Gold market traded below the resistance level of $3,350/ounce as the FED was trying to extend the time and said it needed more time to assess the US labor market and the inflationary trajectory, according to the minutes of the July monetary policy meeting.

Although two members of the Federal Reserve voted to cut interest rates at the July meeting, the minutes showed widespread support for the central bank's neutral monetary policy stance, because the threat of inflation is greater than the slowdown in the US labor market.

The participants mainly pointed out the risks to both of the Committees goals, highlighting the risks of rising inflation and the risks of job loss. The majority of members see the risk of rising inflation as a bigger risk in both, while some see both as quite balanced, and some see the risk of job loss as a more notable risk," the minutes said.

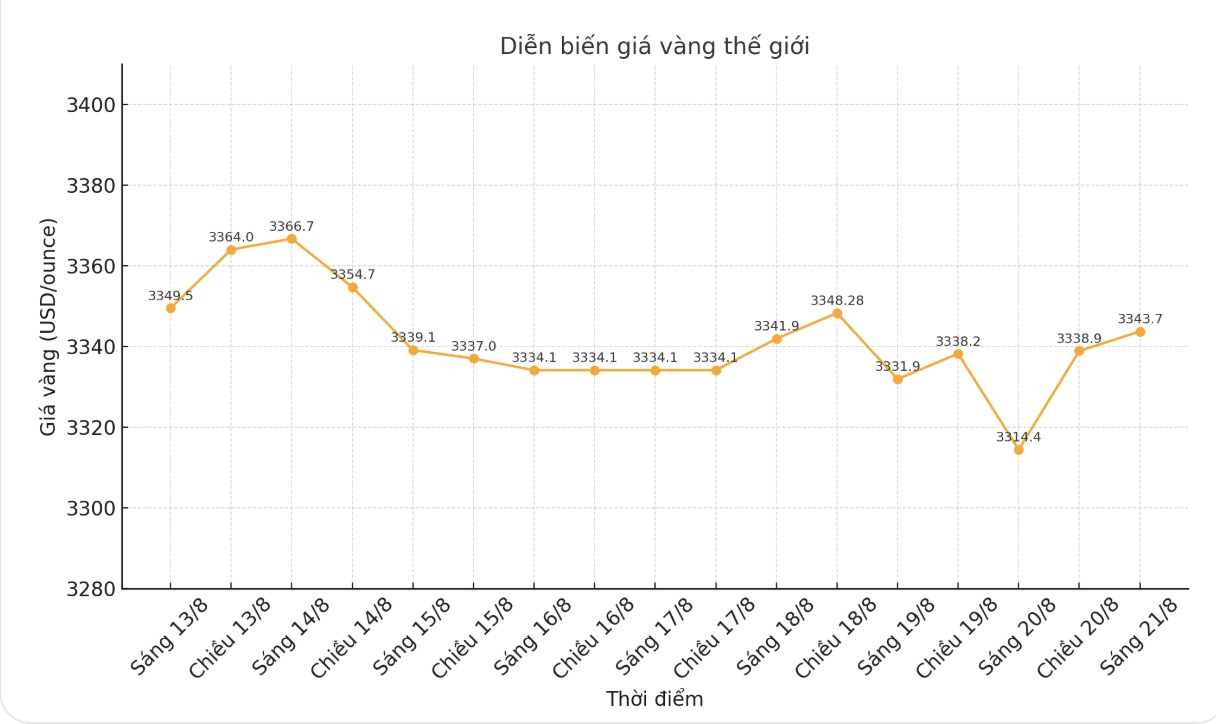

The gold market did not react much to the meeting minutes, which continued to highlight the central bank's hesitation. The price of spot gold was last traded at 3,343.60 USD/ounce, up 0.89% from the previous day.

The tone of the minutes did not change expectations of a rate cut next month. According to the CME FedWatch tool, the market sees an 82% chance of a rate cut in September.

Although the September rate cut is almost included in the price, the Federal Reserve's hesitant stance could reduce expectations of a strong rate cut for the rest of the year.

Some members emphasized that maintaining the impact of tariffs on inflation will depend significantly on monetary policy stance.

Some members commented that the current target range of the federal funds rate may not be much higher than the neutral level; among the factors cited to support this assessment is the possibility that current broad financial conditions can be neutral or support stronger economic activities" - the minutes said.

Chris Zaccarelli, chief investment officer at Northlight Asset Management, said he expects the Federal Reserve to cut interest rates in September; however, it could be a close decision.

The minutes of the Feds meeting clearly show why they didnt cut rates at the previous meeting as the majority of officials say the higher risk of inflation is greater than the higher risk of unemployment but the more important question is how they will assess the risks at the next meeting.

For the Fed to cut in September - something we believe it will do, unless there is any disappointment from the CPI or PPI before, all members of the Commission will need to assess the unemployment risk higher than the long-term inflation risk, he said in a note.

The market will receive additional cues about the Federal Reserve's monetary policy on Friday in Jerome Powell's speech at the annual central bank conference in Jackson Hole, Wyoming.

Chairman Powell is likely to keep the information confidential, stressing that the Fed is very interested in its dual task and explaining that it depends on data, Zaccarelli said.

See more news related to gold prices HERE...