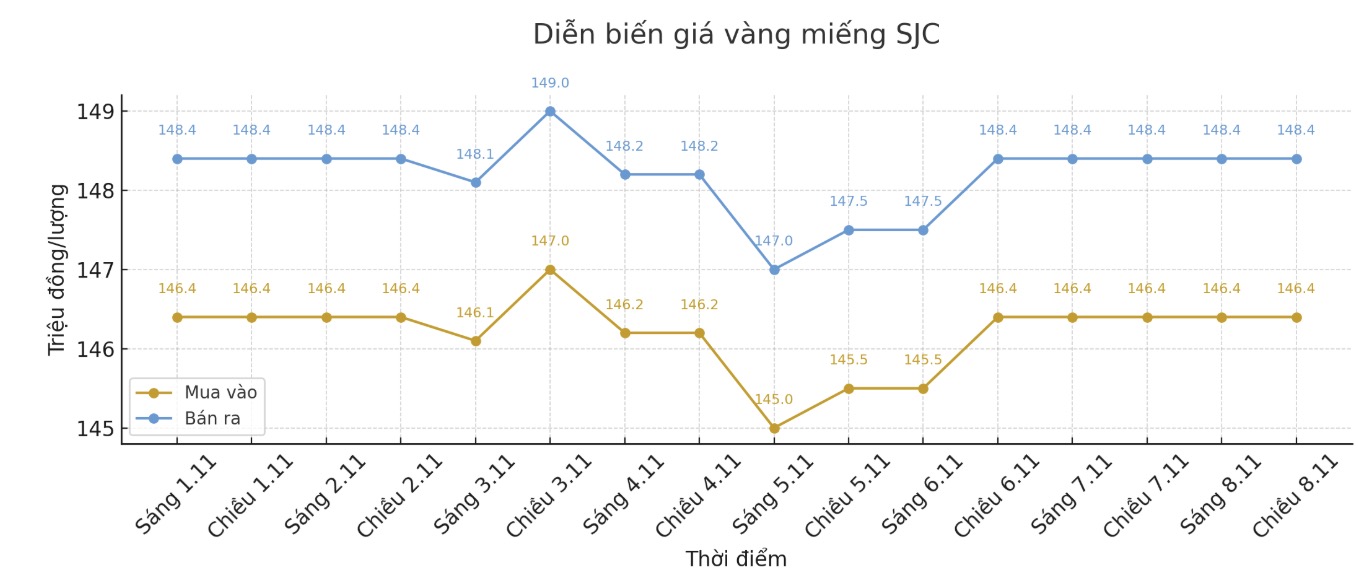

SJC gold bar price

As of 6:30 p.m., DOJI Group listed the price of SJC gold bars at 146.4-148.4 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 146.9-148.4 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 145.4-148.4 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 3 million VND/tael.

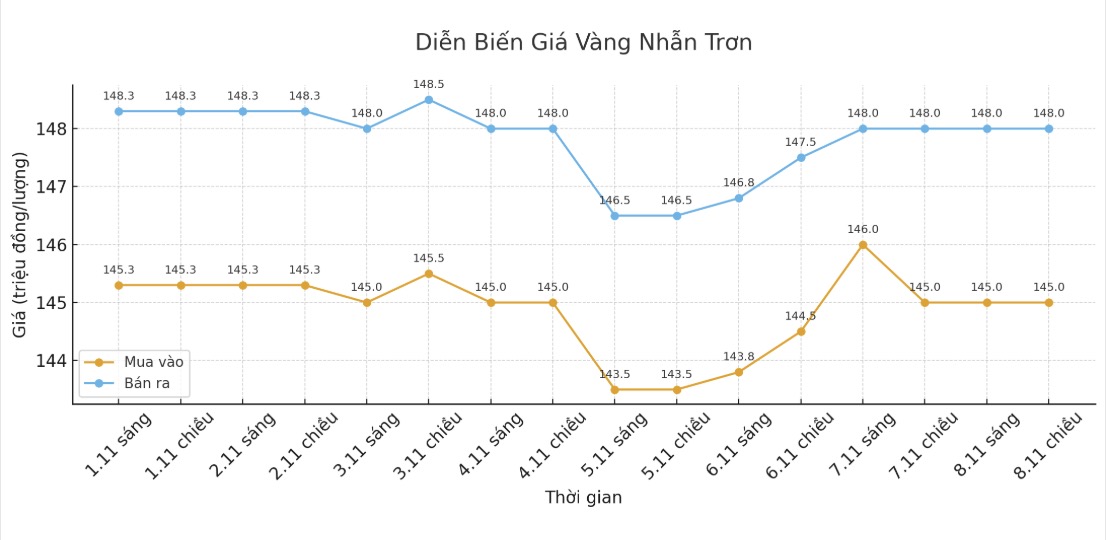

9999 gold ring price

As of 6:30 p.m., DOJI Group listed the price of gold rings at 145-148 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 145.8-148.8 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 145.4-148.4 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

The high buying and selling distance increases the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

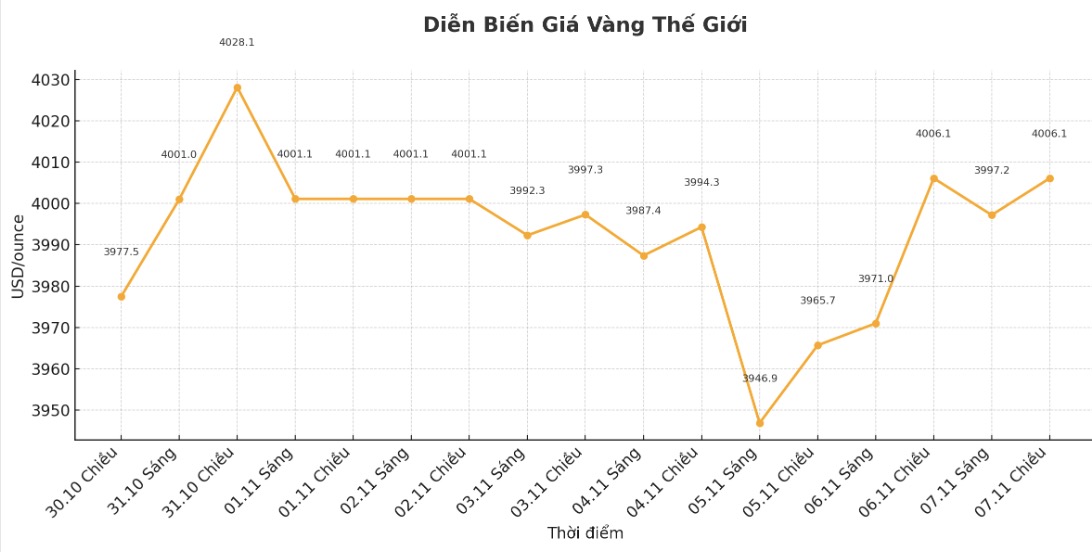

World gold price

The world gold price was listed at 6:30 p.m., at 3,999.6 USD/ounce, up 6.5 USD compared to a day ago.

Gold price forecast

The gold market ended the trading week almost unchanged from the beginning of the week, with the threshold of 4,000 USD/ounce emerging as an important resistance level and a psychological barrier. Although most experts agree that the long-term fundamental factors of gold are still solid, they believe that the market needs a new "catalyst" to create momentum for increase.

Analysts say that gold prices may move sideways in the next few weeks, but the upside prospects are still greater than the downside risk.

Gold prices are likely to fluctuate within a narrow range. Although trade policy tensions have somewhat subsided, the conflict has not been resolved. Therefore, gold will still be popular as a safe haven asset, even as the USD has recently strengthened. We also continue to expect the US Federal Reserve (FED) to cut interest rates more strongly than the current expectations of the market. As the US economic situation becomes clearer after the data is released again, gold prices could benefit," said Ms. Barbara Lambrecht, commodity analyst at Commerzbank, on Friday.

Mr. Michael Brown - senior analyst at Pepperstone - also said that gold still has room for price increase, although it can continue to trade in the sideways zone. According to him, the $4,000/ounce mark "will be a difficult challenge to overcome".

I think gold is forming a fairly wide range of $3,900-4,400/ounce which could be a reasonable trading range in the near term. The risk is still leaning towards price increases not only because of the need for shelter and concerns about uncontrolled inflation, but also because demand from central banks and reserve funds remains strong, he said.

Technically, gold prices are still in a slight uptrend. The buyer's goal is to push the price above the strong resistance level of 4,100 USD/ounce. Conversely, if selling pressure dominates, prices could fall below the important support zone of $3,800/ounce.

Currently, the nearest resistance zone is at 4,028.7 USD, followed by 4,059.9 USD/ounce. The support levels are at $3,973.2 and deeper at $3,935.7/ounce. According to veteran technical analyst Jim Wyckoff's technical scale, gold reached 6.0 - meaning the uptrend still dominated moderately, but the market could fluctuate if strong selling pressure appeared.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...