Updated SJC gold price

As of 20:00, the price of SJC gold bars was listed by Saigon Jewelry Company at 118.5-121 million VND/tael (buy in - sell out), an increase of 1.7 million VND/tael in both directions. The difference between buying and selling prices is at 2.5 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 118.5-121 million VND/tael (buy - sell), an increase of 1.7 million VND/tael in both directions. The difference between buying and selling prices is at 2.5 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 118.5-121 million VND/tael (buy - sell), an increase of 1.7 million VND/tael in both directions. The difference between buying and selling prices is at 2.5 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 118-121 million VND/tael (buy - sell), an increase of 1.7 million VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

9999 round gold ring price

As of 20:00, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 112.5-115 million VND/tael (buy - sell), an increase of 1 million VND/tael for buying and an increase of 500,000 VND/tael for selling. The difference between buying and selling prices is at 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 114.5-117.5 million VND/tael (buy - sell), an increase of 700,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 112.5-125.5 million VND/tael (buy in - sell out), an increase of 1 million VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

In the context of strong fluctuations in domestic gold prices, the buying-selling gap is pushed too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

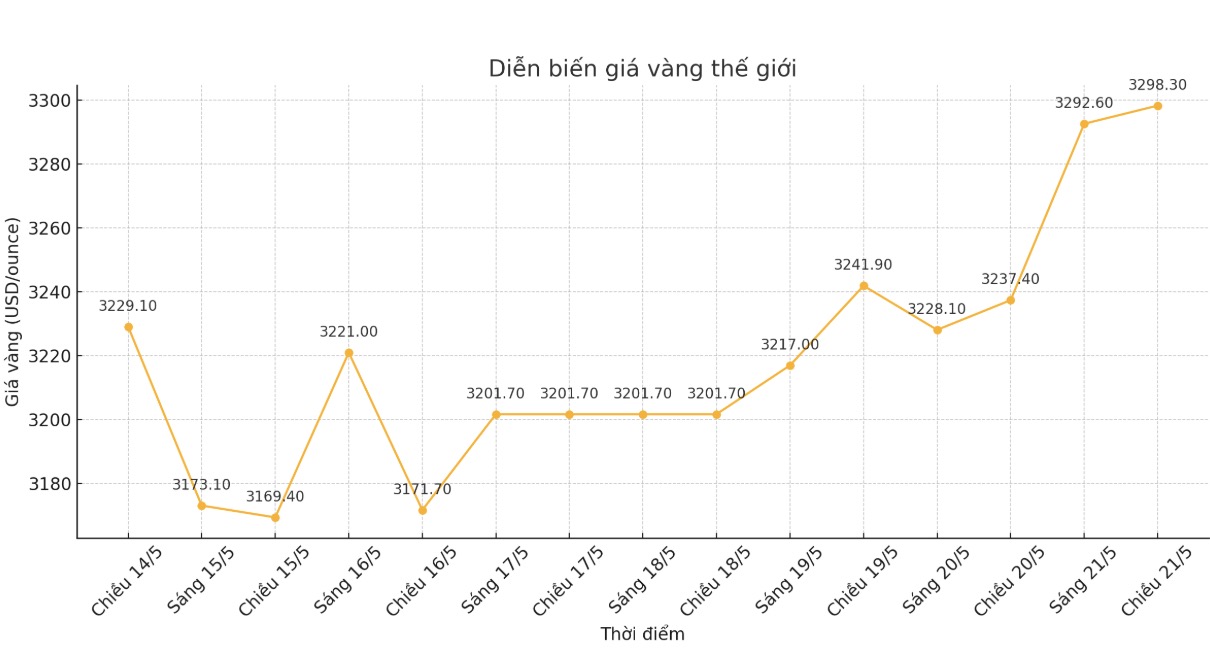

World gold price

At 7:48 p.m., the world gold price listed on Kitco was around 3,298.3 USD/ounce, up 60.9 USD/ounce.

Gold price forecast

According to Reuters, world gold prices increased sharply, reaching a one-week peak thanks to the weakening of the USD and concerns about US fiscal instability, stimulating capital flow into safe-haven assets.

"The US dollar index has fallen more than one point over the past 24 hours due to Moody's decline in confidence, combined with doubts about Donald Trump's tax bill continuing to weaken the USD, which is a positive signal for gold prices," said senior analyst Edward Meir from Marex.

Donald Trump's tax and spending cuts will face a major test of the day as Republican lawmakers in the US House of Representatives seek to overcome internal divides over cuts to the Medicaid health program and tax incentives in coastal states with high costs.

Gold, which is considered a safe asset in the context of political and economic instability, often tends to increase in price when interest rates are low.

"In the medium and long term, gold prices tend to increase, but if there is positive news about trade deals, this could hinder gold from conquering the $3,500/ounce threshold," said Timerer, senior market analyst at KCM Trade.

The Chairman of the US Federal Reserve (FED) St. Petersburg branch. Louis, Alberto Musalem, told the Minnesota Economic Club that reducing trade tensions will help the labor market maintain strength and keep inflation on track to reach the Fed's 2% target.

See more news related to gold prices HERE...