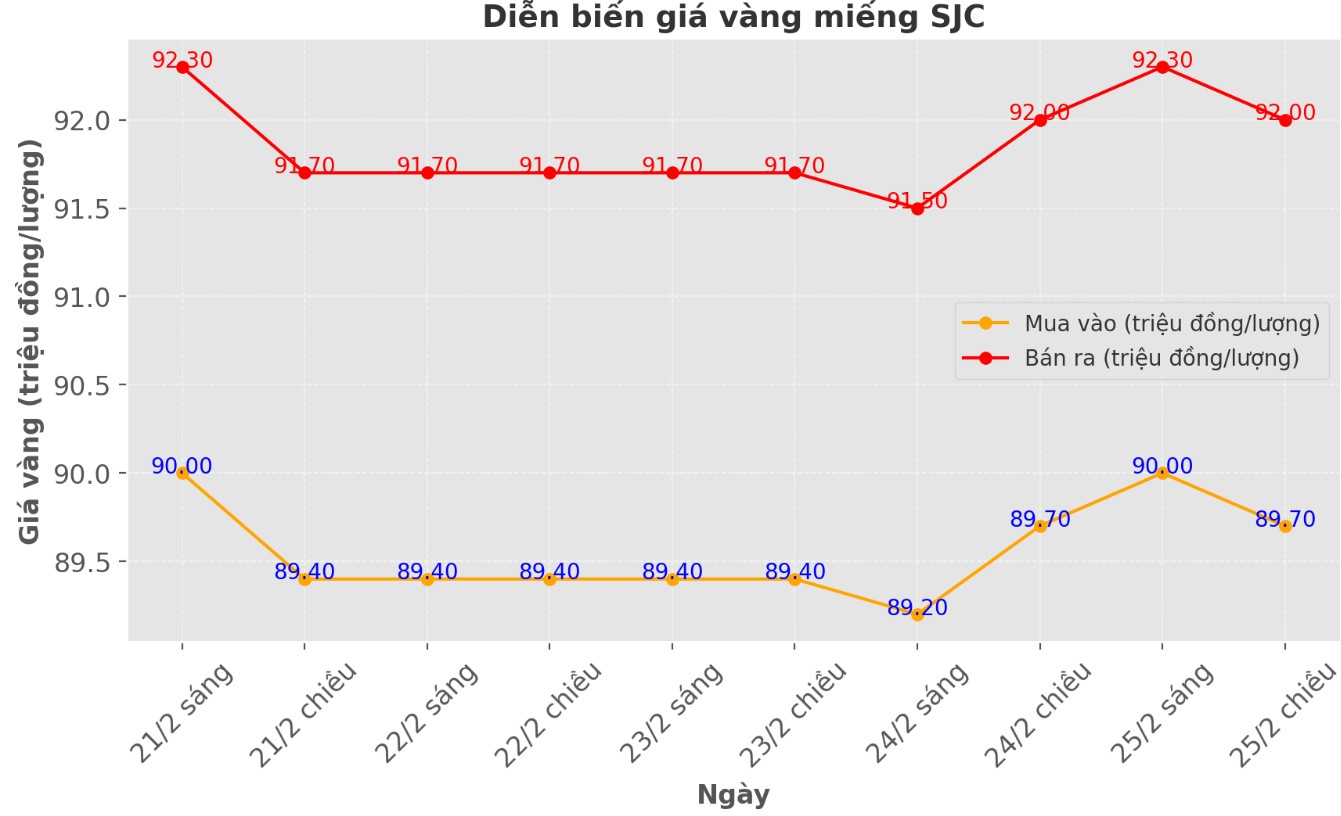

Updated SJC gold price

As of 20:00, the price of SJC gold bars was listed by Saigon Jewelry Company at VND89.7-92 million/tael (buy in - sell out), unchanged in both directions.

The difference between the buying and selling prices of SJC gold at Saigon Jewelry Company SJC is at 2.3 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 90.1-92.2 million VND/tael (buy - sell), an increase of 100,000 VND/tael for buying and an increase of 200,000 VND/tael for selling. The difference between the buying and selling prices of SJC gold was listed by Bao Tin Minh Chau at 2.1 million VND/tael.

DOJI Group listed the price of SJC gold bars at VND89.7-92 million/tael (buy in - sell out), unchanged in both directions. The difference between the buying and selling prices of SJC gold was listed by DOJI at 2.3 million VND/tael.

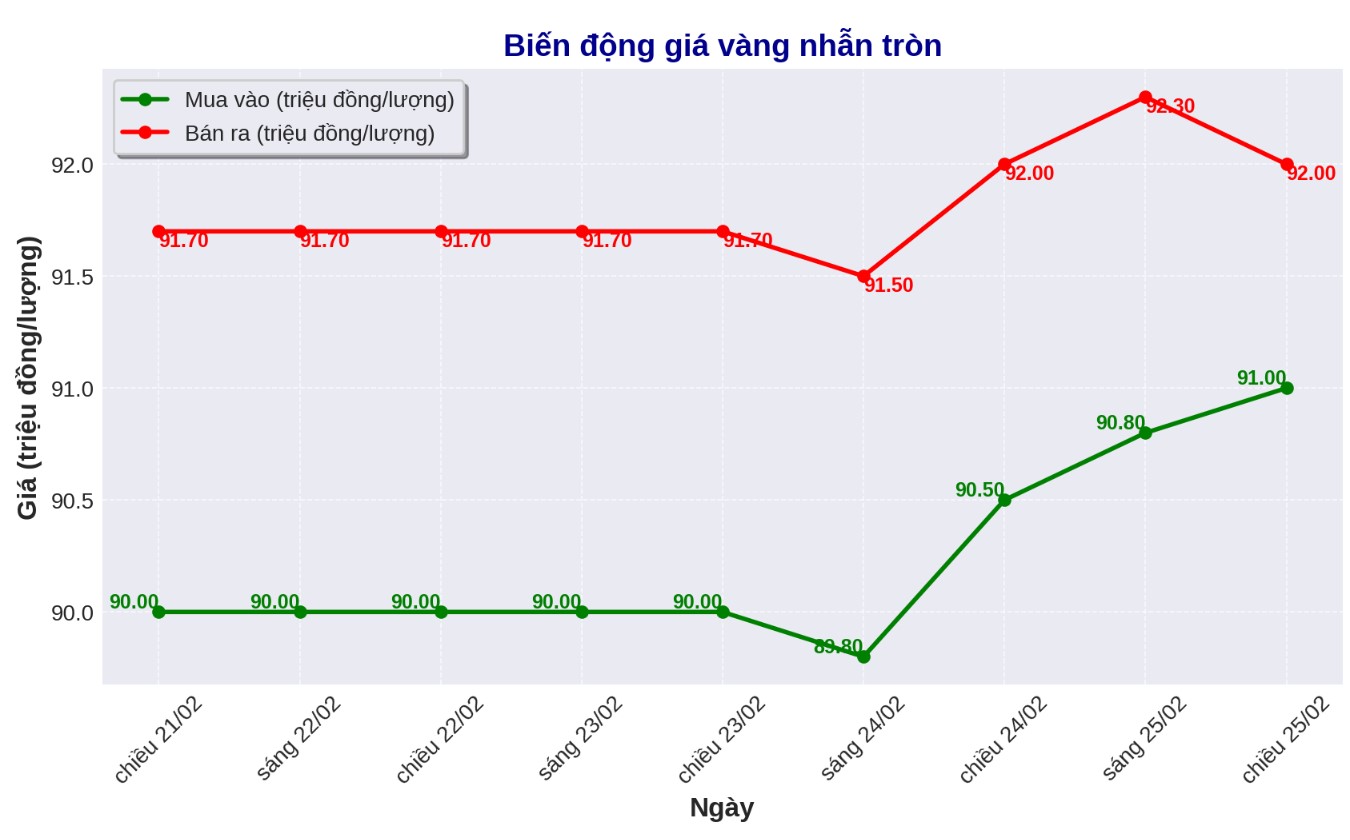

9999 round gold ring price

As of 20:00 today, the price of Hung Thinh Vuong 9999 round gold rings at DOJI is listed at 91-92 million VND/tael (buy - sell); increased by 500,000 VND/tael for buying and kept the same for selling. The difference between buying and selling is listed at 1 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 90.7-92.2 million VND/tael (buy - sell); increased by 100,000 VND/tael for both buying and selling. The difference between buying and selling is 1.5 million VND/tael.

World gold price

As of 20:00, the world gold price listed on Kitco was at 2,928.8 USD/ounce, down 11.7 USD/ounce compared to the same time of the previous session.

Gold price forecast

World gold prices fell despite the decline of the USD. Recorded at 20:00 on February 25, the US Dollar Index measuring the fluctuations of the greenback against 6 major currencies was at 106.380 points (down 0.11%).

Gold prices fell as investors took profits after the precious metal was listed around a historical peak. The market is waiting for new data on new home sales in the US.

Data on new home sales in the US may influence gold prices through reflecting economic situation and market sentiment. As home sales increase, this shows that the economy is growing, which could lead to the US Federal Reserve (FED) raising interest rates to control inflation. Higher interest rates reduce the attractiveness of gold, because gold does not yield interest. Conversely, when home sales fall, it could signal an economic slowdown, allowing the Fed to maintain or cut interest rates. Lower interest rates increase the attractiveness of gold as a safe investment channel.

However, gold prices are also affected by many other factors such as inflation, political fluctuations and other economic data. Therefore, although new home sales are an important indicator, it is necessary to consider all other factors to accurately assess the gold price trend.

Adrian Day - chairman of Adrian Day Asset Management believes that gold prices will decrease: "The increase in gold in the past two months has far exceeded the usual trend, so there may be a correction. However, I think this decline will be short and insignificant. The reasons for investors to buy gold are still there, while North American investors are not yet taking a strong stance."

Marc Chandler - CEO of Bannockburn Global Forex warned about the possibility of a short-term correction: "Gold hit a record high of nearly 2,955 USD/ounce on February 20. However, technically, it is starting to show signs of being easily adjusted down. The increase of more than 13% since the beginning of the year may make investors hesitate and slow down their buying momentum".

Meanwhile, Jim Wyckoff - senior analyst at Kitco expects gold prices to continue to increase in the short term: "Gold will increase due to safe-haven demand and positive technical factors will create a solid foundation for the gold market".

Upcoming economic events affect gold prices

Wednesday: New home sales in the US.

Thursday: US Q4 preliminary GDP, US long-term goods orders, US weekly jobless claims, US pending home sales.

Friday: US core PCE index, personal income and spending.

Note: The article data compares with the same time of the previous trading session.

See more news related to gold prices HERE...