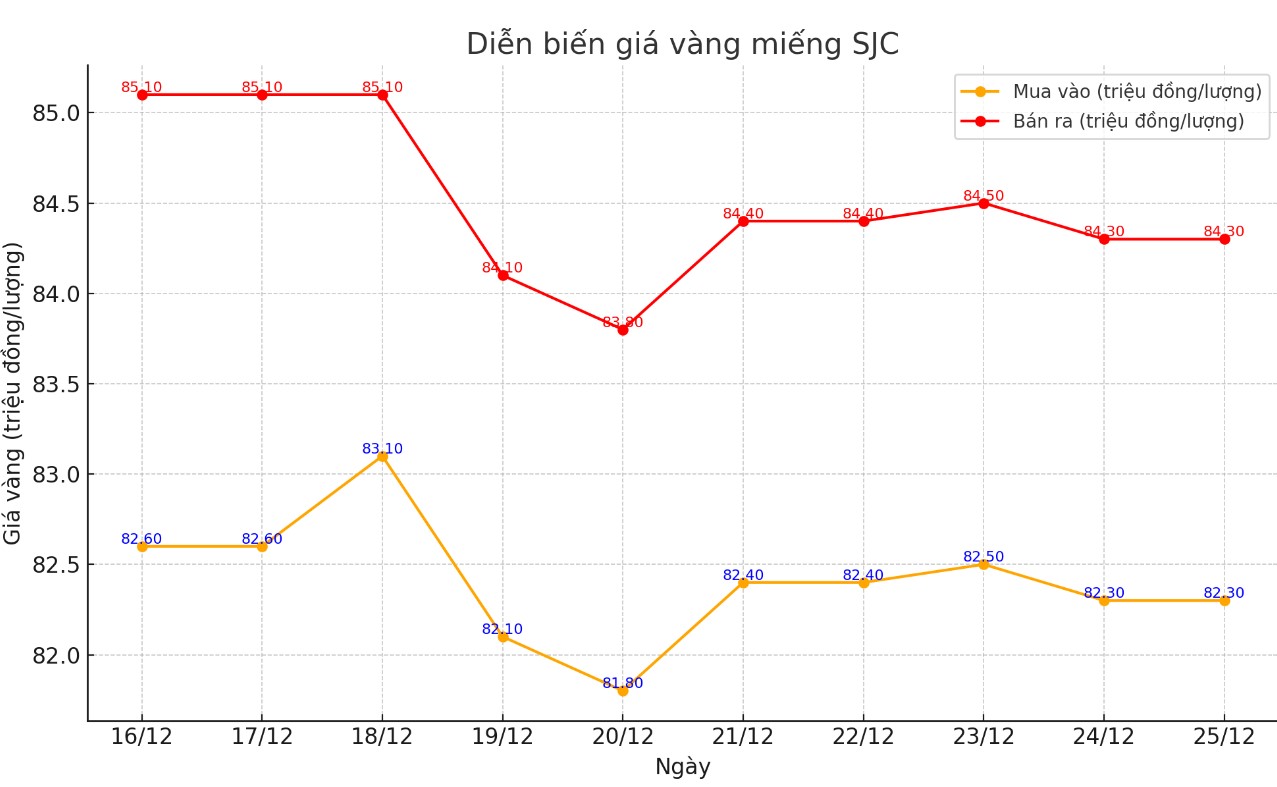

Update SJC gold price

As of 7:00 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at 82.3-84.3 million VND/tael (buy - sell), unchanged in both directions.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

Meanwhile, DOJI Group listed the price of SJC gold at 82.3-84.3 million VND/tael (buy - sell), unchanged in both directions.

The difference between buying and selling prices of SJC gold at DOJI Group is at 2 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 82.3-84.3 million VND/tael (buy - sell), unchanged in both directions.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 2 million VND/tael.

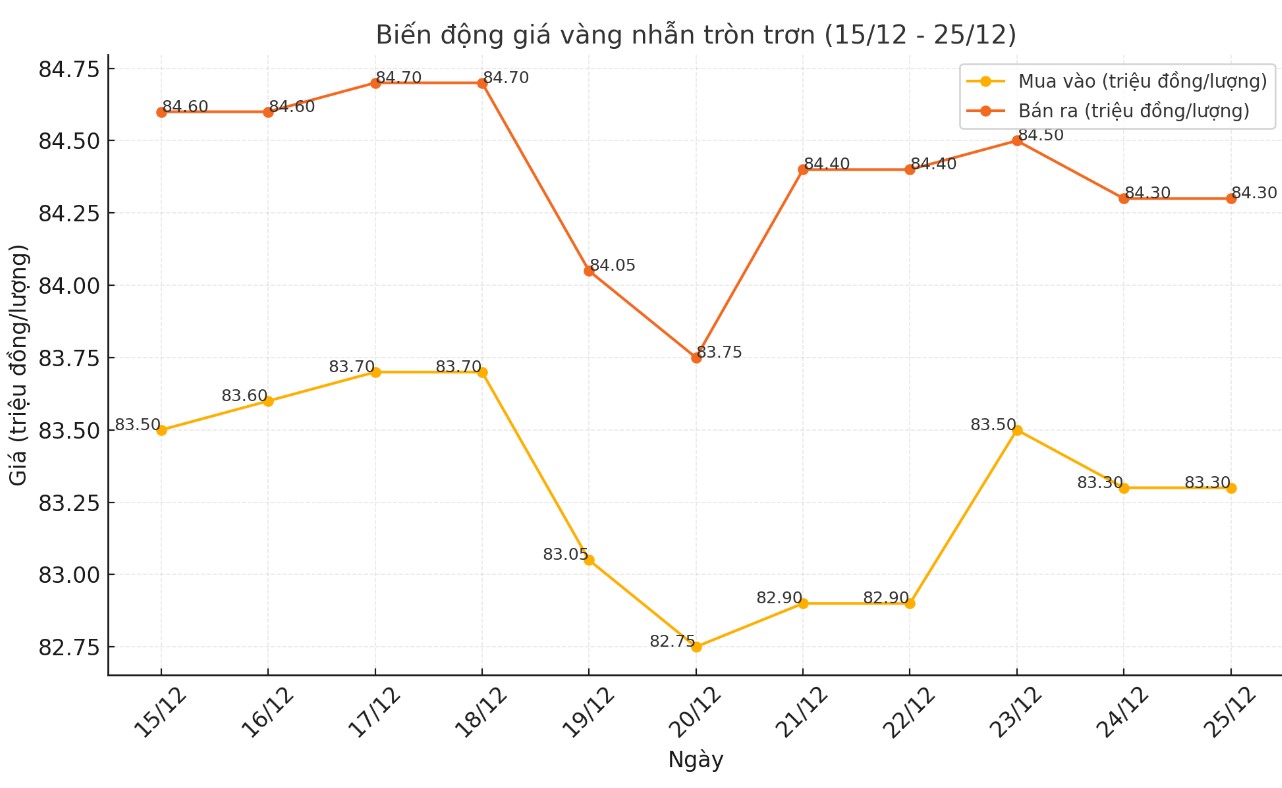

Price of round gold ring 9999

As of 6:15 p.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 83.3-84.3 million VND/tael (buy - sell); both buying and selling prices remain unchanged compared to the close of the previous trading session.

Bao Tin Minh Chau listed the price of gold rings at 82.5-84.3 million VND/tael (buy - sell), keeping both buying and selling prices unchanged compared to the closing price of yesterday's trading session.

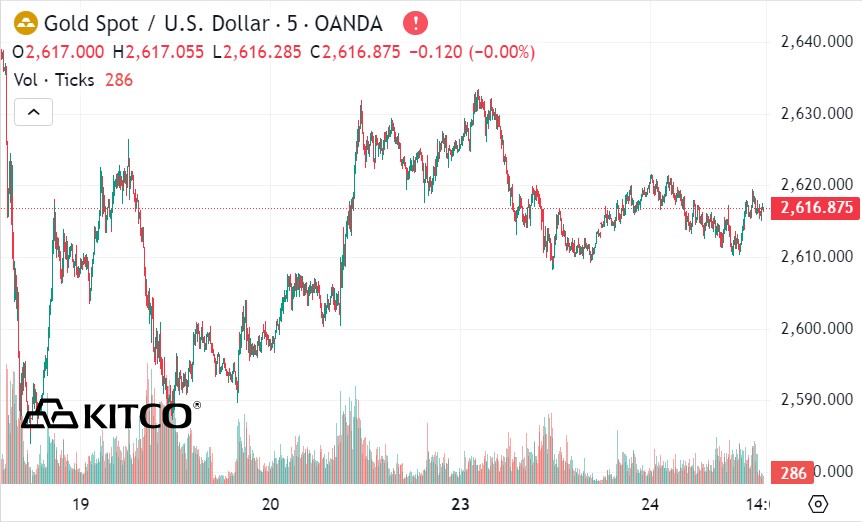

World gold price

As of 7:00 p.m., the world gold price listed on Kitco was at 2,616.8 USD/ounce, down 1.2 USD/ounce compared to the close of the previous trading session.

Gold Price Forecast

World gold prices fell slightly as the USD index maintained its upward trend. Recorded at 7:00 p.m. on December 25, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, stood at 108 points (up 0.18%).

In 2024, gold prices made history with memorable milestones. According to experts, the gold "fever" shows no signs of cooling down.

In an interview with Kitco, George Milling-Stanley - chief gold strategist at State Street Global Advisors - said that he expects 2025 to be an interesting year and could set a new record for gold.

Milling-Stanley's team at State Street has released its official gold price forecast for 2025. The investment firm sees a 50% chance of gold trading between $2,600 and $2,900 an ounce, and a 30% chance of gold trading between $2,900 and $3,100 an ounce.

On the downside, State Street estimates a 20% chance of gold prices falling to $2,200 - $2,600/ounce.

“That means we are 80% confident that gold prices will stay the same or move higher in 2025,” he said.

One notable aspect of State Street's forecast is the wider range of price swings. Milling-Stanley explained that this range reflects increased volatility in financial markets.

He noted that while gold prices are expected to rise in 2025, investors need to prepare for strong volatility.

Meanwhile, Tom Bruce, macro investment strategist at Tanglewood Total Wealth Management, told Kitco News in an interview that he has a “fairly positive” view on gold, despite some tough headwinds facing the precious metal.

Bruce said that, although he did not give a specific price, he predicted that gold prices would increase by about 10% next year, but still below $3,000 an ounce.

He believes the biggest near-term challenges for gold in 2025 will be rising real yields and solid economic growth in the US.

“We believe that the 10-year bond yield has now bottomed out. It could easily exceed 5%. If inflation does not change much, real interest rates will rise significantly,” he said.

However, Bruce added that while gold may experience short-term volatility due to higher real yields, the long-term uptrend in the precious metal remains intact as central banks continue to buy gold, creating a new dynamic in the market.

See more news related to gold prices HERE...