Gold price developments last week

Gold prices have started the new week slowly and steadily, but rising trade tensions along with policy rotation signals from US Federal Reserve Chairman Jerome Powell have quickly pushed the precious metal to a new record high.

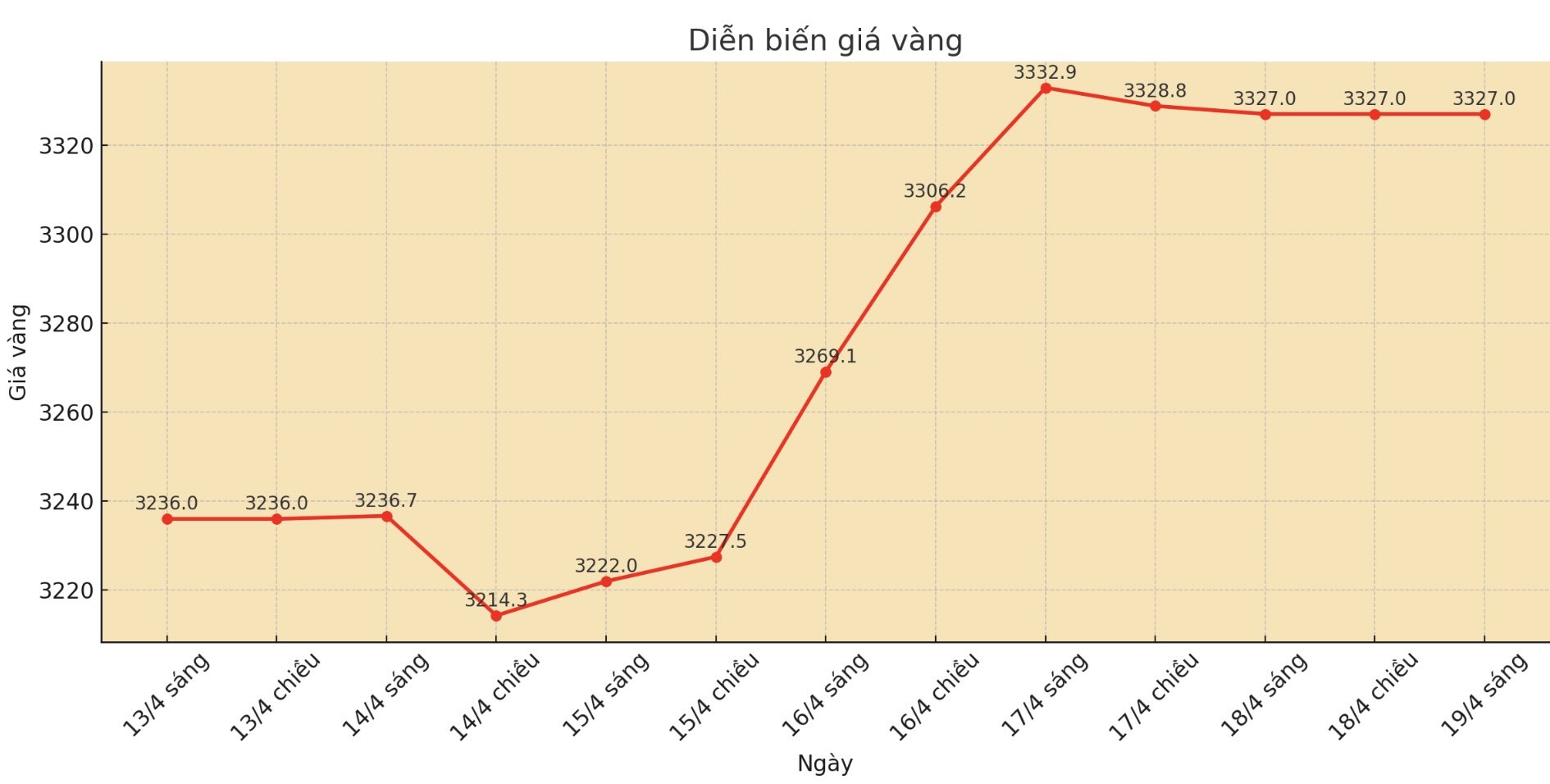

Spot gold prices started the week at $3,180/ounce, then increased beyond $3,220/ounce on Sunday evening. After re-evaluating the $3,200 support level, gold maintained trading within a narrow range of about $35 for the next three days, closing the North American market trading session on Tuesday at $3,231/ounce.

However, like many weeks ago, the "fever" really took place in the Asian trading session. At 1:00 a.m. Eastern time, gold prices soared to $3,290 an ounce.

As the European market began trading, gold had surpassed $3,300. And after Fed Chairman Jerome Powell harshly criticized the Trump administration's tariff policies for increasing inflation and holding back growth, gold prices continued to be pushed to a new record high, nearly $3,360/ounce.

By Wednesday evening, world gold prices had adjusted slightly, falling to a session low of $3,284/ounce in the trading session on Thursday, but then quickly regained the $3,200 mark and traded steadily above this threshold before the long holiday of the Lunar New Year.

Experts predict gold prices next week

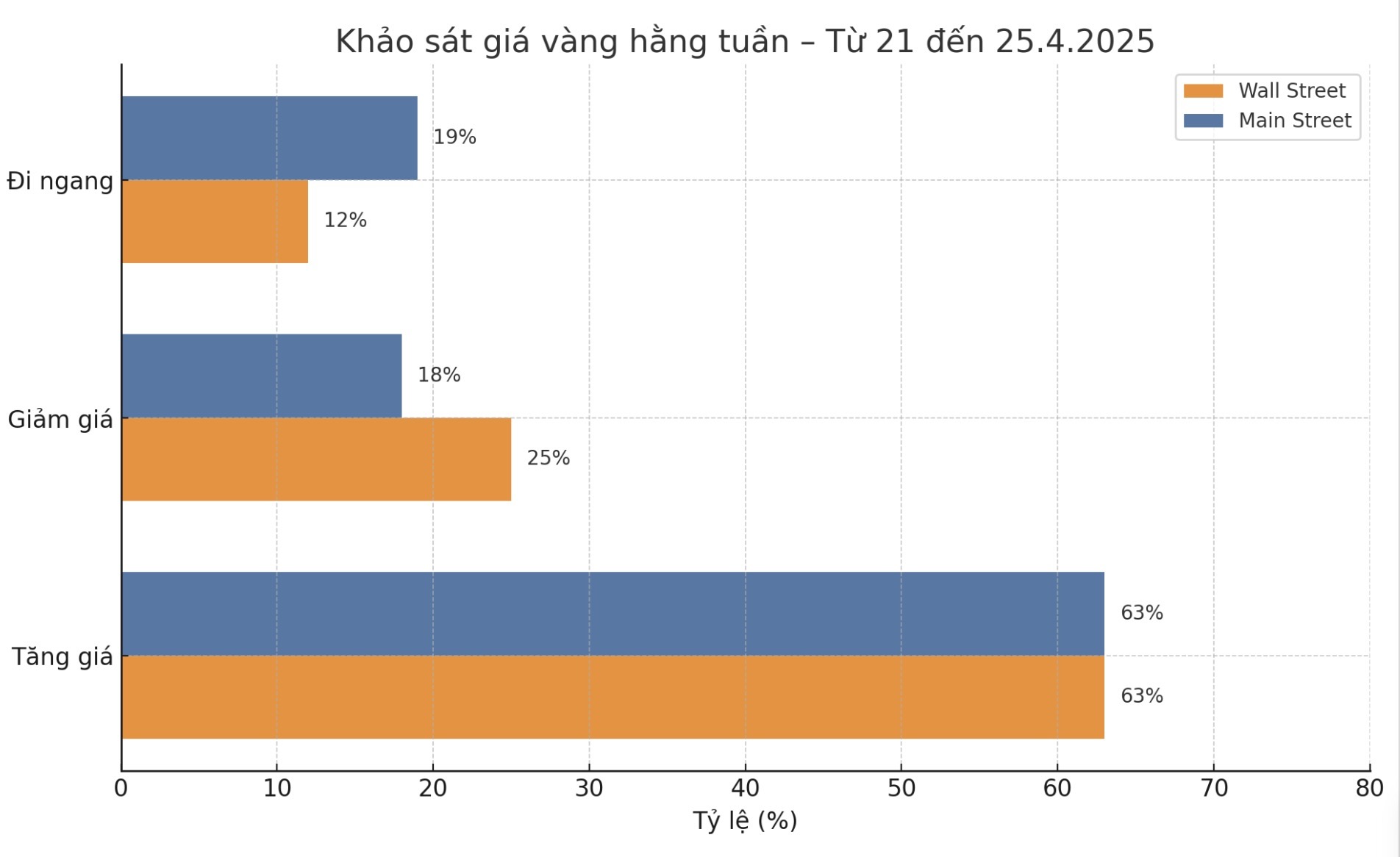

The latest weekly gold survey from Kitco News shows that both Wall Street experts and individual investors are being more cautious as gold prices surpass the $3,300/ounce mark a price zone considered view-high.

This week, 16 analysts participated in the Kitco News survey. Compared to last week when most were optimistic, Wall Street analysts this week have eased their excitement, although most still expect gold prices to continue to rise.

10 people (63%) predict gold prices will increase next week. Meanwhile, four (25%) see prices falling. The remaining two (12%) see gold prices moving sideways around the new peak.

Kitco's online survey also recorded 312 participants from the group of individual investors. Of these, 195 people (63%) see gold prices continuing to rise next week, 57 people (18%) see prices falling, and the remaining 60 people (19%) see prices moving sideways.

US economic calendar affects gold prices next week

There will not be many important economic reports next week, especially when the market will close on Monday due to the holiday.

On Wednesday, the market will receive the preliminary report on the S&P Global's AP PMI and new home sales data for March. On Thursday, a series of important figures will be released such as: long-term goods orders, weekly jobless claims and existing home sales. The weekend will end with the University of Michigan's final report on the consumer confidence index.

The market will also be closely watching speeches from Neel Kashkari, Austan Goolsbee, Adriana Kugler and Patrick Harker, especially after Fed Chairman Jerome Powell's noteworthy comments on Wednesday.

See more news related to gold prices HERE...