Updated SJC gold price

As of 6:20 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND 118.5-121 million/tael (buy - sell); an increase of VND 2 million/tael for buying and an increase of VND 1.5 million/tael for selling compared to early in the morning. The difference between buying and selling prices is at 2.5 million VND/tael.

At the same time, DOJI Group listed the price of SJC gold bars at 118.5-121 million VND/tael (buy - sell); an increase of 2 million VND/tael for buying and an increase of 1.5 million VND/tael for selling compared to early in the morning. The difference between buying and selling prices is at 2.5 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 118.5-121 million VND/tael (buy - sell); an increase of 2 million VND/tael for buying and an increase of 1.5 million VND/tael for selling compared to early this morning. The difference between buying and selling prices is at 2.5 million VND/tael.

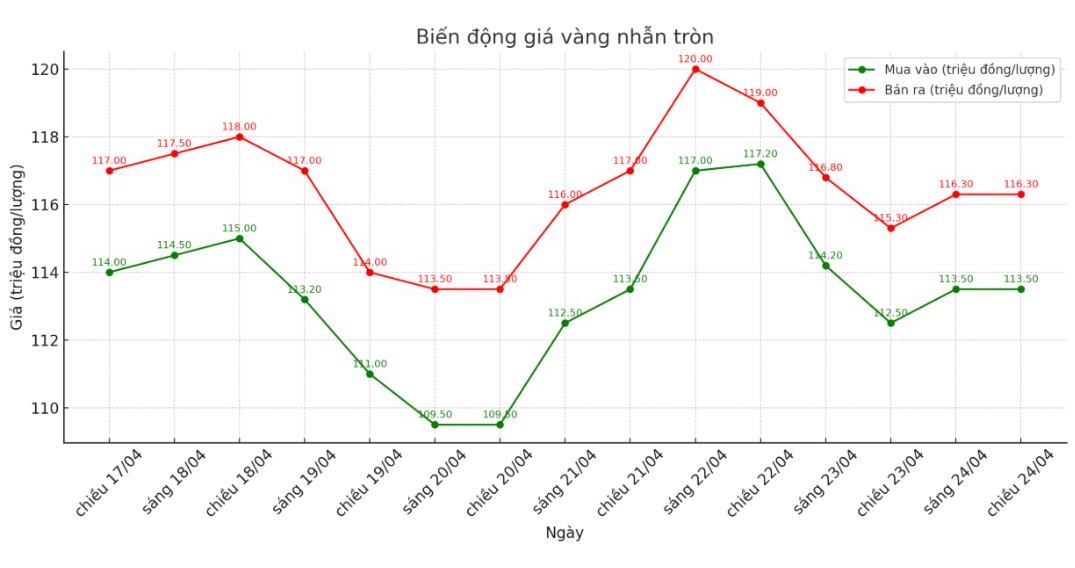

9999 round gold ring price

As of 6:20 p.m. today, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 113.5-116.3 million VND/tael (buy - sell); an increase of 1 million VND/tael for both buying and selling compared to early in the morning. The difference between buying and selling prices is at 2.8 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 117-120 million VND/tael (buy - sell); an increase of 2 million VND/tael for both buying and selling compared to early in the morning. The difference between buying and selling prices is at 3 million VND/tael.

In the context of strong fluctuations in domestic gold prices, the buying-selling gap is pushed to an excessively high level, causing risks for individual investors to increase.

World gold price

As of 6:24 p.m., the world gold price was listed at 3,337.98 USD/ounce.

Gold price forecast

According to Reuters, gold prices recovered on Thursday as investors bought gold bars after a sharp decline in the previous trading session. Spot gold increased 1.6% to $3,340.79/ounce at 09:07 GMT. US gold futures also rose 1.8%, to $3,352.10 an ounce.

Han Tan - Market Analyst at Exinity Group - said: "Previous gold price declines have eased the price increase too quickly, thereby attracting investors to buy when prices fall, in the context of concerns about the global trade war continuing.

With the current momentum, gold supporters could hit $3,500 an ounce solidly."

According to him, although not profitable, gold has long been considered a risk hedge in the context of global instability, increasing by more than 27% this year.

Agreeing, Ole Hansen - Director of Commodity Strategy at Saxo Bank - commented: "If the economic outlook continues to deteriorate, there is no reason why gold should not continue to receive strong attention."

In addition, the weakening of the USD is also a factor that drives gold prices, making gold bars cheaper for international buyers.

See more news related to gold prices HERE...