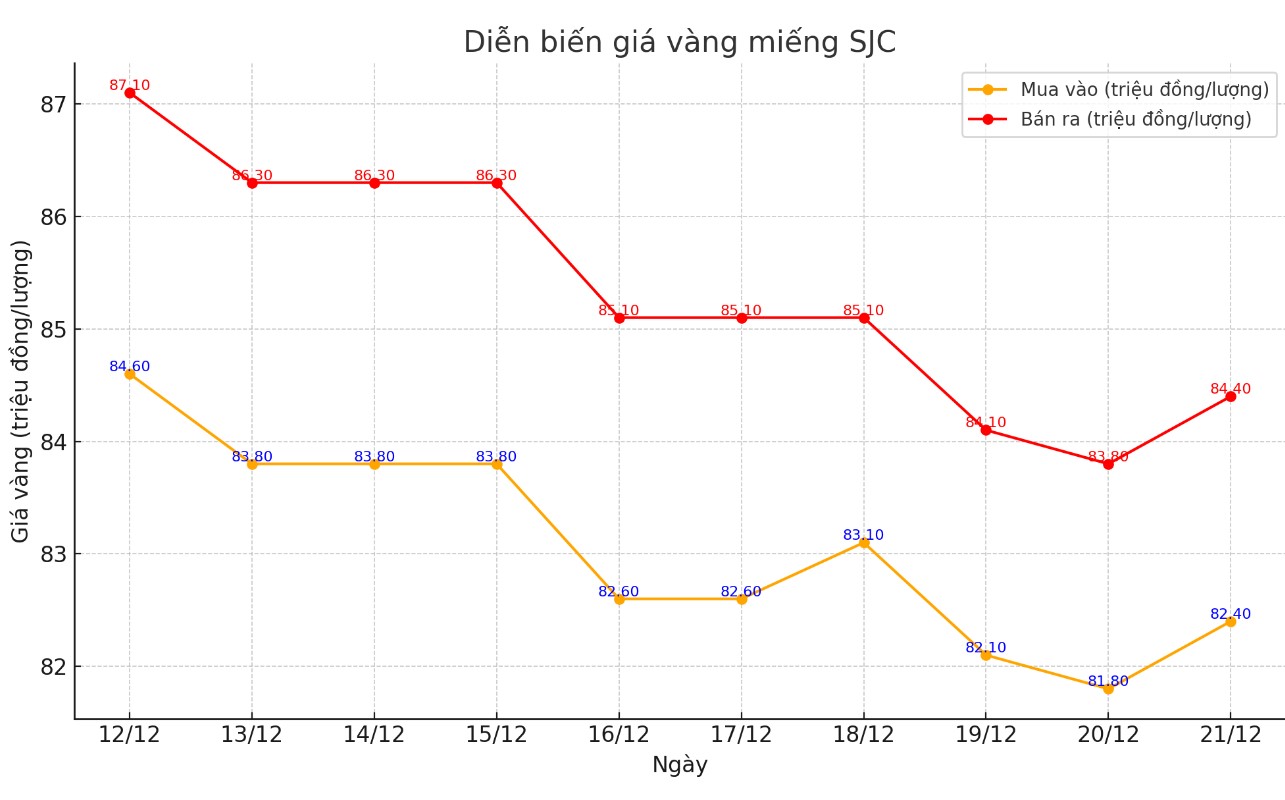

Update SJC gold price

As of 6:15 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at 81.8-83.8 million VND/tael (buy - sell).

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

Meanwhile, DOJI Group listed the price of SJC gold at 82.4-84.4 million VND/tael (buy - sell).

The difference between buying and selling price of SJC gold at DOJI Group is at 2 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 82.4-84.4 million VND/tael (buy - sell).

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 2 million VND/tael.

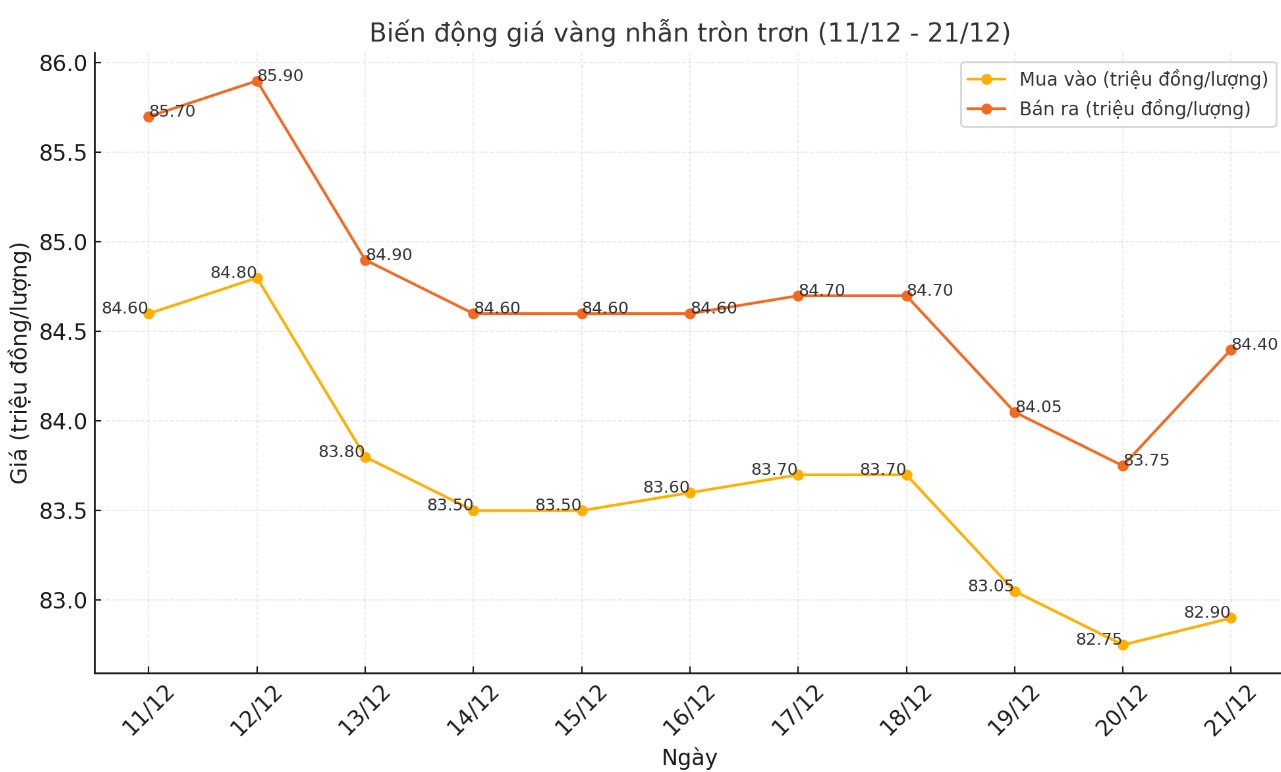

Price of round gold ring 9999

As of 5:50 p.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 82.9-84.4 million VND/tael (buy - sell); an increase of 150,000 VND/tael for buying and an increase of 650,000 for selling compared to the close of the previous trading session.

Bao Tin Minh Chau listed the price of gold rings at 82.7-84.4 million VND/tael (buy - sell), an increase of 400,000 VND/tael for buying and 600,000 VND/tael for selling compared to the closing price of yesterday's trading session.

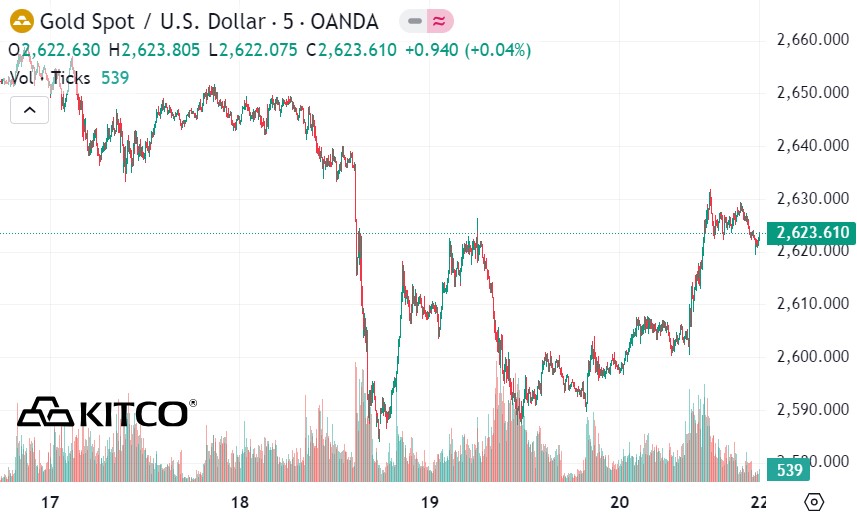

World gold price

As of 6:15 p.m., the world gold price listed on Kitco was at 2,623.6 USD/ounce, up 17.2 USD/ounce compared to the close of the previous trading session.

Gold Price Forecast

World gold prices increased as the USD index decreased. Recorded at 6:25 p.m. on December 21, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 107.350 points (down 0.74%).

Despite ending the week in negative territory, the gold market still maintained an important support level around the $2,600/ounce threshold, even as the US Federal Reserve (FED) signaled that it would slow down the pace of interest rate cuts in 2025.

Gold struggled last week as investors braced for a hawkish Fed announcement that it would cut interest rates.

As expected, the Fed cut the federal funds rate by 25 basis points. However, new economic projections show that the rate forecast, or “dot plot,” points to just two rate cuts next year, bringing the benchmark rate to 4%. In September, the Fed had forecast four cuts in the new year.

Gold's path of least resistance is likely to be lower in the short term, commodity analysts at TD Securities said in a note Thursday.

“While we do not expect a collapse in the gold market, given the uncertainty surrounding Fed policy, particularly if inflation continues to be higher than expected (e.g. due to tariffs) and the economy begins to slow, coupled with renewed geopolitical risks and a renewed round of central bank gold buying, there is still room for gold to fall slightly in the short term. It would not be surprising to see prices fall to the November low of $2,537/oz,” the analysts said.

Jim Wyckoff - senior analyst of Kitco commented that the gold market is in a state of unpredictable fluctuations.

For active traders, market “noise” is a major concern, causing rapid intraday dips and spikes. However, this trend could change by 2025, especially as key global geopolitical factors come to the fore.

The new US President Donald Trump will take office at the end of January 2025. Traders are still watching for his first policy and economic moves, especially in relations with China and the European Union surrounding the tariffs he has said.

Wyckoff said that Donald Trump may not be as tough on international partners as many feared. If true, this could provide a positive boost to the precious metals market, as better economic relations between the US and international partners could boost global economic growth and increase demand for metals.

For long-term investors, gold sentiment remains firmly bullish. The weekly and monthly charts show a steady uptrend with no signs of a major top in the short term. Wyckoff predicts that gold prices could surpass $3,000 an ounce and even higher in the next few years.

See more news related to gold prices HERE...