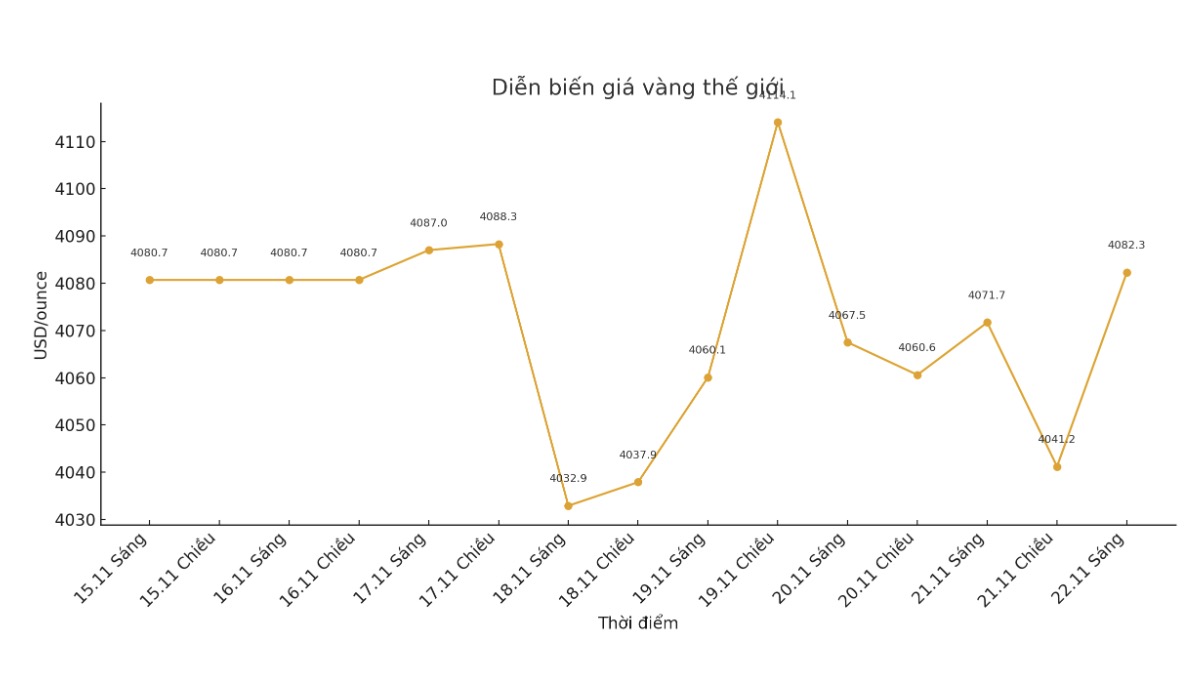

The world gold market ended the trading week with many notable fluctuations when a series of important economic data in the US were released.

Despite still holding the support zone above $4,000/ounce, the precious metal is facing many mixed factors related to consumer sentiment, inflation and economic health.

Data from the University of Michigan shows that US consumer sentiment in November improved slightly after the federal government ended the closure. The consumer psychology index was at 51 points, higher than the forecast but still lower than last month.

Survey Director Joanne Hsu said consumers continue to feel pressured by high prices and weak income. In particular, the assessment of personal finances and shopping conditions decreased by more than 10% during the month.

A positive point is the expectation of simultaneous cooling of inflation. Yearly inflation expectations fell to 4.5%, the third consecutive month of decline; while long-term expectations fell to 3.4%, only slightly above the beginning of the year. However, people still say that the current high prices are eroding their finances.

At the same time, the market received new signals from S&P Global's PMI data. The preliminary tong thong PMI rose to 54.8, a four-month high, showing that US economic activity remains stable. The main driver came from the service sector with an increase of 55.0, exceeding the forecast. The manufacturing PMI decreased slightly but was still in the growth zone.

According to expert Chris Williamson, current PMI data implies that US GDP growth in the fourth quarter could reach about 2.5% per year. However, he also warned of the risks from sharp increase in finished product inventories and slowing down the rate of new orders - a sign that production may cool down in the coming time. In addition, faster increases in input costs and selling prices are creating new pressures on inflation.

In the face of a series of both positive and cautious data, world gold prices are continuously reversing. Lower inflation expectations have helped gold, but the still-solid US economic outlook could reduce safe-haven demand.

In general, the gold market is between opposing forces: Consumer psychology and cooling inflation support gold, while strong economic data and the risk of rising prices can weaken the increase.

In that context, investors continue to closely monitor signals from the US Federal Reserve (FED) and economic developments in the coming weeks to determine a clearer trend for the precious metal.

See more news related to gold prices HERE...