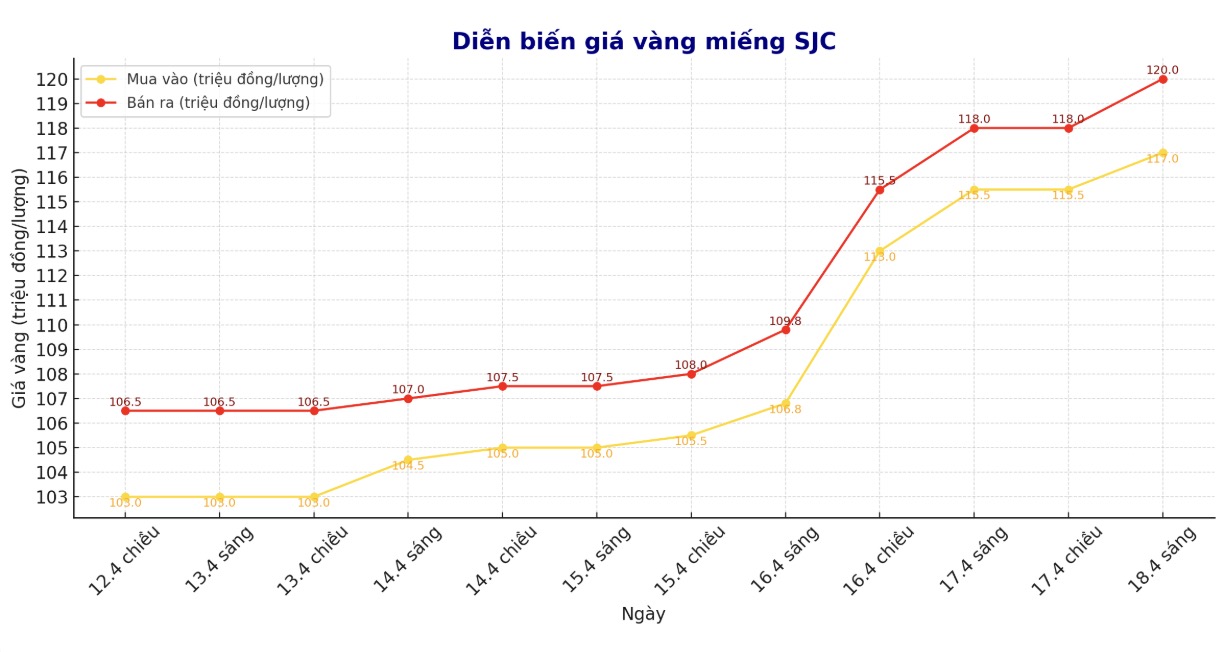

Updated SJC gold price

Last night, when the world gold price plummeted, many people waited for a cooling session in the domestic market. However, early this morning, world gold almost regained the entire decline of the previous session. Domestic gold prices even increased sharply, breaking a new peak.

As of 9:55 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND117 - SJC at VND117 million/tael (buy - sell), an increase of VND1.5 million/tael for buying and VND2 million/tael for selling. The difference between buying and selling prices is at 3 million VND/tael.

At the same time, DOJI Group listed the price of SJC gold bars at 117-120 million VND/tael (buy - sell), an increase of 1.5 million VND/tael for buying and an increase of 2 million VND/tael for selling. The difference between buying and selling prices is at 3 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 117-120 million VND/tael (buy - sell), an increase of 1.5 million VND/tael for buying and an increase of 2 million VND/tael for selling. The difference between buying and selling prices is at 3 million VND/tael

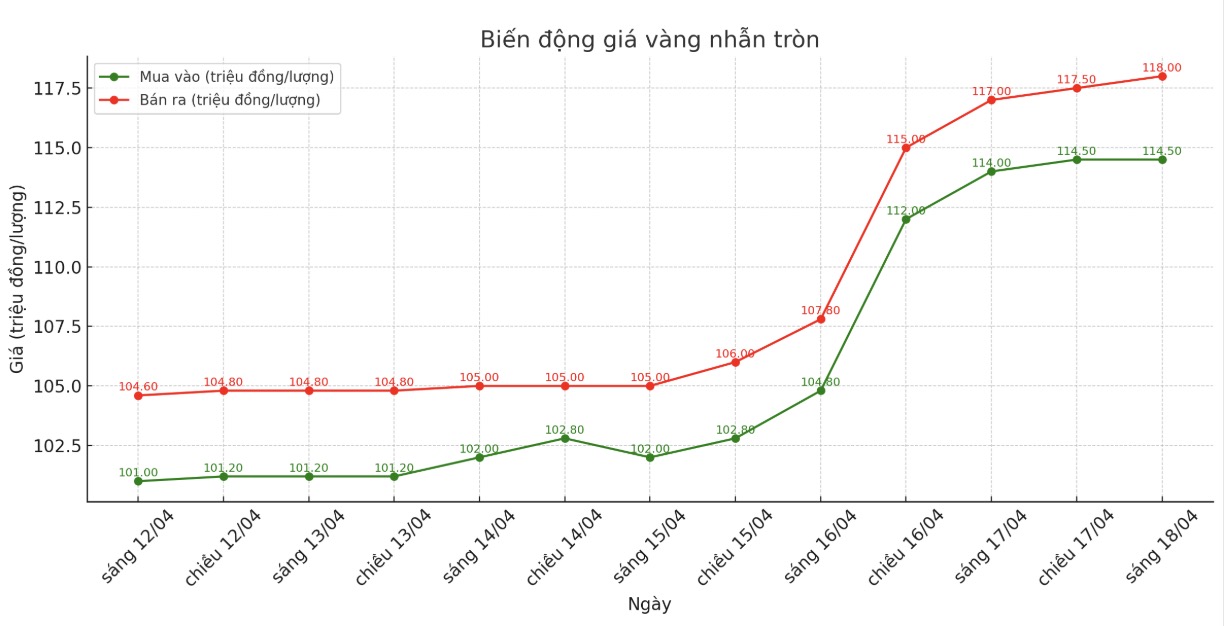

9999 round gold ring price

As of 9:55 a.m., the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at VND 114.5-118 million/tael (buy - sell), an increase of VND 500,000/tael for buying and an increase of VND 1 million/tael for selling. The difference between buying and selling prices is at 3.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 116.5-1195 million VND/tael (buy - sell), an increase of 2 million VND/tael for both buying and selling. The difference between buying and selling is 3 million VND/tael.

In the context of strong fluctuations in domestic gold prices, the buying-selling gap is pushed to an excessively high level, causing risks for individual investors to increase.

In the context of many fluctuations in the world gold market, the large difference between buying and selling in the domestic market is a clear warning sign. If gold prices turn down, buyers will face a huge loss. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

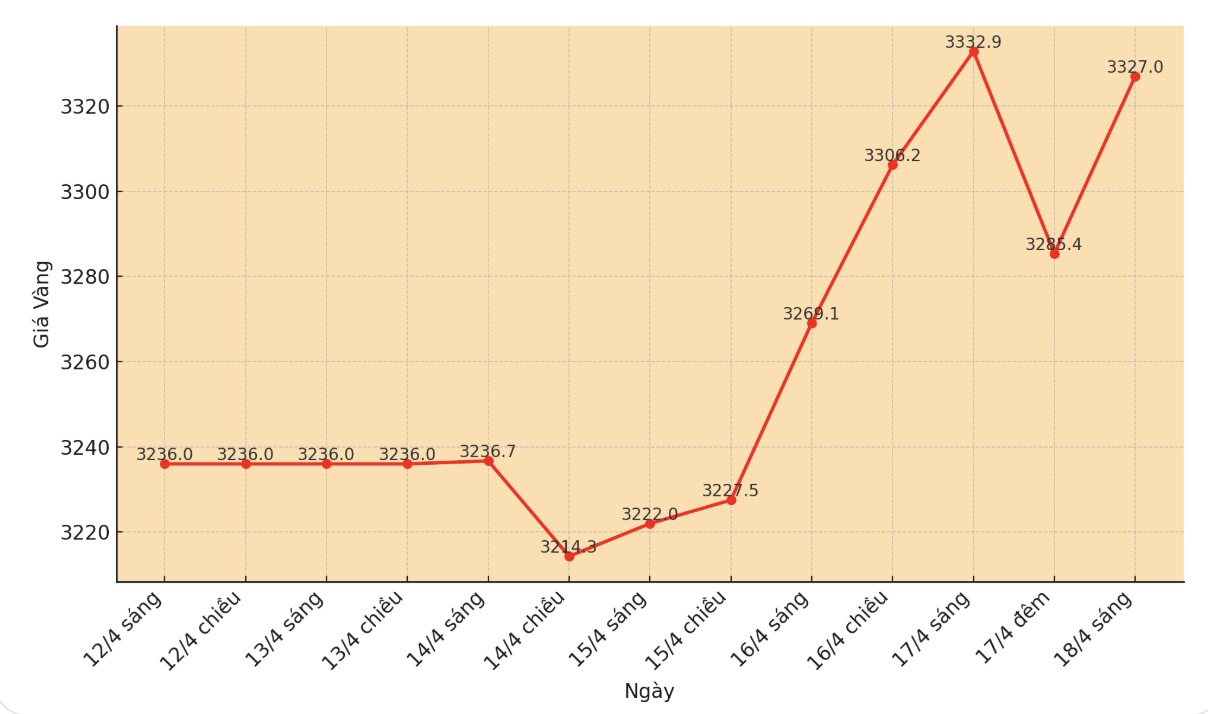

World gold price

At 9:55 a.m., the world gold price was listed on Kitco around 3,327 USD/ounce.

Gold price forecast

In an interview with Kitco News, Mike McGlone - senior commodity strategist at Bloomberg Intelligence said that the recent increase in gold prices may be just the beginning of another strong increase.

This expert believes that gold prices could reach $4,000/ounce, in the context of traditional safe-haven channels gradually losing their effectiveness, Bitcoin weakening and the US stock market at too high valuations.

Currently, gold is forming a fairly solid foundation around the $3,000/ounce mark. Prices will move towards 4,000/ounce, the problem is just time. The price gap between these two levels is just a playground for speculators, like me before, McGlone said.

Goldman Sachs (one of the world's largest financial and banking groups, headquartered in New York, USA) also recently raised its year-end gold price forecast to $3,700/ounce and said that the precious metal could reach $3,900/ounce if the economy recessioned.

McGlone believes that gold's strength reflects a shift in capital flows from speculative assets. Gold is currently the most expensive ever compared to US long-term bonds. This shows that the burden of public debt is too great, while tax policies push inflation up, he said.

In another development, gold prices hit a peak against the euro when the ECB cut interest rates. This move comes amid economic uncertainty and weak inflationary pressures.

As expected, the ECB continued to cut three key interest rates by 25 basis points on Thursday. Interest rates for deposits, major refinancing and frontier lending will decrease to 2.25%, 2.40%, and 2.65%, respectively.

The ECB warned that the risk of economic downturn still exists, but this policy message does not provide much new information.

Inflation continued to move in line with forecasts, with both general inflation and core inflation falling in March. Inflation in the service sector has also cooled down significantly in the past few months.

Most of the core inflation indicators show that inflation will remain around the Board of Directors' medium-term target of 2%, the ECB said.

See more news related to gold prices HERE...