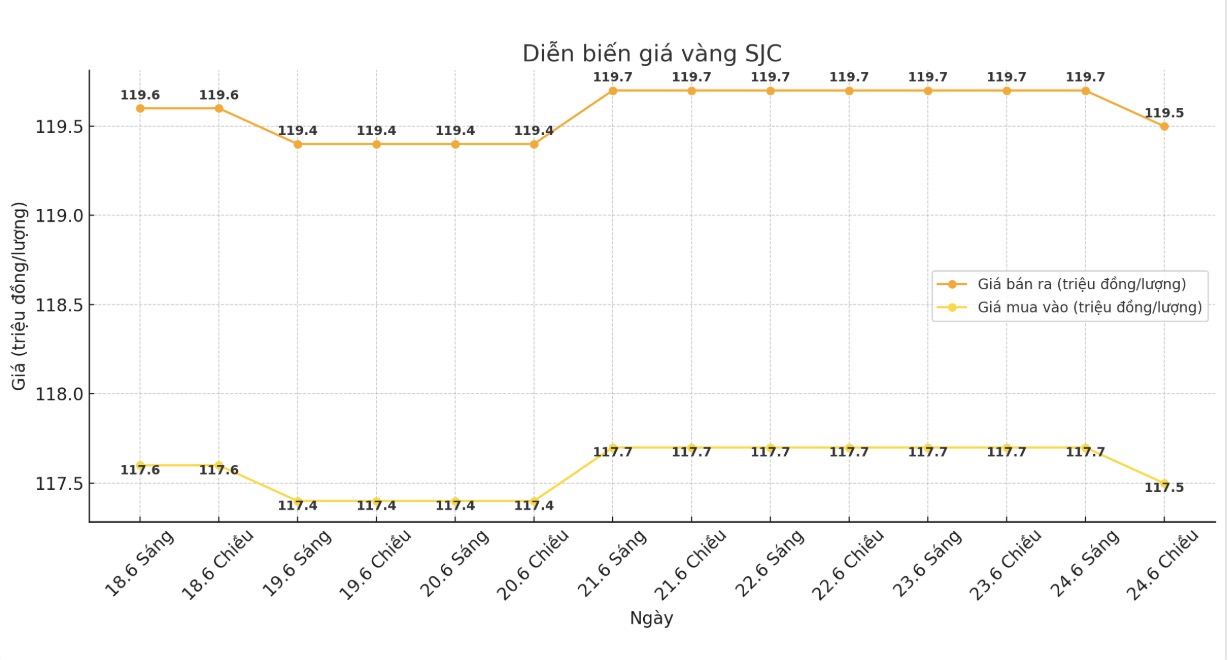

SJC gold bar price

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at 117.5-111.5 million VND/tael (buy in - sell out); down 200,000 VND/tael. The difference between buying and selling prices is at 2 million VND/tael.

DOJI Group listed at 117.5-111.5 million VND/tael (buy - sell); down 200,000 VND/tael. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at the listed price at 117.5-112.5 million VND/tael (buy in - sell out); down 200,000 VND/tael. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 117-111.5 million VND/tael (buy in - sell out); unchanged. for buying and down 200,000 VND/tael for selling. The difference between buying and selling prices is at 2.5 million VND/tael.

9999 gold ring price

As of 6:00 a.m., DOJI Group listed the price of gold rings at 114-116 million VND/tael (buy - sell), down 500,000 VND/tael in both directions. The difference between buying and selling is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 114.5-117.5 million VND/tael (buy - sell), down 100,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 113.2-116.2 million VND/tael (buy in - sell out), down 400,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

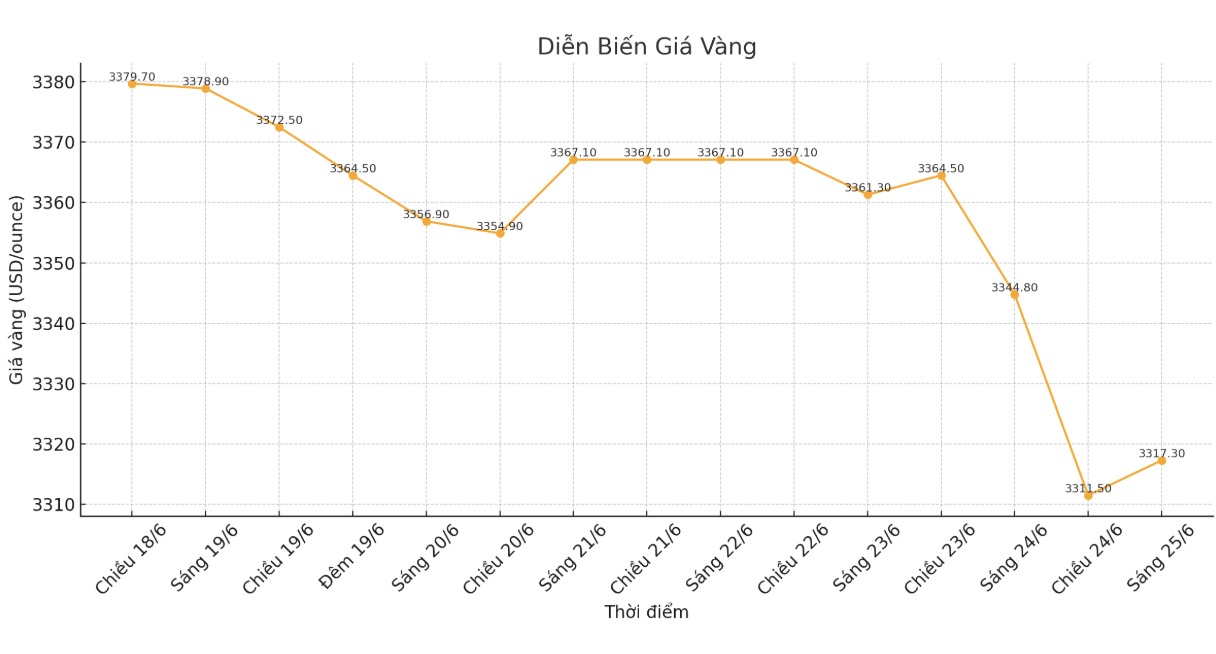

World gold price

The world gold price listed at 0:00 fell sharply to 3,317.3 USD/ounce, down to 70 USD.

Gold price forecast

Gold prices fell sharply as the geopolitical situation in the Middle East suddenly changed direction to cool down the military conflict - at least for now.

August gold contract fell611% to $3,333.9/ounce. July delivery silver prices also fell $0.092 to $26.095 an ounce.

Information that Iran and Israel have reached a ceasefire agreement, along with predictions that Iran is unlikely to continue retaliating against the US, has returned to market risk appetite today.

US President Donald Trump wrote on social media: assuming everything goes as planned, and that happens, I would like to congratulate both countries, Israel and Iran, for having enough determination, courage and intelligence to end the so-called 12-day war.

Asian and European stocks mostly increased overnight. US stock indexes are expected to open up strongly in today's session in New York.

In other news, China today eased monetary policy slightly by pumping liquidity into the financial market.

Technically, speculators who buy gold for August delivery will still have a short-term technical advantage but are gradually weakening. The next upside price target is to close above the resistance level of $3,476.30/ounce. The next downside price target for bears is to push the futures contract price below $3,300/ounce.

The first resistance was recorded at an overnight high of $3,385/ounce, then $3,400/ounce. The first support was at $3,313.1/ounce, followed by $3,300/ounce.

In other key markets, the USD index fell. Nymex crude oil prices fell and traded around 66.50 USD/barrel. The yield on the 10-year US Treasury note is currently at 4.33%.

Economic data to watch this week

Wednesday: New home sales; FED Chairman holds a hearing before the Senate Banking, Housing and Urban Committee.

Thursday: Weekly jobless claims, long-term US orders, final Q1/2025 GDP, Waiting for sale house transactions.

Friday: US PCE core inflation.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...