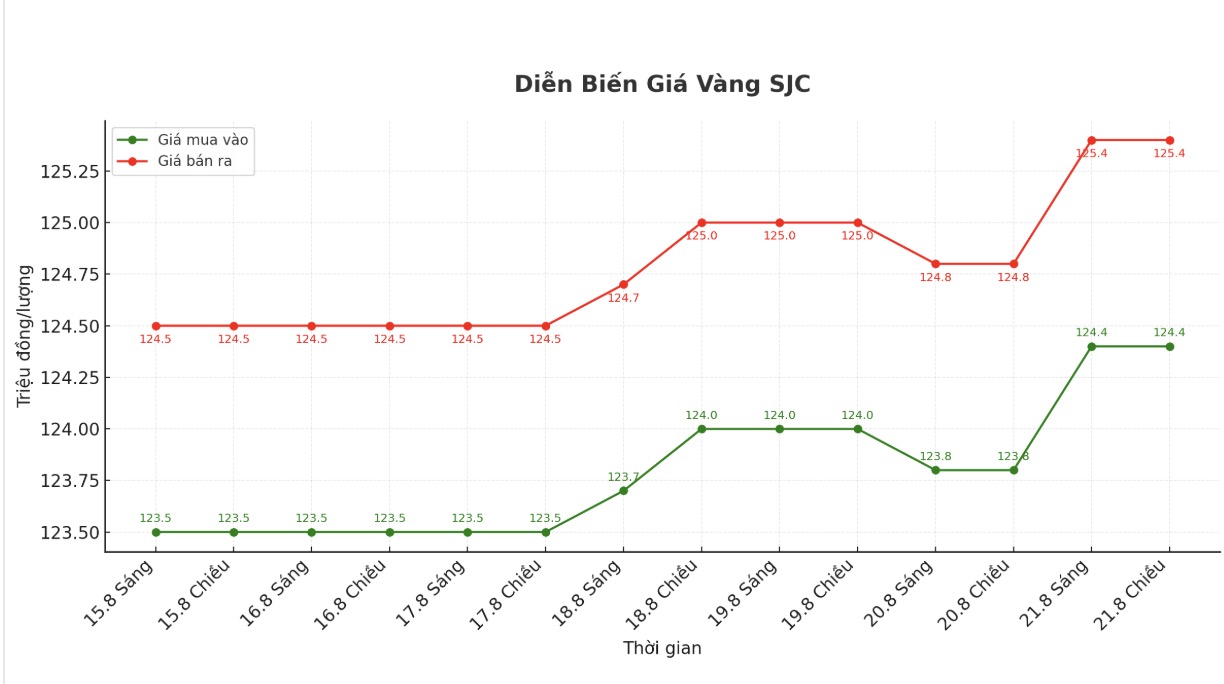

SJC gold bar price

As of 5:20 p.m., DOJI Group listed the price of SJC gold bars at VND124.4-125.4 million/tael (buy in - sell out), an increase of VND600,000/tael in both directions. The difference between buying and selling prices is at 1 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 124.4-125.4 million VND/tael (buy - sell), an increase of 600,000 VND/tael in both directions. The difference between buying and selling prices is at 1 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 123.4-125.4 million VND/tael (buy - sell), an increase of 600,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

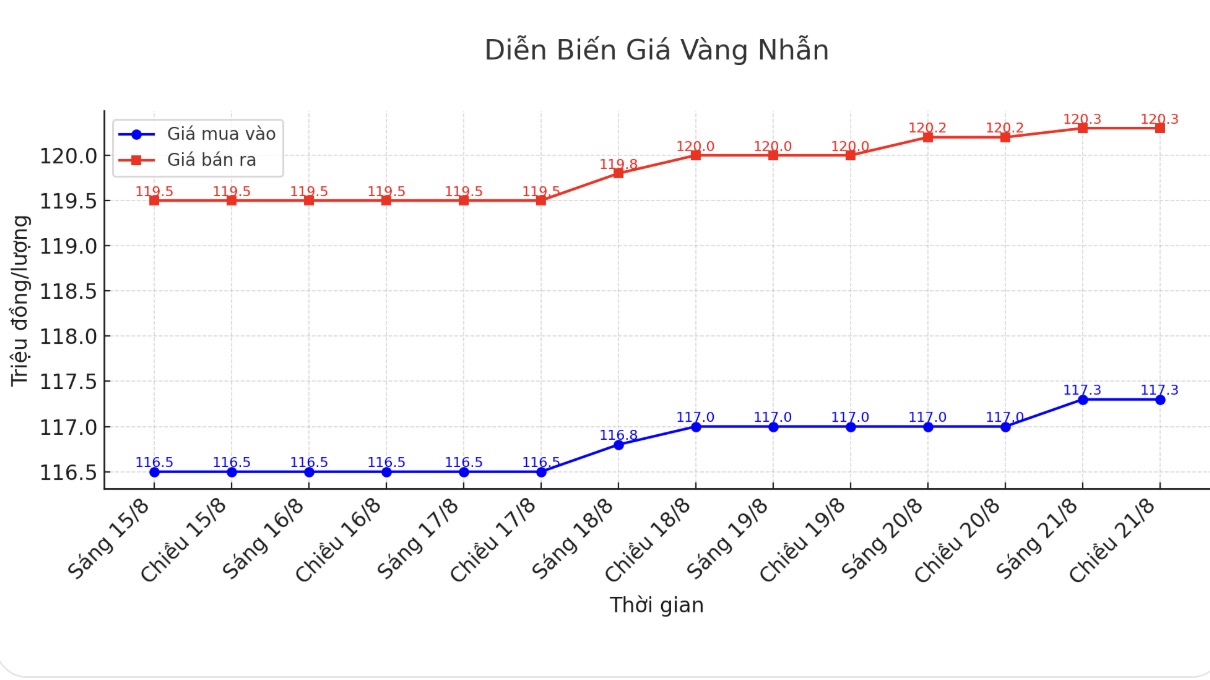

9999 gold ring price

As of 5:20 p.m., DOJI Group listed the price of gold rings at 117.3-120.3 million VND/tael (buy - sell), an increase of 300,000 VND/tael for buying and an increase of 100,000 VND/tael for selling. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 117.5-120.5 million VND/tael (buy - sell), an increase of 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 117-120 million VND/tael (buy in - sell out), an increase of 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Currently, the difference between buying and selling gold rings is at a very high level, around 3 million VND/tael, posing a potential risk of loss for investors.

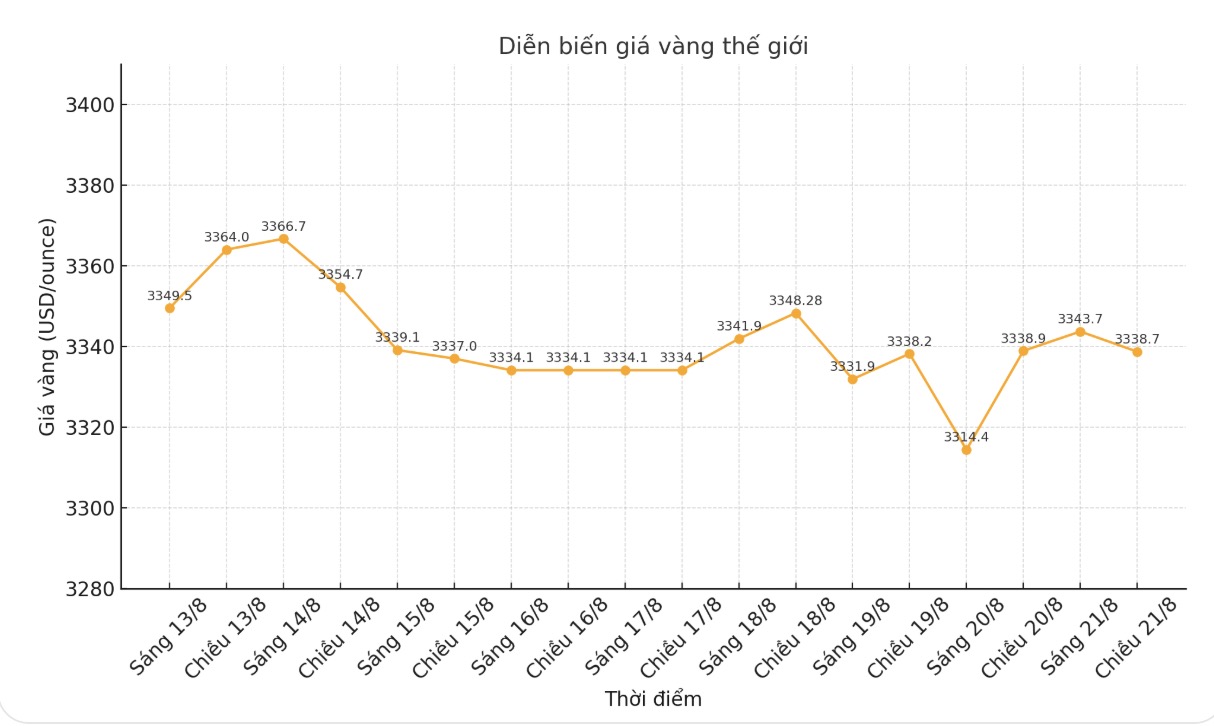

World gold price

The world gold price was listed at 5:25 p.m. at 3,338.7 USD/ounce, almost unchanged from a day ago.

Gold price forecast

World gold prices are less volatile as investors wait for signals about the monetary policy of the Federal Reserve (FED) ahead of the Jackson Hole annual conference.

Fed Chairman Jerome Powell is scheduled to speak on Friday at an event from August 21-23, with investors interested in whether he will prioritize measures to support the labor market or focus on controlling inflation.

Chris Zaccarelli, chief investment officer at Northlight Asset Management, said he expects the Federal Reserve to cut interest rates in September; however, it could be a close decision.

The minutes of the Feds meeting clearly show why they didnt cut rates at the previous meeting as the majority of officials say the higher risk of inflation is greater than the higher risk of unemployment but the more important question is how they will assess the risks at the next meeting.

For the Fed to cut in September - something we believe it will do, unless there is any disappointment from the CPI or PPI before, all members of the Commission will need to assess the unemployment risk higher than the long-term inflation risk, he said in a note.

The market will receive additional cues about the Federal Reserve's monetary policy on Friday in Jerome Powell's speech at the annual central bank conference in Jackson Hole, Wyoming.

Chairman Powell is likely to keep the information confidential, stressing that the Fed is very interested in its dual task and explaining that it depends on data, Zaccarelli said.

Brian Lan - CEO of Gold Silver Central commented: "We did not think gold prices would increase sharply, but are currently in a flat period. Even if interest rates fall slightly, gold prices could increase and move towards $3,400/ounce. Otherwise, prices could continue to move sideways or fall slightly to near $3,300/ounce.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...