Updated SJC gold price

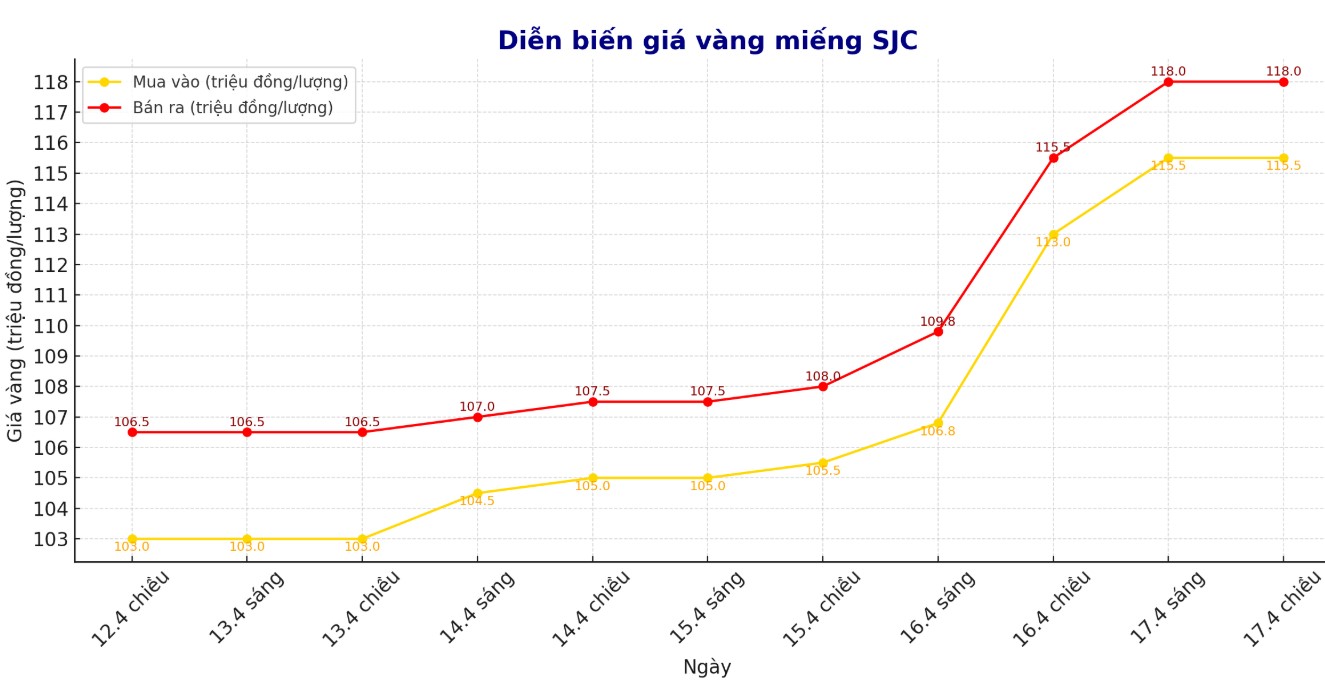

As of 6:15 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND115.5-118 million/tael (buy in - sell out); increased by VND2.5 million/tael for both buying and selling. The difference between buying and selling prices is at 2.5 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 115.5-118 million VND/tael (buy - sell); an increase of 2.5 million VND/tael for both buying and selling. The difference between buying and selling prices is at 2.5 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 115.5-118 million VND/tael (buy - sell); increased by 3 million VND/tael for buying and increased by 2.5 million VND/tael for selling. The difference between buying and selling prices is at 2.5 million VND/tael.

9999 round gold ring price

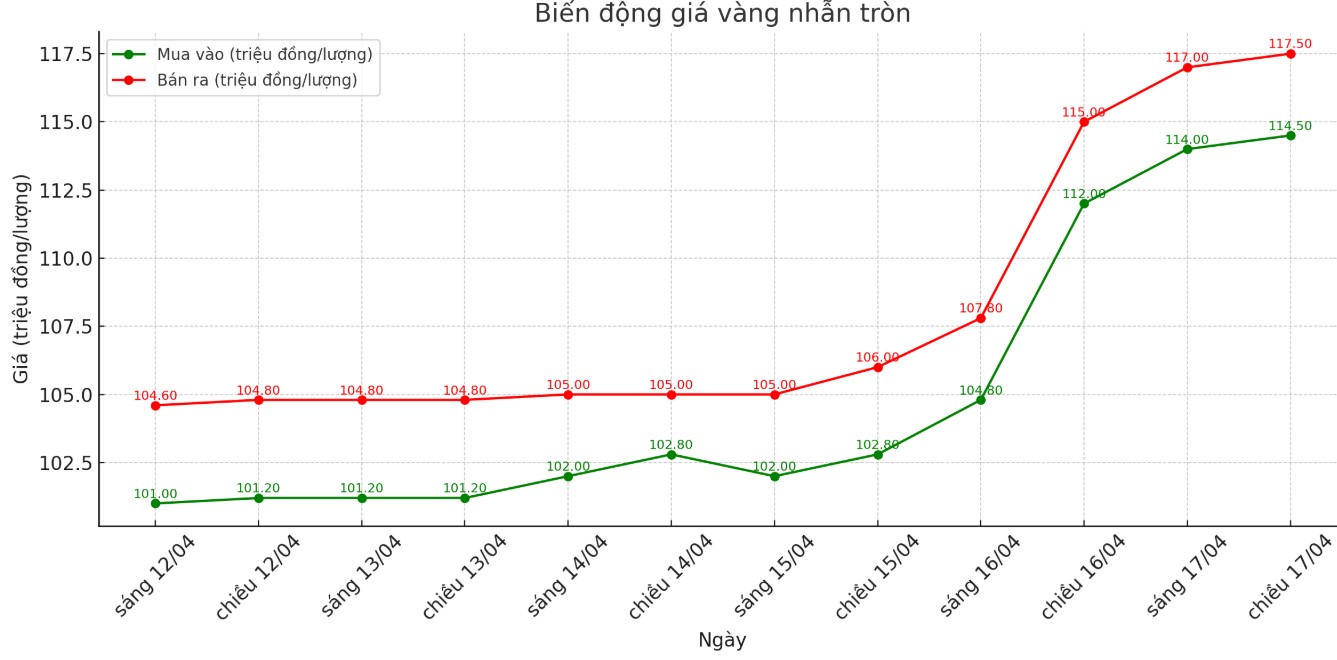

As of 6:15 p.m. today, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 114.5-117.5 million VND/tael (buy in - sell out); increased by 4 million VND/tael for both buying and selling. The difference between buying and selling prices is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 115-118 million VND/tael (buy - sell); an increase of 3 million VND/tael for both buying and selling compared to early in the morning. The difference between buying and selling prices is at 3 million VND/tael.

The soaring price of gold has caused many gold shops on Tran Nhan Tong and Cau Giay streets (Hanoi) to be packed with people coming to trade. Some big stores such as Bao Tin Minh Chau, DOJI, PNJ, Phu Quy... recorded a sudden increase in the number of customers, had to temporarily stop because they were out of stock and ensured security.

Recorded at 6:15 p.m. at a store on Cau Giay Street, many people were still lining up to buy even though each person could only buy 2 taels of gold. Mr. Nguyen Anh Tuan (Nam Tu Liem, Hanoi) said that he has been queuing since morning, only those who arrived early could buy 1 tael. Ms. Nguyen Thi Anh (Long Bien) shared that she had to go home empty-handed because many places were out of stock or lacked for too long.

This development comes as investors seek gold as a safe haven amid inflationary concerns and economic instability. However, experts warn that buying gold at high prices has potential risks, especially for short-term investors. The State Bank also recommends that people should not follow the crowd mentality and closely monitor market developments.

World gold price

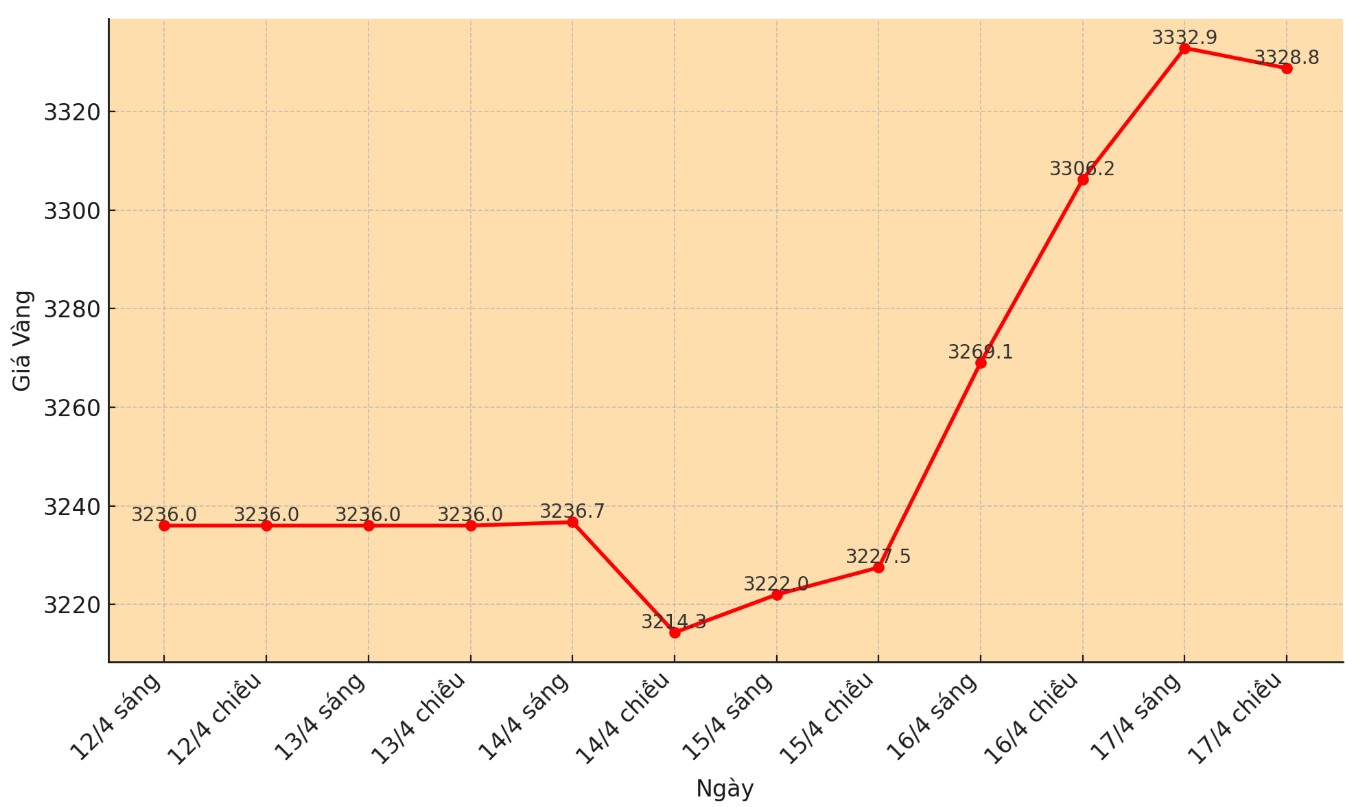

As of 6:15 p.m., the world gold price was listed at 3,328.8 USD/ounce, up 22.6 USD.

Gold price forecast

World gold prices fell on Thursday after hitting a record high, as investors took advantage of profit-taking after a recent strong increase.

Ross Norman - an independent analyst commented: "It is possible that the price reversed after reaching a peak due to some investors taking profits. The slight increase in the USD also partly reduces the attraction of gold. However, the discounts were quickly bought in, showing that market sentiment is still very positive".

The US dollar index recovered slightly after hitting its lowest level in nearly 3 years, making gold more expensive for buyers in other currencies.

Federal Reserve Chairman Jerome Powell said the agency will wait for more data before adjusting interest rates, while warning that Trump's tax policies could cause inflation to deviate from the Fed's target.

Jerome Powell spoke more openly than usual about the new administration and the impact of its policies in his speech at the Chicago Economic Club on Wednesday afternoon.

Powell said that in 2024, the US economy will grow by 2.4%, the unemployment rate will remain at about 4%, close to what is considered "all-inclusive labor force". Inflation has also decreased, to about 2.5% by the end of the year. That is the time when the economy is operating relatively stably.

However, he warned that the new administration is now implementing many new policies, especially in trade, which could cause the US economy to deviate from employment and price control targets.

Carsten Menke - an expert at Julius Baer - said: "The market is currently thinking that no matter the scenario, gold will still benefit".

However, physical demand for gold in India is still weak this week due to price increases being too hot, while in China, the price difference remains stable.

Norman warned: The fact that traditional gold buyers are less involved in the rally this time could be a sign that the market is about to peak. But there is no reason for gold to fall so low at the moment, except for the technical factor of overbought prices.

Note: The article data compares with the same time of the previous trading session.

See more news related to gold prices HERE...