold price forecasts, due to the uncertain policy environment in the US.

UBS forecasts demand to strengthen in many segments, from central banks, investment funds to individual investors. "The prolonged uncertainty is increasing demand for portfolio diversification, which is beneficial for gold," analysts at UBS said.

Meanwhile, Bank of America - the second largest bank in the US, believes that gold prices in 2025 will average about 3,063 USD/oz, compared to the previous forecast of 2,750 USD/oz. The banks new report also predicts gold prices will average $3,350/oz by 2026, compared to a previous forecast of $2,625/oz.

Bank of America analysts expect gold prices to reach $3,500/oz within the next 2 years. Last month, Bank of America said global gold investment demand needs to increase by 10% so that prices can reach 3,500 USD/z.

Its a lot to hear, but its not impossible, Bank of America analysts wrote in their latest report.

Here is the latest gold price forecast table for 2025 and 2026 (unit: USD/ounce):

Note: The article data compares with the same time of the previous trading session.

See more news related to gold prices HERE...