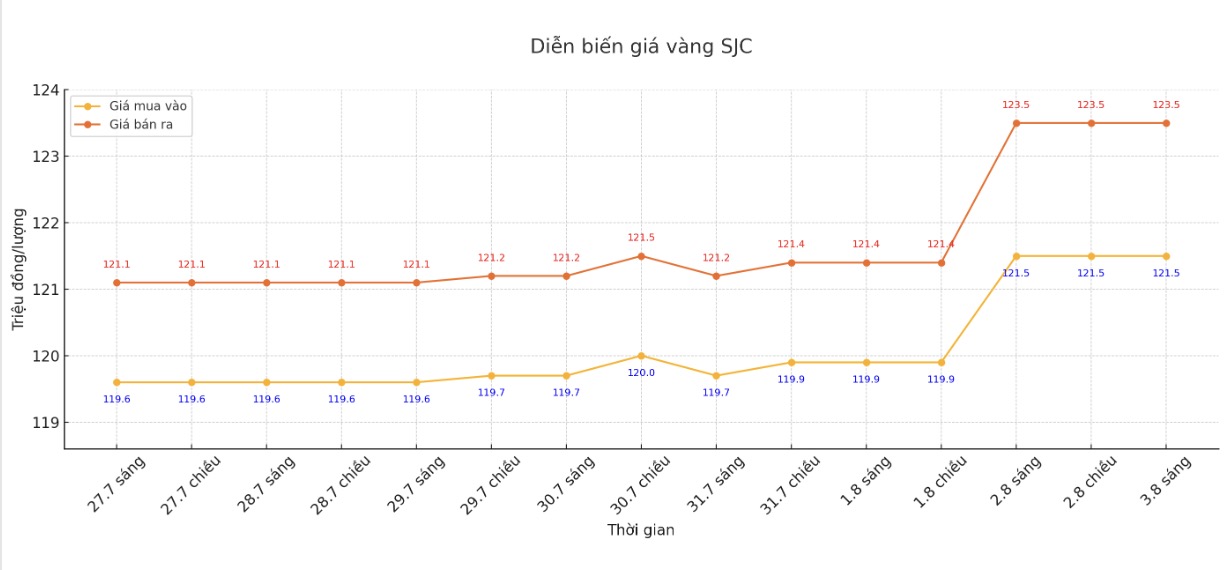

SJC gold bar price

At the end of the trading session of the week, Saigon Jewelry Company SJC listed the price of SJC gold at 121.5-123.5 million VND/tael (buy in - sell out).

Compared to the closing price of last week's trading session (July 27, 2025), the price of SJC gold bars at Saigon Jewelry Company SJC increased by 1.9 million VND/tael for buying and increased by 2.4 million VND/tael for selling. The difference between the buying and selling prices of SJC gold at Saigon Jewelry Company SJC is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 121.5-123.5 million VND/tael (buy in - sell out).

Compared to a week ago, the price of SJC gold bars was increased by 1.9 million VND/tael for buying and 2.4 million VND/tael for selling. The difference between the buying and selling prices of SJC gold at Bao Tin Minh Chau is at 2 million VND/tael.

If buying SJC gold at Bao Tin Minh Chau and Saigon Jewelry Company SJC in the session of July 27 and selling it in today's session (8/ 3), buyers will make the same profit of VND 400,000/tael.

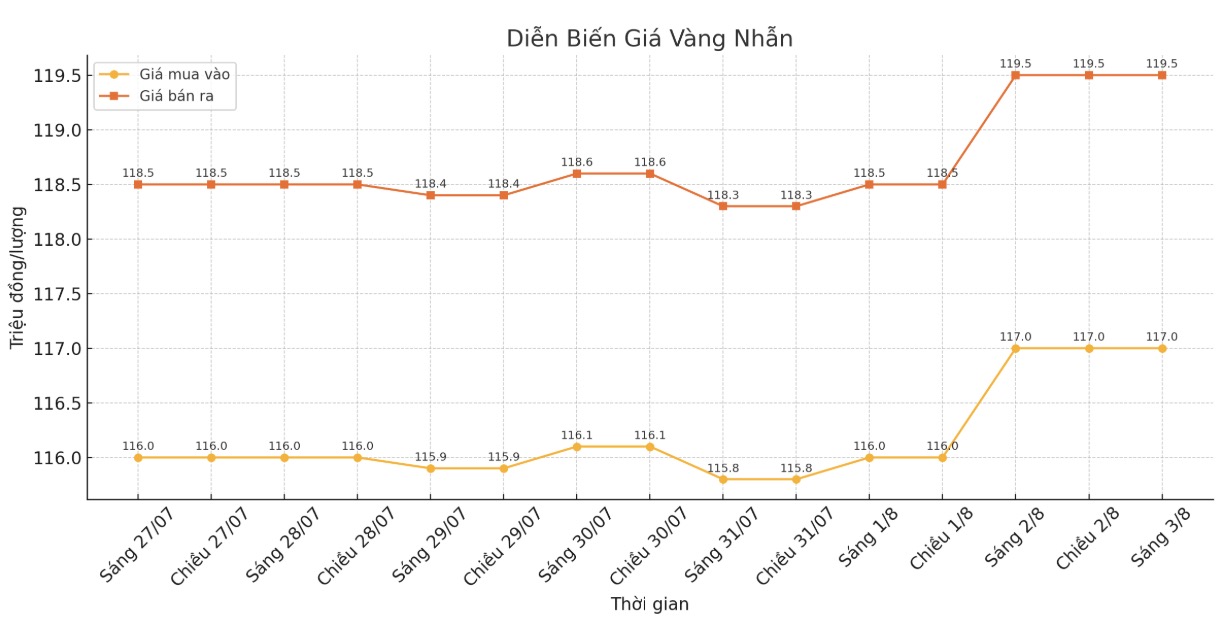

9999 gold ring price

This afternoon, Bao Tin Minh Chau listed the price of gold rings at 117.2-120.2 million VND/tael (buy - sell); an increase of 1 million VND/tael in both directions compared to a week ago. The difference between buying and selling is at 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 116.2-119.2 million VND/tael (buy - sell), an increase of 1.1 million VND/tael in both directions compared to a week ago. The difference between buying and selling is 3 million VND/tael.

If buying gold rings in the session of July 27 and selling in today's session (September 3), buyers at Bao Tin Minh Chau will lose 2 million VND/tael, while the loss when buying in Phu Quy is 1.9 million VND/tael.

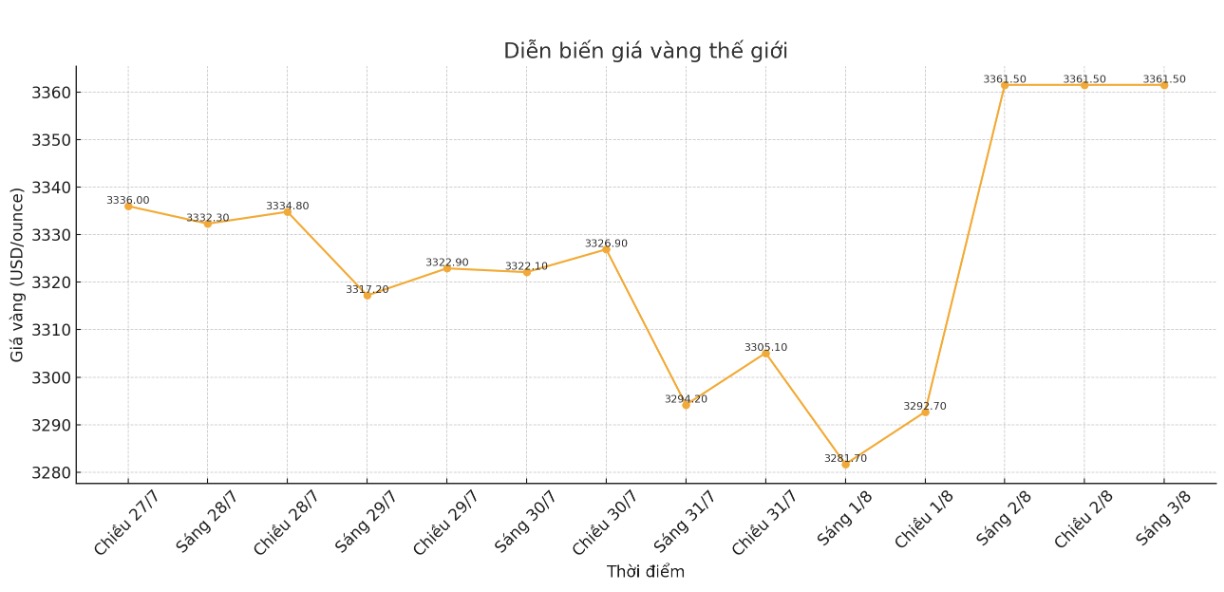

World gold price

At the end of the trading session of the week, the world gold price was listed at 3,361.5 USD/ounce, up 25.5 USD/ounce compared to the closing price of the previous trading session.

Gold price forecast

Darin Newsom - Senior Analyst at Barchart.com - said he is optimistic about gold due to increasing geopolitical instability from the US President Donald Trump trade war.

Sharing the same view, Mr. Aaron Hill - Senior Market Analyst at FP Markets - said: "The weaker-than-expected jobs report weakens confidence in the US economy, putting pressure on the USD as the market expects the FED to loosen policy to stimulate growth. With gold, poor labor data further strengthens the role of safe-haven assets, boosting prices as investors seek stability.

Meanwhile, David Morrison - an analyst at Trade Nation is neutral, saying that employment data is a supporting factor for gold prices, but he does not expect gold prices to soon break out of the current fluctuation zone.

Although gold prices increased sharply last weekend, the precious metal is still fluctuating within range. Perhaps gold prices need a period of accumulation before there is enough momentum to surpass the $3,400 mark again, not to mention holding this level after adjustments.

We need to note that today's increase is largely due to the sudden reversal of the USD. The reason for that change is the worse-than-expected US non-farm payrolls. While this increases the likelihood of a rate cut in September, don't forget that this is just a figure - along with a downward correction in a series of data that is notoriously volatile," he said.

Jamie Cox CEO at Harris Financial Group commented: In September, the Fed will almost certainly cut interest rates, possibly by 50 basis points to make up for the lost time.

According to the CME FedWatch tool tool tool, the probability of the Fed cutting interest rates in September has now increased to about 92%, compared to only 38% on Thursday.

Meanwhile, Lukman Otunuga - Senior Market Strategist at FXTM - commented: "Buyers are attacking strongly with the mark of 3,400 USD/ounce less than 2%. When it closes the week above $3,330/ounce, gold prices could head towards $3,400.

Mr. Naeem Aslam - Investment Director at Zaye Capital Markets - commented that interest rate cut expectations are changing rapidly and gold is likely to reach the mark of 3,400 USD/ounce.

If the Fed signals a dovish stance, speculative capital flows could push prices above the psychological level of $3,400, especially in the context of investors seeking safe assets amid economic uncertainty.

Notable economic data next week

Tuesday: ISM Service PMI (USA).

Wednesday: The US auctions a 10-year Treasury note.

Thursday: Bank of England monetary policy decision, US weekly jobless claims.

See more news related to gold prices HERE...