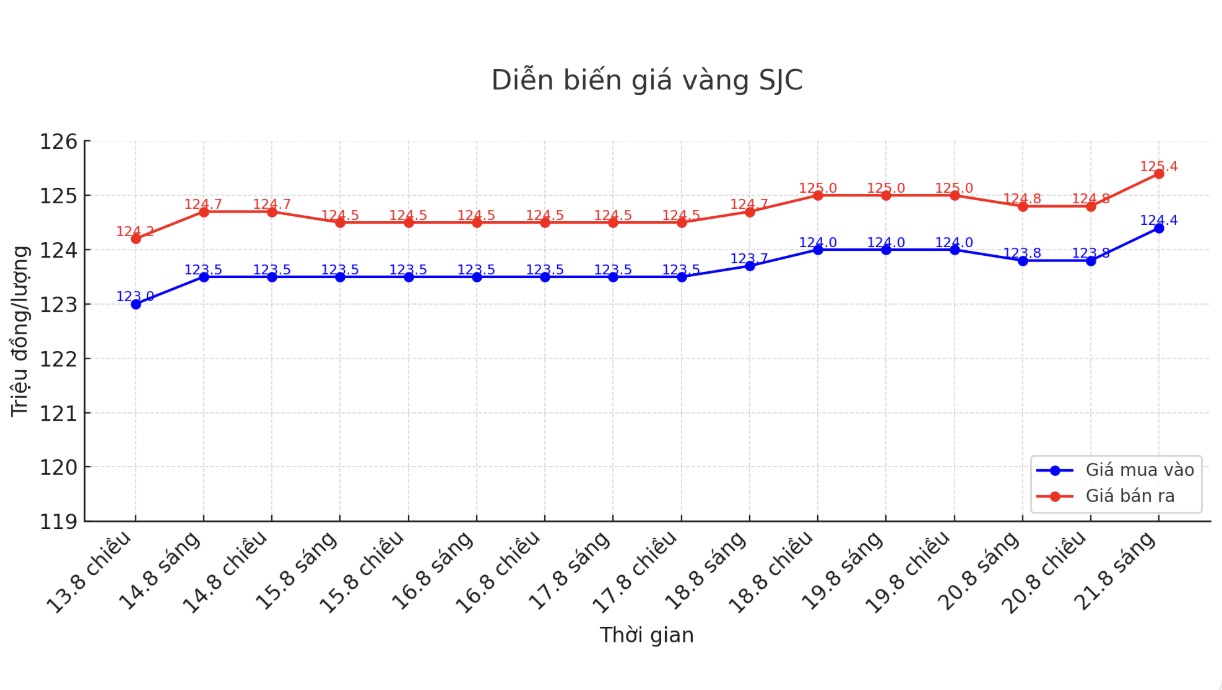

Updated SJC gold price

As of 9:50 a.m., DOJI Group listed the price of SJC gold bars at VND124.4-125.4 million/tael (buy in - sell out), an increase of VND600,000/tael in both directions. The difference between buying and selling prices is at 1 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 124.4-125.4 million VND/tael (buy - sell), an increase of 600,000 VND/tael in both directions. The difference between buying and selling prices is at 1 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 123.4-125.4 million VND/tael (buy - sell), an increase of 600,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

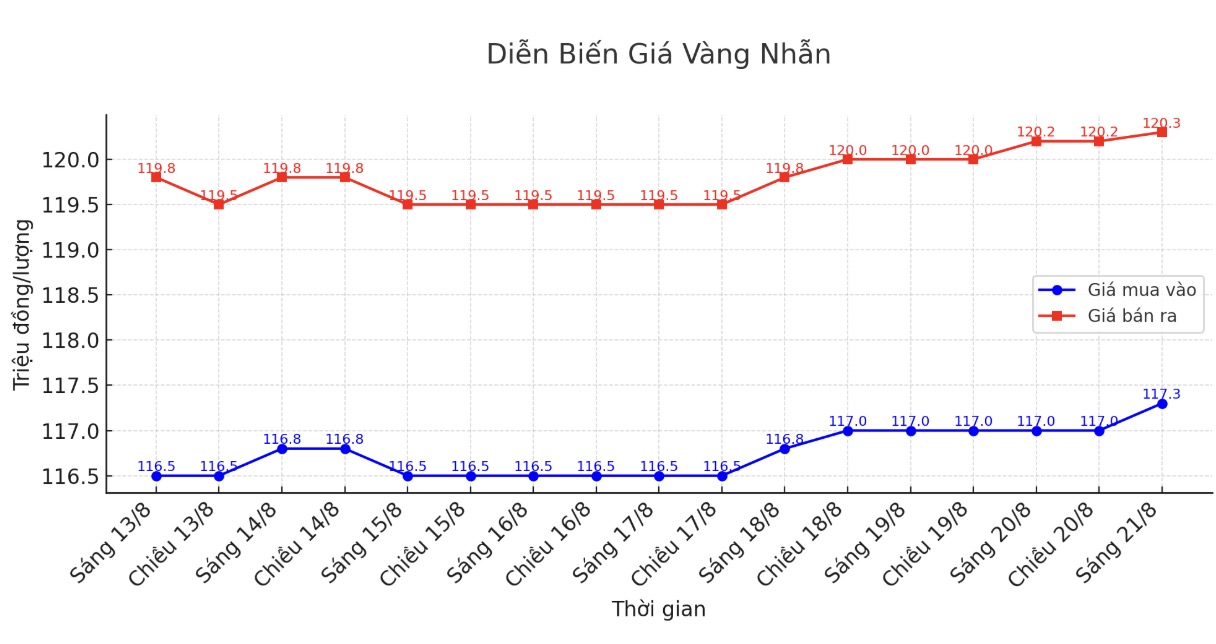

9999 round gold ring price

As of 9:50 a.m., DOJI Group listed the price of gold rings at 117.3-120.3 million VND/tael (buy - sell), an increase of 300,000 VND/tael for buying and an increase of 100,000 VND/tael for selling. The difference between buying and selling is 3.2 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 117.5-120.5 million VND/tael (buy - sell), an increase of 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 117-120 million VND/tael (buy in - sell out), an increase of 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

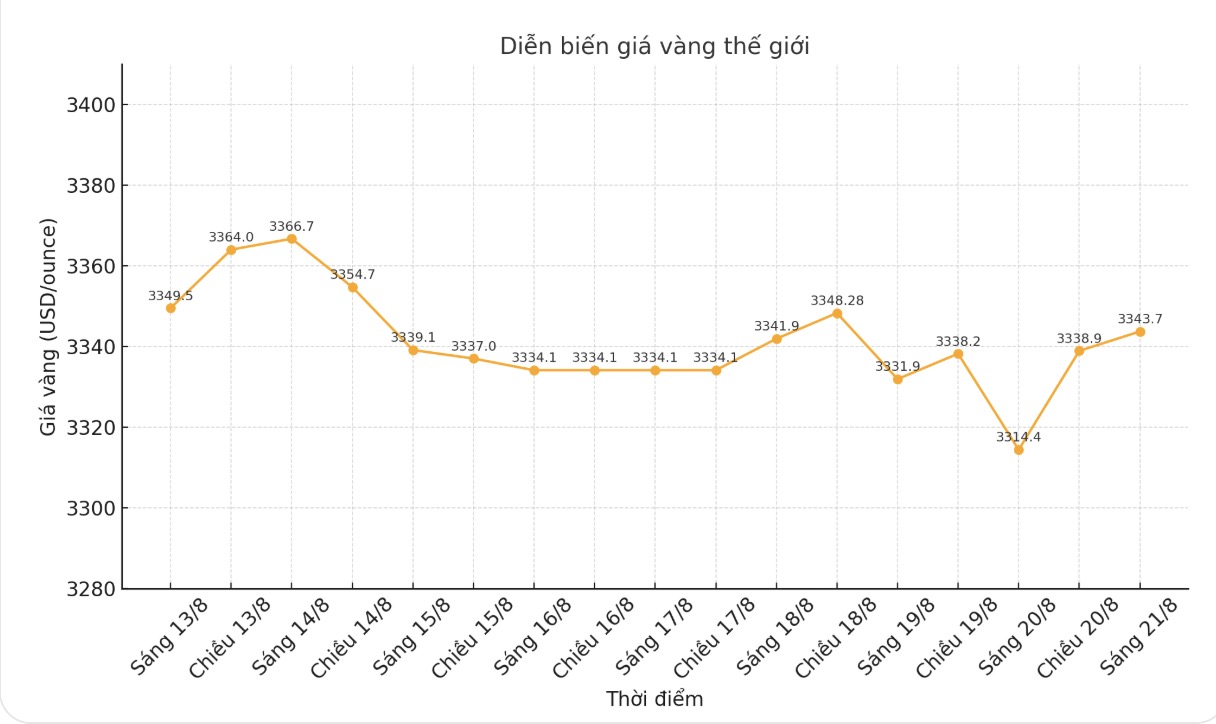

World gold price

At 9:55 a.m., the world gold price was listed around 3,343.7 USD/ounce, up 29.3 USD compared to a day ago.

Gold price forecast

World gold prices increased sharply partly due to the decline in US stocks in the middle of the week and partly due to new technical buying power.

Stock investors are also starting to worry as they enter the September and October period which are months that often have strong fluctuations in the US stock market.

In addition, the market is waiting for the US Federal Reserve (FED) to release a report. When the minutes of the most recent meeting of the FOMC are released, investors will analyze carefully to find signals for upcoming monetary policy.

Financial markets this week are quite quiet ahead of the Jackson Hole annual conference hosted by the Kansas City branch of the Fed, starting Thursday.

Nicky Shiels - Head of Metals Research and Strategy at PAMP Agency has just raised the precious metal forecast to the end of the year. She said traditional factors, including the upcoming rate cut, will support the price increase.

In the update, Shiels forecasts gold prices to average around $3,200/ounce this year, up 8% from the initial forecast, and expects prices to peak at $3,600/ounce by the end of the year.

She commented: "We are entering a new era of fiscal dominance (record public debt and increased borrowing costs put pressure on central banks, not only the US Federal Reserve FED).

The US, Europe and China are all stimulating tai chinh, with a budget deficit of 6% becoming the new standard. The market will shift, focusing back on fundamental factors such as macroeconomic data and the Fed's policies, instead of being dominated by short-term news on tariffs.

She said that the Fed's interest rate cut will continue to weaken the USD, while geopolitical instability will also promote the trend of global de-dollarization: "In my opinion, the US no longer has the ability and will to maintain the previous monopoly world order. The world is moving from an unbalanced united globe to a more balanced multipolar one.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...