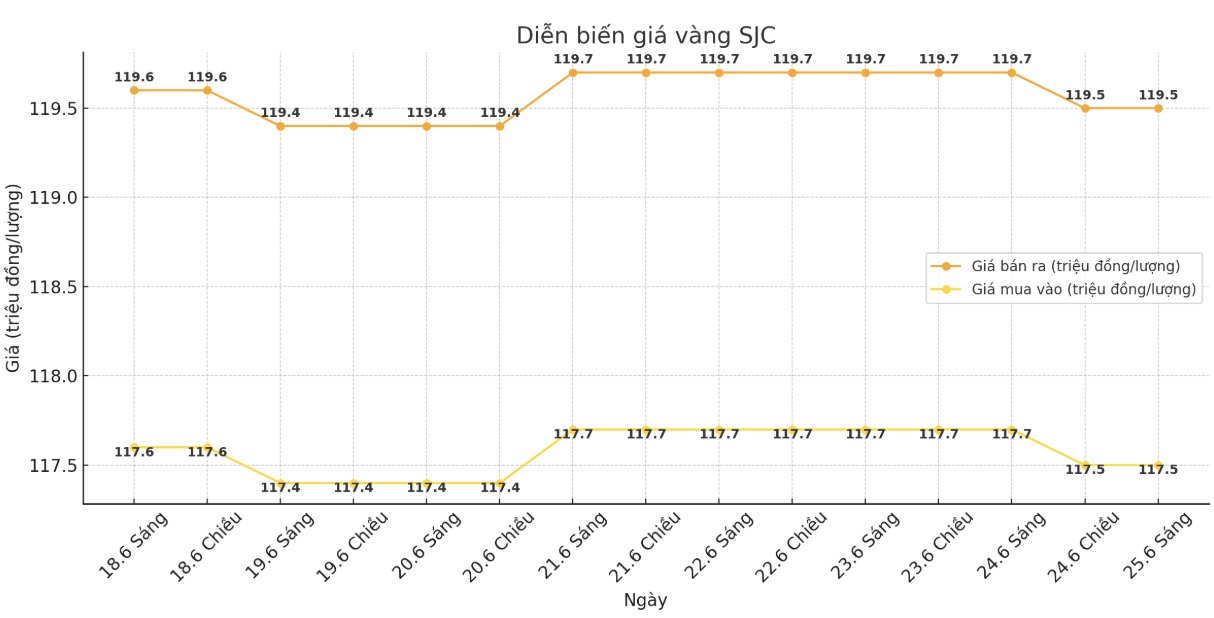

Updated SJC gold price

As of 9:53, the price of SJC gold bars was listed by Saigon Jewelry Company at 117.5-111.5 million VND/tael (buy in - sell out), down 200,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

DOJI Group listed the price of SJC gold bars at 117.5-111.5 million VND/tael (buy in - sell out), down 200,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 117.5-111.5 million VND/tael (buy in - sell out), down 200,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 116.8-111.5 million VND/tael (buy in - sell out), down 200,000 VND/tael in both directions. The difference between buying and selling prices is at 2.7 million VND/tael.

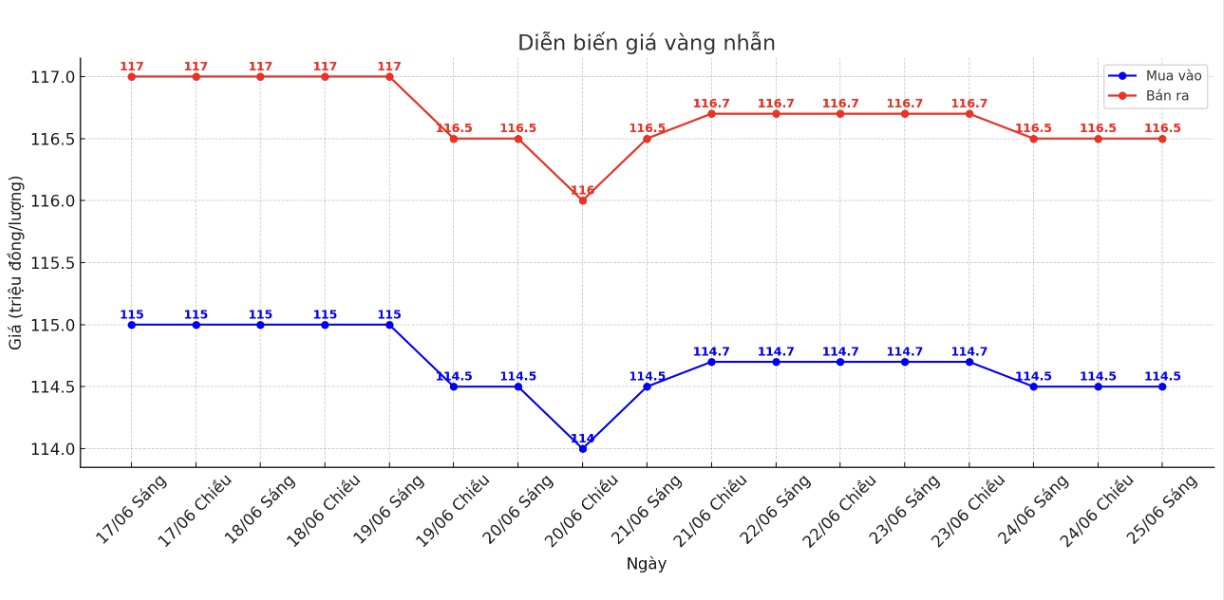

9999 round gold ring price

As of 9:53, Bao Tin Minh Chau listed the price of gold rings at 114.5-117.5 million VND/tael (buy in - sell out), down 100,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

DOJI Group listed the price of gold rings at 114.5-116.5 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling is at 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 113.3-116.3 million VND/tael (buy in - sell out), down 200,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

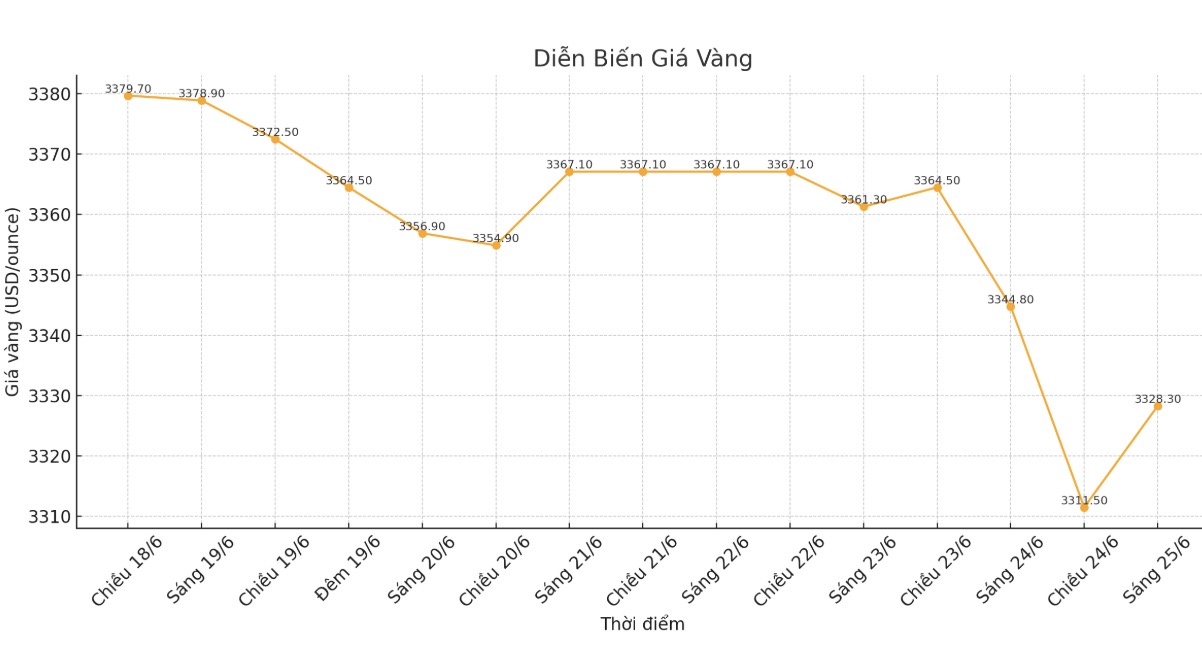

World gold price

At 9:53, the world gold price was listed around 3,328.3 USD/ounce, down 16.5 USD compared to 1 day ago.

Gold price forecast

Financial markets shifted strongly away from defense on Tuesday, after Israel and Iran reached a ceasefire agreement, ending 12 days of tense military confrontation.

The fragile deal, which came into effect on Tuesday morning, was initially questioned but reinforced after US President Donald Trump intervened and the two sides reaffirmed their commitment to compliance. The market reacted immediately with confidence in the prospect of peace.

Gold futures fell sharply, losing about $60 compared to the closing price on June 13. Silver futures fell to 35.85 USD/ounce, falling below the 36 USD mark for the first time since June 6. The US dollar also weakened, with the ICE US Dollar Index falling 0. 90% to 97.88 near a two-year low.

The psychology of accepting the risk of spreading, investors shift to assets for growth, causing short-term pressure on precious metals.

"The cooling of tensions in the Middle East is the main reason for the pressure on gold. Asylum demand has decreased. The market is now turning to risky assets," said Peter Grant, commodity strategist at Zaner Metals.

This expert believes that the current support level for gold prices is 3,300 USD per ounce. "There are still some doubts about whether the ceasefire will be maintained. Before everything was clear, I thought the possibility of further gold declines was quite limited," Grant added.

David Morrison - Senior Analyst at Trade Nation said that it is noteworthy that there was no wave of escape from risky assets in the second session. The general view seems to be that the US will participate at a limited military level but effectively, significantly weakening Iran's nuclear ambitions.

In another development, data recently released by the World Gold Council (WGC) shows that 95% of reserve managers expect central banks to continue to increase gold reserves in the next 12 months. This is a record high since the survey began in 2019 and increased by 17% compared to the data recorded in 2024. Therefore, central banks, especially in China and Russia, are continuing to accumulate gold as part of a strategy to diversify their portfolios away from the US dollar.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...