The financial market has clearly shifted away from defensive positions on Tuesday, as traders poured into risky assets after Israel and Iran reached a ceasefire agreement, ending a 12-day military confrontation that has increased global geopolitical tensions.

The fragile ceasefire, which came into effect on Tuesday morning, initially faced many doubts as the two sides repeatedly accused each other of violations. US President Donald Trump intervened, and the deal was eventually strengthened as officials of the two countries reaffirmed their commitment to compliance, with conditions for appropriate response.

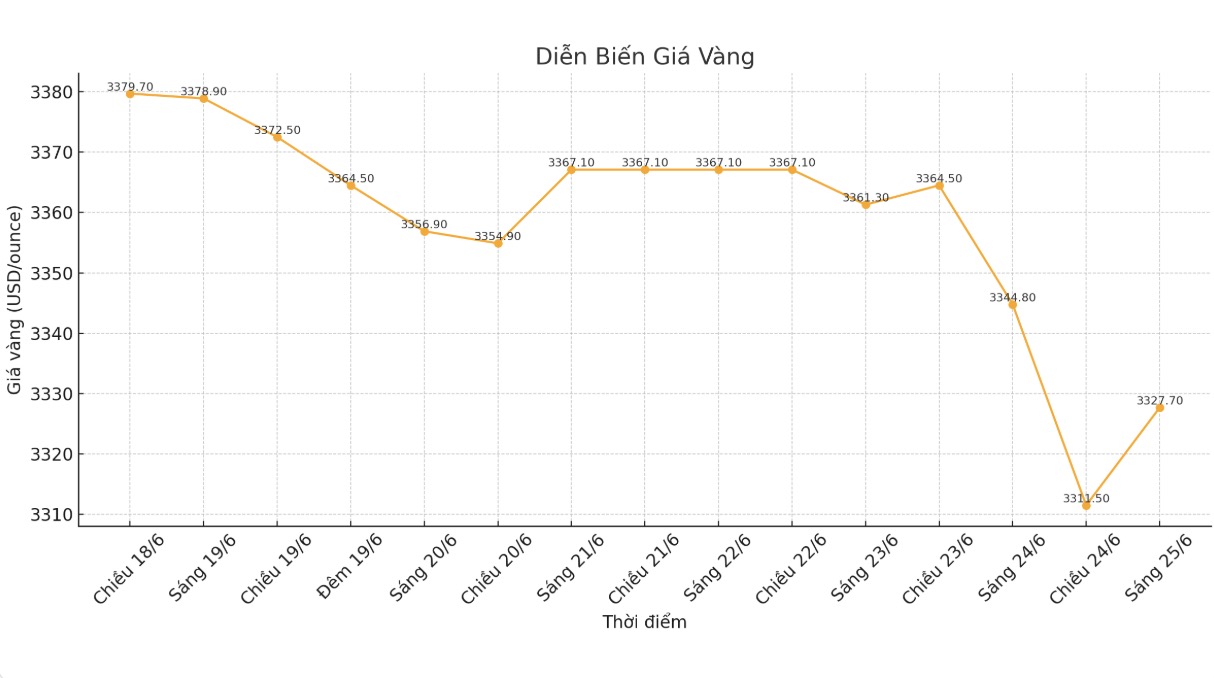

The market responded quickly and decisively, showing high confidence in the sustainability of the peace agreement. Gold futures have reversed sharply, trading about $60 lower than the closing price on June 13 - when Israel attacked Iran's nuclear facilities.

As of 3:47 p.m. ET, gold futures fell 57.7 USD, equivalent to 1.70%, to 3,336.5 USD/ounce - almost completely erasing the increase caused by the conflict in the past two weeks.

Other safe-haven assets also fell, although not as strong as gold. Silver futures fell $0.33 to $35.85 an ounce for the first time below the psychological threshold of $36 since June 6.

The US dollar, despite being a typical safe haven asset, has also weakened significantly. The ICE US Dollar Index fell 0. 90% to 97.88 nearing its lowest level in more than two years.

The massive shift from defensive assets to risk assets is most clearly demonstrated in the stock market, with key indicators increasing sharply. Nasdaq composite jumped 1.58% to 22,225, approaching or reaching a historical peak. The S&P 500 increased by 1.19%, while Dow Jones increased by 1.25%, showing optimism spreading across all industries.

This comprehensive change in market sentiment is not simply a response to the post-confliction, but also reflects expectations for a new risk-off period when geopolitical instability eases.

This capital reallocation could continue to put pressure on precious metals in the short term, as investors prioritize shifting to growth assets that were once avoided during times of escalating tensions.

See more news related to gold prices HERE...