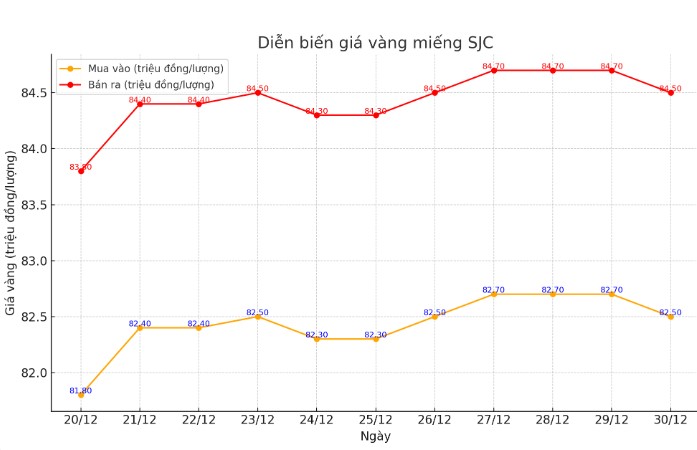

Update SJC gold price

As of 8:30 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND82.5-84.5 million/tael (buy - sell), down VND200,000/tael.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

Meanwhile, DOJI Group listed the price of SJC gold at 82.5-84.5 million VND/tael (buy - sell), down 200,000 VND/tael.

The difference between buying and selling price of SJC gold at DOJI Group is at 2 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 82.5-84.5 million VND/tael (buy - sell), down 200,000 VND/tael.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 2 million VND/tael.

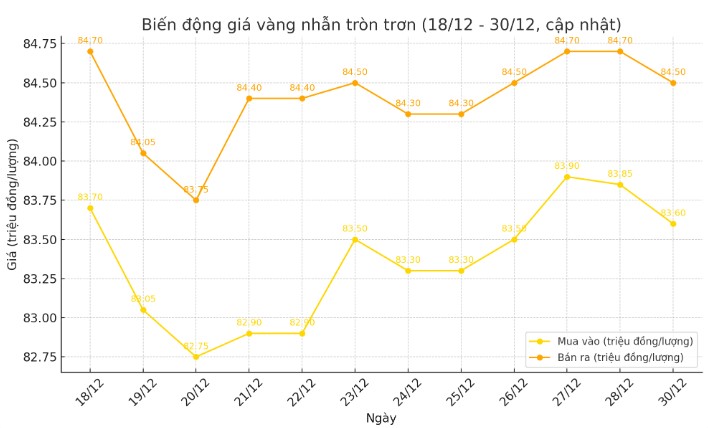

Price of round gold ring 9999

As of 7:30 p.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 83.60-84.50 million VND/tael (buy - sell); down 150,000 VND/tael for buying and down 200,000 VND/tael for selling compared to the closing price of yesterday's trading session.

Bao Tin Minh Chau listed the price of gold rings at 82.90-84.50 million VND/tael (buy - sell), down 200,000 VND/tael for both selling prices compared to the close of yesterday's trading session.

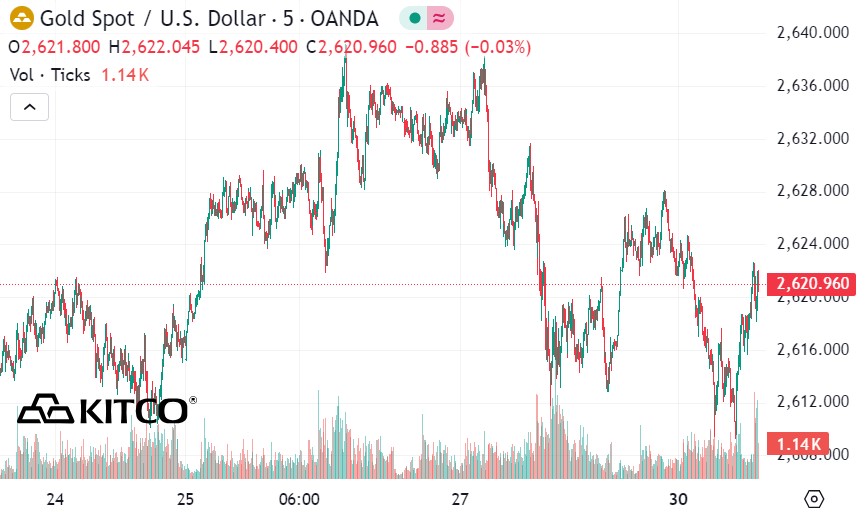

World gold price

As of 8:30 p.m., the world gold price listed on Kitco was at 2,620.9 USD/ounce, down 1.1 USD/ounce compared to the close of the previous trading session.

Gold Price Forecast

World gold prices fell despite a slight decrease in the USD index. Recorded at 20:30 on December 30, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 107.695 points (down 0.09%).

Kelvin Wong, senior market analyst for Asia-Pacific at OANDA, said geopolitical tensions were one of the main factors driving the gold price rally this year, and are expected to continue to dominate the market in 2025, especially when former President Donald Trump returns to politics.

According to Mr. Wong, until the new year, the gold market may continue to fluctuate slightly. "Uncertainties surrounding upcoming economic and political decisions will have a significant impact on gold prices," Mr. Wong commented.

Gold prices have risen more than 27% this year, hitting a record high of $2,790.15 an ounce on October 31. Key factors driving up gold prices include the US Federal Reserve’s easing of interest rates and rising geopolitical uncertainties.

The Fed has cut rates by a total of 100 basis points this year, but it has signaled that there will be fewer rate cuts in 2025. After its December 18 meeting, the Fed announced another quarter-point rate cut and hinted that there would be just two rate cuts next year.

Former President Donald Trump’s return to the White House in January is expected to have a profound impact on the economic structure. His economic platform includes threats of sharply higher tariffs, expanded tax cuts and mass deportations of immigrants.

Fed Chairman Jerome Powell stressed in a recent speech that the proposals in Mr Trump’s platform were considered when the Fed’s interest rate policy-setting committee met. The decision on the number of rate cuts expected next year reflects this.

In the context of geopolitical and economic fluctuations, the gold market is forecast to maintain a trend of great volatility in 2025. Decisions from the FED and policies of the US government will continue to play a role in shaping the future trend of the gold market.

See more news related to gold prices HERE...