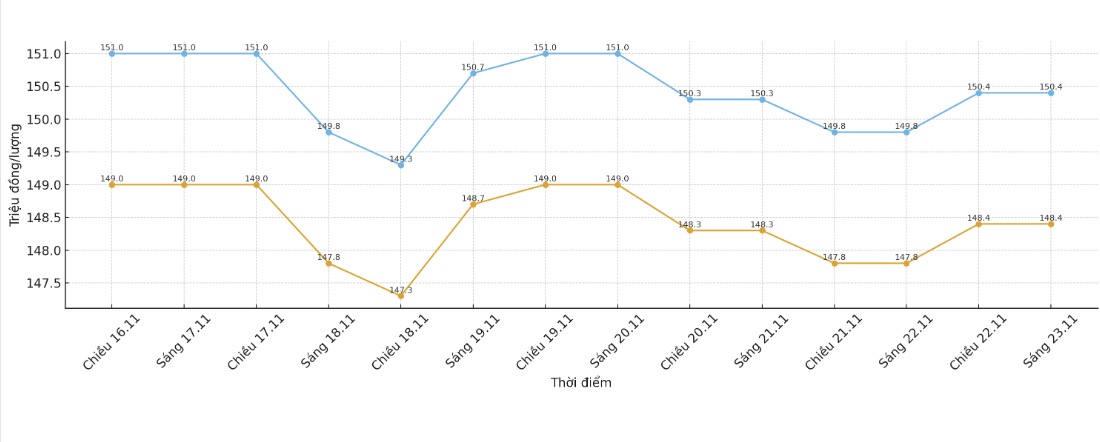

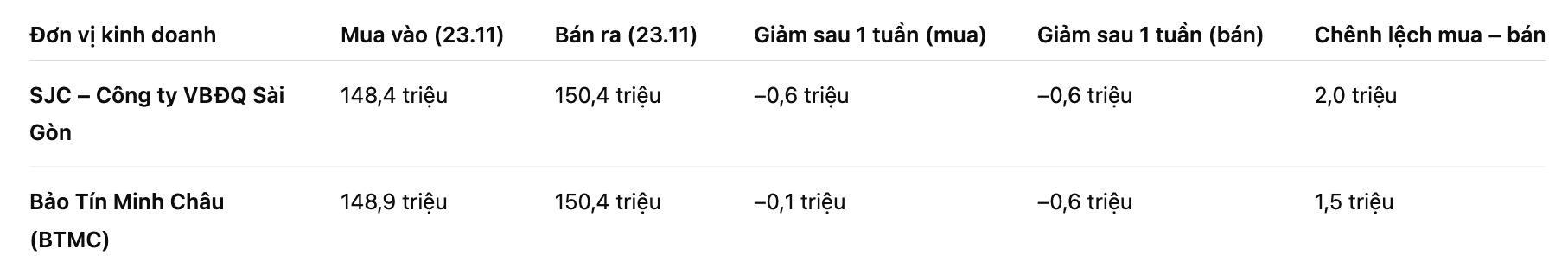

SJC gold bar price

At the end of the trading session of the week, Saigon Jewelry Company SJC listed the price of SJC gold at 148.4-150.4 million VND/tael (buy in - sell out). The difference between buying and selling is at 2 million VND/tael.

Compared to the closing price of the previous trading session (November 16, 2025), the price of SJC gold bars at Saigon Jewelry Company SJC decreased by 600,000 VND/tael in both directions. The difference between the buying and selling prices of SJC gold at Saigon Jewelry Company SJC is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 148.9-150.4 million VND/tael (buy in - sell out). The difference between buying and selling is 1.5 million VND/tael.

Compared to a week ago, the price of SJC gold bars was reduced by 100,000 VND/tael for buying and 600,000 VND/tael for selling. The difference between the buying and selling prices of SJC gold at Bao Tin Minh Chau is at 2.5 million VND/tael.

If buying SJC gold at Saigon Jewelry Company SJC and Bao Tin Minh Chau on November 16 and selling it today (November 23), buyers will lose VND 2.6 million and VND 2.1 million/tael, respectively.

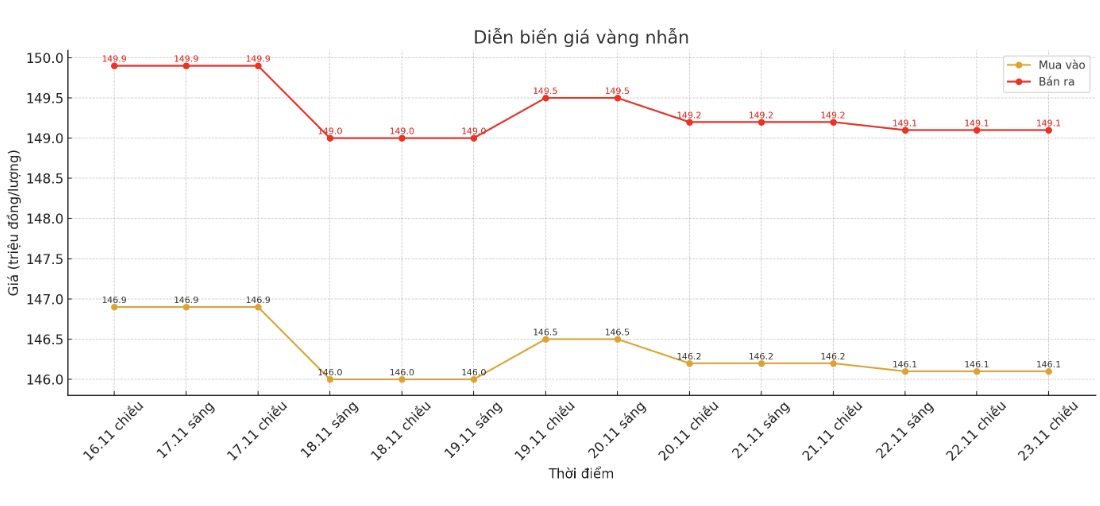

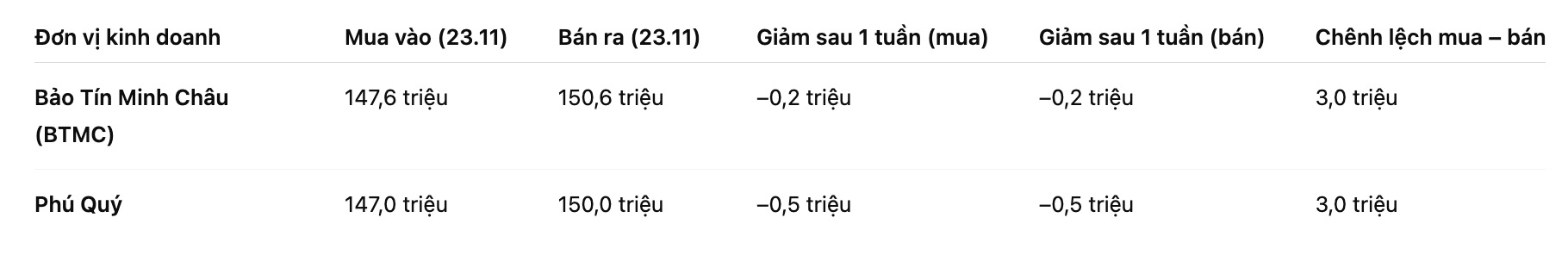

9999 gold ring price

Bao Tin Minh Chau listed the price of gold rings at 147.6-150.6 million VND/tael (buy - sell); down 200,000 VND/tael in both directions. The difference between buying and selling is at 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 147-150 million VND/tael (buy - sell), down 500,000 VND/tael in both directions compared to a week ago. The difference between buying and selling is 3 million VND/tael.

If buying gold rings in the session of November 16 and selling in today's session (November 23), buyers at Bao Tin Minh Chau will lose 3.2 million VND/tael. Meanwhile, the loss when buying in Phu Quy was 3.5 million VND/tael.

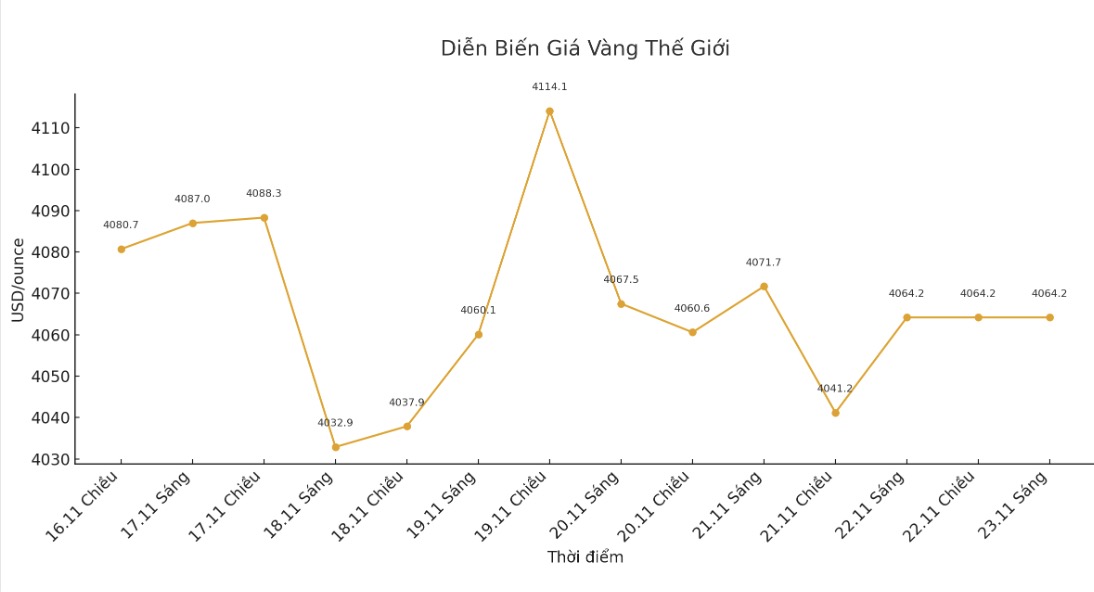

World gold price

At the end of the trading session of the week, the world gold price was listed at 4,064.2 USD/ounce, down 16.5 USD compared to a week ago.

Gold price forecast

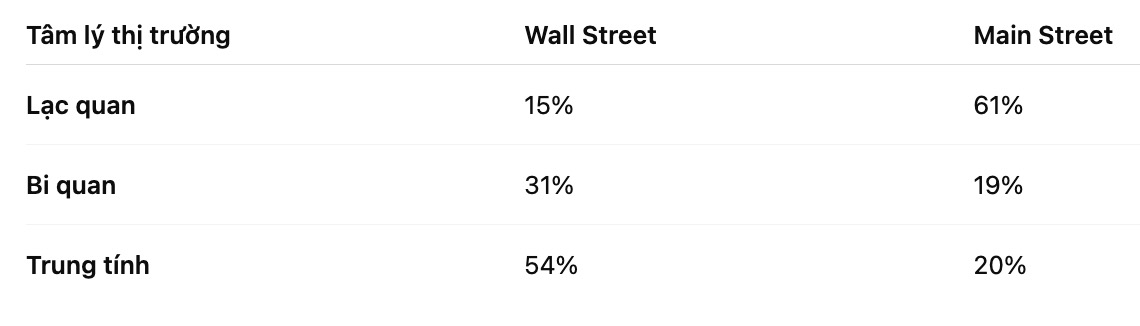

In the short term, the majority of Wall Street experts have shifted to a bearish or neutral view, while individual investors have maintained a majority optimism rate.

This week, 13 analysts participated in the gold survey, with only a small group of Wall Street experts holding an upward view. Only two people (equivalent to 15%) predict gold prices will increase next week, while four others (accounting for 31%), predict prices will decrease. The remaining seven analysts (equivalent to 54%) expect the precious metal to move sideways next week.

Meanwhile, the online survey recorded 228 votes, with the optimistic sentiment of investors on Main Street somewhat decreasing compared to last week. 138 individual investors (61%), while 44%, see gold prices rising next week, see prices falling. The remaining 46 people (equivalent to 20%), expect gold prices to enter the accumulation phase next week.

In the medium term, UBS (Switzerland's leading financial services group) has just raised its gold price target in mid-2026 to 4,500 USD/ounce - from the previous 4,200 USD, based on expectations that the US Federal Reserve (FED) will cut interest rates, prolonged geopolitical risks, financial concerns and strong demand from central banks and ETF investors.

We expect gold demand to continue to increase in 2026, affected by the Feds forecast of rate cuts, real yield cuts, prolonged geopolitical uncertainties, and changes in the domestic policy environment in the US, UBS wrote in a report on Thursday.

Notably, Sagar Khandelwal - strategist at UBS Global Wealth Management believes that real interest rates falling, the US dollar weakening, government debt increasing and geopolitical fluctuations could push gold prices to 4,700 USD/oz in the first quarter of 2026, while gold mining stocks may increase more strongly.

Economic data to watch next week

Tuesday: US PPI, core retail sales, Waiting for sale home contracts.

Wednesday: Sustainable commodity orders, preliminary GDP in the third quarter, Personal Consumption Expenditures Index (PCE).

Thursday: US market closed for Thanksgiving holiday.

See more news related to gold prices HERE...