Update SJC gold price

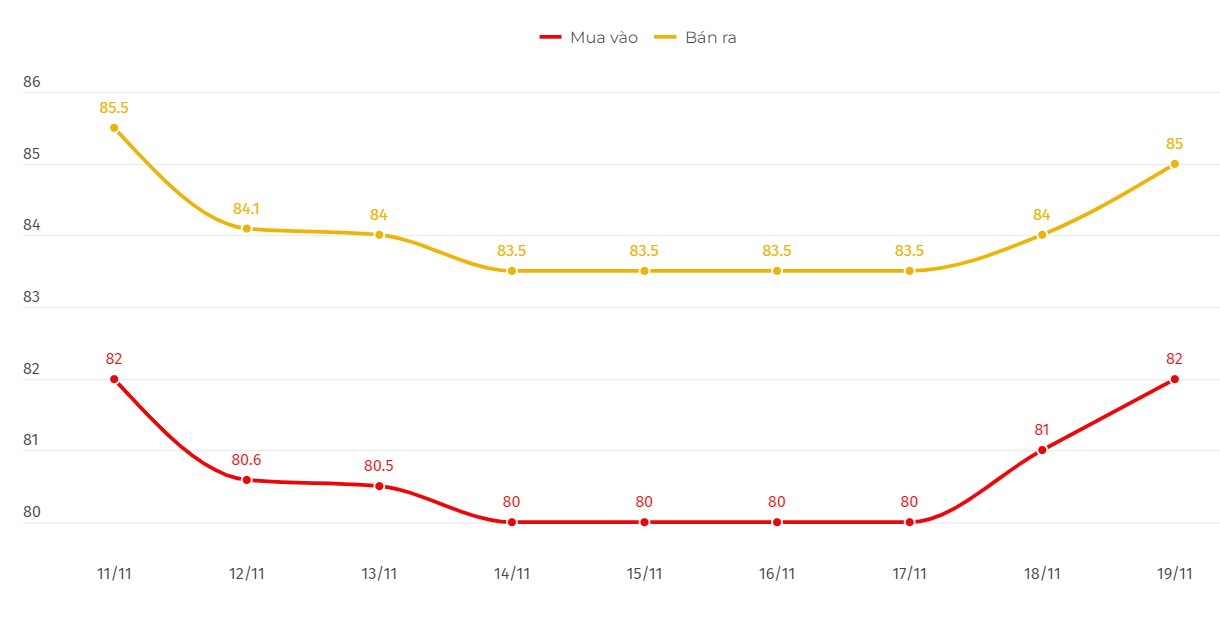

As of 5:00 p.m., the price of SJC gold bars was listed by DOJI Group at 82-85 million VND/tael (buy - sell).

Compared to the previous trading session, gold price at DOJI increased by 1 million VND/tael for both buying and selling.

The difference between buying and selling price of SJC gold at DOJI Group is at 3 million VND/tael.

Meanwhile, Saigon Jewelry Company listed the price of SJC gold at 82-85 million VND/tael (buy - sell).

Compared to the previous trading session, the gold price at Saigon Jewelry Company SJC increased by 1 million VND/tael for both buying and selling.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 3 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 83-85 million VND/tael (buy - sell).

Compared to the previous trading session, gold price at Bao Tin Minh Chau increased by 1.8 million VND/tael for buying and increased by 1 million VND/tael for selling.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 2 million VND/tael.

Currently, the difference between the buying and selling price of gold is listed at around 3 million VND/tael. Experts say that this difference is very high, causing investors to face the risk of losing money when investing in the short term.

Price of round gold ring 9999

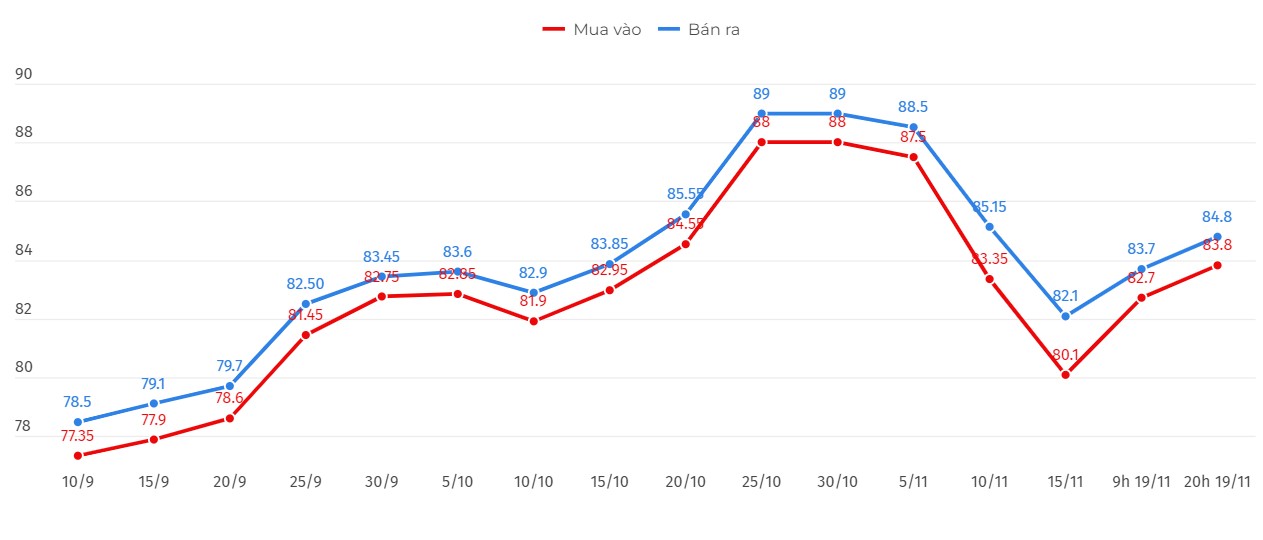

As of 8:00 p.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 83.8-84.8 million VND/tael (buy - sell), an increase of 1.4 million VND/tael for buying and an increase of 1.1 million VND/tael for selling compared to the close of the previous trading session.

Bao Tin Minh Chau listed the price of gold rings at 83.88-84.78 million VND/tael (buy - sell); an increase of 1.85 million VND/tael for buying and an increase of 1.3 million VND/tael for selling.

World gold price

As of 8:00 p.m., the world gold price listed on Kitco was at 2,638.6 USD/ounce, up 46.6 USD/ounce compared to the close of the previous trading session.

Gold Price Forecast

World gold prices increased sharply as the USD index stopped increasing. Recorded at 20:00 on November 20, the US Dollar Index, which measures the greenback's fluctuations against 6 major currencies, was at 106.272 points.

Recent strong US economic data has raised concerns about whether the US Federal Reserve (FED) will continue to cut interest rates after cutting them by 0.75 percentage points since September.

Comments from several Fed officials this week could provide clues on the path of rate cuts. Traders are pricing in a 58.9% chance of a 25 basis point cut in December, compared with a 41.1% chance of a hold.

Kyle Rodda, a financial market analyst at Capital.com, a financial markets website, said recent market movements have been largely technical, influenced by the strengthening of the US dollar.

Meanwhile, geopolitical tensions in some parts of the world have recently escalated. Russia recently launched its largest military action in nearly three months in Ukraine, causing severe damage to the country’s power grid. Non-interest-bearing assets such as gold tend to rise in value in a lower interest rate environment and amid geopolitical uncertainty.

“The Biden administration’s agreement to allow Ukraine to use long-range weapons produced by the country to attack military targets inside Russia is creating geopolitical uncertainty, resulting in increased uncertainty in the gold market,” said Daniel Pavilonis, chief strategist at RJO Futures.

RT reported that Russia has issued a stern warning to the US and its allies, stating that any use of long-range missiles by Ukraine to strike deep into Russian territory would mean direct involvement of Western powers in the conflict.

The statement by the Russian Foreign Ministry on the evening of November 18 (local time) was made in the context of unconfirmed information that US President Joe Biden allowed Kiev to use ATACMS missiles provided by the US to attack deep inside Russian territory.

See more news related to gold prices HERE...