Update SJC gold price

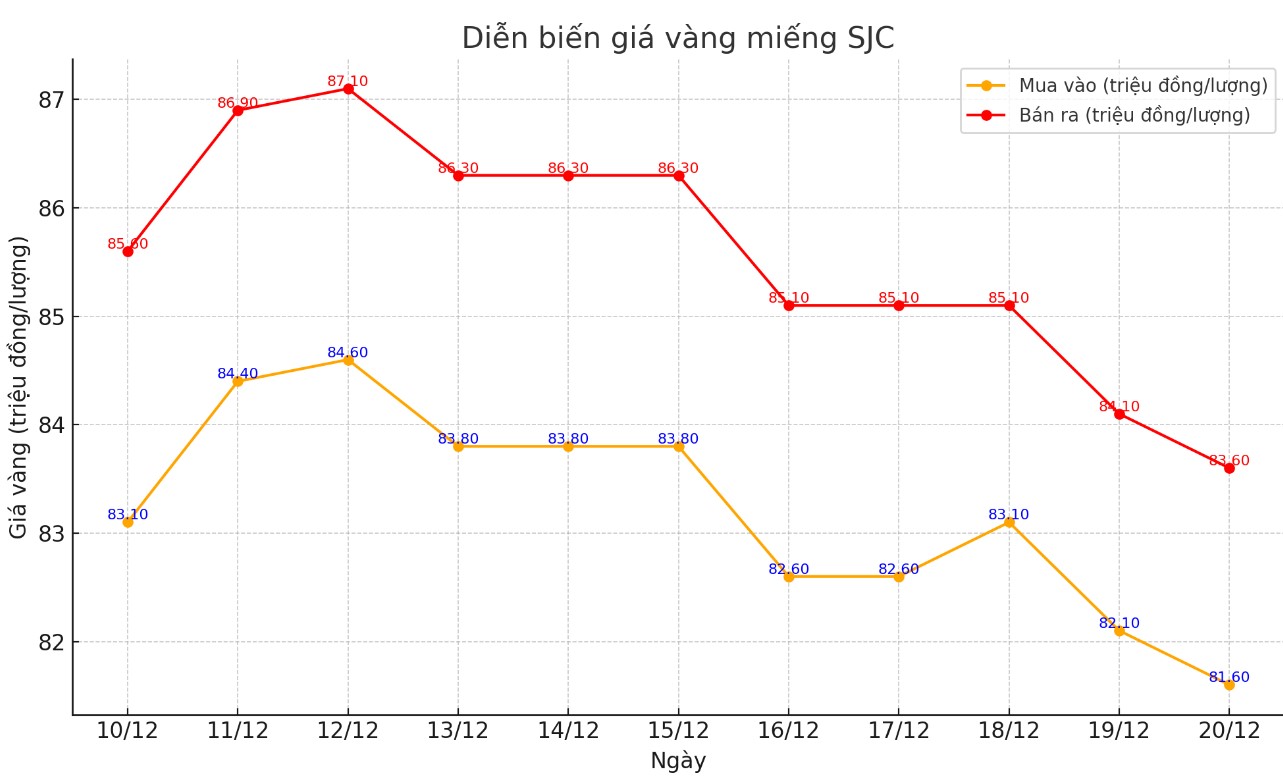

As of 9:30 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND81.6-83.6 million/tael (buy - sell); down VND500,000/tael for both buying and selling.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

Meanwhile, the price of SJC gold bars listed by DOJI Group is at 81.6-83.6 million VND/tael (buy - sell); down 500,000 VND/tael for both buying and selling.

The difference between buying and selling price of SJC gold at DOJI Group is at 2 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 81.6-83.6 million VND/tael (buy - sell); down 500,000 VND/tael for both buying and selling.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 2 million VND/tael.

Currently, the difference between buying and selling gold prices is listed at around 2.5 million VND/tael. Experts say this difference is still very high. The difference between buying and selling prices is a factor that investors need to consider when participating in the gold market. It directly affects the ability to make a profit, especially in the short term.

Price of round gold ring 9999

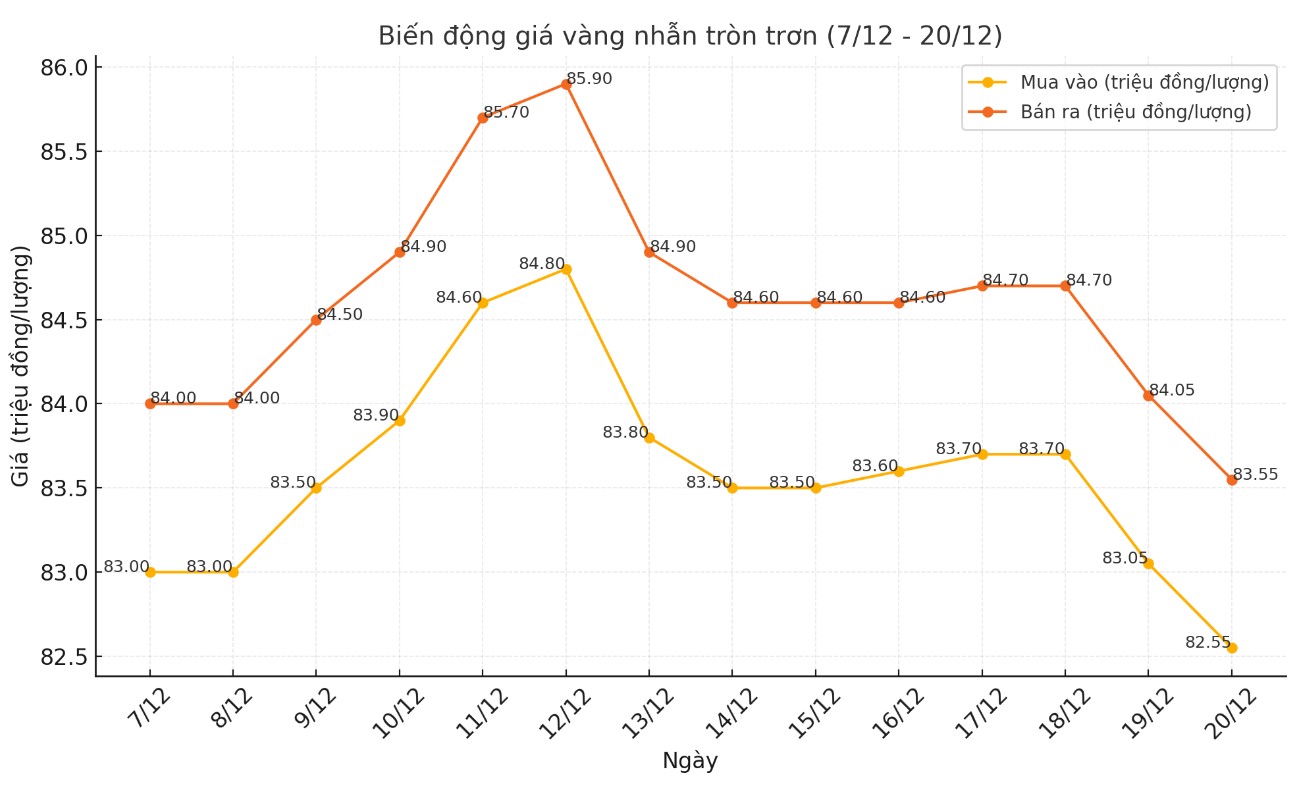

As of 9:30 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 82.55-83.55 million VND/tael (buy - sell); down 600,000 VND/tael for both buying and selling compared to early this morning.

Bao Tin Minh Chau listed the price of gold rings at 82.6-83.6 million VND/tael (buy - sell), down 230,000 VND/tael for buying and down 430,000 VND/tael for selling compared to early this morning.

World gold price

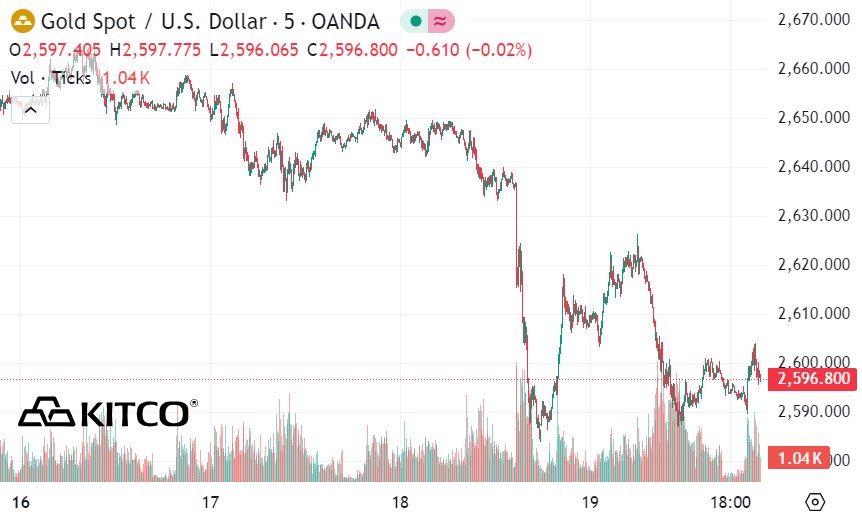

As of 9:40 a.m., the world gold price listed on Kitco was at 2,596.8 USD/ounce, down 12.7 USD/ounce compared to the beginning of the previous trading session.

Gold Price Forecast

World gold prices fell sharply as the USD increased. Recorded at 9:40 a.m. on December 20, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 108.170 points (up 0.02%).

Gold selling pressure continues to increase after the announcement of the US Federal Reserve (FED) yesterday. Gold prices are falling sharply.

The Fed delivered a 25 basis point rate cut as expected, but the real surprise came in its latest Summary of Economic Projections (SEP).

This document includes an updated chart, revealing adjusted interest rate projections from 2024 to 2027. The chart is published quarterly during alternating FOMC meetings, providing anonymous forecasts from the 19 members of the Fed Committee on future federal funds rates.

The chart released yesterday shows a significant change from the September forecast. Most notably, the Fed is now expected to cut interest rates next year from four to just one, a 25-point cut. This is significantly more hawkish than the market had expected, although Fed Chairman Jerome Powell had hinted at the policy change in several speeches before the pre-meeting “news pause.”

The announcement sent shockwaves through U.S. financial markets. Stocks plunged, and gold prices fell more than $60 an ounce. The most-traded February gold contract, which opened yesterday at $2,663.30 an ounce, closed at $2,599 an ounce.

Multinational investment bank Goldman Sachs predicts that demand for gold will continue to increase strongly as central banks seek to diversify their reserves, especially after Russia's assets are frozen in 2022.

Peter Grant, vice president and senior metals strategist at Zaner Metals, said gold remains in a long-term uptrend.

Analysts predict that central banks, especially China, will increase gold purchases, pushing gold prices to reach $3,000 an ounce by the end of 2025.

See more news related to gold prices HERE...