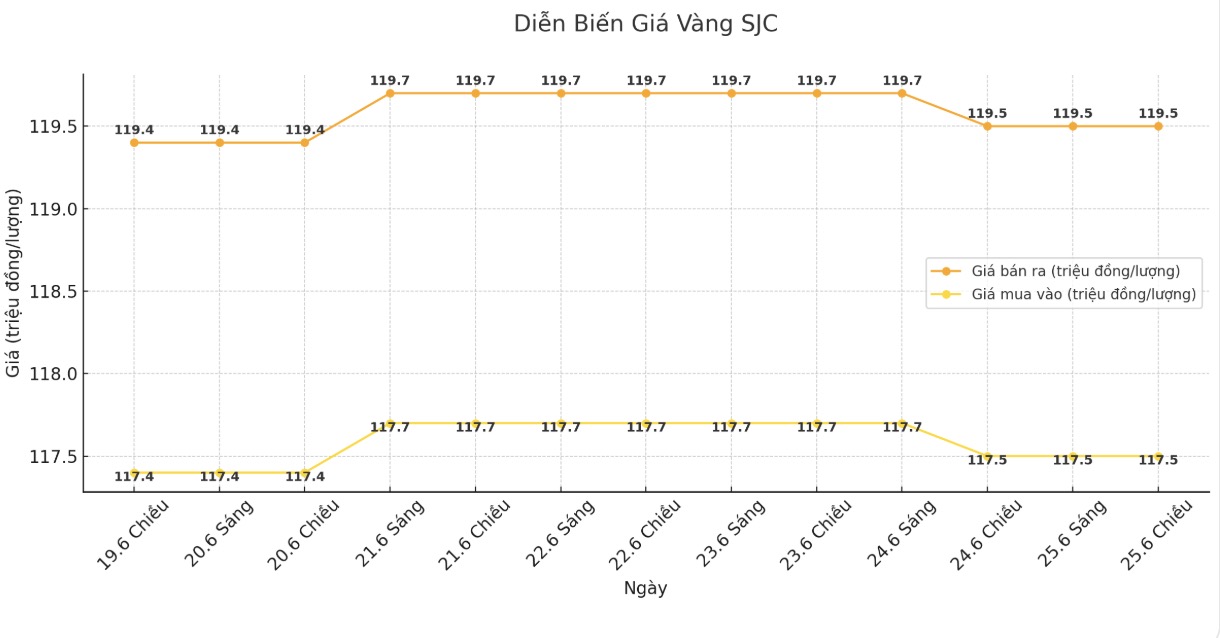

SJC gold bar price

As of 6:15 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at 117.5-111.5 million VND/tael (buy in - sell out); unchanged in both directions. The difference between buying and selling prices is at 2 million VND/tael.

DOJI Group listed at 117.5-111.5 million VND/tael (buy in - sell out); unchanged in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 117.5-111.5 million VND/tael (buy in - sell out); unchanged in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 116.8-111.5 million VND/tael (buy - sell); down 200,000 VND/tael for buying and kept the same for selling. The difference between buying and selling prices is at 2.7 million VND/tael.

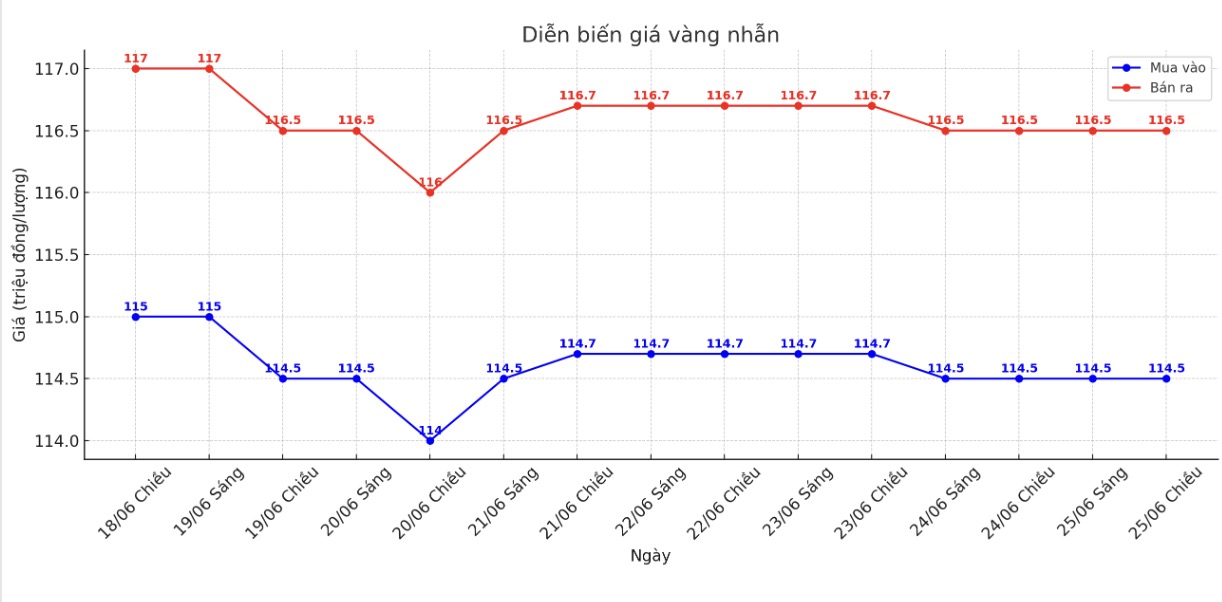

9999 gold ring price

As of 6:18 p.m., DOJI Group listed the price of gold rings at VND 114.5-116.5 million/tael (buy in - sell out), an increase of VND 500,000/tael in both directions. The difference between buying and selling is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 114.5-117.5 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 113.3-116.3 million VND/tael (buy in - sell out), an increase of 100,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

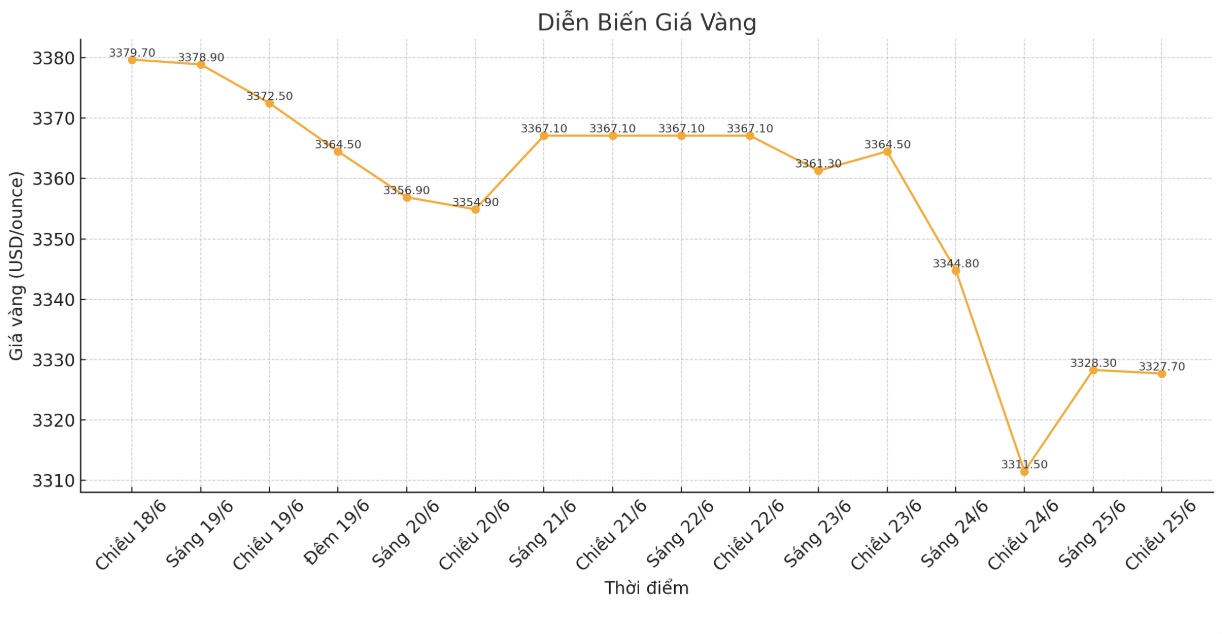

World gold price

The world gold price was listed at 6:20 p.m. at 3,327.7 USD/ounce, up 16.2 USD.

Gold price forecast

Gold prices increased despite increased risk-off sentiment due to a ceasefire between Israel and Iran, while the market shifted its focus to upcoming US economic data.

Spot gold prices remained almost unchanged at $3,325.56/ounce at 10:45 GMT. Earlier, on Tuesday, gold prices hit a more than two-week low. US gold futures increased 0.2% to $3,339.30/ounce.

Less tensions in the Middle East and reduced demand for safe-haven assets are the reasons why gold prices have abandoned their previous gains. However, uncertainty over Iran's nuclear program has kept investors holding a portion of their portfolios, said Giovanni Staunovo, an analyst at UBS.

The ceasefire mediated by US President Donald Trump between Iran and Israel appears to be maintained on Wednesday, a day after both countries signaled an end to the air war.

The USD (.DXY) has struggled to recover as investors tend to accept more risks after the ceasefire agreement. A weak US dollar makes gold - which is priced in USD - more attractive to holders of other currencies.

A report shows that global central banks are considering switching from USD to gold, euro and Chinese yuan to foreign exchange reserves, in the context of increasing geopolitical instability.

Gold is considered a safe haven asset in times of uncertainty and often performs well when interest rates are low.

The market is currently focusing on US GDP data for the first quarter of 2025 to be released on Thursday, to assess economic growth rate. On Friday, personal consumption expenditure (PCE) data - the Federal Reserve's preferred inflation measure - will be released.

If the PCE data is lower than expected, the pressure on the Fed to cut interest rates will increase and this will support gold prices, Staunovo said.

Fed Chairman Jerome Powell told the National Assembly on Tuesday that higher tariffs could start raising inflation from this summer. Meanwhile, data showed that US consumer confidence unexpectedly decreased in June.

Spot silver prices fell 0.6% to 35.70 USD/ounce; platinum lost 1.7% to 1,294.06 USD; while paladi decreased 2% to 1,044.92 USD.

See more news related to gold prices HERE...